Quick Navigation

Overview

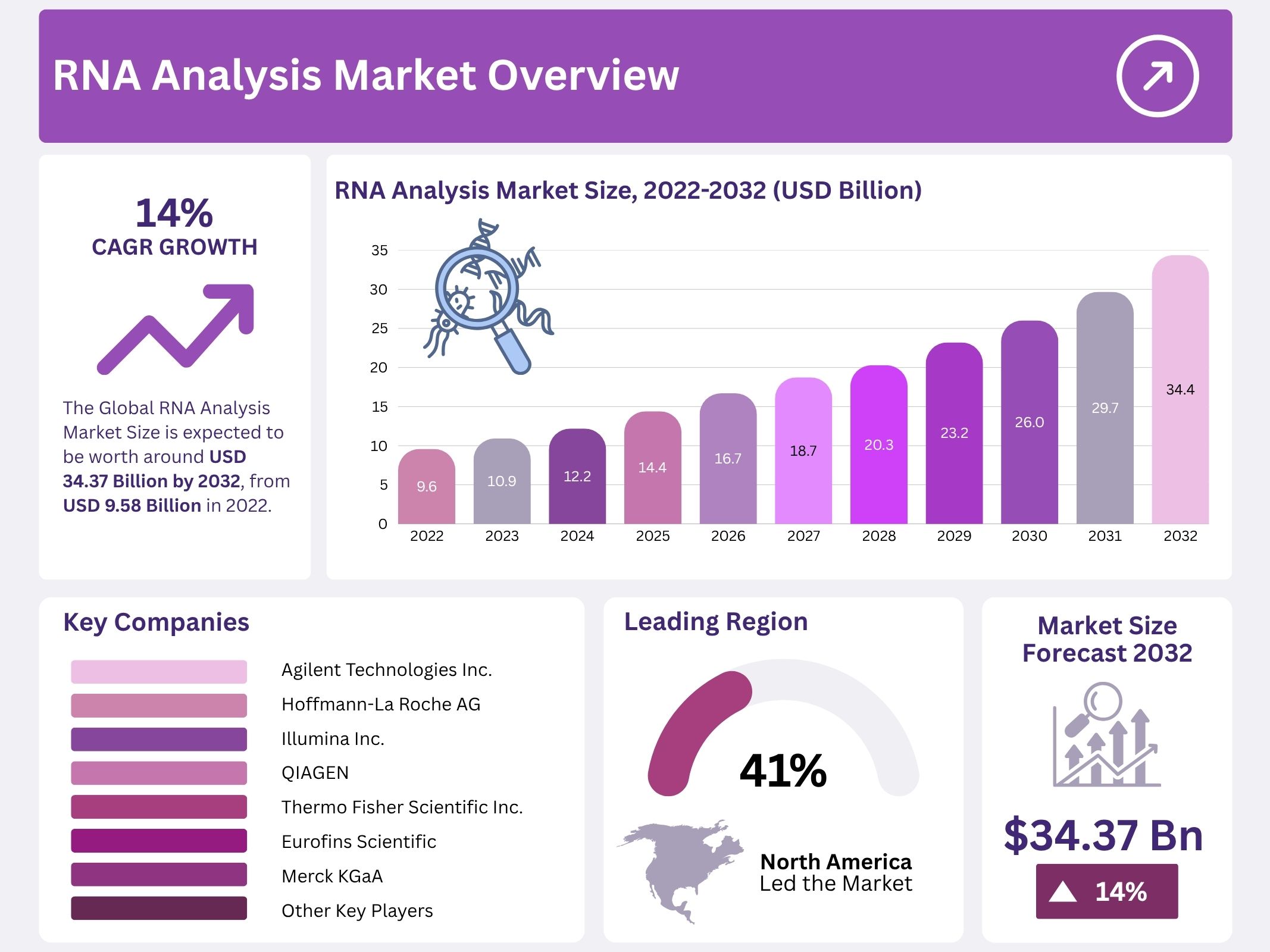

The Global RNA Analysis Market was valued at USD 9.58 billion in 2022. It is projected to reach USD 34.37 billion by 2032. A compound annual growth rate of approximately 14% is anticipated during 2023–2032. Growth is being driven by increasing demand for molecular understanding and accurate profiling of biological systems. Greater use of transcriptomics for research and clinical decision-making is also contributing. Expanding adoption in pharmaceutical and biotechnology sectors has further strengthened the industry outlook.

A strong focus on decoding gene expression and disease pathways has supported market progress. Researchers are prioritizing molecular signatures that explain disease onset and progression. Precision medicine initiatives are expanding, and demand for targeted therapies is increasing. RNA-based platforms enable accurate disease characterization and treatment selection. As a result, their deployment across oncology, neurology, and immune-related disorders has accelerated. Market growth is expected to remain steady as research becomes more patient-specific and data-driven.

