Quick Navigation

Overview

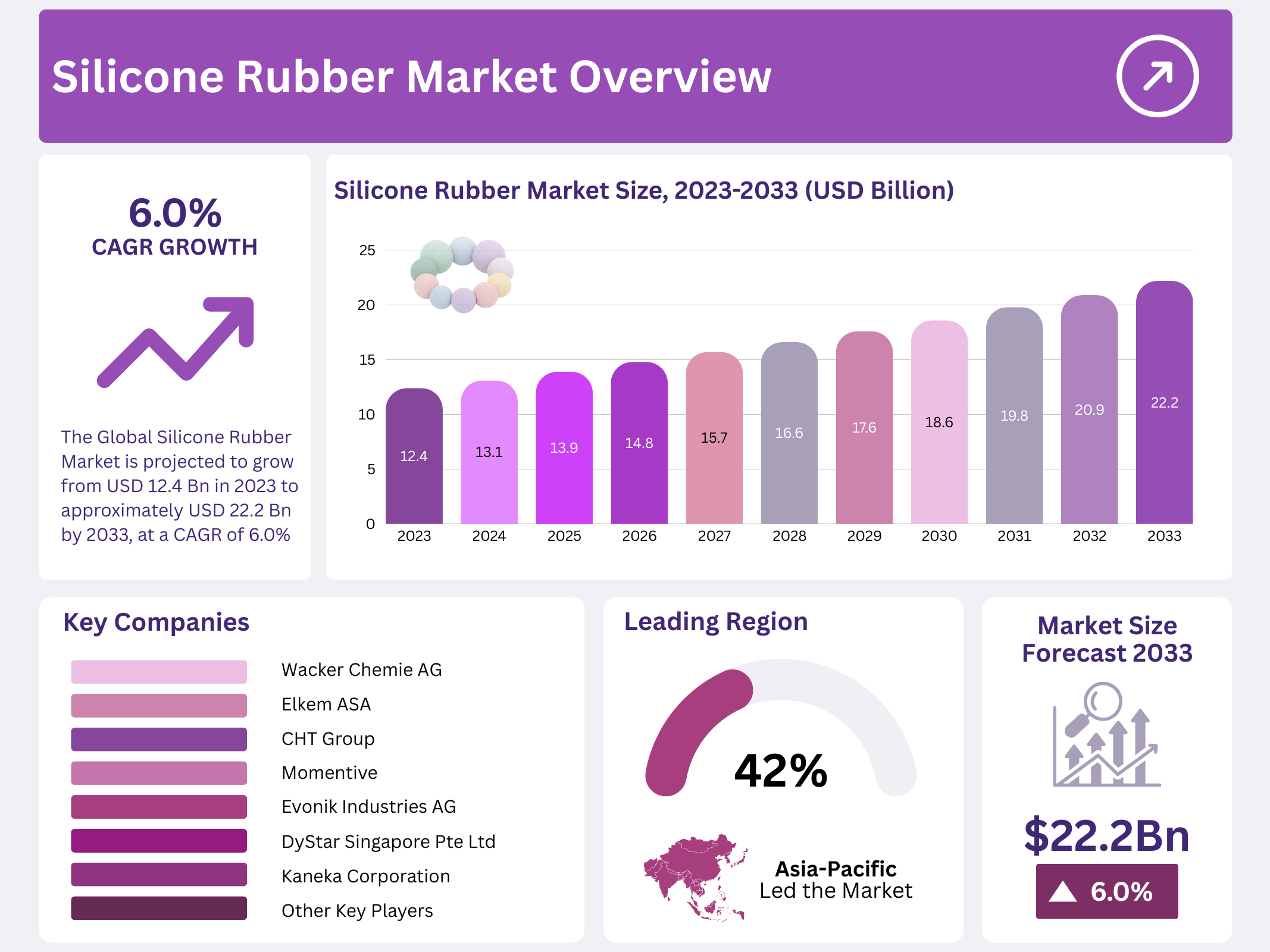

New York, NY – January 01, 2026 – The global Silicone Rubber Market is projected to reach a value of approximately USD 22.2 billion by 2033, rising from USD 12.4 billion in 2023. This growth reflects a steady CAGR of 6.0% over the forecast period from 2023 to 2033, supported by increasing demand across multiple industrial and consumer applications.

