Quick Navigation

Overview

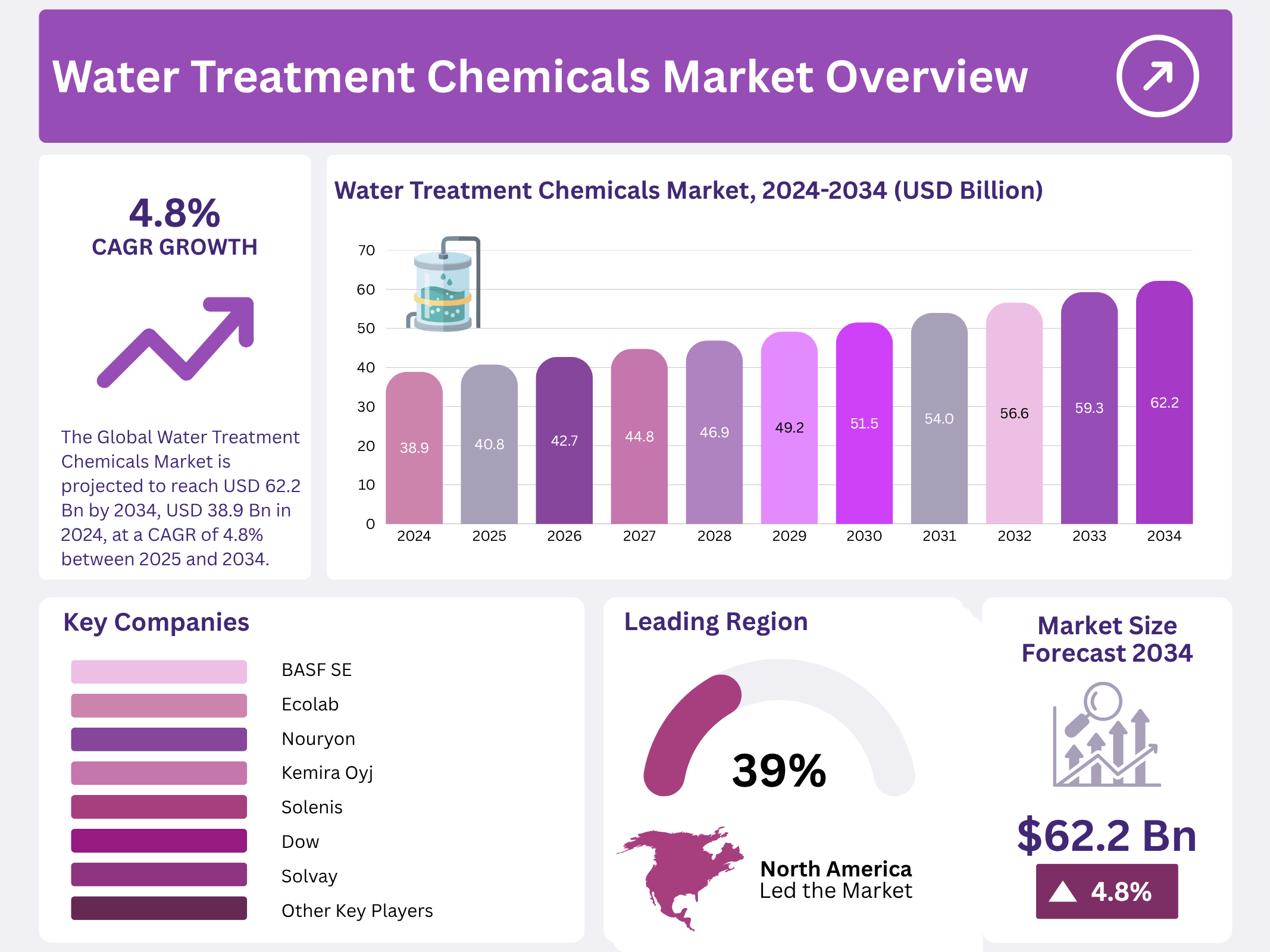

New York, NY – November 05, 2025 – The Global Water Treatment Chemicals Market is projected to reach USD 62.2 billion by 2034, up from USD 38.9 billion in 2024, expanding at a CAGR of 4.8% between 2025 and 2034. Water treatment chemicals are specialized compounds added during purification processes to achieve vital objectives such as disinfection, pH control, corrosion and scale prevention, and the removal of impurities and harmful contaminants.

