Quick Navigation

Introduction

The global Robotic Process Automation (RPA) market is experiencing rapid acceleration as organizations increasingly adopt automation to drive cost-efficiency, accuracy, and digital transformation. With rising operational complexities, enterprises are turning to RPA as a scalable solution that enhances workflow speed and reduces human error.

Moreover, integration with advanced technologies like artificial intelligence and machine learning continues to expand RPA’s capabilities. As industries seek improved productivity, agility, and data-driven decision-making, RPA stands at the forefront of next-generation enterprise automation strategies worldwide.

Additionally, the global market’s strong compound annual growth highlights its expanding relevance. Businesses across sectors—from BFSI to healthcare—are embracing RPA to automate high-volume tasks and modernize legacy processes, contributing to its rising global demand.

Key Takeaways

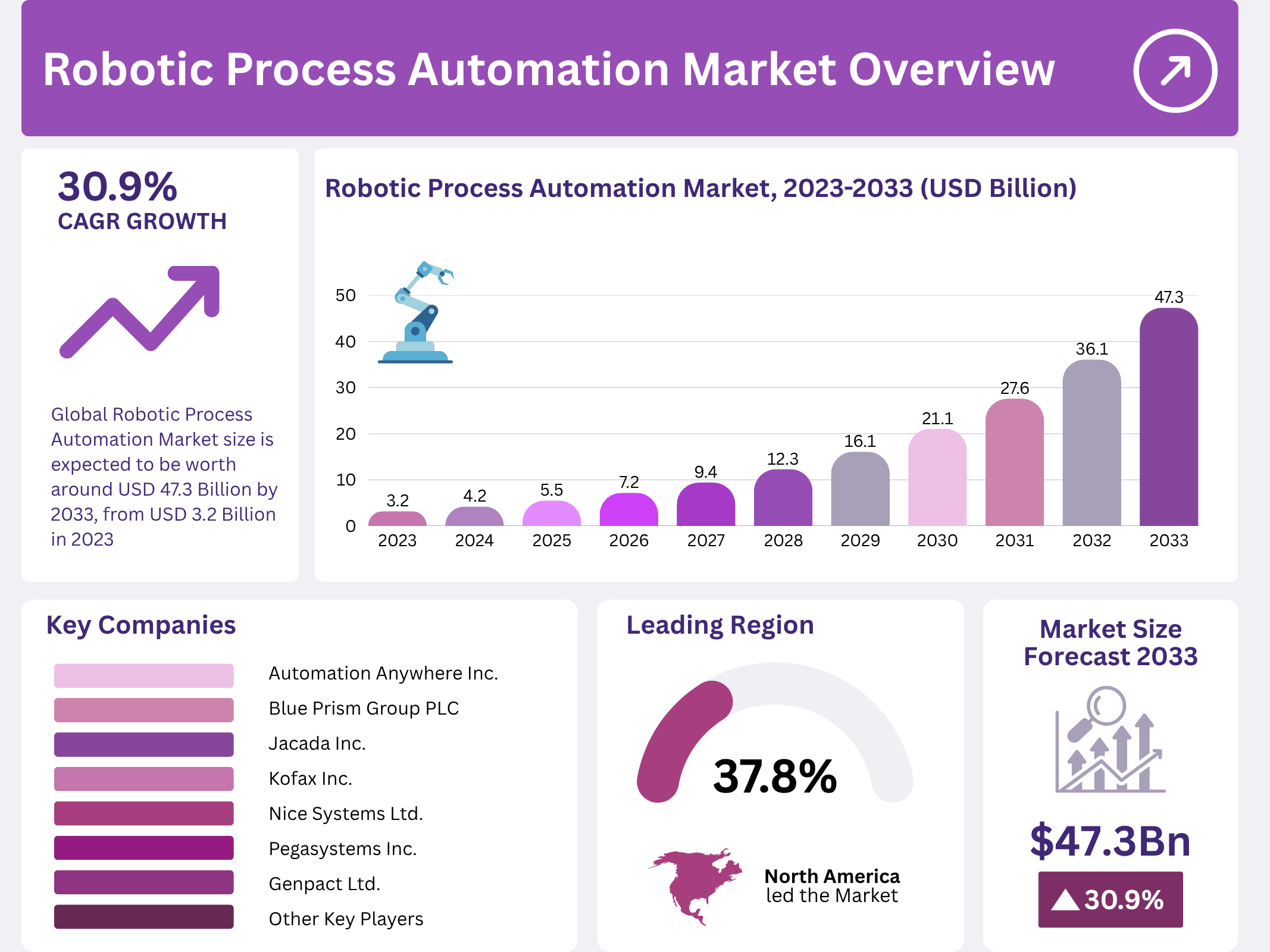

- The Global Robotic Process Automation Market size is expected to be worth around USD 47.3 Billion by 2033, from USD 3.2 Billion in 2023, growing at a CAGR of 30.90% from 2024 to 2033.

- In 2023, Service held a dominant market position in the By Component segment with a 63.4% share.

