Quick Navigation

Overview

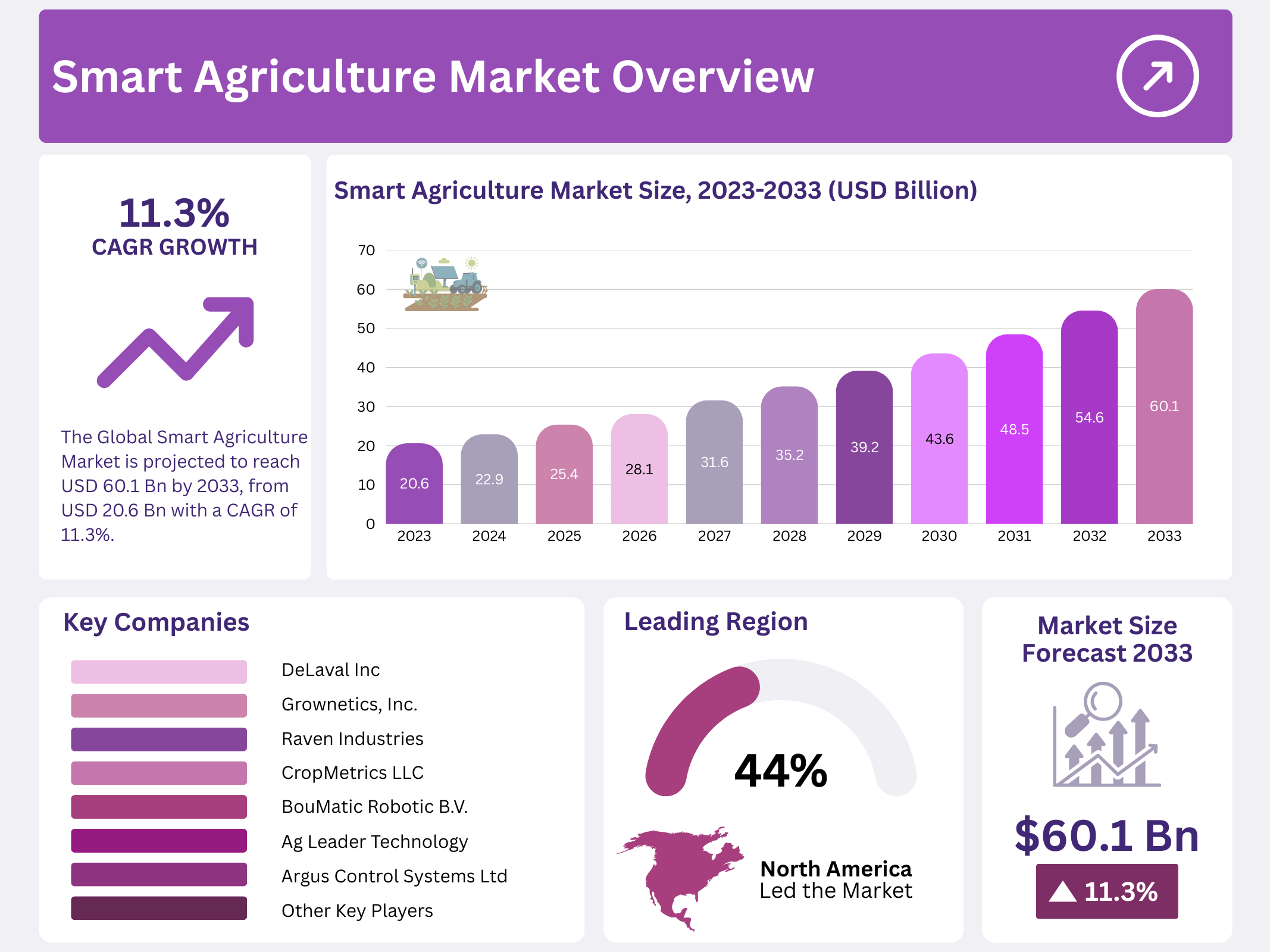

New York, NY – November 25, 2025 – The Global Smart Agriculture Market is projected to reach USD 60.1 billion by 2033, growing from USD 20.6 billion in 2023 at a steady CAGR of 11.3% between 2023 and 2033. The growth reflects rising adoption of digital tools and automation in farming as the agriculture sector seeks to improve productivity, sustainability, and operational efficiency.

Smart agriculture, also known as precision or digital farming, emphasizes the use of advanced technologies such as sensors, drones, GPS systems, robotics, and data analytics to optimize farming activities. These technologies help streamline processes, reduce wastage, and improve yield accuracy by enabling farmers to monitor and manage crop conditions more precisely.

Through real-time monitoring and data-driven decision-making, smart agriculture supports improved irrigation planning, fertilization accuracy, pest control, and overall farm management. The core objective is to maximize resource utilization, minimize environmental impact, reduce costs, and enhance overall farm output. As global demand for food grows and climate challenges intensify, smart agriculture continues to play a crucial role in transforming traditional farming into a more efficient and sustainable model.

