Quick Navigation

Overview

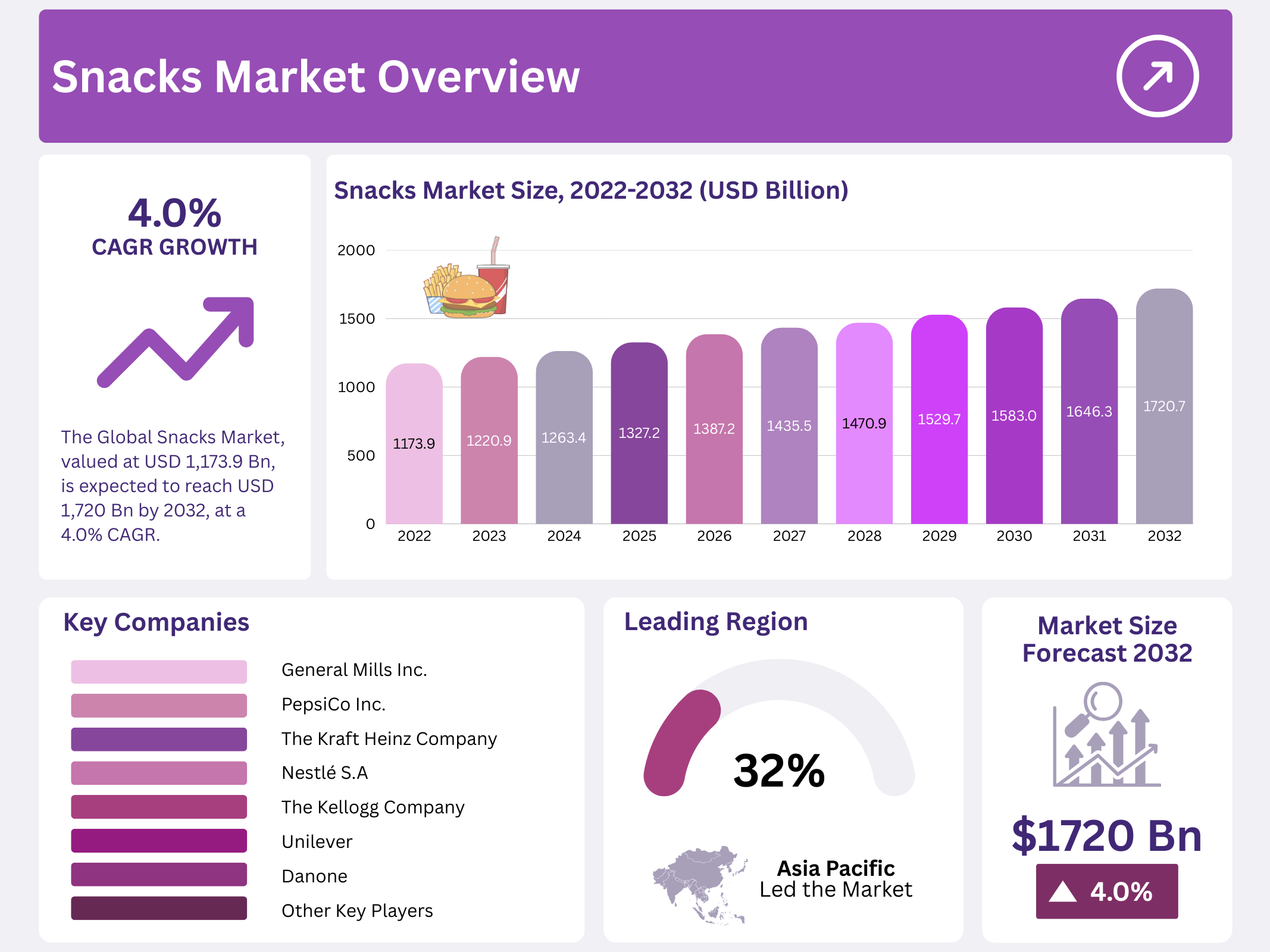

New York, NY – September 11, 2025 – The Global Snacks Market was valued at USD 1173.9 billion and is projected to reach USD 1720.7 billion by 2032, growing at a CAGR of 4.0% between 2023 and 2032. Snacks are smaller food items that are typically less filling than full meals, often made with easily available ingredients. They can be consumed between meals and come in a wide variety of forms, ranging from processed products to refined carbohydrates.