These chemicals form the foundation of modern water treatment operations, ensuring safe, reliable, and efficient water use across multiple sectors. Their application is essential for public health protection, process optimization, and compliance with stringent environmental standards. The market serves a broad range of end users, including municipal water systems, industrial manufacturing, power generation, pharmaceuticals, food and beverage, and wastewater treatment facilities.

Growth in demand is driven by rapid urbanization, industrial expansion, rising water scarcity, and heightened awareness of water quality. As developing nations work to enhance access to clean water and developed economies shift toward sustainable and eco-friendly treatment technologies, water treatment chemicals continue to play a critical role in global water management and resource conservation.

Key Takeaways

- The Global Water Treatment Chemicals Market is projected to reach USD 62.2 billion by 2034, up from USD 38.9 billion in 2024, at a CAGR of 4.8% between 2025 and 2034.

- Among types, coagulants & flocculants accounted for the largest market share of 31.9%.

- Among sources, synthetic accounted for the majority of the market share at 79.3%.

- By application, wastewater treatment accounted for the largest market share of 34.5%.

- By end-use, municipal accounted for the majority of the market share at 57.4%.

- North America is estimated as the largest market for water treatment chemicals with a share of 38.9% of the market share.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 38.9 Billion |

| Forecast Revenue (2034) | USD 62.2 Billion |

| CAGR (2025-2034) | 4.8% |

| Segments Covered | By Type (Coagulants and Flocculants, Corrosion Inhibitors, Scale Inhibitors, pH Adjusters and Stabilizers, Biocide and Disinfectant, Anti-Foaming Agents, Others), By Source (Bio-based, Synthetic), By Application (Wastewater Treatment, Boiler Water Treatment, Cooling Water Treatment, Raw Water Treatment, Desalination, Others), By End-use (Municipal, Industrial) |

| Competitive Landscape | BASF SE, Ecolab, Nouryon, Kemira Oyj, Solenis, Dow, Solvay, Kurita Water Industries Ltd., SNF, Cortec Corporation, Italmatch Chemicals, Veolia, Thermax Ltd, Baker Hughes Company, Buckman Laboratories International Inc., Other Key Players |

Key Market Segments

Type Analysis

Coagulants & Flocculants Dominate the Water Treatment Chemicals Market

The water treatment chemicals market is segmented by type into coagulants & flocculants, corrosion inhibitors, scale inhibitors, pH adjusters & stabilizers, biocides & disinfectants, anti-foaming agents, and others. In 2024, the coagulants & flocculants segment captured a substantial revenue share of 31.9%. This dominance stems from their effectiveness in removing suspended solids by destabilizing and aggregating particles, facilitating easy separation.

Their combined mechanism sharply reduces turbidity, a key measure of water quality, making them indispensable for drinking water purification. These chemicals provide a reliable and efficient solution for both potable and wastewater treatment. In wastewater processes, they can achieve up to 90% reduction in suspended solids and organic loads. Their proven performance and wide applicability continue to fuel strong industry demand.

Source Analysis

Synthetic Chemicals Lead the Water Treatment Market

By source, the market is divided into bio-based and synthetic categories. In 2024, synthetic chemicals commanded a dominant 79.3% market share. This leadership arises from their critical role across diverse industries, including chemical processing, pharmaceuticals, power generation, and municipal water treatment. Widely used synthetic options, such as aluminum sulfate, ferric chloride, and polyacrylamide, excel in impurity removal, microbial control, and overall water quality improvement.

