Quick Navigation

Introduction

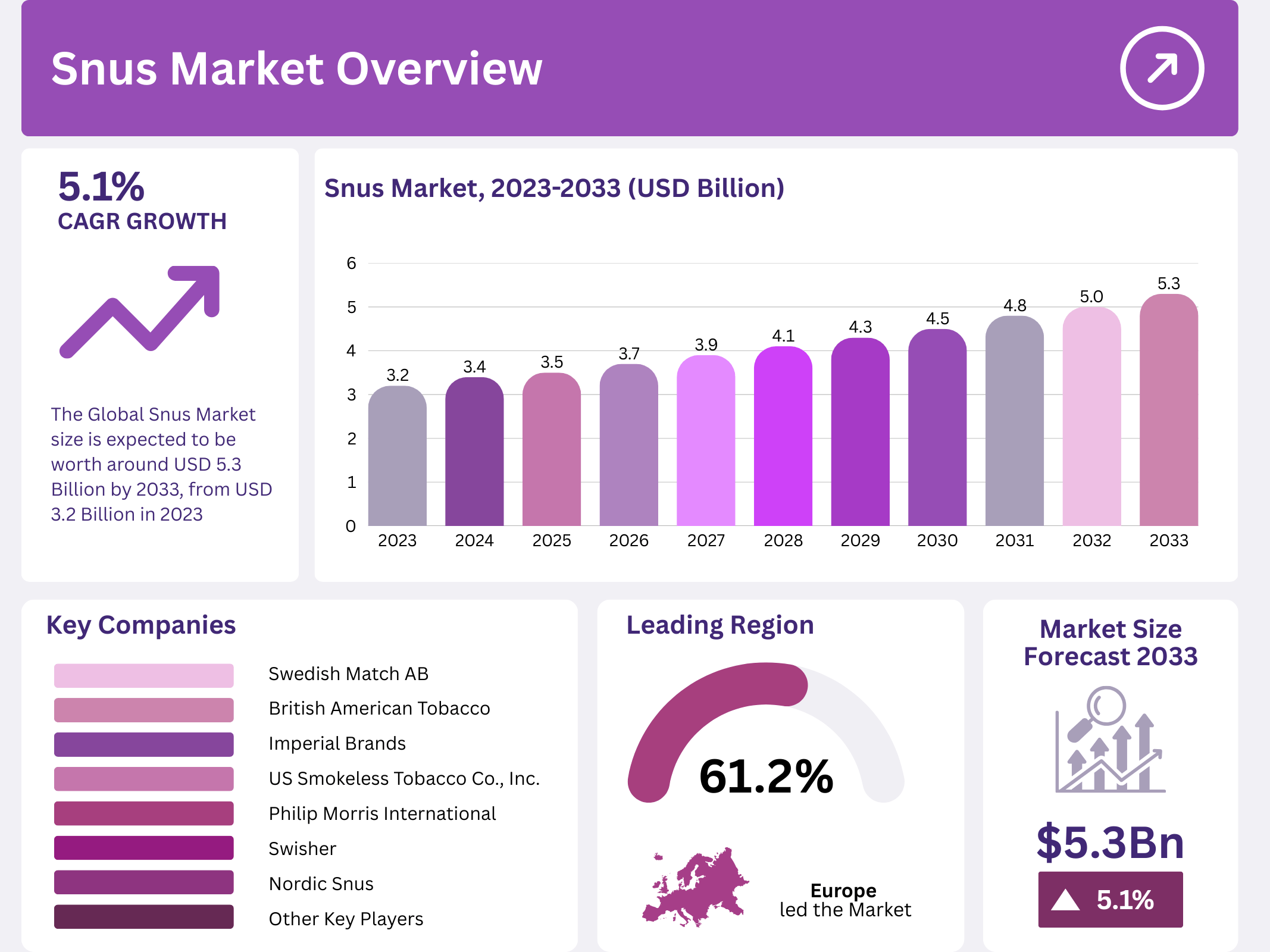

The global snus market is gaining significant traction as consumers increasingly seek healthier alternatives to traditional smoking. According to industry insights, the market is projected to grow from USD 3.2 billion in 2023 to USD 5.3 billion by 2033, expanding at a steady CAGR of 5.1%.

