Quick Navigation

Introduction

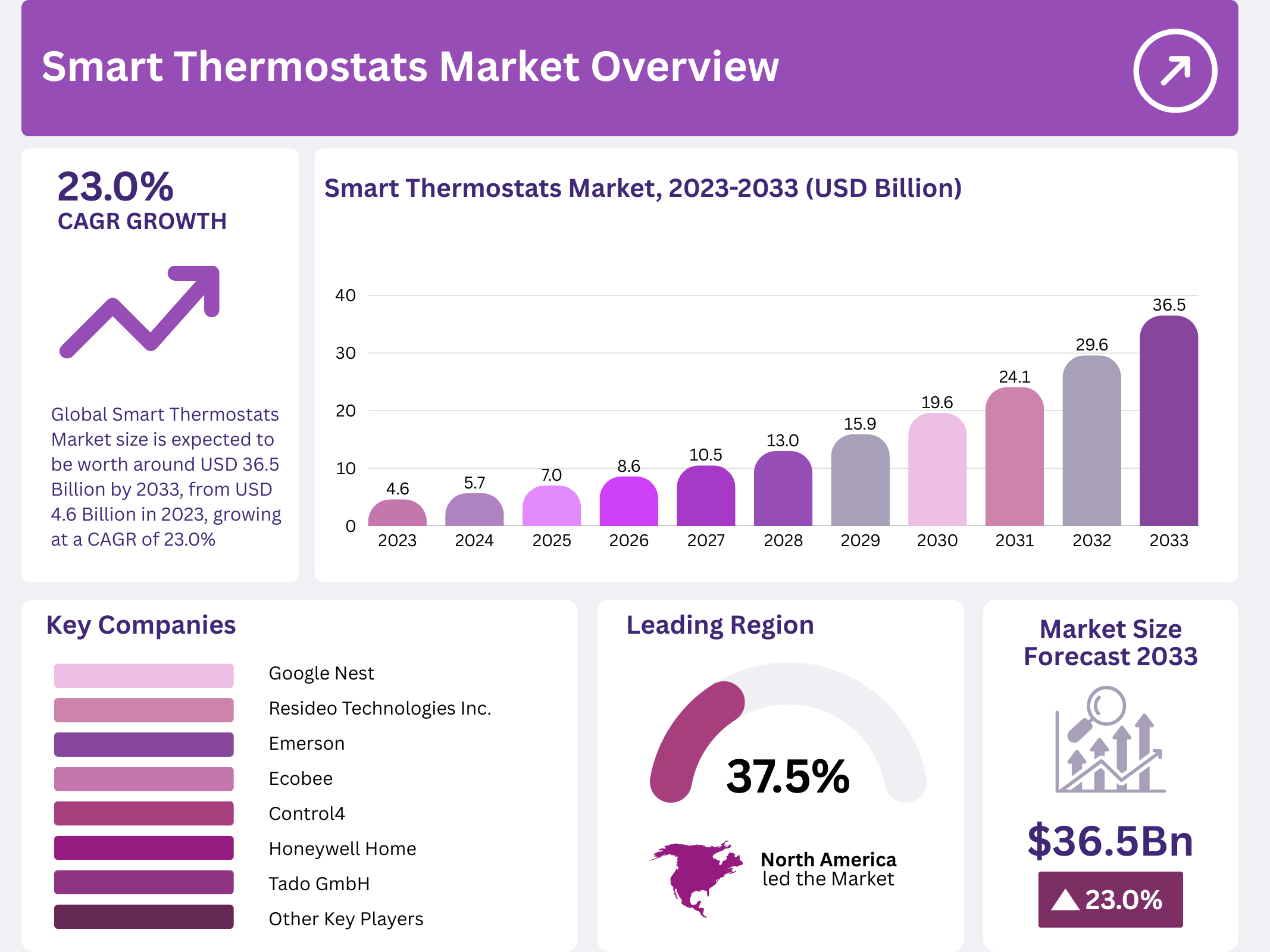

The Global Smart Thermostats Market surges forward, projected to reach USD 36.5 Billion by 2033, up from USD 4.6 Billion in 2023, fueled by a robust 23.0% CAGR from 2024 to 2033. These innovative devices revolutionize temperature control in homes and buildings through internet connectivity, enabling app-based or voice-command adjustments. Consequently, users enjoy optimized energy usage and substantial bill reductions.

