Quick Navigation

Overview

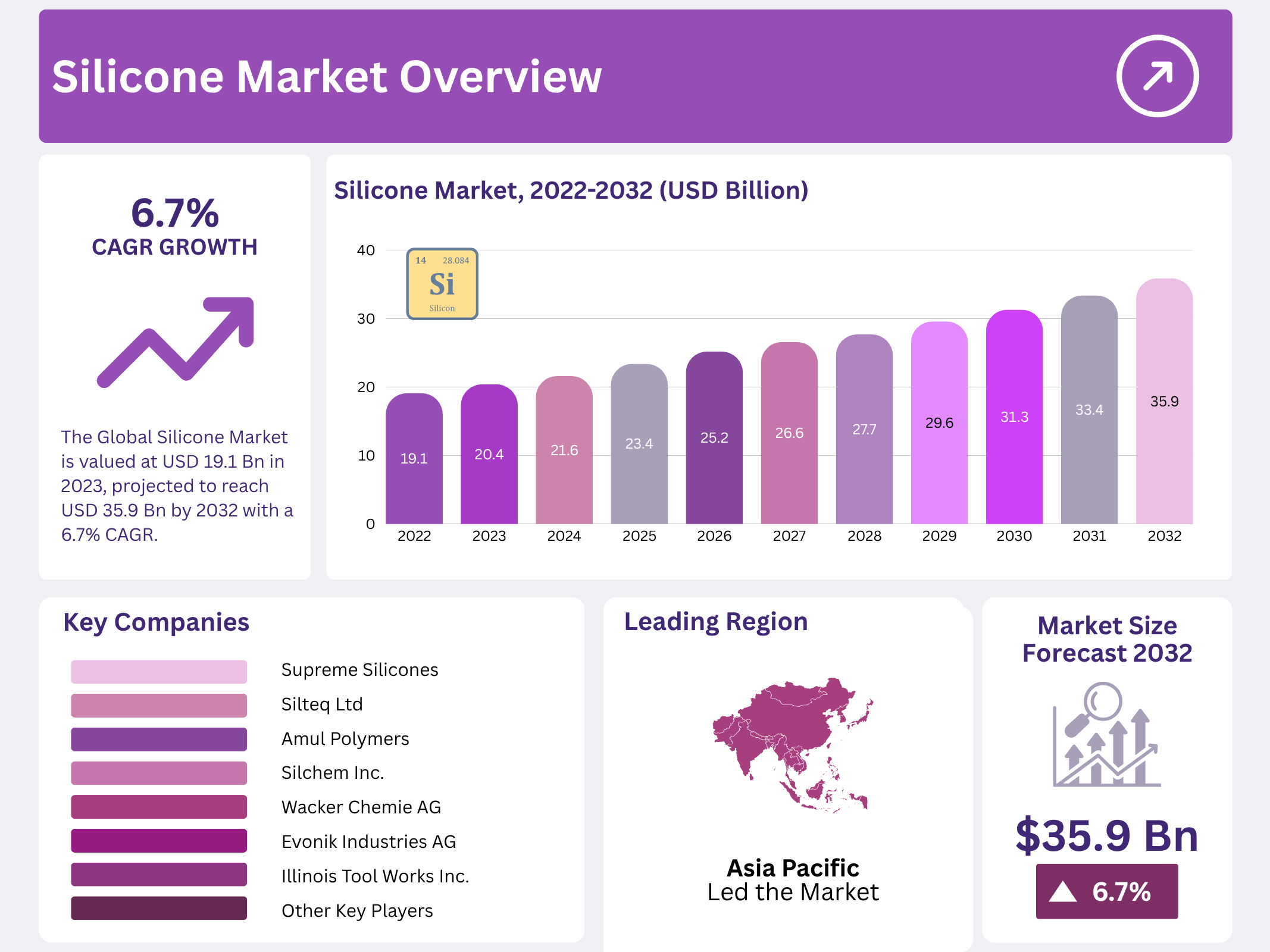

New York, NY – November 05, 2025 – The Global Silicone Market was valued at USD 19.1 billion and is projected to reach USD 35.9 billion by 2032, expanding at a CAGR of 6.7% from 2023 to 2032. Growth in this market is primarily fueled by the increasing demand for silicones across a range of end-use industries such as construction, personal care, automotive, and industrial processes.

