Quick Navigation

Overview

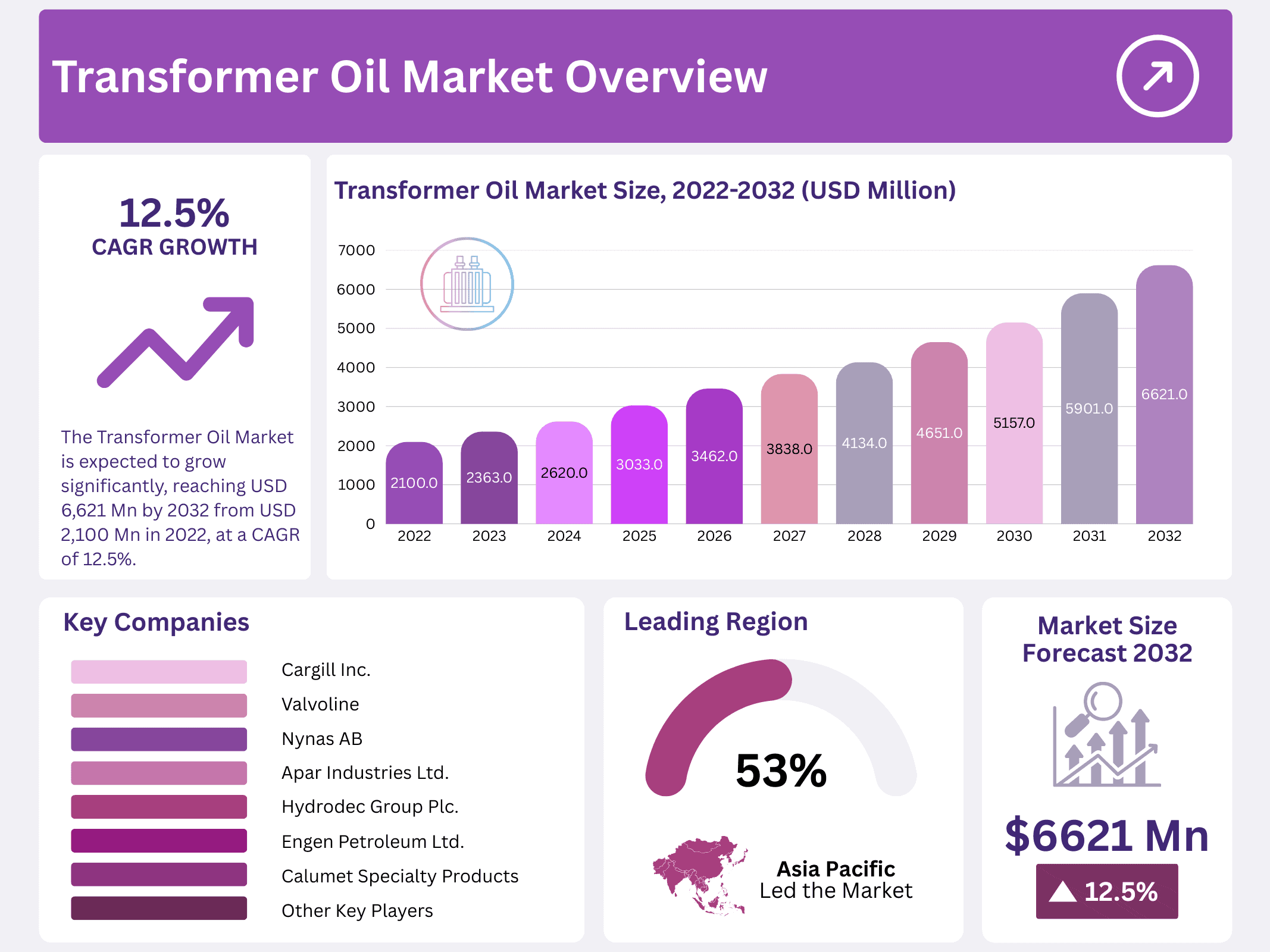

New York, NY – January 19, 2026 – The Global Transformer Oil Market is projected to reach USD 6,621 million by 2032, rising from USD 2,100 million in 2022 at a CAGR of 12.5%. Transformer oil, derived from crude petroleum, plays a crucial role in preventing arcing, dissipating heat, enabling insulation, and ensuring chemical stability within transformers. Its ability to withstand high temperatures, resist oxidation, and provide strong electrical insulation makes it essential for transformer performance. As global grid expansion continues, the demand for reliable transformer oils is expected to grow steadily.

