Quick Navigation

Overview

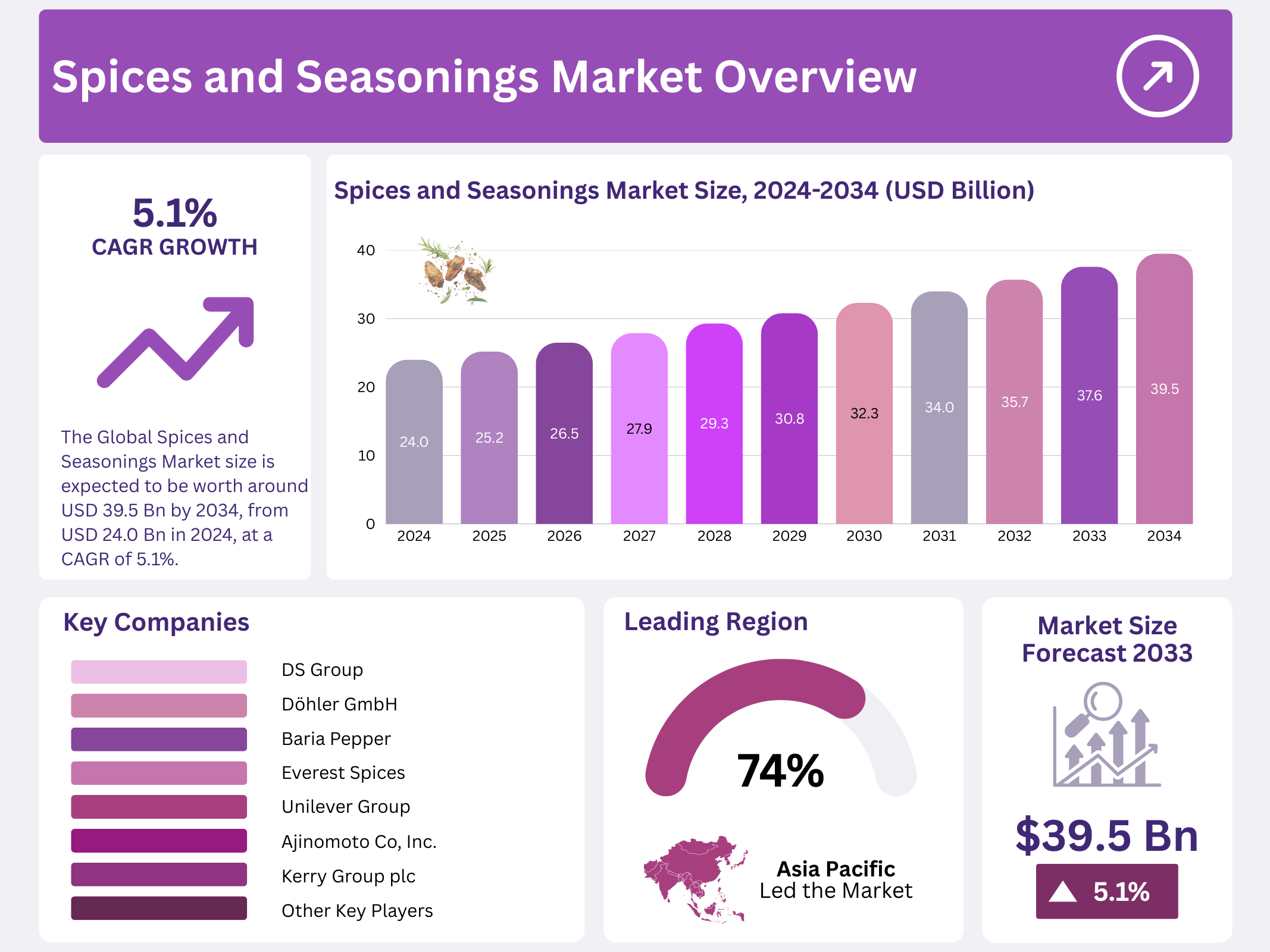

New York, NY – December 17, 2025 – The Global Spices and Seasonings Market is expected to reach around USD 39.5 billion by 2034, up from USD 24.0 billion in 2024, growing at a steady CAGR of 5.1% between 2025 and 2034. This consistent expansion is supported by rising demand from household cooking, food processing, and foodservice channels, as consumers increasingly seek authentic flavors and clean-label ingredients in everyday meals.