Silicone rubber is a high-performance elastomer produced from a combination of silicon, oxygen, carbon, and hydrogen. It is valued for its exceptional properties, including high thermal stability, flexibility, resistance to extreme temperatures, strong electrical insulation, and excellent weathering performance. These characteristics make silicone rubber suitable for use in demanding environments where durability and reliability are critical.

The market includes a broad ecosystem of manufacturers, suppliers, and end-users involved in the production and application of silicone rubber products. Key end-use sectors include automotive, electronics, construction, healthcare, and consumer goods. Continuous innovation in material formulations and processing technologies is further enhancing product performance, supporting the expanding adoption of silicone rubber worldwide.

Key Takeaways

- The Global Silicone Rubber Market is projected to grow from USD 12.4 billion in 2023 to approximately USD 22.2 billion by 2033, at a CAGR of 6.0% during the 2023–2033 forecast period.

- HTV (High-Temperature Vulcanizing) silicone rubber held the leading position with over 48.5% market share in 2023.

- The Automotive & Transportation sector was the largest end-use segment in 2023, accounting for 36.7% of the market share.

- The Asia-Pacific (APAC) region dominated global demand in 2023, capturing over 42.3% share with a market value of USD 5.02 billion.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 12.4 Billion |

| Forecast Revenue (2033) | USD 22.2 Billion |

| CAGR (2024-2033) | 6.0% |

| Segments Covered | By Product Type(Room Temperature Vulcanized (RTV), High-Temperature Vulcanized (HTV), Liquid Silicone Rubber (LSR)), End-Use(Automotive & Transportation, Electrical & Electronics, Industrial Machinery, Consumer Goods, Construction, Healthcare, Others) |

| Competitive Landscape | Wacker Chemie AG, Dow Shin-Etsu Chemical Co. Ltd, Elkem ASA, Momentive Silicone, BRB International, CHT Group, DyStar Singapore Pte Ltd, Evonik Industries AG, Hoshino Silicon Industry Co. Ltd, Jiangsu Mingzhu Silicone Rubber Material Co. Ltd, Kaneka Corporation, Mitsubishi Chemical Holdings Corporation, Momentive, Shin-Etsu Chemical Co. Ltd., Wynca Group |

Key Market Segments

By Product Type

High-Temperature Vulcanized (HTV): In 2023, HTV led the silicone rubber market with over 48.5% share. Its dominance is driven by superior heat resistance and mechanical strength, making it well-suited for demanding applications such as automotive components and heavy-duty industrial parts that operate under extreme conditions.

Room Temperature Vulcanized (RTV): RTV maintained a strong market position in 2023 due to its ease of use and curing at room temperature. Commonly applied in sealants, adhesives, and mold-making, its flexibility and convenience continue to support steady adoption across multiple end-use sectors.

Liquid Silicone Rubber (LSR): LSR emerged as a significant segment in 2023, capturing substantial market traction. Its liquid form enables precision molding and high production efficiency, driving widespread use in medical devices, consumer products, and automotive components where consistency and design flexibility are critical.

By Application

Automotive & Transportation: Automotive & Transportation dominated the market in 2023, accounting for a 36.7% share. Silicone rubber is widely used for gaskets, hoses, and insulation materials due to its durability, thermal stability, and electrical performance.

Electrical & Electronics: The Electrical & Electronics segment recorded strong demand in 2023. Silicone rubber’s excellent insulation properties, flexibility, and resistance to heat and moisture make it essential for protecting sensitive electronic components.

Industrial Machinery: Industrial Machinery applications showed solid growth in 2023. Silicone rubber supports equipment reliability by withstanding harsh operating environments, contributing to longer service life and improved operational efficiency.

