Quick Navigation

Overview

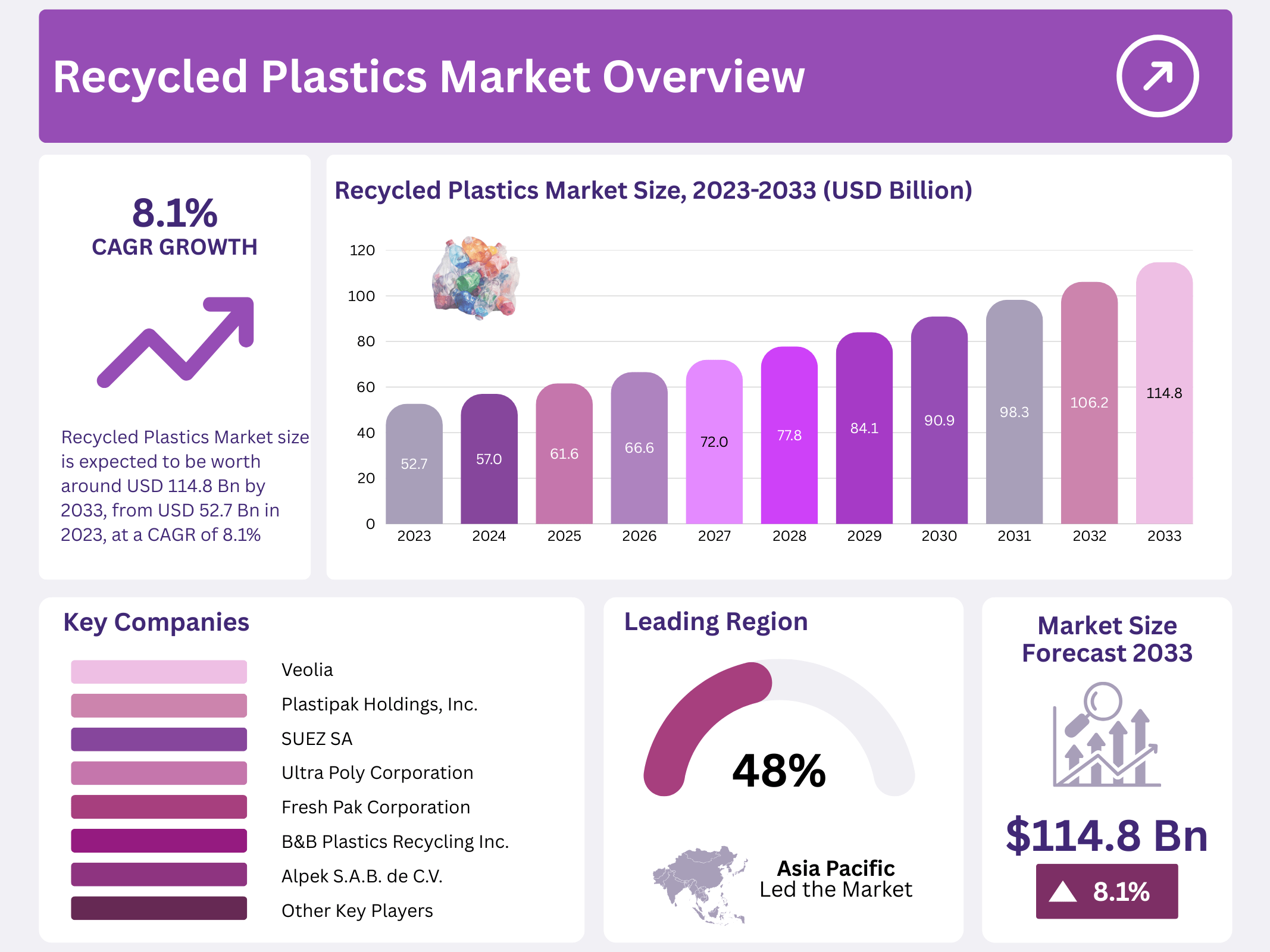

New York, NY – September 15, 2025 – The Global Recycled Plastics Market is on the cusp of substantial transformation, projected to grow from USD 52.7 billion in 2023 to around USD 114.8 billion by 2033, at a steady CAGR of 8.1% between 2023 and 2033.