Technological improvements have played a crucial role in shaping this market. Sequencing systems have become more efficient, while bioinformatics capabilities have advanced. High-throughput platforms now enable faster and more cost-effective RNA sequencing and analysis. These advancements have increased accessibility for academic research laboratories and clinical testing facilities. The development of scalable computational tools supports large-volume data interpretation and enhances scientific accuracy. Expanded infrastructure in molecular biology and genomics centers has reinforced technological adoption.

The increasing global burden of cancer, infectious diseases, and genetic disorders has driven strong demand for RNA-focused diagnostic and monitoring tools. RNA-Seq, single-cell transcriptomics, and biomarker-based assays are being explored for early detection and therapeutic evaluation. Their role in identifying disease-specific molecular markers is growing. Healthcare providers are actively integrating RNA platforms into research workflows. Broader use in clinical research and drug development pipelines has strengthened future adoption prospects and reinforced clinical relevance.

Supportive regulatory frameworks and collaborative developments have encouraged industry innovation. Emergency authorizations for mRNA-based vaccines demonstrated the clinical utility and scalability of RNA platforms. This validation has stimulated additional investment and accelerated commercialization. Public and private funding for genomics programs has expanded infrastructure and enhanced research output. Collaboration between academic institutions, pharmaceutical companies, and biotechnology firms has advanced technology development. The market is expected to benefit from sustained investment, improved regulatory clarity, and expanding clinical applications.

Key Takeaways

- The market was valued at USD 9.58 billion in 2022 and is projected to reach USD 34.37 billion by 2032, growing at a strong 14% CAGR.

- Kits and reagents currently represent approximately 57% of the market, driven by significant demand for RNA sequencing, while advanced instruments dominate specialized technology segments.

- Real-time PCR (qPCR) holds roughly 44% of the technology share, supported primarily by extensive adoption in COVID-19 diagnostic workflows and infectious disease testing programs.

- Clinical diagnostics account for around 37% of total applications, with growth supported by rising adoption of personalized medicine and advanced molecular testing protocols.

- Government research bodies and academic institutions contribute nearly 35% market share, supported by high-throughput technology investments and expanding research initiatives.

- North America maintains leadership with approximately 41% market share, backed by advanced healthcare infrastructure, strong research funding, and wider adoption of molecular technologies.

Regional Analysis

North America has been observed as the leading region in the RNA analysis market, holding nearly 41% share. This dominance is supported by strong biopharmaceutical R&D investment and rapid progress in structure-based drug design technologies. Significant focus on transcriptomics research has strengthened regional market performance. Supportive funding environments and private-sector participation have enhanced research capabilities. The rising demand for innovative therapeutic solutions has encouraged pharmaceutical developers to expand RNA-focused projects. These factors together have resulted in robust market growth across North America.

Growing biopharmaceutical investment has been identified as a key driver for market expansion in the United States and Canada. Emphasis on early-stage drug discovery, alongside advancements in precision-based medicine, has accelerated technology adoption. Universities, research institutes, and pharmaceutical enterprises have scaled funding toward genomics and transcriptomics. Favorable regulatory frameworks and advanced healthcare infrastructure have enabled faster adoption of sophisticated RNA sequencing tools. These combined developments have strongly contributed to sustained revenue growth within this regional segment.

Asia Pacific is projected to experience the fastest compound annual growth rate during the forecast timeframe. Increasing government-backed biotechnology initiatives have encouraged rapid scientific innovation. Research funding has risen across major economies, including China, India, and Japan. Investments in modern laboratories and educational programs have improved regional scientific capabilities. Growing interest in precision medicine and personalized therapy has supported demand for RNA analysis technologies. In addition, supportive policy reforms have strengthened research collaborations between academic and industrial bodies across the region.

Japan has demonstrated consistent support for biotechnology and life sciences research through government and non-profit funding. This support has enabled researchers to broaden transcriptomics studies and pursue advanced medical innovation. The Asia Pacific region benefits from cost-efficient manufacturing infrastructure, which attracts global biotechnology partnerships. Strategic collaborations have been established to enhance cancer diagnostics and RNA-based research. For instance, a partnership between Genetron Holdings Ltd. and Thermo Fisher Scientific in China has advanced precision cancer monitoring and strengthened clinical adoption of RNA analytical solutions.

Segmentation Analysis

The kits and reagents segment has been observed to account for approximately 57% of the RNA analysis market. This dominance is attributed to the extensive use of RNA isolation kits, amplification kits, and sequencing kits. The rising focus on transcriptome studies and RNA sequencing has been increasing demand for these products. Major companies operating in this segment include Qiagen N.V., Bio-Rad Laboratories Inc., and New England Biolabs Inc. Instruments such as PCR systems, sequencers, and microarrays also hold notable significance in supporting advanced molecular research.