Over the past two years, the snacks industry has experienced significant growth, largely driven by the pandemic, which encouraged at-home dining and the adoption of work-from-home lifestyles. This shift made packaged snacks such as chips, noodles, and macaroni more popular as consumers sought convenience and comfort during lockdowns. The pandemic also influenced long-term snacking behavior. With extended lockdowns, snacks became an essential household food category.

At the same time, the demand for on-the-go options grew, even as people continued working from home. International brands responded by offering innovative packaging formats designed to extend shelf life and support convenient consumption. Additionally, rising health awareness and evolving lifestyles have fueled demand for healthier, plant-based, and vegan snack alternatives. This transition reflects a broader change in consumer habits, where indulgence is increasingly balanced with a preference for nutrition, variety, and sustainability in snack choices.

Key Takeaways

- The Global Snacks Market, valued at USD 1,173.9 billion, is expected to reach USD 1720.7 billion by 2032, growing at a 4.0% CAGR from 2023 to 2032.

- Frozen snacks lead the market within the frozen and refrigerated category.

- Hypermarkets and supermarkets dominate global snack sales, especially in higher-income countries.

- Growth driven by evolving tastes, busy lifestyles, innovative flavors, and convenient packaging.

- Challenges include health concerns, market competition, and demand for healthier snack options.

- Rising demand for healthier snacks with organic, natural ingredients and eco-friendly packaging.

- Asia Pacific held 32.4% of the global packaged snacks market share in 2013.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 1,173.9 Billion |

| Forecast Revenue (2032) | USD 1720.7 Billion |

| CAGR (2023-2032) | 4.0% |

| Segments Covered | By Product – Frozen and Refrigerated, Fruit, Bakery, Savory, Confectionery, Dairy, and Other Products; By Distribution Channel – Supermarkets & Hypermarkets, Convenience Stores, Online, and Other Distribution Channels. |

| Competitive Landscape | General Mills Inc., PepsiCo Inc., The Kraft Heinz Company, Nestlé S.A., The Kellogg Company, Unilever, Calbee, Intersnack Group GmbH & Co. KG, Conagra Brands Inc., ITC Limited, Grupo Bimbo, Danone, and Other Key Players. |

Key Market Segments

Product Analysis

Busy Lifestyles and Long-Lasting Factors Fueling Frozen Snacks Demand

Frozen snacks hold a leading position in the global snacks market, with frozen and refrigerated products emerging as the most popular category. These products cover a wide range, including vegetables, fruit-based snacks, meat and poultry, seafood, bakery items, and even plant-based meat substitutes. Their extended shelf life and convenience make them highly appealing to modern consumers.

Savory snacks, especially meat-based options like jerky and dried meats, are expected to record the fastest CAGR over the forecast period, with strong demand in North America, the Middle East, and Africa. To match the rising health-conscious trend, producers are offering gluten-free, low-calorie, and low-fat products. Consumers, who are now more focused on health and longevity, are spending more on nutritious, value-added options like protein bars and granola bars.

Fruit snacks are another important segment, designed primarily for children but gaining wider popularity. With improved purchasing power and a preference for healthy ready-to-eat (RTE) foods, fruit snacks are growing steadily. Distribution through supermarkets and modern retail outlets has also expanded their availability, while busy work schedules and evolving lifestyles continue to drive consumer demand for quick, nutritious snacking.

Distribution Channel Analysis

Supermarkets and Hypermarkets Remain the Dominant Channels

Supermarkets and hypermarkets continue to hold the largest share of snack distribution worldwide, especially in high-income countries. In the U.S., Walmart alone controls over half of all grocery sales. Expanding retail infrastructure across Asia, Africa, and the Middle East is further strengthening the role of hypermarkets and supermarkets in the snacks supply chain.

