Quick Navigation

Overview

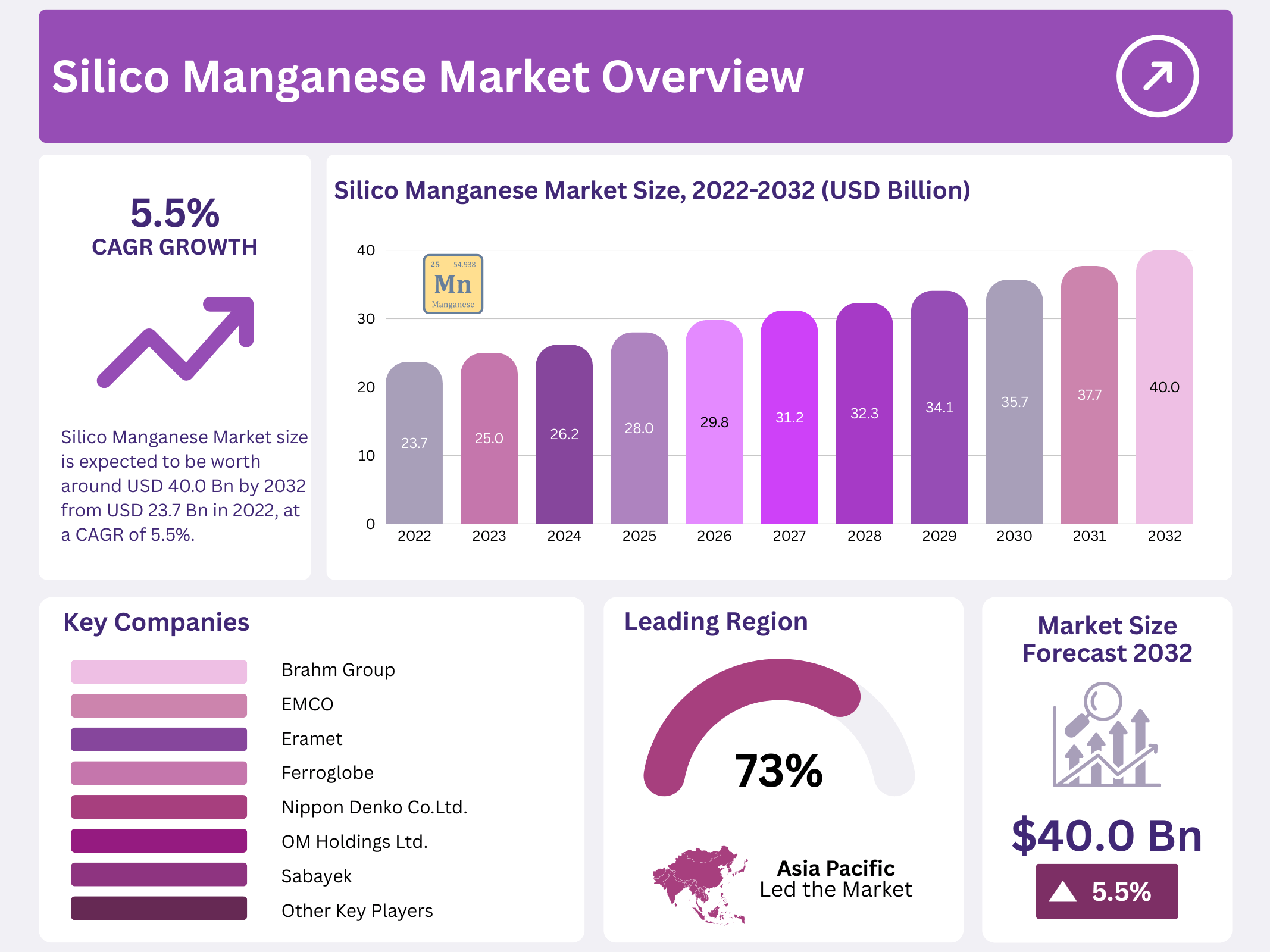

New York, NY – September 18, 2025 – The Global Silico Manganese Market is on a steady growth path, with the market size expected to reach USD 40.0 billion by 2032, up from USD 23.7 billion in 2022, growing at a CAGR of 5.5% over that period. Demand is being driven by rising steel production, especially in construction, infrastructure, and automotive sectors, since silico-manganese provides strength, durability, and improved performance in steel alloys.

The increasing pace of urbanization, industrialization, and large public works globally is also fuelling that demand. Market popularity is high in regions where steelmaking is expanding, Asia-Pacific being a key contributor, while innovations in processing methods and technology upgrades are helping producers offer higher-purity and more efficient products.

Opportunities exist in developing newer, cleaner production technologies, in emerging markets with fast growth in infrastructure needs, and in the increasing demand for specialized steel grades. Market expansion is likely in regions investing heavily in infrastructure, as well as in industries pushing for higher-performance steels (automotive, appliances, construction). Despite challenges such as raw material price volatility and environmental regulation pressures, the overall fundamentals point to solid growth over the next decade.

Key Takeaways

- The Global Silico Manganese Market was valued at USD 23.7 billion in 2022, projected to reach USD 40.0 billion by 2032 with a 5.5% CAGR.

- Low-carbon silico manganese held over 33.0% of the global market share in 2022, widely used in stainless steel production.

- Carbon steel accounted for over 32.0% of market revenue in 2022, with stainless steel.

- Asia Pacific led with over 73.0% of global revenue in 2022, fueled by infrastructure investments.