However, in mature markets like the U.S., growth is expected to remain moderate due to limited expansion opportunities in the manufacturing sector. Despite this, ongoing product innovation and technological advancements are creating new avenues for silicone applications, particularly in electric vehicles (EVs) and health & personal care products.

Silicones encompass a broad family of polymers and higher oligomers available in various physical forms ranging from solids and liquids to semi-viscous pastes, oils, and greases. These materials are valued for their unique multifunctional properties, including sealing, lubricating, bonding, releasing, defoaming, and encapsulating capabilities. They are electrically conductive, resistant to cracking, peeling, or crumbling with age, and offer excellent insulation, waterproofing, and coating performance, making them indispensable across numerous modern industrial and consumer applications.

Key Takeaways

- The Global Silicone Market is valued at USD 19.1 billion in 2023, projected to reach USD 35.9 billion by 2032 with a 6.7% CAGR.

- Elastomers hold the largest revenue share due to versatility in processing and base molecules.

- The industrial process segment leads in revenue with uses as antifoams, lubricants, drilling fluids, and paint additives.

- Silicones in coatings/paints enhance durability, heat resistance, corrosion protection, and reduce maintenance costs.

- Asia Pacific dominates the market with the highest revenue from diverse manufacturers and production scale.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 19.1 Billion |

| Forecast Revenue (2032) | USD 35.9 Billion |

| CAGR (2023-2032) | 6.7% |

| Segments Covered | By Product – Fluids (Straight Silicone Fluids and Modified Silicone Fluids), Gels, Resins, Elastomers (HTV, LSR, and RTV), and Other Products (Adhesives, and Emulsions); By End-User Industry – Electronics, Transportation, Construction, Healthcare, Personal care and Consumer Goods, Energy, Industrial Processes, and Other End-User Industries |

| Competitive Landscape | Supreme Silicones, Elkay Chemicals Pvt. Ltd., Shin-Etsu Chemical Co., Ltd., Silchem Inc., Silteq Ltd, Amul Polymers, Wacker Chemie AG, Specialty Silicone Products, Inc., Illinois Tool Works Inc., Evonik Industries AG, Nano Tech Chemical Brothers Private Ltd., and Other Key Players |

Key Market Segments

Product Analysis

Elastomers lead the silicone market, holding the largest revenue share. Made by blending linear polymers with cross-linkers and reinforcing agents, these vulcanized materials vary by processing temperature and base molecules. Room-temperature vulcanizing (RTV) silicone rubber offers soft-to-medium hardness, strong adhesion without heat, and easy removal. With superior heat and electrical resistance, it seals gaps, forms gaskets, and supports electric vehicles, aerospace, energy, and consumer electronics.

End-User Analysis

The industrial process segment generates the highest revenue in silicone applications. Widely used as antifoams, lubricants, drilling fluids, paper production aids, and paint additives, silicones enhance performance across industries. In coatings and paints, they boost durability, heat resistance, and protection against corrosion and chemicals, cutting maintenance costs and extending the life of machinery and infrastructure.

Construction follows closely as a key revenue driver. Silicone sealants secure expansion, connection, and movement joints, ensuring structural stability. They add flexibility to buildings, helping materials withstand wind and earthquake stress. By sealing cracks, these sealants improve energy efficiency, keeping out moisture and cold air while supporting durable, sustainable structures.

Regional Analysis

Asia Pacific Leads with the Largest Market Share

Asia Pacific dominates the global silicone market, capturing the biggest revenue slice. The region hosts a mix of small, medium, and large manufacturers, fueling strong production. Companies are shifting factories here from North America and Europe due to abundant raw materials, low labor costs, and growing demand in transportation, construction, electronics, personal care, and healthcare. Rising prices and market expansion will drive the fastest growth in these key sectors.

Europe Holds Second Position with Steady Growth

Europe ranks second, powered by demand for lightweight silicones in construction and transportation. Booming building activity in France, Germany, Spain, and the UK supports a steady market rise. Government incentives, tax breaks, and EU funding boost construction projects. Though COVID-19 slowed demand in buildings, vehicles, and consumer goods, the shift to electric vehicles is now reviving growth in the transportation sector.

North America Secures Third Place with Diverse Applications

North America stands third, driven by widespread silicone use in transportation, construction, personal care, manufacturing, and energy. The region excels in silicone additives for plastics, composites, paints, coatings, and food products. Strong healthcare infrastructure and major producers fuel demand for medical-grade silicones. Future growth looks bright with rising needs for minimally invasive surgeries, advanced implants, and high-quality medical devices across the United States.