Bio-based transformer oils are gaining attention because they are non-toxic, PCB-free, environmentally friendly, and easier to dispose of compared to conventional mineral-based alternatives. The rise in transformer installations worldwide, along with efforts to enhance the safety and performance of aging grid infrastructure, is boosting the adoption of these sustainable products. Declining crude oil prices have also helped manufacturers reduce raw material costs, further supporting market development.

The market faces challenges due to strict regulatory guidelines surrounding energy efficiency and environmental protection. In the United States, for example, the Environmental Protection Agency (EPA) has implemented stringent rules to reduce electricity waste, influencing transformer oil demand patterns. Additionally, the global shift toward eco-friendly technologies is expected to restrict the expansion of mineral-based transformer oils, reinforcing the long-term transition toward greener alternatives.

Key Takeaways

- The Global Transformer Oil Market is expected to grow significantly, reaching USD 6,621 million by 2032 from USD 2,100 million in 2022, at a strong CAGR of 12.5%.

- Mineral-based oils held the dominant position in 2021, with 81.7% of the total volume share, thanks to their wide availability and good fit with existing high-voltage equipment like transformers, switches, and circuit breakers.

- The insulation application led the market, fueled by high demand for insulating high-voltage infrastructure due to oil’s excellent dielectric strength, viscosity, and temperature resistance, which reduces losses and extends equipment life.

- Small-scale transformers dominated the bio-based transformer oil segment, supported by rising electricity needs and rural electrification efforts in countries like India, Sri Lanka, and Bangladesh.

- Asia Pacific emerged as the top regional market, with over 53.0% of total revenue, driven by fast-growing demand in developing economies such as China, India, Japan, and Australia from expanding commercial, industrial, and substation projects.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 2100 Million |

| Forecast Revenue (2032) | USD 6621 Million |

| CAGR (2023-2032) | 12.5% |

| Segments Covered | By Type: Silicone-based Oil, Naphthenic Oil, Bio-based Oil, Paraffinic Oil, and Others; By Function: Insulator, Chemical Stabilizer, Cooling Agent, and Lubricant; By End-Use: Small Transformer, Distribution Transformers, Power Transformers, Utility Transformers, Large Transformer, and Others; and By Application: Residential, Industrial, and Commercial. |

| Competitive Landscape | Sinopec Lubricant Company, Cargill Inc., Valvoline, Nynas AB, PetroChina Lubricant Company, Ergon International Inc., Apar Industries Ltd., Calumet Specialty Products, Hydrodec Group Plc., Engen Petroleum Ltd. |

Key Market Segments

Type Analysis

Mineral-based oils dominated the market in 2021, capturing 81.7% of the total volume share. Their broad availability and strong compatibility with existing equipment have encouraged widespread use in high-voltage switches, circuit breakers, transformers, and capacitors. The naphthenic oil segment accounted for the largest market share by type in 2020, driven by rising demand for bio-based transformer oils across electric utilities, including transmission networks, power plants, and industrial systems. The global transformer oil market is expected to grow steadily, supported by the strong advantages of mineral oils such as high thermal stability, superior oxidation resistance, cost efficiency, and easy availability.

Function Analysis

The insulation segment held the largest share of the global transformer oil market, driven by increasing demand for insulating high-voltage electrical infrastructure such as transformers, capacitors, switches, and circuit breakers. Transformer oil is widely used as an insulating medium between windings due to its high dielectric strength, optimal viscosity, and strong temperature tolerance. These properties ensure safe operation, minimize electrical losses, and enhance equipment lifespan, making insulation the most critical functional application.

Application Analysis

Small-scale transformers dominated the bio-based transformer oil market in 2022, largely due to growing electricity demand in rural and semi-urban regions. Countries such as India, Sri Lanka, and Bangladesh have experienced rapid rural electrification and urban expansion, significantly supporting segment growth.

Large-scale transformers are expected to grow at a strong CAGR between 2023 and 2032, as utilities increasingly invest in bulk procurement to offset high oil-filling costs. Rising demand for eco-friendly transformers, driven by strict energy-efficiency standards and low-carbon emission policies, further supports growth.

Technological advancements, expanding industrial activity, and increased investment in renewable energy generation have strengthened demand from utility applications. Equipment operating under extreme moisture and pressure conditions requires regular use of maintenance oils; however, this segment is expected to grow more slowly compared to others.

End-User Analysis

In 2020, small transformers accounted for the largest share by end-use, primarily due to their extensive deployment in rural electrification projects. As electricity demand continues to rise, transformer installations are expected to increase, directly boosting transformer oil consumption. At the same time, declining demand for transformer oils in certain regions has reduced production volumes, leading to lower selling prices. Rising production costs, combined with price pressure, have influenced overall market dynamics, prompting manufacturers to focus on efficiency improvements and cost optimization strategies.