Regional Analysis

The Asia-Pacific (APAC) region held a dominant position in the global Silicone Rubber Market, accounting for over 42.3% of total demand and reaching a market value of USD 5.02 billion. This strong performance reflects sustained growth supported by broad-based industrial consumption across the region.

APAC’s leadership is closely linked to high silicone rubber usage in key industries such as automotive, electrical & electronics, and healthcare. Expanding vehicle production, rising electronics manufacturing, and growing medical device demand significantly boosted material consumption, reinforcing the region’s market strength.

Rapid economic development across major APAC economies further accelerated silicone rubber demand. Large-scale infrastructure projects, increased industrial investments, and continuous expansion of manufacturing capacities created a favorable environment for market growth. In parallel, population growth and a rising middle-class base drove higher consumption of automobiles, consumer electronics, and healthcare products—each relying heavily on silicone rubber for performance, durability, and safety.

Top Use Cases

- Medical Devices: Silicone rubber is widely used in healthcare for making implants, catheters, and seals in medical pumps due to its biocompatibility and inert nature. It withstands sterilization processes and doesn’t react with body fluids, making it ideal for long-term implants and IV components. This ensures safety and reliability in patient care applications.

- Automotive Parts: In the automotive sector, silicone rubber serves in gaskets, seals, hoses, and wire insulation. Its ability to handle extreme temperatures and resist chemicals helps in engine components and electrical systems. This enhances vehicle performance, reduces maintenance, and supports electric vehicle advancements with better insulation.

- Electronics Protection: Silicone rubber protects electronic components like circuit boards and LED devices from moisture, dust, and heat. It’s used in insulators, coatings, and encapsulants to ensure durability in gadgets and communication infrastructure. This makes it essential for reliable performance in consumer electronics and displays.

- Construction Materials: For construction, silicone rubber is applied in sealants, adhesives, and weatherproofing for buildings, bridges, and pipelines. Its resistance to weathering and UV rays helps maintain structural integrity in harsh environments. This is crucial for long-lasting infrastructure in residential and commercial projects.

- Food Processing: Silicone rubber is popular in food storage and preparation items like bakeware, baby bottles, and seals due to its non-toxic and heat-stable qualities. It prevents contamination and withstands high temperatures in ovens or freezers, making it a safe choice for household and dairy products.

Recent Developments

1. Wacker Chemie AG

Wacker is expanding its silicone rubber portfolio for sustainable mobility, focusing on high-consistency rubber (HCR) for low-compression-set, high-voltage cable gaskets in EVs. They also launched new liquid silicone rubber (LSR) grades for soft-touch, flame-retardant components in consumer electronics and automotive interiors, enhancing performance under extreme temperatures.

2. Dow Shin-Etsu Silicones

A joint venture between Dow and Shin-Etsu, the company is advancing silicones for next-gen EVs. Key developments include new thermally conductive LSR formulations for battery thermal interface materials (TIMs) and specialized HCR for sealing autonomous vehicle sensors, ensuring durability and signal clarity.

3. Elkem ASA

Elkem is innovating in sustainable silicone rubber with its “BlueSight” range, incorporating traceable, recycled silicone raw materials. They have launched new self-adhering LSR grades that bond to thermoplastics without primers, simplifying multi-material manufacturing for automotive and medical device overmolding applications.

4. Momentive Performance Materials

Momentive introduced the Silplus LSR 9000 series, designed for advanced e-mobility applications like battery pack seals and cooling system components. These grades offer superior hydrolysis resistance and stable dielectric properties, critical for protecting high-voltage EV systems from moisture and harsh environments.

5. BRB International

BRB has expanded its SILFOS range of fluorosilicone rubber materials, which offer exceptional fuel and oil resistance. Recent developments target aerospace and premium automotive sectors, providing high-temperature stable sealing solutions for demanding fuel system and engine applications where standard silicones fail.

Conclusion

Silicone Rubber stands out as a highly adaptable material, driving innovation across industries, fueled by growing demands in construction, electronics, and healthcare. Its expanding applications in emerging areas like electric vehicles and personal care reflect ongoing product development and technological progress, positioning it for sustained relevance in diverse markets amid urbanization and industrial growth.