Originating from Sweden, snus has transformed into a global category with broad acceptance across Scandinavia, North America, and parts of Europe. Offering convenience, varied flavors, and reduced health risks compared to cigarettes, snus is increasingly positioned as a key product in the harm-reduction tobacco strategy.

Key Takeaways

- The global snus market is projected to grow from USD 3.2 billion in 2023 to USD 5.3 billion by 2033, with a CAGR of 5.1%.

- The Portion segment dominated in 2023 with an 84.2% share, driven by convenience and discreet use.

- The Flavored snus segment led with an 84.2% share, with mint flavors alone contributing over 40%.

- Tobacco Stores captured a 67.2% share in 2023, reflecting consumer trust and specialized offerings.

- Europe led the market with a 61.2% share, driven by Scandinavian cultural acceptance and favorable regulation.

Market Segmentation Overview

The Portion segment accounted for 84.2% of the market in 2023, supported by ease of use and consistent dosage. These pouches are widely favored among younger consumers and first-time users.

The Flavored snus segment led with an 84.2% market share in 2023, where mint flavors contributed over 40%. This highlights a shift towards taste-driven purchasing, especially among youth and women.

The Tobacco Stores segment dominated distribution, securing 67.2% of market share in 2023. These outlets remain the most trusted purchase points due to their wide assortment and brand availability.

Drivers

- One of the primary growth drivers is the rising demand for smokeless tobacco products, as consumers increasingly turn toward harm-reduction alternatives. Snus provides a discreet, smoke-free experience and aligns with stricter global smoke-free policies.

- Another driver is the growing consumer preference for flavored nicotine products. The availability of diverse flavor options, especially mint and fruit, has created strong demand among younger demographics, reshaping consumption patterns.

Use Cases

- Snus has become a preferred option in workplaces and public spaces, where smoking restrictions are tight. Its discreet nature and lack of secondhand smoke make it widely accepted.

- It is also being increasingly used by smokers looking to quit or reduce cigarette intake, serving as a transition product that helps mitigate nicotine withdrawal while avoiding combustion risks.

Major Challenges

- The biggest challenge facing the industry is stringent regulatory frameworks. In the European Union, snus sales remain banned outside Sweden, limiting expansion potential. Compliance costs and advertising restrictions add further complexity.

- Another challenge is public health opposition. Despite being less harmful than cigarettes, concerns over nicotine dependency and youth targeting create resistance among regulators and advocacy groups.

Business Opportunities

- The most promising opportunity lies in expansion into emerging markets. Asia-Pacific and Latin America, with their large smoker populations and rising disposable incomes, represent untapped growth potential.

- Another opportunity is in organic and tobacco-free snus products. With rising demand for clean-label alternatives, manufacturers can capture health-conscious consumers seeking nicotine satisfaction without traditional tobacco.

Regional Analysis

- Europe dominated the market in 2023 with a 61.2% share, supported by Sweden and Norway’s cultural acceptance of snus and favorable harm-reduction policies. These markets account for the highest per-capita consumption globally.

- North America is experiencing rapid adoption, particularly in the United States, where awareness of smoke-free alternatives is rising. Strategic investments, such as PMI’s USD 600 million facility in Colorado, highlight the region’s growing importance.

Recent Developments

- 2024 – BAT introduced synthetic nicotine-based Velo pouches in the U.S. to bypass FDA’s tobacco regulations.

- 2024 – Philip Morris International (PMI) announced a USD 600 million investment in a high-tech manufacturing facility in Colorado, expected to create 500 jobs and generate USD 550 million annually in economic benefits.

- 2023 – Altria Group, Inc. reported 2.3% EPS growth, distributing nearly USD 7.8 billion in dividends and buybacks, supported by its smoke-free product portfolio.

- 2024 – Turning Point Brands, Inc. reported strong Q2 financial performance, emphasizing portfolio expansion in smoke-free alternatives.

Conclusion

The snus market is poised for sustainable growth, reaching USD 5.3 billion by 2033. While regulatory hurdles and health debates remain, the rising demand for smokeless tobacco, product innovations, and expansion into new regions offer strong growth prospects. With leading players like Swedish Match, BAT, and PMI driving innovation, the industry is expected to evolve rapidly in the coming decade.