This rising valuation reflects growing market demand, especially from industries like packaging, automotive, building & construction, and electrical & electronics, all of which are seeking lightweight, cost-effective, and eco-friendlier materials. Growth factors fueling this demand include heightened environmental awareness, stricter regulations on plastic waste, and advances in recycling technologies that make recycled plastics more accessible and reliable.

The popularity of recycled plastics is increasing as consumers, businesses, and regulators push for sustainable products, driving manufacturers toward materials that help reduce carbon footprints and meet circular economy goals. At the same time, market opportunities are swelling: innovations like advanced chemical recycling, improved sorting and contamination control, and the development of high-quality recycled polymers are enabling recycled plastics to replace virgin plastics in higher-value applications.

Key Takeaways

- The Global Recycled Plastics Market is expected to grow from USD 52.7 billion in 2023 to USD 114.8 billion by 2033, with an 8.1% CAGR.

- Polyethylene Terephthalate (PET) held 29.3% of the global Recycled Plastics market revenue in 2023.

- Plastic bottles comprised 65% of the global Recycled Plastics market revenue in 2023, the primary source of recycled products.

- The packaging industry led with over 42.1% of the global Recycled Plastics market revenue in 2023.

- Asia Pacific dominated with 48.3% of global Recycled Plastics sales in 2023, driven by construction demand.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 52.7 Billion |

| Forecast Revenue (2033) | USD 114.8 Billion |

| CAGR (2023-2033) | 8.1% |

| Segments Covered | Plastic Type(Polyethylene, Polyethylene Terephthalate, Polypropylene, Polyvinyl Chloride, Polystyrene, Other Products), By Source(Plastic Bottles, Plastic Films, Polymer Foam, Other Sources), By Application(Building & Construction, Packaging of Products, Electrical & Electronics, Textiles, Automotive, Other Applications) |

| Competitive Landscape | Veolia, Plastipak Holdings, Inc., SUEZ SA, Ultra Poly Corporation, Fresh Pak Corporation, B&B Plastics Recycling Inc., Alpek S.A.B. de C.V., Indorama Ventures, Far Eastern New Century Corporation, Envision Plastics Industries, Custom Polymers, Inc., Berry Global Inc., Other Key Players |

Key Market Segments

Plastic Type

The recycled plastics market is segmented into Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), and others. Among these, Polyethylene Terephthalate (PET) held the largest share in 2023, accounting for 29.3% of global revenue. PET’s dominance comes from its widespread use in packaging across food & beverages, consumer goods, and industrial applications, including laundry detergent bottles and milk cartons.

Polypropylene (PP) also plays a critical role due to its strong chemical and mechanical resistance. Its applications range from laboratory equipment, medical devices, and packaging to labels, hinges, and piping systems. With its fatigue-resistant properties, PP is increasingly adopted in automotive, construction, and consumer product industries. Growing demand in these sectors is expected to accelerate recycled PP usage during the forecast period.

Source Channel

Plastic bottles contributed nearly 65% of the global recycled plastics revenue in 2023, making them the primary feedstock for recycling. Bottles are widely used for packaging oils, pharmaceuticals, and carbonated drinks. In addition, polymer foams, particularly Expanded Polystyrene (EPS), are extensively utilized in protective packaging. Major automotive and electronics manufacturers, including Hitachi, Panasonic, and Honda, are shifting toward recycled foams to reduce reliance on virgin materials.

Application Analysis

The packaging sector led the market in 2023, with more than 42.1% of global revenue. This growth is driven by the rising consumption of packaged foods, beverages, electronics, and textiles. Demand is further supported by the Asia Pacific region, where advanced packaging technologies are being rapidly adopted. Beyond packaging, recycled plastics are gaining traction in personal care appliances, automotive components, and industrial materials, supporting overall market expansion.