Regional Analysis

Asia Pacific accounted for more than 53.0% of total revenue, establishing itself as the leading regional market. Rapid growth in transformer oil demand across developing economies such as China, India, Japan, and Australia has been a key contributor. Expanding commercial and industrial activity across the region is driving the construction of new substations, which is expected to significantly increase transformer installations and oil demand in the near future.

Rising investments in the power sector have enabled Chinese manufacturers to strengthen their market presence and expand capacity. At the same time, large-scale additions to renewable energy capacity in China and India are accelerating demand within the sub-transmission segment. However, the strong presence of established domestic manufacturers across the Asia-Pacific region continues to pose a notable entry barrier for foreign players seeking market penetration.

Top Use Cases

- Insulation in Power Transformers: Transformer oil acts as a key insulator in power transformers, preventing electrical shorts between windings and the core. It ensures safe operation by maintaining high dielectric strength, which is vital for handling high voltages. This use is common in utility grids where reliable insulation helps avoid breakdowns and extends equipment life in demanding environments.

- Cooling for Electrical Equipment: In transformers and switches, transformer oil serves as a coolant, absorbing heat from coils and cores during operation. It circulates naturally or with pumps to dissipate warmth, keeping temperatures low. This application is essential in industrial settings where overheating could lead to failures, ensuring smooth performance and energy efficiency.

- Arc Suppression in High-Voltage Devices: Transformer oil quenches arcs and suppresses corona discharges in circuit breakers and capacitors. Its properties help interrupt electrical faults quickly, reducing damage risks. This is widely applied in transmission networks, where it enhances safety and reliability by preventing explosions or fires during high-voltage switching operations.

- Use in Renewable Energy Systems: Transformer oil is employed in wind and solar power setups to insulate and cool step-up transformers that connect to grids. It supports efficient energy transfer from variable sources, adapting to fluctuating loads. This growing application aids the shift to green energy, improving system durability in remote or harsh outdoor installations.

- Application in Industrial Lubricants: Beyond transformers, oil is blended into lubricants and hydraulic fluids due to its stability and viscosity. It provides smooth operation in machinery, resisting oxidation and moisture. This versatile use appears in manufacturing plants, where it extends equipment lifespan and reduces maintenance needs in heavy-duty processes.

Recent Developments

1. Sinopec Lubricant Company

- Sinopec has developed “Jia Bao” brand ultra-high voltage transformer oils compliant with the latest IEC 60296 standards, focusing on enhanced oxidation stability and gassing performance. Recent efforts target the growing UHV grid infrastructure in China and Asia-Pacific, with products designed for longer service life and improved safety in demanding applications. They are also integrating more Group II/III base oils into production.

2. Cargill Inc.

- Cargill has accelerated its market presence with the FR3 natural ester fluid, emphasizing sustainability and fire safety. Recent developments include promoting its use in grid transformers to support renewable energy integration and EV charging infrastructure. They highlight the fluid’s superior biodegradability and ability to extend transformer life by managing moisture and preserving paper insulation, aligning with global decarbonization trends.

3. Valvoline

- Valvoline (now part of Aramco) has focused on expanding its Valvoline TransRe New dielectric fluid line. A key recent development is the launch of a recycled transformer oil, promoting a circular economy. This re-refined oil meets industry standards and targets utilities and operators seeking to reduce their environmental footprint without compromising dielectric performance or equipment reliability.

4. Nynas AB

- Nynas continues to be a technical leader in naphthenic transformer oils. Recent developments are centered on securing sustainable supply chains and producing oils with very low viscosity and excellent cold-start properties for high-efficiency transformers. They actively advocate for the continued use of naphthenic specialties in long-life applications and invest in R&D for new applications like ester-naphthenic hybrid fluids.

5. PetroChina Lubricant Company

- PetroChina’s Kunlun brand has introduced a new series of environmentally aware transformer oils, including low-sulfur naphthenic oils for reduced corrosion. Developments focus on serving China’s massive power transmission projects, with products certified for UHV equipment. They are also progressing in research on synthetic esters and improving the oxidation stability of their mineral oil-based products for extended drain intervals.

Conclusion

Transformer Oil plays a crucial role in modern energy systems, with trends leaning toward eco-friendly alternatives like ester-based options for better safety and sustainability. The push for grid upgrades and renewable integration will keep demand strong, while innovations in bio-oils address environmental concerns, ensuring a resilient future for power infrastructure without compromising performance.