Quick Navigation

Introduction

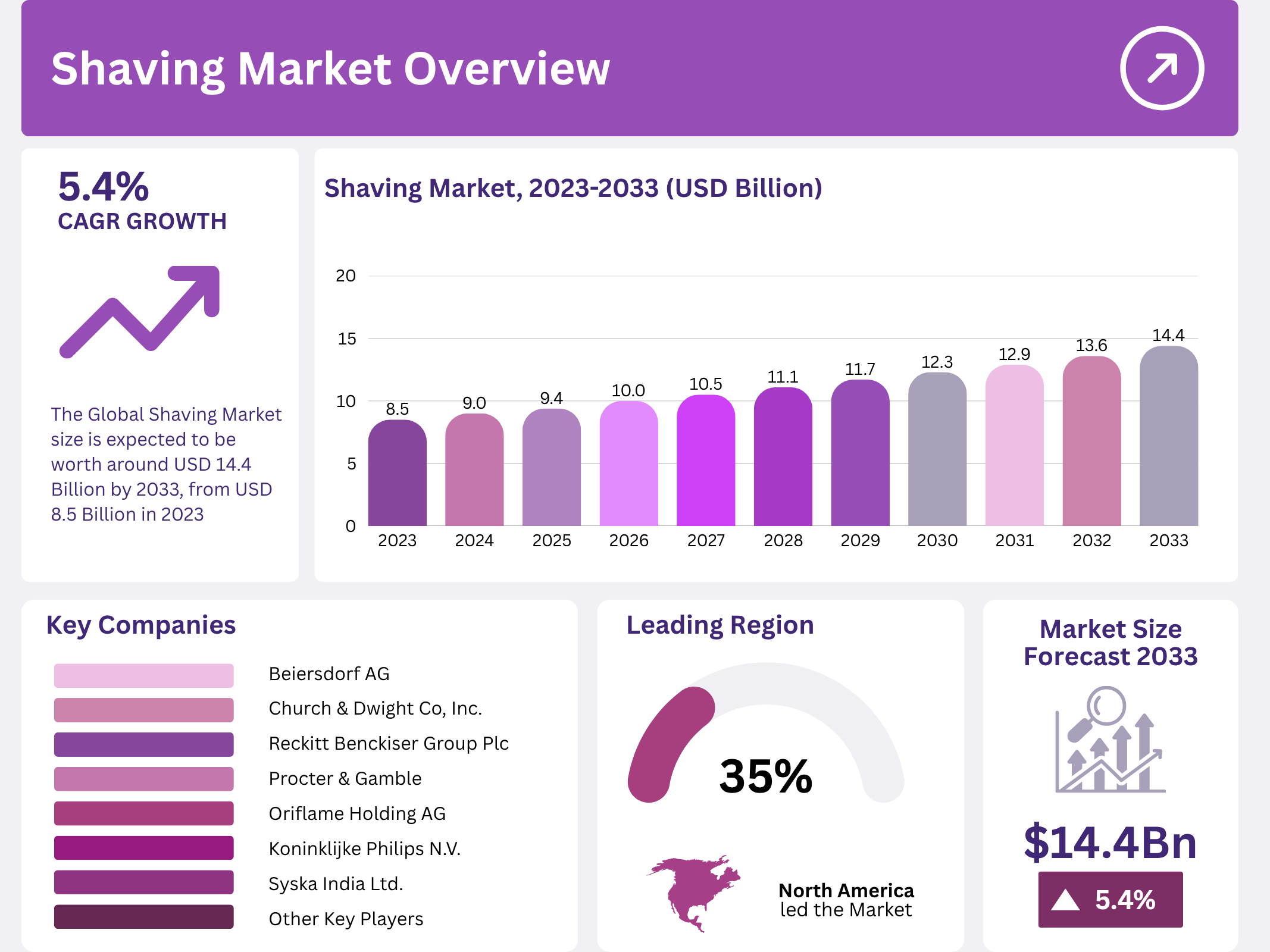

The Global Shaving Market has witnessed consistent expansion, valued at USD 8.5 Billion in 2023 and projected to reach USD 14.4 Billion by 2033, growing at a CAGR of 5.4%. The rising trend of grooming and self-care among both men and women continues to propel demand across global markets.

Shaving is an essential grooming routine encompassing razors, blades, gels, and electric shavers. Growing disposable income and lifestyle changes are driving adoption, particularly in urban areas. Moreover, the surge in sustainable and organic products has reshaped consumer purchasing decisions toward eco-friendly options.

Additionally, the influence of digital marketing and e-commerce channels has expanded the accessibility of shaving products. The convenience of online platforms and personalization options are creating a new wave of innovation in this evolving market landscape.