Key Takeaways

- The Global Smart Agriculture Market is projected to reach USD 60.1 billion by 2033, from USD 20.6 billion with a CAGR of 11.3% from 2023–2033.

- Sensors & Control Systems was the leading hardware segment due to its critical role in precision agriculture and data-driven decisions.

- Large-scale farms dominated the market in 2023 because smart solutions scale effectively and boost efficiency on big operations.

- Precision Farming held the largest share in 2023, exceeding 41%, driven by demand for higher yields and resource efficiency.

- North America led the global market in 2023 with over 44% share, supported by advanced technology, precision farming adoption, and key industry players.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 20.6 Billion |

| Forecast Revenue (2033) | USD 60.1 Billion |

| CAGR (2024-2033) | 11.3% |

| Segments Covered | By Hardware (HVAC system, LED grow lights, Valves & pumps, Sensors & control systems, Others), By Sensing Devices (Soil sensor, Water sensors, Climate sensors and Others), By Software( Web-based, Cloud-based), By Services (Data services, Analytics services, Farm operation services, Supply chain management services, Climate information services, System integration & consulting, Maintenance & support, Managed services, Others), By Farm Size (Small, Medium, Large), By Application (Precision Farming, Livestock Monitoring, Precision Aquaculture, Precision Forestry, Smart Greenhouse, Others) |

| Competitive Landscape | Autonomous Solutions, Inc., GEA Group Aktiengesellschaft, CropMetrics LLC, Ag Leader Technology, BouMatic Robotic B.V., Raven Industries, Argus Control Systems Ltd, Grownetics, Inc., DeLaval Inc, DICKEY-john, AgJunction, Inc., Farmers Edge Inc, Gamaya, Deere & Company, CropZilla, Topcon Positioning Systems, DroneDeploy, Granular, Inc., Trimble Inc., CLAAS KGaA mbH |

Key Market Segments

Hardware Analysis

In 2023, hardware remained a foundational element of the Smart Agriculture market, with Sensors and Control Systems leading the landscape. Their dominance was mainly due to their role in supporting precision farming and real-time automation. Devices such as crop health sensors, environmental sensors, and soil moisture systems supplied continuous insights that enabled farmers to optimize input usage and make accurate decisions.

The growing adoption of IoT accelerated demand, as farms increasingly relied on connected devices for efficiency and predictive analytics. With advancements in AI and machine learning, the Sensors and Control Systems category continued to strengthen its market position and set the stage for further innovation.

Sensing Devices Analysis

The sensing devices segment experienced notable growth in 2023, with soil sensors holding the leading share. Their importance was tied to their ability to provide real-time metrics on soil conditions such as nutrient concentration, temperature, and moisture. These insights helped farmers apply irrigation and fertilizers more precisely, leading to improved yields and smarter resource management. Water sensors also saw increased adoption during the year, particularly as water scarcity became a global concern.

Software Analysis

Cloud-based platforms emerged as the leading software segment in 2023, supported by rising digital transformation across farms. The flexibility of cloud solutions allowed users to access, analyze, and store large volumes of operational data with ease. Farmers used these platforms to monitor weather trends, automate operations, and gain predictive insights for crop and resource management. The scalability and remote accessibility of cloud-based tools made them particularly attractive for modern agricultural systems, ensuring continued adoption and growth.

Services Analysis

In 2023, services played an essential role in strengthening smart agriculture adoption, with Data Services taking the top position. These solutions supported activities such as data collection, interpretation, and delivery across soil, crop, and environmental parameters. Farmers increasingly relied on these services for informed planning and on-ground execution. By converting raw data into actionable recommendations, Data Services helped improve yields, reduce operational risk, and increase input efficiency.

By Farm Size Analysis

Large-scale farms led the market in 2023, driven by their greater financial capacity and higher need for automation. These farms leveraged smart agriculture tools to manage vast land areas, reduce labor dependency, and improve overall productivity. The scalability of technology-driven solutions made them particularly suitable for this segment, solidifying their dominant position.

By Application Analysis

Precision Farming maintained a leading share in 2023, accounting for more than 41% of the total market. Its adoption was driven by the need to maximize production while reducing waste and environmental strain. Technologies such as GPS-guided tractors, automated irrigation, and drone-based crop monitoring supported this shift. Livestock Monitoring continued gaining momentum as well, with farms adopting IoT-based systems to enhance animal health tracking, prevent disease outbreaks, and boost productivity.

Regional Analysis

In 2023, North America dominated the global smart agriculture market, accounting for over 44% of the total share. This leadership stems from advanced technological infrastructure, widespread adoption of precision farming techniques, and the presence of major industry players. The United States and Canada, in particular, have led the way by harnessing data analytics, IoT, and artificial intelligence to enhance agricultural productivity and sustainability. Supportive government policies and initiatives aimed at modernizing agriculture have further accelerated market growth in the region.

