Quick Navigation

Introduction

The global Smart Packaging market is entering a decisive growth phase, driven by rising demand for advanced packaging solutions that go beyond traditional containment. Increasingly, industries are adopting smart technologies to improve product safety, shelf life, and traceability. As a result, smart packaging is becoming integral to modern supply chains.

Moreover, smart packaging integrates active and intelligent systems that interact with products or provide real-time information. These technologies support quality monitoring, tamper detection, and environmental tracking. Consequently, manufacturers are able to reduce waste, ensure compliance, and enhance consumer trust across multiple end-use sectors.

In addition, regulatory pressure and consumer awareness are reshaping packaging strategies worldwide. Governments and international bodies are promoting sustainable packaging initiatives, encouraging innovation in eco-friendly materials and smart labels. Therefore, smart packaging is increasingly positioned at the intersection of technology advancement and sustainability goals.

Furthermore, digitalization and IoT integration are accelerating adoption across food, pharmaceuticals, and e-commerce. Smart indicators, sensors, and connected packaging solutions enable real-time data flow across logistics networks. As a result, businesses gain greater visibility, operational efficiency, and improved inventory management.

Overall, the Smart Packaging market reflects a broader shift toward intelligent, data-driven packaging ecosystems. With continued investment and technological development, the market is expected to witness sustained expansion. This evolution signals strong long-term potential for stakeholders across the global packaging value chain.

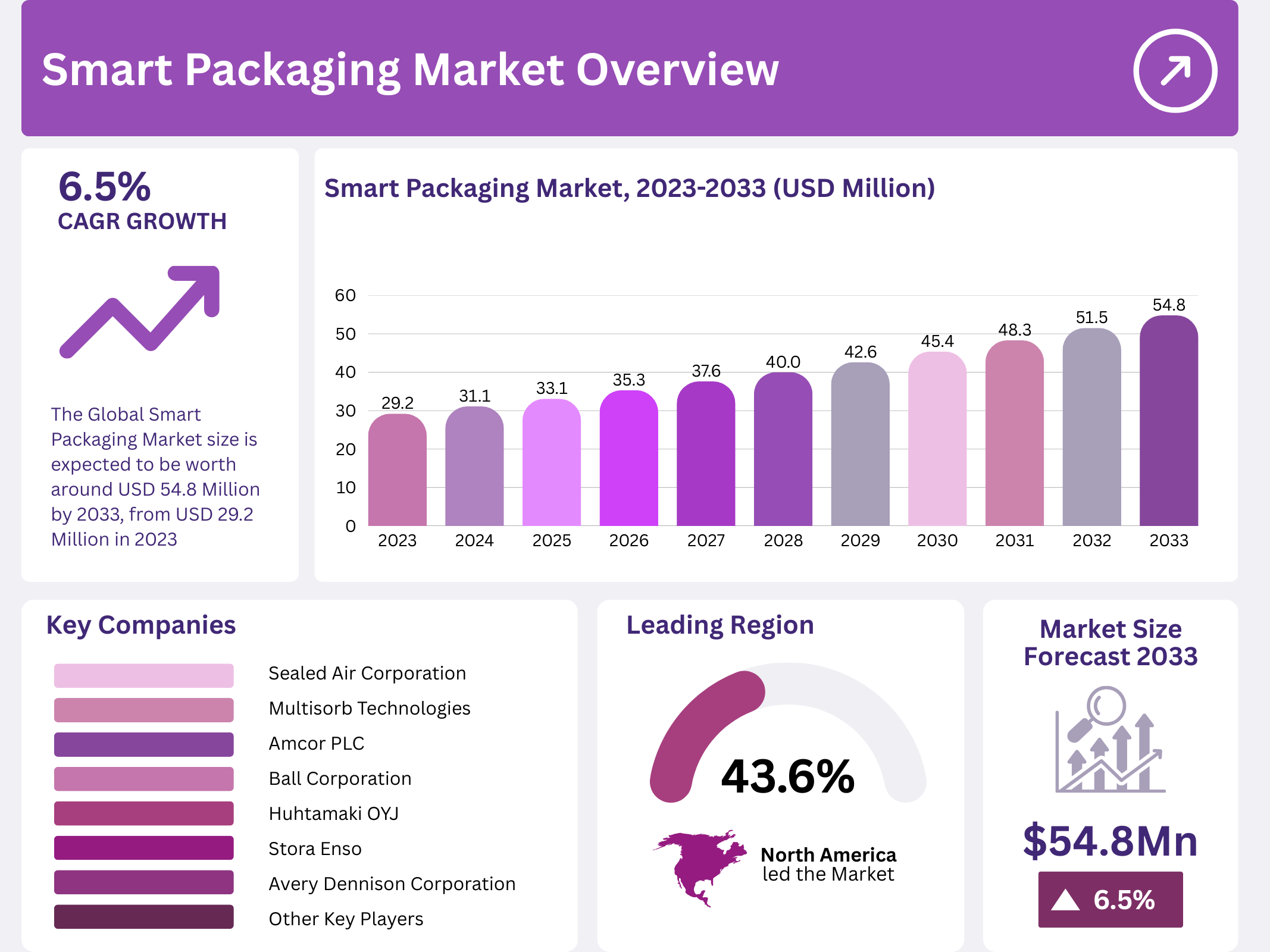

The Global Smart Packaging Market size is expected to be worth around USD 54.8 Million by 2033, rising from USD 29.2 Million in 2023, and growing at a CAGR of 6.5% during the forecast period from 2024 to 2033.

