Quick Navigation

Introduction

The global recreational boat market is experiencing strong momentum, underpinned by rising leisure spending and marine tourism interest. Increasing disposable incomes have empowered consumers to explore luxury outdoor activities like boating, thereby supporting significant industry expansion.

Additionally, evolving consumer lifestyles, especially among millennials and Gen Z, are reshaping market dynamics. These demographics are embracing boating for relaxation and adventure, prompting manufacturers to diversify offerings and enhance appeal across all age segments.

Technological innovation further catalyzes growth. Integration of electric propulsion, AI-enabled navigation, and IoT-driven safety features is redefining the boating experience. These advancements make recreational boating not only more efficient but also environmentally friendly and accessible.

Regulatory support and safety investments also contribute to market expansion. In the U.S., over 86 million individuals engaged in boating activities in 2018, and programs like the RBS Grant Program allocate over $2.1 million annually toward boating safety, reinforcing public confidence.

However, challenges remain. High ownership costs and accident rates, such as 5,265 boating accidents and $62.5 million in property damage in 2020, highlight the need for enhanced safety protocols. Yet, these concerns also unlock opportunities for innovation in safety and education.

Key Takeaways

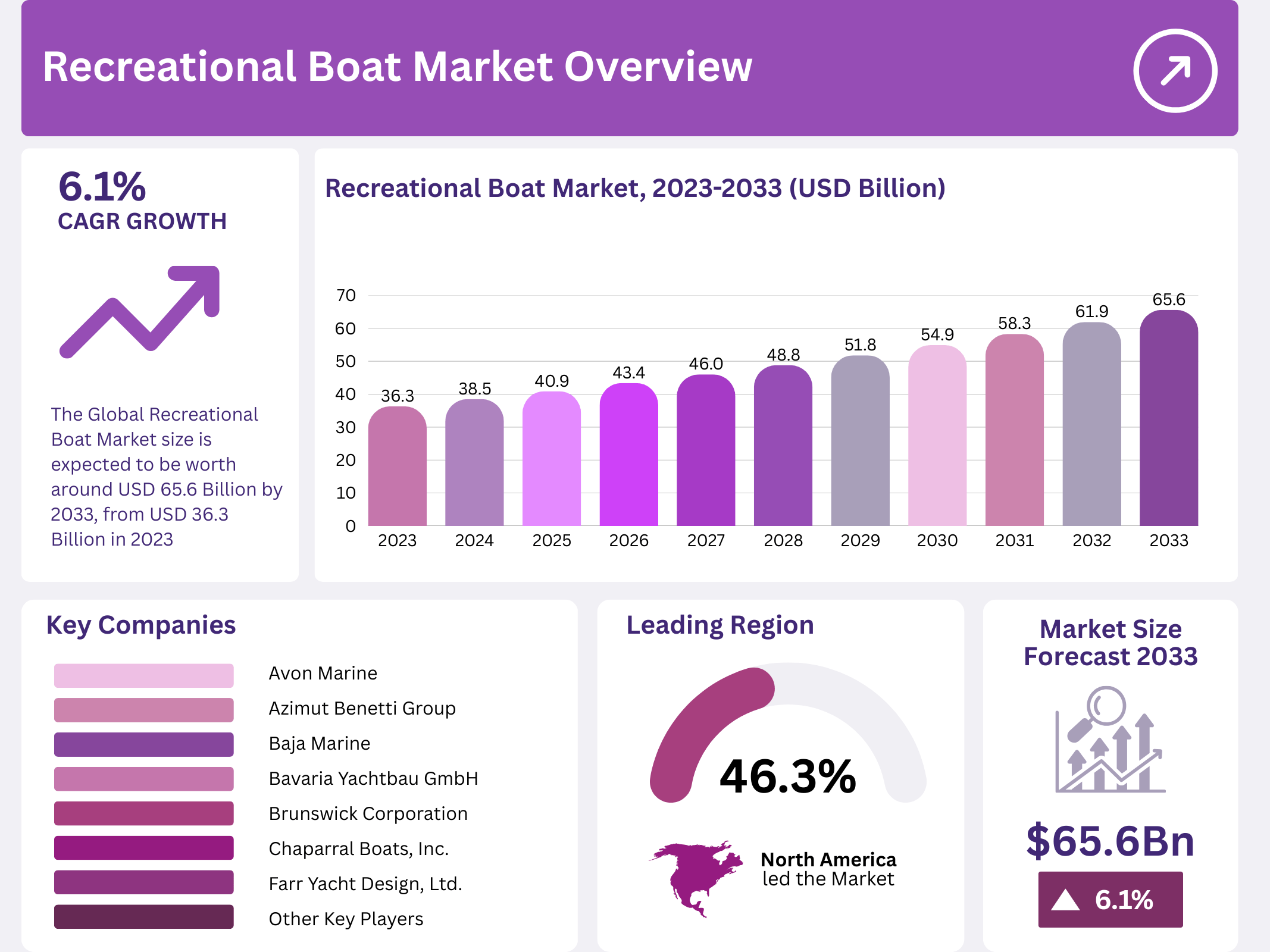

- The Global Recreational Boat Market size is expected to be worth around USD 65.6 Billion by 2033, from USD 36.3 Billion in 2023, growing at a CAGR of 6.1%.

