Quick Navigation

Introduction

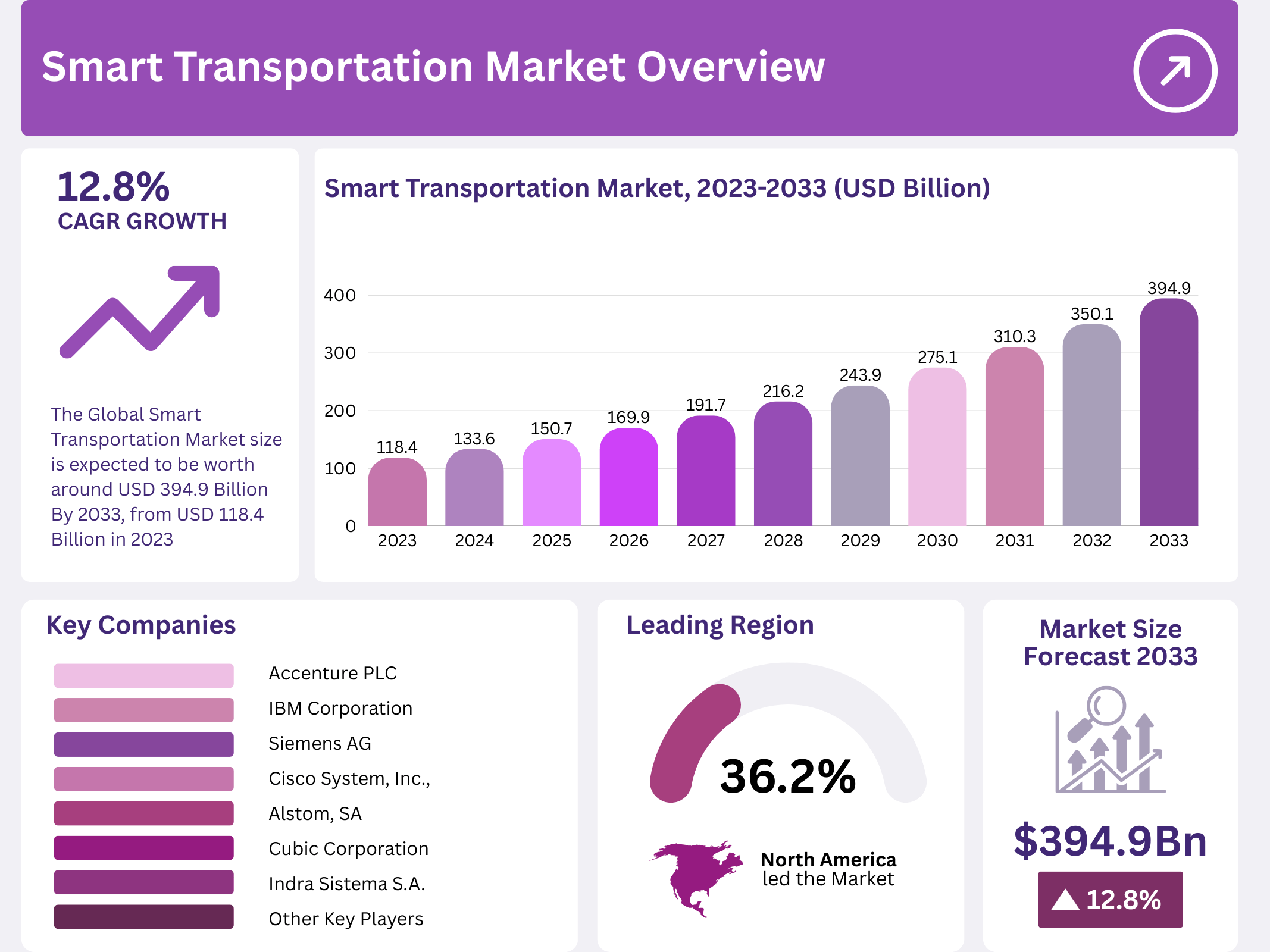

The Global Smart Transportation Market is undergoing a transformative phase, driven by cutting-edge technologies and robust government support. Valued at USD 118.4 Billion in 2023, the market is projected to reach USD 394.9 Billion by 2033, growing at a CAGR of 12.8% during 2024–2033.