- In 2023, Large Enterprises led the By Organization segment with a 66.5% share.

- In 2023, Rule Based automation led the By Operation segment with a 67.3% share.

- In 2023, Administration and Reporting dominated the By Application segment with a 26.4% share.

- In 2023, the BFSI sector led the end-use segment with a 28.4% share.

- North America dominated with a 37.8% market share in 2023 and revenues of USD 1.12 Billion.

Market Segmentation Overview

The component segment shows significant demand for service-based RPA offerings, as enterprises increasingly prioritize consulting, deployment, and support services. This segment’s strong growth reflects the need for skilled guidance during RPA integration, enabling businesses to streamline workflows and enhance operational accuracy across complex environments.

The organization segment is led by large enterprises that continue adopting RPA to automate high-volume processes across global operations. Their financial capacity and technological readiness accelerate large-scale RPA deployments, while SMEs gradually enter the market through more affordable and flexible automation solutions.

In the operation segment, rule-based automation dominates due to its ease of implementation and applicability across repetitive, structured tasks. This model drives rapid efficiency gains in industries such as finance and insurance, while knowledge-based automation gradually rises with AI-enhanced decision-making capabilities.

Within the application segment, administration and reporting lead, as companies automate routine tasks like data entry, scheduling, and report generation. RPA strengthens accuracy, reduces manual workload, and improves compliance, helping businesses enhance their overall operational effectiveness.

The end-use segment is primarily driven by the BFSI sector, which relies heavily on automation for claims processing, compliance management, fraud detection, and customer service enhancements. Other sectors such as retail, manufacturing, healthcare, and telecom also adopt RPA to streamline operations and optimize resource utilization.

Drivers

Growing need for operational efficiency: Organizations increasingly adopt RPA to eliminate manual errors, reduce processing times, and minimize labor costs. As enterprises face rising competitive pressure, automating repetitive tasks helps them maintain productivity and deliver consistent output while improving process accuracy.

Integration with AI and ML technologies: Advancements in artificial intelligence and machine learning enhance RPA’s capabilities, enabling it to manage more complex tasks involving decision-making and predictive analytics. This convergence accelerates adoption across industries that require faster data interpretation and cognitive automation.

Use Cases

Financial transaction processing: In the BFSI sector, RPA automates high-volume workflows such as loan processing, claims handling, KYC verification, and regulatory reporting. This reduces turnaround times and strengthens accuracy, helping financial institutions improve customer experience and operational precision.

Healthcare data management: Hospitals and healthcare providers deploy RPA to automate patient record updates, appointment scheduling, billing, and insurance verification. This reduces administrative burdens on staff and ensures faster, error-free handling of sensitive medical information.

Major Challenges

High initial implementation costs: The financial burden associated with software licensing, system upgrades, staff training, and IT integration poses challenges, particularly for SMEs. Many organizations hesitate due to the substantial upfront investment required to deploy RPA effectively.

Data security concerns: Automating processes involving sensitive information raises risks related to unauthorized access and data breaches. Highly regulated industries must ensure strict governance and monitoring, which complicates deployment and increases compliance responsibilities.

Business Opportunities

Increasing adoption by SMEs: As RPA platforms become more affordable and user-friendly, small and medium-sized enterprises are expected to accelerate adoption. This opens new opportunities for vendors to offer tailored automation solutions that cater to smaller operational scopes.

Expansion through AI-driven automation: Demand for intelligent automation continues rising as companies seek to automate decision-based and cognitive tasks. Vendors integrating AI, natural language processing, and analytics into RPA platforms can unlock new revenue streams across data-intensive industries.

Regional Analysis

North America leads global adoption: With strong investment in digital transformation, North America maintains dominance supported by the presence of leading RPA vendors and large enterprises. High adoption in BFSI, healthcare, and telecom drives the region’s substantial market share and revenue growth.

Asia Pacific shows rapid expansion: Driven by increasing automation initiatives and widespread digitalization, Asia Pacific emerges as the fastest-growing region. Countries such as China, India, and Japan are accelerating RPA deployments to modernize business operations and strengthen competitiveness in global markets.

Recent Developments

- In September 2023, Nice Systems Ltd. secured a USD 50 million investment to expand RPA solutions in healthcare and telecommunications.

- In August 2023, Datamatics Global Services Limited launched a new RPA tool tailored for BFSI, enhancing accuracy and transaction speed.

- In July 2023, Kofax Inc. acquired an AI-focused technology firm to strengthen its intelligent automation capabilities.

Conclusion

The global Robotic Process Automation market is poised for substantial long-term growth as businesses accelerate digital transformation efforts. With rising demand across sectors for efficiency, accuracy, and scalability, RPA continues evolving through AI integration and cloud adoption, unlocking broader possibilities for automation.

As organizations navigate challenges such as implementation costs and security concerns, the expanding ecosystem of innovative RPA vendors ensures sustained development. Ultimately, RPA remains a cornerstone technology shaping the future of intelligent enterprise operations worldwide.