Europe maintained a strong competitive position in the same year, driven by the European Union’s emphasis on sustainable agriculture and environmental protection. Strict regulations on food safety, traceability, and environmental standards have encouraged the uptake of smart farming technologies that ensure transparent and efficient supply chains. Germany and France have been at the forefront of this technological integration, contributing to Europe’s substantial market share.

The Asia-Pacific (APAC) region emerged as one of the fastest-growing markets in 2023. Rapid urbanization, population growth, and the pressing need to optimize limited arable land have fueled demand for smart agriculture solutions, particularly in China and India. Government-led initiatives to modernize farming, improve food security, and increase yields have significantly boosted the regional market.

Latin America also made notable strides, with a growing focus on precision agriculture and sustainable practices. Brazil emerged as a standout leader, applying smart technologies across its vast agricultural landscapes to improve productivity and resource efficiency, thereby strengthening the region’s presence in the global market.

Top Use Cases

- Precision Irrigation: Farmers use sensors and apps to check soil wetness and weather in real time, turning on water only where and when plants need it. This saves water, cuts down on waste, and keeps crops healthy without over-soaking the ground. It’s a simple way to grow more food while being kind to the earth, especially in dry areas where every drop counts for better harvests.

- Crop Health Monitoring: Drones and cameras fly over fields to spot sick plants or bugs early, using smart tech to scan leaves and soil from above. Farmers get alerts on their phones to fix issues fast, like spraying just the right spots. This helps plants stay strong, boosts food output, and stops small problems from ruining whole crops, making farming smarter and less guesswork.

- Livestock Tracking: Wearable tags on animals send info about where they are, if they’re eating well, or if they’re sick, all through connected devices. Herders can check this from afar and step in quickly to keep the herd safe and growing. It eases daily chores, cuts losses from lost animals, and ensures healthier meat and milk, turning ranching into a more reliable business.

- Smart Greenhouses: Inside sealed growing spaces, sensors control light, air, and heat to match what plants love best, like a perfect indoor garden. Growers tweak settings via apps to speed up growth year-round, even in bad weather. This setup grows fresh veggies steadily, uses less space, and meets city food needs without relying on seasons, making local farming easier and greener.

- Pest and Disease Control: AI tools watch fields for early signs of bugs or plant sickness using data from ground sensors and sky views. They suggest targeted fixes, like spot treatments, instead of blanketing everything. Farmers save on chemicals, protect helpful insects, and keep yields high, creating a balanced farm that fights threats smartly while staying safe for people and nature.

Recent Developments

1. Autonomous Solutions, Inc.

ASI is advancing its “Farmer-as-a-Service” model, deploying fully autonomous tractor fleets for tillage and spraying. Their Command Center software allows a single operator to manage multiple vehicles from different manufacturers simultaneously. Recent focus includes integrating more robust perception systems for complex, mixed-fleet row-crop operations, enhancing safety and operational efficiency without modifying existing farm machinery.

2. GEA Group Aktiengesellschaft

GEA is leveraging IoT and data analytics to optimize dairy farming through its DairyNet platform. This system connects milking robots, herd management, and cooling equipment, providing farmers with predictive insights. A key development is the use of machine learning to analyze real-time milk data for early detection of health issues like mastitis, improving animal welfare, and reducing antibiotic use through targeted treatments.

3. CropMetrics LLC

Now part of Valmont Industries, CropMetrics focuses on precision irrigation management. Their recent development integrates the Valley Variable Rate Irrigation (VRI) system with advanced soil moisture sensors and satellite imagery. This creates dynamic management zones that automatically adjust water application in real-time, significantly boosting water use efficiency and crop yield while minimizing nutrient leaching in center-pivot irrigation systems.

4. Ag Leader Technology

Ag Leader has deepened the integration between its SureForce hydraulic downforce control and the InCommand display. The latest development uses field-level data to automatically and precisely adjust individual row unit downforce in real-time. This optimizes seed depth and emergence in variable soil conditions, from soft to compacted, directly from the cab and integrated with their full suite of planting and yield data.

5. BouMatic Robotic B.V.

BouMatic is enhancing its robotic milking systems with advanced animal monitoring. Their latest Merlin AI system uses 3D cameras and machine learning to analyze cow behavior and body condition scoring automatically. This provides farmers with actionable insights on cow health, estrus detection, and feed efficiency, enabling proactive herd management and reducing daily labor while improving individual animal care.

Conclusion

Smart Agriculture as a game-changer for feeding the world while guarding our planet’s resources. Blending simple tech like sensors and apps into everyday farming helps growers make quick, wise choices that cut waste and lift output without harming the soil or air. This shift not only eases the strain on land and water but also opens doors for fresh jobs in tech-savvy rural spots.