Key Takeaways

- The Shaving Market was valued at USD 8.5 Billion in 2023 and is projected to reach USD 14.4 Billion by 2033, growing at a CAGR of 5.4%.

- In 2023, Razors and Blades held the largest revenue share due to essential grooming needs.

- Beard Moisturizers and Pre-Shave Creams experienced the fastest growth, supported by rising male grooming trends.

- Offline Distribution dominated with 65.8% market share, driven by accessibility and immediate availability.

- Online Distribution recorded the fastest growth, aligning with the rapid expansion of e-commerce platforms.

- North America dominated the market with 35.0% share, valued at USD 2.98 Billion.

Market Segmentation Overview

In the product category, Razors and Blades dominated the global shaving market in 2023. The segment benefits from constant innovation, including ergonomic designs, precision-engineered blades, and advanced materials that enhance durability and comfort. Companies continue to introduce multi-blade systems and sustainable alternatives catering to diverse skin types.

In terms of distribution channels, Offline Stores retained the majority share at 65.8% in 2023, supported by consumer preference for in-store purchases and immediate availability. Meanwhile, the Online Channel witnessed rapid expansion due to the rise of e-commerce, subscription-based sales, and global reach through digital marketing.

Drivers

Increasing Grooming Awareness: Rising awareness about personal hygiene and grooming standards has significantly boosted demand for shaving products. Consumers view grooming as part of self-expression and professionalism, increasing the market penetration of premium razors, gels, and skincare products.

Rising Disposable Income: According to the Bureau of Economic Analysis (BEA), disposable personal income in the U.S. rose by 4.2% in Q4 2023. This economic uplift supports higher spending on grooming essentials and luxury shaving kits, fueling the adoption of premium and customized solutions.

Use Cases

Daily Personal Grooming: Shaving remains integral to daily hygiene routines, especially among working professionals seeking a clean appearance. Regular beard maintenance also supports continuous demand for blades, razors, and after-shave care products globally.

Specialized Skin and Beard Care: The rise of sensitive-skin products and beard moisturizers caters to consumers seeking comfort and skin protection. Pre- and post-shave products have become part of an expanding self-care regimen among both men and women.

Major Challenges

High Competition and Price Pressure: The shaving industry is crowded with established brands and emerging startups. This intense competition forces companies to innovate continuously while maintaining competitive pricing, putting pressure on profit margins.

Environmental Impact and Health Concerns: Disposable razors and non-recyclable packaging have raised environmental issues. Furthermore, concerns about skin irritation and allergies from chemical-based products deter some consumers, pushing brands toward cleaner, eco-conscious alternatives.

Business Opportunities

Eco-Friendly Product Development: Growing consumer demand for sustainable and biodegradable grooming tools presents a key opportunity. Brands investing in recyclable packaging, reusable razors, and natural shaving formulations stand to gain long-term loyalty.

Expansion in Emerging Markets: Rapid urbanization and rising middle-class incomes in regions such as Asia Pacific and Latin America open doors for international brands. Localized product strategies and affordable premium options can help companies tap into these growing segments.

Regional Analysis

North America: Holding a 35.0% market share worth USD 2.98 Billion, North America remains dominant due to strong consumer spending and brand loyalty. Premium grooming products, advanced retail networks, and sustainable innovations continue to drive steady regional growth.

Asia Pacific: The region is witnessing rapid expansion fueled by younger demographics, digital adoption, and rising disposable incomes. Countries such as China, Japan, and South Korea are fostering local brands that cater to personalized grooming preferences and sustainability trends.

Recent Developments

- October 2024 – OneBlade Dawn Razor: Designed by PENSA in collaboration with OneBlade, this razor emphasizes sustainability with recyclable stainless steel and aluminum. It won the 2024 Green Good Design Award for eco-friendly innovation.

- September 2024 – Dentsu X & Vi-John Partnership: Dentsu X secured the integrated media mandate for Vi-John Healthcare’s shaving segment, focusing on cross-platform brand engagement and strategic campaigns.

- April 2024 – Bombay Shaving Company Funding: The brand raised INR 24 Crore (USD 3 Million) in debt funding from Alteria Capital to expand its offline presence and strengthen its razor portfolio.

- September 2024 – MANSCAPED® Product Launch: MANSCAPED® introduced The Chairman™ Pro electric foil shaver with SkinSafe® Technology and waterproof features, expanding premium face shaving solutions in North America.

Conclusion

The Global Shaving Market continues to evolve with innovation, sustainability, and digital transformation at its core. As consumers demand more personalized, eco-friendly, and technologically advanced grooming solutions, companies that prioritize research, strategic partnerships, and regional diversification will sustain long-term growth. With robust demand across key markets, the industry remains poised for dynamic expansion through 2033.