Moreover, smart thermostats adapt to preferences, learning behaviors to enhance efficiency. This capability not only cuts costs but also promotes sustainability. For example, devices like Google Nest save 10-12% on heating and 15% on cooling, yielding USD 131-145 annual savings per household. Thus, investments recoup within two years, boosting adoption rates swiftly.

Furthermore, legislative support accelerates growth. The U.S. Infrastructure Investment and Jobs Act allocates USD 369 Billion for energy initiatives, spurring retrofits and renewable integrations. As a result, manufacturers seize opportunities in energy-efficient upgrades. Meanwhile, commercial sectors retrofit buildings, aligning with sustainability goals and cost reductions.

In addition, funding like Washington’s USD 267 Million for smart grid enhancements in 2023 amplifies demand. This fosters a vibrant market for thermostats in residential and commercial spaces. Beyond individuals, these devices alleviate grid pressures, as the International Energy Agency predicts 4% global electricity demand growth in 2024.

Additionally, renewables integration propels the sector. The World Economic Forum anticipates renewable electricity rising from 30% in 2023 to 35% by 2025. Smart thermostats thus balance loads effectively. Competition intensifies with leaders like Google, Ecobee, and Honeywell innovating affordable models, expanding access to diverse consumers.

Overall, this dynamic landscape underscores smart thermostats’ role in energy transition. By merging convenience with conservation, they drive market expansion. As awareness grows, stakeholders anticipate transformative impacts on global sustainability efforts, solidifying their position in smart home ecosystems.

Key Takeaways

- The Smart Thermostats Market was valued at USD 4.6 Billion in 2023 and is expected to reach USD 36.5 Billion by 2033, with a CAGR of 23.0%.

- In 2023, Standalone Products had the highest revenue share, reflecting their affordability and ease of installation.

- In 2023, Wired Technology led with the largest market share, indicating preference for stable connections.

- In 2023, the Residential application dominated, showing widespread adoption in homes.

- In 2023, North America accounted for 37.5% of the market, valued at USD 1.73 Billion, due to advanced home automation trends.

Market Segmentation Overview

By Product

Standalone thermostats dominate revenue, thanks to affordability and simple setup, attracting first-time upgraders. This accessibility broadens market reach. Meanwhile, Connected variants enable remote control via smartphones, enhancing convenience. Consequently, they integrate seamlessly with smart home devices, driving efficiency gains.

Furthermore, Learning thermostats advance automation by adapting to user habits, minimizing manual inputs. This innovation fosters energy savings and comfort. As competition heats up, these segments evolve, spurring broader adoption across demographics and propelling overall market innovation.

By Technology

Wired technology claims the top share for its reliability and uninterrupted performance, ideal for new builds or renovations. It integrates effortlessly with existing heating systems. Thus, it appeals to users prioritizing stability over flexibility.

Conversely, Wireless options gain momentum through Wi-Fi and Bluetooth, offering easy retrofits in older structures. This flexibility boosts remote monitoring. As reliability improves, wireless shifts dynamics, potentially overtaking wired in future installations.

By Application

Residential leads applications, powered by smart home enthusiasm for remote control and bill reductions. Homeowners embrace these for daily comfort. This segment thus anchors market growth, reflecting consumer-driven tech integration.

Commercial and Industrial follow, optimizing large HVAC systems for cost savings. Businesses retrofit to meet sustainability mandates. Consequently, these areas expand opportunities, diversifying revenue streams amid rising energy demands.