The spices and seasonings industry is one of the most diverse segments within the food and beverage sector, shaped by deep-rooted culinary traditions and changing consumer lifestyles. Spices and seasonings include dried seeds, fruits, roots, bark, and vegetables used to enhance the taste, aroma, color, and shelf life of foods. Growing exposure to global cuisines, along with heightened awareness of the natural and functional benefits of spices, has strengthened demand across both developed and emerging markets.

Global production remains highly concentrated. According to the Food and Agriculture Organization (FAO), worldwide spice production reached approximately 13.6 million metric tons in 2023, led by India, Bangladesh, Turkey, and China. India alone accounted for nearly 75% of global output, producing about 10.2 million metric tons, underlining its dominance in the global spice trade. In parallel, the United States Department of Agriculture (USDA) reported that U.S. spice consumption exceeded 635 million pounds in 2022, growing at an annual rate of 2.8%, reflecting sustained demand from both home cooking and commercial food applications.

Key Takeaways

- Spices and Seasonings Market size is expected to be worth around USD 39.5 Bn by 2034, from USD 24.0 Bn in 2024, growing at a CAGR of 5.1%.

- Spices held a dominant market position, capturing more than a 68.3% share of the global spices and seasonings market.

- Meat & Poultry Products held a dominant market position, capturing more than a 38.2% share.

- Asia-Pacific (APAC) region holds a commanding position in the global spices and seasonings market, dominating with a substantial 74.2% market share, which translates to revenues of approximately USD 17.8 Bn in 2024.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 24.0 Bn |

| Forecast Revenue (2034) | USD 39.5 Bn |

| CAGR (2025-2034) | 5.1% |

| Segments Covered | By Product Type (Spices, Herbs, Salt and Salt Substitutes, Others), By Application (Meat and Poultry Products, Snacks and Convenience Food, Soups, Sauces and Dressings, Bakery and Confectionery, Frozen Products, Beverages, Others) |

| Competitive Landscape | Ajinomoto Co. Inc., Sensient Technologies Corporation, Associated British Foods PLC, Kerry Group plc, McCormick & Company Inc., Baria Pepper, Döhler GmbH, DS Group, Everest Spices, Unilever Group, The Watkins Company, The Spice House |

Key Market Segments

Product Type Analysis

Spices dominate with a 68.3% market share, supported by strong demand for authentic flavors.

In 2024, spices held a dominant position in the global spices and seasonings market, accounting for over 68.3% of total demand. This strong share reflects the continued dependence on natural and traditional spices across global food systems. Core ingredients such as turmeric, cumin, black pepper, and cardamom remain widely used in household cooking, packaged foods, and the expanding ready-to-eat meal category.

Growing consumer interest in authentic ethnic cuisines—including Indian, Middle Eastern, and Southeast Asian foods—played a major role in sustaining spice consumption during 2024. At the same time, rising awareness of the natural health benefits of spices, such as the anti-inflammatory properties of turmeric and the antioxidant content of cinnamon, encouraged regular dietary use.

By Application

Meat & Poultry Products lead with a 38.2% share, driven by demand for seasoned proteins.

In 2024, meat and poultry products emerged as the leading application segment, capturing more than 38.2% of the global spices and seasonings market. This dominance highlights strong consumer demand for flavorful, marinated, and pre-seasoned meat products across retail and foodservice channels.

The rising consumption of ready-to-cook and ready-to-eat meat products, particularly in North America, Europe, and Asia, has significantly increased the use of spice blends and seasoning mixes. Popularity of ethnic meat dishes such as Middle Eastern kebabs, Indian tandoori preparations, and Latin American grilled meats further supported growth. Consumers increasingly favor bold and complex flavors, encouraging food manufacturers to develop innovative spice combinations tailored for meat and poultry applications.

Regional Analysis

The Asia-Pacific (APAC) region maintains a dominant position in the global spices and seasonings market, accounting for a strong 74.2% market share and generating revenues of around USD 17.8 Bn in 2024. This leadership is closely linked to the region’s deep-rooted culinary heritage and vast agricultural areas devoted to spice cultivation, which support both large-scale production and everyday consumption.