Real-time PCR (qPCR) technology holds an estimated 44% share of the technology segment. The growth can be attributed to its extensive use during the COVID-19 pandemic for viral RNA detection and monitoring. qPCR provides high sensitivity and quantitative capabilities for clinical and research applications. Its role in evaluating viral RNA, detecting mutations, and assessing antiviral drugs strengthened market adoption. Advanced sequencing platforms and single-cell RNA sequencing technologies are expected to drive further expansion, supported by improved bioinformatics tools and next-generation sequencing developments.

The clinical diagnostics segment commands roughly 37% of the application market. Increasing adoption of RNA-based testing in disease detection and treatment monitoring has been a key driver. Personalized medicine trends have strengthened demand for RNA-focused diagnostic tools. In addition, drug discovery applications are expanding due to the need for innovative therapeutics. Toxicogenomics also represents a growing area, with transcriptomic tools being applied to predict toxicity and develop safer chemicals. Major participants include Roche Diagnostics, Thermo Fisher Scientific Inc., Novartis International AG, and Pfizer Inc.

Government institutes and academic centers represent nearly 35% of end-user demand. This growth is supported by increasing adoption of high-throughput RNA analysis technologies in research environments. Studies in transcriptomics, drug discovery, and clinical development continue to expand institutional investments. Pharmaceutical and biotechnology firms are also increasing utilization of RNA-based platforms for therapeutic advancements. The introduction of platforms like TORNADO-seq in 2021 highlighted ongoing innovation in sequencing workflows. Overall, sustained funding, research programs, and technological advancements are contributing to segment expansion.

Key Market Segments

Based on Product Type

- Kits & Reagents

- Instruments

- Services

Based on Technology

- Real Time-PCR (qPCR) Technology

- Sequencing Technology

- Microarray Technology

- Other Technologies

Based on Application

- Clinical Diagnostics

- Drug Discovery

- Toxic genomics

- Competitive Transcriptomics

Based on End-User

- Government Institutes & Academic Centers

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Hospitals & Clinics

- Other End-Users

Key Players Analysis

The RNA analysis market is characterized by strong competition among established biotechnology and life sciences companies. The competitive landscape is driven by continuous innovation in sequencing systems, sample preparation tools, and computational platforms. Players focus on improving data accuracy, workflow speed, and sequencing cost-efficiency. Major investments in R&D and strategic collaborations strengthen product portfolios. Market expansion in clinical diagnostics, drug discovery, and personalized medicine continues to stimulate competitive advancement across regions, especially in North America, Europe, and Asia-Pacific.

Product launches and technological upgrades are seen as core strategies. Emphasis is placed on developing advanced RNA sequencing kits, extraction systems, and depletion technologies. In May 2021, a leading industry player introduced a ribodepletion kit to enhance RNA sequencing efficiency by removing unwanted rRNA fragments. Companies emphasize high product reliability and broaden applications across transcriptomics, oncology studies, and infectious disease research. Strengthening distribution networks supports penetration into academic institutes, hospitals, and pharmaceutical organizations.

Strategic partnerships and acquisitions play an important role. Alliances with research institutes, biopharma companies, and clinical laboratories support technology uptake and accelerate innovation cycles. Expansion in emerging markets is encouraged through regional partnerships and local product customization. Market players enhance service offerings, including sequencing services and bioinformatics support, to increase customer retention and unlock recurring revenue streams. Growing demand for precision medicine and advanced RNA-based therapeutics supports long-term opportunities.

The competitive environment involves leading biotechnology firms with global operations. Key participants include Thermo Fisher Scientific, Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, Hoffmann-La Roche AG, Danaher Corp., Bio-Rad Laboratories, Inc., Pacific Biosciences of California, Inc., Eurofins Scientific, Merck KGaA, Promega Corporation, and Affymetrix, Inc. Other emerging companies also contribute to market growth through innovation in sequencing workflows, scalable platforms, and sample processing solutions. Portfolio expansion and digital integration remain major areas of focus.

Market Key Players

- Agilent Technologies, Inc.

- Hoffmann-La Roche AG

- Illumina, Inc.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Eurofins Scientific

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- Pacific Bioscience of California, Inc.

- Affymetrix, Inc.

- Danaher Corp.

- Promega

- Other Key players

Conclusion

The global RNA analysis market is expected to expand steadily over the coming years due to rising interest in understanding how genes behave and how diseases develop at the molecular level. Ongoing research in precision medicine and demand for targeted treatments have strengthened the use of RNA technologies in healthcare and drug development. Continued improvements in sequencing tools and data analysis software are making RNA research faster and more accurate. Growing adoption in hospitals, research institutes, and biotechnology companies is expected to support long-term growth. Strong funding support, wider clinical use, and active industry partnerships are likely to keep driving innovation and market expansion.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

RNAi Technology Market || mRNA Therapeutics Market || Antisense and RNAi Therapeutics Market || miRNA Sequencing and Assay Market || gRNA Market || RNA Based Therapeutic Market