Drivers

Rising Demand for Energy Efficiency: Consumers and businesses increasingly seek solutions to slash bills and environmental harm. Smart thermostats optimize HVAC operations, yielding measurable savings. This demand integrates with smart ecosystems, amplifying growth as households link devices for holistic control.

Government Initiatives and Regulations: Policies worldwide incentivize energy conservation through rebates and standards. These measures encourage installations, especially in regulated regions. As a result, adoption accelerates, with funding like the IIJA unlocking billions for efficient upgrades.

Use Cases

Residential Energy Optimization: Homeowners use smart thermostats to schedule temperatures remotely, learning routines for automatic adjustments. This reduces waste during absences, cutting utility costs by up to 15%. Families thus enjoy comfort while advancing personal sustainability goals.

Commercial Building Management: Offices deploy thermostats across zones for precise climate control, integrating with occupancy sensors. This lowers operational expenses and complies with green certifications. Managers thereby enhance tenant satisfaction and grid stability during peak hours.

Major Challenges

High Initial Costs: Upfront expenses deter adoption, particularly for integrating with legacy HVAC systems. Budget constraints in emerging markets exacerbate hesitation. Consequently, manufacturers face slower penetration, needing financing options to bridge affordability gaps.

Data Privacy and Security Concerns: Devices collect usage data, raising cyber risks and eroding trust. Privacy-focused consumers avoid connected tech. Thus, firms must prioritize robust encryption, yet compliance varies regionally, complicating global strategies.

Business Opportunities

Advances in AI and Machine Learning: AI-driven thermostats predict habits for proactive adjustments, slashing energy use further. Companies innovating here capture premium segments. Partnerships with tech giants expand reach, fostering new revenue from analytics services.

Expansion in Emerging Economies: Urbanization boosts disposable incomes, heightening smart home appeal in Asia Pacific and Latin America. Localized products and distribution networks unlock untapped demand. Developers thus integrate thermostats in new builds, accelerating market entry.

Regional Analysis

North America Dominance: Holding 37.5% share at USD 1.73 Billion in 2023, the region thrives on automation trends and incentives. High awareness and infrastructure support rapid uptake. Consequently, innovations like AI controls sustain leadership amid rising energy prices.

Asia Pacific Rapid Expansion: Urban growth and investments in China, Japan propel adoption for efficient buildings. Rising incomes fuel residential demand. This momentum diversifies supply chains, positioning the region as a future powerhouse in smart tech manufacturing.

Recent Developments

- Building36: On October 2024, Building36 launched the Smart Thermostat HQ, featuring cellular connectivity for reliable setup and operation, bypassing common Wi-Fi issues. The device includes automatic wire detection, simplifying the installation process for HVAC professionals and reducing service call frequency.

- Copeland: On August 2024, Copeland launched the Verdant VX4 smart thermostat, featuring advanced demand response capabilities and fingerprint-resistant glass for enhanced durability in hospitality and multifamily properties.

- Google Nest: On August 2024, Google redesigned the Nest Learning Thermostat, introducing a larger, domed display and AI-powered Smart Schedules for optimized temperature management. The device now includes Smart Ventilation, adjusting airflow based on air quality, and Soli radar technology, which adapts the display as users approach.

- Entergy Solutions: On July 2024, Entergy Solutions offered a limited-time promotion for free Sensi Smart Thermostats to customers in Louisiana as part of its energy efficiency initiatives. The offer, which includes models such as the Sensi Lite and Sensi Touch 2 at discounted prices, aims to help residents reduce energy costs and improve home comfort during peak summer months.

Conclusion

The Global Smart Thermostats Market stands at a pivotal juncture, propelled by innovation and sustainability imperatives. With explosive growth to USD 36.5 Billion by 2033, these devices transcend mere convenience, embodying a commitment to efficient, connected living. Stakeholders must navigate challenges like costs and privacy while capitalizing on AI and regional expansions. Ultimately, smart thermostats herald a greener future, harmonizing technology with environmental stewardship for generations ahead.