Key Takeaways

- The Smart Packaging market is projected to reach USD 54.8 Million by 2033, expanding at a CAGR of 6.5% from 2024 to 2033.

- Active Packaging dominated the market in 2023, accounting for a 71.2% share in the By Type segment.

- Food & Beverages emerged as the leading end-user segment with a 46.2% market share in 2023.

- North America led the global market with a 43.6% share and revenue of USD 12.73 Million in 2023.

Market Segmentation Overview

By type, Active Packaging continues to dominate due to its effectiveness in extending shelf life and preserving product quality. This segment is widely used in food and pharmaceuticals, where spoilage reduction and safety compliance are critical. Consequently, Active Packaging remains a preferred choice for manufacturers.

Meanwhile, Intelligent Packaging and Modified Atmosphere Packaging are gaining traction through technological advancements. Intelligent Packaging supports traceability and consumer engagement using sensors and RFID systems. At the same time, Modified Atmosphere Packaging enhances freshness without preservatives, particularly in food applications.

By end-user, Food & Beverages represent the largest segment, driven by strict safety regulations and consumer demand for freshness. Smart packaging ensures tamper evidence, real-time quality monitoring, and extended shelf life. As a result, adoption in this sector continues to accelerate.

Other end-user segments such as Pharmaceuticals, Personal Care & Cosmetics, Electronics, and E-commerce are steadily expanding. These industries leverage smart packaging to protect product integrity, ensure regulatory compliance, and enhance logistics efficiency. Therefore, diversified end-use adoption strengthens overall market growth.

Drivers

One of the primary drivers is the growing need for extended shelf life and quality assurance. Smart indicators and freshness sensors enable continuous monitoring throughout the supply chain. Consequently, businesses can reduce spoilage, minimize waste, and ensure consumer safety more effectively.

Another key driver is the integration of IoT and connected technologies in packaging. Real-time data collection improves inventory tracking, logistics transparency, and consumer engagement. As a result, smart packaging supports data-driven decision-making and operational efficiency.

Use Cases

In the food and beverage industry, smart packaging is widely used to monitor temperature, freshness, and contamination risks. These applications help maintain quality from production to consumption. Therefore, brands can strengthen consumer trust and regulatory compliance.

In e-commerce and logistics, smart packaging enables real-time tracking and condition monitoring during transportation. This ensures products arrive in optimal condition. Consequently, companies can reduce returns, improve delivery reliability, and enhance customer satisfaction.

Major Challenges

High implementation costs remain a significant challenge for smart packaging adoption. Advanced components such as sensors and connectivity modules increase packaging expenses. As a result, smaller manufacturers may face budget constraints limiting widespread adoption.

Environmental concerns also pose challenges due to electronic components in disposable packaging. Recycling and waste management complexities raise sustainability issues. Therefore, the industry must focus on developing eco-friendly and recyclable smart packaging solutions.

Business Opportunities

Growing demand for sustainable packaging presents strong opportunities for innovation. Biodegradable sensors and recyclable materials align with environmental regulations. Consequently, companies investing in green smart packaging can gain competitive advantage.

The expansion of e-commerce offers another major opportunity. Smart packaging solutions that monitor shipping conditions and authenticate products add value. As a result, brands can enhance supply chain transparency and consumer engagement.

Regional Analysis

North America dominates the Smart Packaging market due to advanced infrastructure and strict food safety regulations. High consumer spending on packaged goods further supports adoption. Therefore, the region continues to lead global revenue generation.

Asia Pacific is witnessing rapid growth driven by urbanization, rising incomes, and expanding e-commerce. Meanwhile, Europe benefits from strong sustainability regulations. These regional dynamics collectively contribute to balanced global market expansion.

Recent Developments

- In October 2023, Ball Corporation acquired an AI-driven packaging technology firm to enhance sustainability and tracking capabilities.

- In September 2023, Stora Enso invested €15 Million in NFC-enabled smart packaging development.

- In August 2023, Huhtamaki OYJ launched biodegradable smart packaging designed to improve food safety.

Conclusion

The Smart Packaging market is evolving rapidly, supported by technological innovation, sustainability initiatives, and changing consumer expectations. With strong growth projections and expanding applications, the market presents significant opportunities. As adoption increases across industries, smart packaging is set to become a core component of future packaging ecosystems.