These chemicals are cost-effective, readily manufactured, and available in varied forms with customizable properties like ionic charge and molecular weight. Their adaptability in liquid or dry formulations enables broad use in wastewater, boiler, cooling, and raw water treatment. This combination of versatility and accessibility solidifies synthetics as the market’s primary source.

Application Analysis

Wastewater Treatment Holds the Largest Share in the Water Treatment Chemicals Market

The market is segmented by application into boiler water treatment, cooling water treatment, wastewater treatment, raw water treatment, desalination, and others. In 2024, wastewater treatment emerged as the leader with a 34.5% share. This position reflects its vital function in contaminant removal, equipment protection, and compliance with environmental standards. Key chemicals—including coagulants, flocculants, disinfectants, and pH adjusters—ensure wastewater is safe for discharge or reuse.

These agents enable efficient pollutant elimination, microbial management, and chemical equilibrium. Such processes are essential in industrial and municipal operations alike. In municipal settings, coagulants and disinfectants play a central role in delivering clean, safe drinking water. The ongoing, universal demand for these treatments cements wastewater as the market’s top application.

End-Use Analysis

Municipal Sector Dominates Water Treatment Chemicals End-Use

By end-use, the market is split into municipal and industrial segments. In 2024, the municipal sector led with a 57.4% share. This dominance is driven by its core mission of supplying safe, potable drinking water to communities. Essential chemicals, such as disinfectants and coagulants, remove harmful contaminants, curb microbial growth, and prevent corrosion and scaling in distribution systems. Their extensive deployment in municipal facilities safeguards public health and upholds water standards. The perpetual need for clean water and infrastructure maintenance underpins the municipal sector’s commanding market presence.

Geopolitical Impact Analysis

Geopolitical Tensions Disrupt the Global Water Treatment Chemicals Supply Chain

Recent geopolitical developments—including trade wars, regulatory shifts, and international conflicts—are significantly hindering the expansion of the global water treatment chemicals market. Persistent disputes, such as the U.S.-China trade war and the Japan-South Korea trade friction, are fracturing the worldwide supply chain for raw materials and finished goods, resulting in escalated costs and production bottlenecks.

Wastewater management, raw water processing, and desalination, any supply interruptions can trigger price surges and delays in water treatment operations. Moreover, government-imposed export controls—often enacted to prioritize national security or economic priorities—profoundly affect the market by blocking cross-border flows of essential production inputs, intensifying competition for scarce resources.

Nations frequently curb exports of raw materials or chemicals to shield local industries, compelling global water treatment chemical producers to grapple with shortages. During crises, such export bans restrict access to vital components, inflating manufacturing expenses and extending lead times. These evolving supply chain pressures not only challenge the water treatment chemicals sector but also exacerbate wider economic volatility, prompting firms to seek alternative suppliers or overhaul risk mitigation approaches amid geopolitical volatility.

Regional Analysis

North America Commands the Largest Share of the Global Water Treatment Chemicals Market

In 2024, North America led the global water treatment chemicals market with a commanding 38.9% share, fueled by escalating needs for clean, safe water in municipal, industrial, and commercial applications. Stringent regional regulations on wastewater effluents and drinking water standards are compelling both government and private entities to invest heavily in robust treatment technologies.

Compounding this, the aging water infrastructure in nations like the United States and Canada is heightening reliance on these chemicals to preserve operational integrity and safety. Rising public consciousness around waterborne illnesses and the imperative for sustainable water stewardship are further accelerating the uptake of cutting-edge treatment formulations.

North America’s robust sectors in power generation, oil and gas, and food processing generate substantial wastewater volumes. To address these challenges and curb pollution, local industries are increasingly turning to water treatment chemicals. The concentration of top-tier chemical producers and persistent advancements in treatment innovations reinforce North America’s preeminent role in the worldwide water treatment chemicals landscape.