Interestingly, online giants such as Amazon in the U.S. and JD.com in China have entered the physical retail space, blending digital efficiency with brick-and-mortar convenience. This trend shows that traditional stores are being reshaped to offer engaging shopping experiences, rather than just transactional visits, to compete with online shopping.

At the same time, younger generations like Millennials and Gen Z show strong preferences for RTE and convenience foods. Partnerships between online delivery platforms and snack producers are bridging this gap. In February 2022, Grubhub announced a partnership with 7-Eleven to launch Grubhub Goods, delivering convenience products across the U.S. Similar collaborations with supermarkets globally are making snack foods more accessible than ever, further boosting demand across both offline and online retail networks.

Regional Analysis

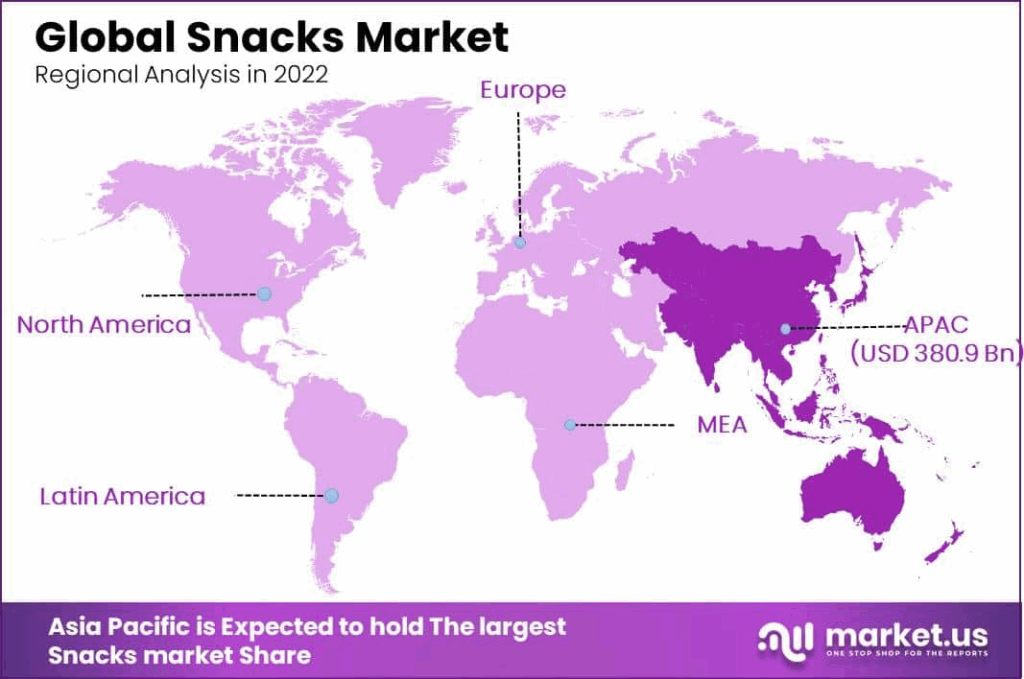

Asia Pacific Leads with 32.4% Share in the Global Snacks Market

Asia Pacific accounted for 32.4% of the global snacks market, making it the leading regional contributor. The popularity of packaged snacks in this region comes from their convenience, ready-to-eat (RTE) format, and flexibility, which suit busy lifestyles. Snacks are often used to complement or speed up traditional meals, creating strong demand for healthier and clean-label snack options.

Consumers in this region continue to favor quick, portable, and easy-to-consume foods, with frozen, refrigerated, and savory snack categories expected to grow further. Major players are also investing in smaller local brands and innovating products like multi-compartment yogurts to capture evolving snacking preferences. In North America, snacking is deeply ingrained in consumer habits, especially among millennials in the U.S. and Canada.