Key countries such as India, China, Vietnam, and Indonesia play a central role in shaping the APAC spice landscape. India stands out as the world’s leading producer and exporter, with spices forming an important part of its agricultural economy. The sector benefits from a well-established farming ecosystem, along with government backing through initiatives such as organic farming subsidies and export promotion programs led by the Spices Board of India.

China and Indonesia also hold strong positions, using their rich biodiversity to produce a wide range of spices, including star anise, cloves, and pepper. To meet rising global demand for authentic and exotic flavors, these countries have increasingly adopted modern processing and packaging technologies. This focus on quality improvement and extended shelf life has strengthened their presence in international markets and reinforced APAC’s overall dominance in the global spices and seasonings industry.

Top Use Cases

- Home Cooking & Meal Kits: Consumers seek authentic, global flavors at home. Spice blends and single-origin products are popular for recreating restaurant dishes. The rise of meal kits directly fuels demand for pre-portioned, high-quality seasonings, simplifying gourmet cooking and reducing food waste from unused bulk spices.

- Health & Wellness: A major driver is the shift towards natural, clean-label ingredients. Spices like turmeric and ginger are valued for their anti-inflammatory properties. Consumers actively reduce sodium intake, replacing salt with herb and spice blends for flavor without health compromises, aligning with holistic wellness trends.

- Plant-Based & Alternative Proteins: Seasonings are critical for masking undesirable notes and building savory, “meaty” flavors in plant-based burgers, sausages, and dairy alternatives. Innovation focuses on masking legume or soy off-notes and creating authentic taste profiles that appeal to flexitarians and vegans alike.

- Convenience & Processed Foods: The broad packaged food industry relies on seasonings for consistent flavor and shelf-life extension. Demand is high for customized, cost-effective blends for snacks, frozen meals, and ready-to-eat products that deliver bold, reliable taste while meeting clean-label expectations.

- Foodservice & Restaurants: Chefs and chains use signature spice blends for brand differentiation and consistent taste. The global popularity of ethnic cuisines, from Mexican to Korean, requires authentic, bulk seasonings. This sector demands scalable, high-impact flavor solutions to enhance dine-in and takeaway experiences.

Recent Developments

1. Ajinomoto Co, Inc.

Ajinomoto is leveraging its expertise in umami to develop next-generation seasoning solutions that enhance savory taste while reducing sodium content. Their focus includes creating clean-label, plant-based flavor boosters for the global market, aligning with health trends. They are also integrating digital tools to better understand regional taste preferences for product development.

2. Sensient Technologies Corporation

Sensient is heavily investing in natural extraction technologies and sustainable sourcing for vibrant spice-derived colors and flavors. Their innovation targets clean-label demands, providing oil-soluble colors and stable flavors for diverse applications. They emphasize traceability and offer custom solutions for meat alternatives and snacks, focusing on visual appeal and taste.

3. Associated British Foods PLC (ABF)

Through its ingredients division, ABF focuses on developing dehydrated vegetable and herb products alongside specialty seasonings. They are expanding capabilities in natural flavor encapsulation for longer shelf life and potency. Their strategy supports the demand for authentic, label-friendly ingredients in processed foods and culinary applications.

4. Kerry Group plc

Kerry is a leader in developing taste solutions for plant-based proteins, creating spice systems that mask off-notes and deliver authentic meaty and savory profiles. Their broad portfolio includes clean-label seasoning blends and marinades designed for sodium reduction and meeting clean-label demands across multiple food and beverage categories.

5. McCormick & Company Inc.

McCormick continues to drive growth through consumer-facing innovation, launching global flavor collections and organic products. They are heavily leveraging data analytics to predict flavor trends. A strong focus exists on sustainability within their supply chain and developing seasonings specifically for the fast-growing air fryer and home cooking segments.

Conclusion

The spices and seasonings market is dynamically evolving beyond basic flavor enhancement. Growth is primarily fueled by the powerful intersection of global culinary exploration and a strong consumer focus on health and natural ingredients. Demand for transparency and clean labels is non-negotiable. Simultaneously, the sectors of plant-based food and home meal solutions represent significant innovation frontiers, requiring advanced seasoning technologies.