- In 2023, Yachts held a dominant position in the By Type segment.

- Electric engines captured a 66.3% share in the Engine Type segment in 2023.

- Boats sized 30–50 Feet dominated the By Size segment in 2023.

- North America held a 46.3% market share with USD 16.8 Billion in revenue in 2023.

Market Segmentation Overview

By Type

Yachts dominated the market in 2023, driven by demand for luxury and high-end features. Their appeal lies in comfort, advanced technology, and prestige. Sailboats maintained strong interest among traditional boating communities and sustainability-conscious consumers.

Personal watercrafts gained traction due to affordability and versatility, especially among younger users. Inflatables and other small boats such as canoes and kayaks saw stable demand due to their low cost, ease of use, and suitability for casual or short-distance boating.

By Engine Type

Electric engines led with a 66.3% market share in 2023, fueled by rising sustainability awareness and stricter emissions regulations. Lower operational costs and quieter rides add to their consumer appeal, especially in eco-sensitive areas.

Internal combustion engine (ICE) boats still serve long-range or high-power needs, but face gradual market decline due to regulatory pressure and environmental concerns. Battery advancements continue to narrow the performance gap between ICE and electric models.

By Size

The 30–50 Feet category emerged as the most preferred size in 2023, offering a balance of luxury, manageability, and affordability. These boats suit weekend cruisers and extended leisure trips, appealing to both novice and experienced boaters.

Boats under 30 Feet remain popular for entry-level buyers and casual users. Meanwhile, over 50 Feet boats cater to a niche luxury audience due to their size, features, and high maintenance requirements.

Drivers

Rising Disposable Income and Tourism: Growing personal income levels and a strong rebound in marine and coastal tourism are major drivers of recreational boat sales worldwide.

Technology and Safety Features: The integration of AI, IoT, and hybrid propulsion has significantly improved boat safety, efficiency, and user experience, attracting tech-savvy consumers and first-time boaters alike.

Use Cases

Leisure and Luxury Travel: Recreational boats, especially yachts and pontoon boats, are widely used for luxury travel, events, and private cruising, meeting the growing demand for personalized outdoor experiences.

Water Sports and Rentals: Personal watercrafts and inflatables support a booming water sports segment and are frequently offered through rental platforms, expanding access without ownership costs.

Major Challenges

High Ownership and Maintenance Costs: Purchasing and maintaining recreational boats remains a significant financial barrier, limiting mass adoption and confining ownership to higher-income segments.

Accident Rates and Regulatory Pressure: With 767 fatalities reported in 5,265 boating accidents in 2020, the industry faces scrutiny over safety standards, necessitating improved regulation and education.

Business Opportunities

Eco-Friendly Propulsion Systems: The transition to electric and hybrid boats creates a lucrative segment for manufacturers focused on green technologies and low-emission designs.

Boat Sharing and Rentals: Peer-to-peer rentals and boat clubs are reducing entry barriers, providing flexibility for users while offering recurring revenue streams for operators.

Regional Analysis

North America: Dominating with a 46.3% market share, North America’s growth stems from a strong boating culture, high consumer spending, and extensive coastlines supporting both luxury and recreational demand.

Asia Pacific: Rapid economic growth and increasing interest in marine tourism are fueling recreational boat demand across countries like China, Japan, and Australia, though the market is still emerging compared to the West.

Recent Developments

- In May 2023, Chaparral Boats introduced a new eco-friendly model featuring hybrid propulsion technology, catering to the increasing demand for sustainable recreational options.

- In March 2023, Brunswick acquired a technology startup specializing in autonomous navigation systems to enhance their boat offerings with advanced safety features.

- In January 2023, BRP launched a new series of luxury pontoon boats, expanding its product line into a rapidly growing segment.

Conclusion

The global recreational boat market is on a solid upward trajectory, powered by rising income levels, environmental shifts, and technological innovation. With electric propulsion gaining traction and boat-sharing platforms democratizing access, the sector is becoming more inclusive and future-ready.