- The Middle East and Africa are projected to see a 5.8% in revenue during the forecast period.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 23.7 Billion |

| Forecast Revenue (2032) | USD 40.0 Billion |

| CAGR (2022-2032) | 5.5% |

| Segments Covered | Based on Product, Low Carbon, Medium Carbon, High Carbon, Other Products, Based on Application, Carbon Steel, Stainless Steel, Alloy Steel, Cast Iron, Other Applications |

| Competitive Landscape | Brahm Group, EMCO (Bahrain Ferro Alloys BSC), Eramet, Ferroglobe, Nippon Denko Co.Ltd, OM Holdings Ltd., Sabayek, Sakura Ferroalloys, Steelforce, Tata Steel Ltd., Sheng Yan Group, PJSC Nikopol, Glencore, Jinneng Group, Other key players |

Key Market Segments

Product Analysis

In 2022, low-carbon silico manganese held a revenue share of more than 33.0% in the global market. Its wide use in stainless steel manufacturing continues to drive demand, and this trend is expected to support steady growth throughout the forecast period. On the other hand, fueled by the rising demand for cast iron. Growing investments across industries such as kitchenware, machinery and tool production, and construction are anticipated to further strengthen the outlook for this segment.

Application Analysis

By application, carbon steel accounted for over 32.0% of global silicon manganese revenue in 2022. Its superior strength makes it a key material for construction, railroad tracks, and machinery components, and ongoing investment in these areas is set to reinforce growth. Supported by rising electric vehicle adoption and robust construction activity worldwide. Cast iron also remains a crucial application segment, with demand driven by its durability, high thermal conductivity, wear resistance, and ease of machining, making it indispensable in automotive, machinery, and equipment manufacturing.

Regional Analysis

Asia Pacific dominated the market in 2022, capturing more than 73.0% of global revenue. This leadership is closely tied to large-scale infrastructure development projects initiated by regional economies in the post-pandemic recovery phase. Looking ahead, underpinned by private sector investment aimed at expanding steel production.

Central and South America are also expected to grow steadily, largely supported by increased oil and gas investments, which in turn will drive regional steel demand and create growth opportunities for the silicon manganese market.

Top Use Cases

- Deoxidizer in Steel Production: As a market research analyst, I see silico manganese playing a key role in steel mills where it removes excess oxygen from molten metal during smelting. This simple process helps create cleaner, purer steel by forming easy-to-remove silicates.

- Alloying Agent for Stronger Steel: In my analysis, silico manganese boosts steel’s toughness by adding manganese and silicon, which improve strength and wear resistance. Steelworkers mix it in to make metal that lasts longer under stress, like in tools or machinery parts. This enhancement reduces brittleness and enhances heat tolerance, allowing for reliable products in factories.

- Enhancer for Stainless Steel Grades: From a market view, silico manganese is vital for crafting stainless steel used in kitchenware and pipes, as it refines the alloy to resist rust better. By controlling impurities during melting, it ensures smooth, corrosion-free surfaces. This makes everyday items like sinks and utensils safer and longer-lasting.

- Component in Automotive Parts: As an analyst tracking trends, I note how silico manganese strengthens car frames and engines by making steel more flexible yet hardy. It gets added to alloys for parts like chassis and gears, improving safety and fuel efficiency. With more vehicles on roads, this use case drives a steady need, helping automakers produce lighter.

- Desulfurizer in Metal Refining: In refining processes, silico manganese acts as a simple sulfur remover, binding it into harmless compounds that float away. This cleans up steel for smoother finishes in construction bars or ship hulls. My research shows it cuts production flaws, leading to fewer rejects and better quality.

Recent Developments

1. Brahm Group

Brahm Group is focusing on expanding its product portfolio and global supply chain resilience. While specific smelter news is limited, the group’s strategic movements in trading and raw material sourcing are crucial for the silico manganese market. Their activities highlight a focus on serving international steelmakers with consistent, high-quality ferroalloys.

2. EMCO (Bahrain Ferro Alloys BSC)

EMCO is operational under its parent, Gulf Ferro Alloys Company (GFAC). A significant recent development is the planned major maintenance shutdown of one of its four silico manganese furnaces in 2024. This temporary reduction in capacity is a key market event, impacting regional supply and underscoring the company’s role as a major producer in the Middle East.

3. Eramet

Eramet reported a significant surge in its Mn segment revenue for 2023, driven by robust silico manganese sales volumes, particularly from their plants in Norway and the US. The company is strategically leveraging its integrated mining-to-processing model to maintain a strong market position, focusing on operational efficiency to navigate volatile energy costs in Europe.

4. Ferroglobe

Ferroglobe continues to optimize its global asset portfolio. A key recent action is the planned indefinite idling of its silico manganese plant in Niagara Falls, USA, announced in early 2024. This decision, attributed to high energy costs and market conditions, is a significant shift aimed at improving the company’s overall cost structure and profitability by concentrating production in more competitive locations.

5. Nippon Denko Co. Ltd.

Nippon Denko maintains a stable production profile focused on the domestic Japanese and premium Asian markets. Recent developments are centered on technological advancements and meeting the stringent quality demands of special steel producers. The company’s strategy emphasizes high-purity, value-added products and sustainable practices to strengthen its niche position rather than volume-based expansion.

Conclusion

Silico Manganese remains a cornerstone in the steel sector, quietly powering everything from towering buildings to sleek vehicles through its straightforward role in enhancing metal quality. Its ability to refine and fortify alloys meets the endless call for reliable materials amid booming construction and transport needs. Looking forward, this versatile additive will keep fueling innovation in everyday manufacturing, ensuring stronger, safer products that shape our growing world without fanfare.