Regional Analysis

In 2023, the Asia Pacific dominated the recycled plastics market with 48.3% of global revenue, fueled by robust construction activity and rising demand for non-residential projects such as schools and hospitals. This drives the need for flooring, carpets, insulation, and roofing products made from recycled plastics.

Europe follows with strong growth, largely due to strict landfill bans and high disposal costs that make recycling more economically viable than dumping. North America ranks third, with steady demand supported by construction, electronics, and packaged food industries across the U.S., Canada, and Mexico. The global push toward a circular economy is further enhancing recycled plastic adoption, reducing reliance on virgin plastics while minimizing environmental impact.

Top Use Cases

- Sustainable Packaging: Recycled plastics, especially PET, are widely used for eco-friendly packaging like bottles and containers for food and beverages, driven by consumer demand for sustainable products and regulations pushing for reduced waste, helping brands meet environmental goals.

- Construction Materials: Recycled plastics like HDPE and PP are transformed into durable materials such as plastic lumber, pipes, and insulation for construction, offering cost-effective, weather-resistant solutions that support green building certifications and reduce environmental impact.

- Automotive Components: The automotive industry uses recycled plastics for interior panels, seat fabrics, and underbody shields, reducing vehicle weight and emissions while meeting sustainability targets, with demand growing as manufacturers adopt eco-friendly materials.

- Textile Production: Recycled PET is spun into fibers for clothing, carpets, and upholstery, catering to the rising demand for sustainable fashion and home textiles, offering an eco-friendly alternative to virgin materials with a lower carbon footprint.

- Electronics Manufacturing: Recycled plastics are used in casings and components for devices like laptops and appliances, driven by the need for sustainable electronics, reducing reliance on virgin plastics and supporting circular economy initiatives.

Recent Developments

1. Veolia

Veolia is expanding its advanced recycling capabilities, partnering with companies like Dow to transform plastic waste into pyrolysis oil for new circular products. A key project is their plant in El Prat de Llobregat, Spain, which will process plastic annually. This focus on chemical recycling aims to create a closed-loop system for hard-to-recycle plastics.

2. Plastipak Holdings, Inc.

Through its Clean Tech recycling division, Plastipak is significantly increasing production of food-grade rPET. A major expansion at their Dundee, Michigan, facility to increase annual capacity. They are also integrating advanced technologies like VACUREMA Prime systems to enhance the quality and yield of recycled material for packaging.

3. SUEZ SA

SUEZ is advancing molecular recycling, notably through its partnership with Loop Industries. They are developing an Infinite Loop manufacturing facility in Europe to produce 100% recycled PET plastic and polyester fiber. This technology depolymerizes waste plastic to its base building blocks, allowing for infinite recycling without quality degradation, targeting the packaging and textile industries.

4. Ultra Poly Corporation

Ultra Poly, a key player in post-industrial plastic recycling, continues to focus on mechanical recycling and compounding to produce high-quality recycled polypropylene (rPP) and polyethylene (rPE) pellets. Their recent developments involve scaling operations to meet growing demand from the automotive and construction sectors, emphasizing consistent supply and performance of their engineered recycled resins.

5. Fresh Pak Corporation

Fresh Pak specializes in recycling post-consumer polystyrene (PS) into food-grade and protective packaging. A key recent development is their investment in advanced washing and extrusion lines to enhance the purity of their recycled PS. This allows them to supply high-quality, cost-effective recycled content for egg cartons, meat trays, and clamshells, supporting the circular economy for foam plastics.

Conclusion

The Recycled Plastics Market is growing rapidly due to rising environmental awareness and demand for sustainable materials. With applications in packaging, construction, automotive, textiles, and consumer goods, recycled plastics offer cost-effective, eco-friendly solutions. Innovations in recycling technology and supportive regulations are driving market expansion, making recycled plastics a key player in the global push for sustainability.