Top Use Cases

- Medical Devices and Implants: Silicone plays a vital role in healthcare by forming safe, flexible components like tubing, seals, and implants. Its non-toxic nature and ability to withstand sterilization make it ideal for devices such as dialysis pumps and feeding tubes, ensuring patient comfort and reliability in life-sustaining treatments. This use case underscores silicone’s contribution to advancing medical innovation and safety.

- Construction Sealants and Adhesives: In building projects, silicone excels as a weatherproof sealant for windows, doors, and roofs, creating airtight barriers that enhance energy efficiency and prevent leaks. Its long-lasting adhesion to various surfaces reduces maintenance needs, making it a go-to choice for durable structures in harsh climates. This application drives cost savings and sustainability in the construction sector.

- Kitchen Utensils and Bakeware: Home cooks rely on silicone for spatulas, baking mats, and molds due to its heat-resistant properties that prevent melting or warping during high-temperature use. Easy to clean and non-stick, it simplifies meal prep while being gentle on cookware, appealing to health-conscious consumers seeking safe, versatile tools for daily cooking routines.

- Automotive Gaskets and Seals: Silicone seals protect vehicle engines and electronics from extreme temperatures and vibrations, ensuring smooth performance in cars and electric vehicles. Its flexibility maintains tight fits over time, reducing wear and improving fuel efficiency, which aligns with the industry’s push for reliable, long-life components in modern transportation systems.

- Electronics Insulation and Coatings: In gadgets like phones and computers, silicone coats wires and components to shield against moisture, heat, and dust, extending device lifespan. This protective layer supports compact designs in consumer tech, meeting demands for robust performance in portable and smart home products amid rising digital connectivity.

Recent Developments

1. Supreme Silicones

Supreme Silicones is focusing on sustainability and high-performance solutions. Recent developments include the launch of new ranges of low-VOC (Volatile Organic Compound) and formaldehyde-free silicone sealants aimed at the green building sector. They are also expanding their production capabilities for silicone-based additives for paints and coatings, emphasizing products that enhance durability and weather resistance, catering to the growing demand for eco-friendly construction materials.

2. Elkay Chemicals Pvt. Ltd.

Elkay Chemicals is expanding its specialized silicone emulsions and compounds portfolio. A key recent development is the introduction of new silicone softeners for the textile industry, designed to provide superior fabric handle with improved yellowing resistance. They are also enhancing their custom manufacturing services, focusing on developing high-purity silicone fluids and antifoams for the pharmaceutical and personal care sectors, aligning with the demand for tailored, high-quality ingredients.

3. Shin-Etsu Chemical Co., Ltd.

Shin-Etsu, a global leader, is making major strategic investments to bolster the silicone supply chain. A significant recent development is the construction of a new integrated silicone manufacturing plant in Southeast Asia to strengthen global supply stability. They are also advancing electronics materials, launching novel silicone adhesives and encapsulants for next-generation semiconductors and electric vehicle power modules. Furthermore, they are expanding production capacity for silicones used in healthcare applications.

4. Silchem Inc.

Silchem Inc. has been actively launching new products for the cosmetics and personal care market. A key recent development is the expansion of their EcoSilicone line, which includes novel elastomer gels and surface-treated powders that are vegan and derived from sustainable processes. These ingredients are designed to provide unique sensory profiles and improved functionality in color cosmetics and skincare, responding to the demand for natural-feeling yet high-performance silicone ingredients.

5. Silteq Ltd

Silteq Ltd continues to specialize in high-consistency rubber (HCR) and liquid silicone rubber (LSR) materials. Their recent developments focus on advanced material formulations for demanding applications. This includes introducing new grades of self-lubricating LSR for dynamic seals in automotive and medical devices, and thermally conductive HCR for thermal management in electronics. They emphasize providing technical solutions and custom-compounded materials to meet specific customer requirements in highly engineered sectors.

Conclusion

Silicone stands out as a cornerstone material in today’s dynamic market, blending unmatched versatility with essential properties like durability and adaptability across diverse sectors. Its quiet yet profound influence on innovation—from safer healthcare tools to efficient building solutions—positions it as a reliable partner for sustainable progress. Looking ahead, as industries prioritize eco-friendly and high-performance options, silicone’s role will only deepen, fostering smarter, more resilient products that enhance everyday life without compromising quality or safety.