This evolution is reshaping urban mobility through intelligent solutions. By integrating AI, IoT, and big data, smart transportation systems reduce congestion, optimize routes, and support sustainability. These tools are enabling real-time decision-making and smarter infrastructure management.

Government programs such as the SMART Grants under the Bipartisan Infrastructure Law further catalyze this transition. With USD 148 million already allocated to 93 projects across 39 U.S. states, these initiatives underscore a long-term vision for connected and sustainable urban ecosystems.

Key Takeaways

- The Global Smart Transportation Market is projected to reach USD 394.9 Billion by 2033, from USD 118.4 Billion in 2023, at a CAGR of 12.8%.

- Traffic Management Systems led the market in 2023 under the “By Solution” segment, accounting for over 35.2%.

- Cloud Services dominated the “By Services” segment in 2023, holding a 43.6% share.

- North America led with a 36.2% market share, valued at USD 42.86 Billion in 2023.

Market Segmentation Overview

The “By Solution” segment is led by the Traffic Management System, which held over 35.2% market share in 2023. These systems use AI and IoT to optimize traffic flow and reduce congestion. Parking Management, Integrated Supervision, and Ticketing Systems also contribute to smoother urban mobility experiences.

Within “By Services,” Cloud Services commanded 43.6% market share in 2023. Their scalability supports real-time data processing. Professional Services provide critical implementation support, while Business Services ensure compliance and streamline smart transport operations.

Drivers

The first major driver is the growing need for effective traffic management in increasingly congested urban areas. Cities seek solutions that reduce travel time, improve air quality, and optimize public transit routes.

Secondly, substantial government support through smart city initiatives and infrastructure grants is accelerating adoption. These investments enable municipalities to implement connected mobility systems with advanced traffic analytics and control technologies.

Use Cases

One prominent use case is real-time traffic monitoring, powered by AI and IoT, which dynamically adjusts signals to improve flow and safety. This significantly enhances urban traffic responsiveness and commuter experience.

Another application is Mobility-as-a-Service (MaaS), integrating multiple transport modes into a unified digital platform. This provides commuters with flexible, real-time travel options and simplifies route planning.

Major Challenges

A key challenge is the high initial capital investment for smart transport infrastructure. Deploying sensors, AI systems, and cloud connectivity demands substantial funding, often a hurdle for budget-constrained municipalities.

Another issue is data privacy and cybersecurity. As systems collect user and vehicle data, ensuring secure handling and maintaining public trust are vital to widespread adoption.

Business Opportunities

Emerging opportunities lie in the deployment of 5G networks. These enable ultra-fast, low-latency communication between vehicles and infrastructure, supporting autonomous vehicle functionality and smart traffic controls.

The increasing adoption of electric and autonomous vehicles opens avenues for smart charging networks and connected vehicle infrastructure, both of which rely heavily on smart transportation systems.

Regional Analysis

North America leads with a 36.2% market share, backed by early technology adoption, extensive funding, and strong policy frameworks. The U.S. is especially active in smart mobility deployments through federal and municipal initiatives.

Asia Pacific is fast emerging as a hotspot due to urbanization and infrastructure development in China, Japan, and South Korea. These countries are heavily investing in smart city projects, including autonomous transport and EV integration.

Recent Developments

- May 2023 – Cubic Corporation received a USD 50 million grant to develop a real-time passenger information system for public transit.

- March 2023 – Alstom SA secured a deal to supply digital signaling systems for European urban rail networks.

- January 2023 – Cisco Systems Inc. launched a new traffic management solution using real-time data analytics for urban congestion control.

Conclusion

The Smart Transportation Market is set for sustained, high-growth momentum, driven by urbanization, sustainability goals, and digitization. With governments prioritizing smart infrastructure and private companies innovating across AI, IoT, and cloud systems, the market is aligning with the future of urban mobility.

Challenges such as funding and data security remain, but strategic collaborations and public-private investments are overcoming barriers. As cities transition to smarter, greener transport systems, the Smart Transportation Market is not just evolving — it is redefining the future of mobility.