Top Use Cases

- Municipal Drinking Water Purification: Water treatment chemicals like disinfectants and coagulants help city water plants clean raw water from rivers or lakes. They remove dirt, germs, and harmful particles to make it safe for homes and schools. This process stops diseases and ensures fresh-tasting water flows from taps every day, supporting healthy communities without interruptions.

- Industrial Wastewater Management: Factories in food processing or chemicals use these chemicals to treat dirty wastewater before releasing it back into nature. Coagulants clump waste for easy removal, while biocides kill bacteria. This keeps rivers clean, follows eco-rules, and lets companies reuse water, cutting costs and protecting local environments from pollution.

- Boiler and Cooling System Protection: Power plants and manufacturing sites add corrosion inhibitors and scale removers to water in boilers and cooling towers. These chemicals stop rust and buildup that could damage equipment. By keeping systems running smoothly, they save on repairs, boost energy efficiency, and help industries operate without costly breakdowns.

- Oil and Gas Extraction Processes: In oil fields, treatment chemicals control microbes and adjust pH in water used for drilling or fracking. They prevent pipe clogs and sour gas formation, making operations safer and more effective. This supports steady production, reduces downtime, and ensures the industry meets strict safety standards for workers and the surroundings.

- Swimming Pool and Leisure Water Safety: Public pools and spas rely on chlorine-based chemicals to kill algae and bacteria, keeping water clear and hygienic. pH adjusters maintain balance to avoid skin irritation or equipment wear. These simple treatments create fun, worry-free spaces for recreation, promoting health during swims and water activities year-round.

Recent Developments

1. BASF SE

BASF is advancing sustainable water treatment solutions, recently launching a new dispersant polymer, Sokalan DCS, designed to improve efficiency in membrane-based desalination by preventing scale. They are also expanding their digital tool, trasar, for cooling water monitoring. A key focus is on developing phosphate-free formulations and bio-based raw materials to reduce the environmental footprint of water treatment processes, aligning with circular economy goals.

2. Ecolab

Ecolab is heavily investing in digital technology, enhancing its ECOLAB3D platform and Smart Water Navigator to provide customers with real-time data and predictive analytics for optimizing water and energy use. A major development is their collaboration with Microsoft to use cloud computing and AI for greater sustainability insights. They are also focused on creating new, less hazardous chemical formulations to improve safety and environmental profiles for their clients.

3. Nouryon

Nouryon is expanding its sustainable product portfolio, notably with the launch of LevaZen, a bio-based additive that enhances the performance of biodegradable scale inhibitors. They are also increasing global production capacity for essential polymers like ethylenediamine (EDA) to meet rising demand. A key strategic development is their focus on providing integrated solutions for the mining industry, helping customers reduce water consumption and recycle process water more effectively.

4. Kemira Oyj

Kemira is focusing on creating higher-value, sustainable chemistries, such as new biopolymers and cellulose-based solutions to replace traditional fossil-fuel-derived products. They are actively forming partnerships, like their collaboration with Veolia, to advance sludge treatment and recycling. A significant R&D direction involves developing solutions for the circular economy of water, enabling industrial customers to efficiently reuse wastewater and recover valuable resources from their process streams.

5. Solenis

Solenis has been actively expanding through strategic acquisitions, including Diversey Holdings and Sigura, significantly broadening its product portfolio and global reach, especially in the pulp and paper segment. They continue to innovate with their PerforMAX line of deposit control technologies and digital solutions under the Solenis Intelligency brand. Their focus is on helping customers achieve water reuse targets and minimize their environmental impact through advanced treatment programs.

Conclusion

Water Treatment Chemicals as a backbone for sustainable growth in a world facing water scarcity and rising pollution. These essential tools help purify supplies for daily needs, shield industries from operational hiccups, and align with global pushes for cleaner environments. With urbanization speeding up and eco-regulations tightening, the sector is set for steady expansion, driven by smarter, greener innovations that promise reliable access to quality water everywhere. This creates exciting opportunities for stakeholders to build resilient systems that benefit society and the planet long-term.