Products such as snack bars, savory items, and even convenient meal-like snacks, such as burgers, have gained wide popularity. Manufacturers are increasingly focusing on creating healthier and premium-quality snack options to meet rising health-conscious demands in the region. Europe is both a leading producer and consumer of snacks, with a strong culture of snacking during social events and on-the-go lifestyles.

The shift toward healthier eating is evident, as consumers increasingly choose organic and natural snacks as part of their balanced diets. Europe currently holds the largest market share in organic and natural snack categories and is projected to show strong growth potential during the forecast period, driven by its emphasis on health, sustainability, and convenience.

Top Use Cases

-

Health-Conscious Snacking: Consumers are choosing snacks with low sugar, high protein, and natural ingredients, like plant-based bars and nut mixes, to support healthier lifestyles and boost immunity, driving demand for functional snacks that offer nutritional benefits without sacrificing taste.

-

Convenience for Busy Lifestyles: Busy professionals and families prefer ready-to-eat snacks like jerky, granola bars, and fruit snacks, which fit into hectic schedules, fueling market growth as manufacturers focus on portable, single-serve packaging for on-the-go consumption.

-

Innovative Flavor Profiles: Shoppers crave bold and unique flavors, such as sweet-smoky or globally inspired options like mango habanero, encouraging brands to experiment with new taste combinations to attract adventurous eaters, especially younger demographics.

-

Sustainable Packaging Solutions: Eco-conscious consumers demand snacks in recyclable or resealable packaging, pushing companies to adopt sustainable materials and upcycled ingredients to appeal to environmentally aware shoppers and align with global sustainability trends.

-

E-Commerce and Delivery Growth: Online platforms and delivery services, like partnerships with convenience stores, make snacks more accessible, with digital sales rising as millennials and Gen Z shop for niche, healthy options through e-commerce and quick-delivery apps.

Recent Developments

1. General Mills Inc.

General Mills is expanding its better-for-you snack portfolio. A key development is the growth of its Veganuary offerings, including new dairy-free alternatives under the Lärabar and Annie’s brands. They are also innovating with new flavors for established brands like Old El Paso Mexican snacks and Bugles, focusing on bold tastes to drive consumer engagement in the competitive salty snack segment.

2. PepsiCo Inc.

PepsiCo continues to lead with its direct-store-delivery model and significant snack innovation. Recent highlights include the launch of miniaturized Doritos and Cheetos for the Indian market and the global expansion of its D2C. The company is also aggressively reformulating products to reduce sodium and saturated fats, aligning with health and wellness trends across its vast Frito-Lay portfolio.

3. The Kraft Heinz Company

Kraft Heinz is leveraging its iconic Lunchables brand to re-enter the kids’ snack segment aggressively. Recent developments include the launch of Lunchables with Whole Grain and new fruit-centric options to address nutritional concerns. They are also testing innovative, heatable snack kits for adults under the “Lunchables for Grown-ups” concept, aiming to capture a new demographic with convenient, nostalgic products.

4. Nestlé S.A.

Nestlé is strategically reshaping its snack business by divesting its mainstream peanut butter brand (Butterfinger) to focus on premium and functional wellness. Key innovations include the global rollout of Yes! snack bars, made with whole nuts and fruits, and the expansion of its nutrient-packed, baked snack line N3, designed to support specific health needs like immunity and energy.

5. The Kellogg Company (now Kellanova)

Following its separation, Kellanova is driving growth with consumer-centric innovation. Key moves include the launch of Cheez-It Smokey Provolone and Scorchin’ Hot Cheddar Puff varieties, capitalizing on flavor trends. They are also expanding Pringles with new limited-edition collaborations and flavors like “Pringles Wavy Applewood Smoked Cheddar” to maintain momentum in the salty snack aisle.

Conclusion

The Snacks Market is growing fast due to changing consumer needs, with a focus on health, convenience, and bold flavors. Demand for plant-based, protein-rich, and eco-friendly snacks is rising, especially among younger shoppers. E-commerce and innovative packaging are also boosting sales. Brands that adapt to these trends and prioritize sustainability and unique offerings will thrive in this dynamic market.