Quick Navigation

Overview

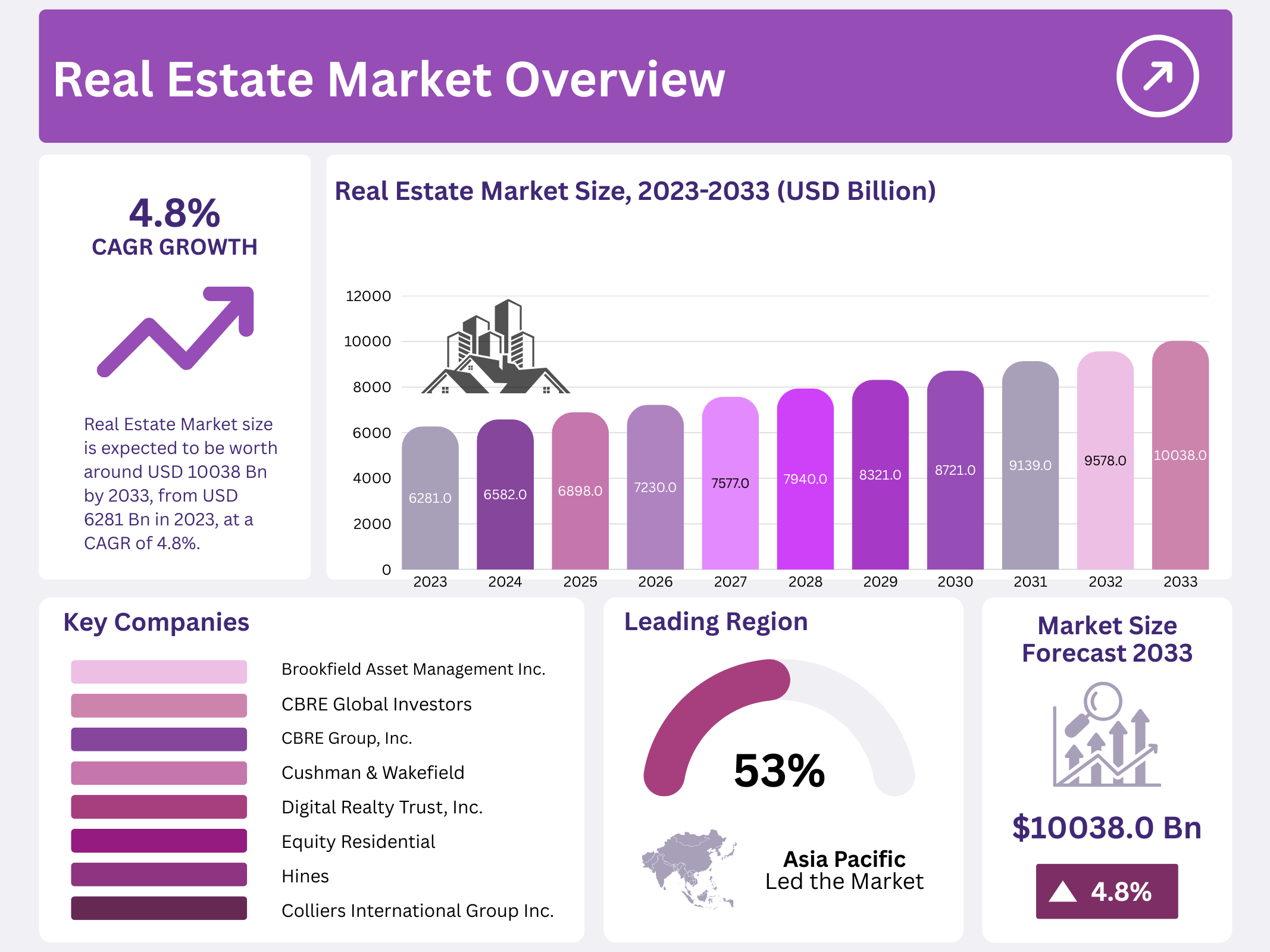

New York, NY – August 25, 2025 – The Global Real Estate Market is projected to grow from USD 6,281 billion in 2023 to approximately USD 10,038 billion by 2033, achieving a CAGR of 4.8% during the forecast period. Encompassing diverse property types and regions, the global real estate industry is influenced by factors such as demographic shifts, geopolitical events, technological advancements, and economic conditions. Market dynamics vary significantly by country. For instance, the residential sector dominates in the U.S., while the commercial sector leads in China. Local factors, including interest rates, government policies, and supply-demand dynamics, significantly impact regional real estate performance. Overall, the real estate market is widely regarded as a stable and reliable investment.

Key Takeaways

- Market Size: Real Estate Market projected to reach USD 10038 billion by 2033, growing at 4.8% CAGR from USD 6281 billion in 2023.

- Segment Dominance: The Residential segment captured over 38.3% market share in 2024, indicating strong demand for housing properties.

- Property Preferences: Fully furnished properties held 41.6% market share in 2024, followed by semi-furnished and unfurnished options.

- Business Segment Significance: Rental properties accounted for over 54.5% market share in 2024, reflecting demand for flexible accommodation.

- Mode Analysis: Offline transactions dominated with 76.3% market share in 2024, although online transactions are expected to grow rapidly.

- Latest Trends: Global urbanization and technological integration drive market growth, particularly in the Asia Pacific region, which captured 53% market share in 2024.

Report Scope

| Market Value (2023) | USD 6281 Billion |

| Forecast Revenue (2033) | USD 10038 Billion |

| CAGR (2023-2033) | 4.8% |

| Segments Covered | Based on Property(Residential, Commercial, Industrial, Land, Other Properties), By Property Type(Fully Furnished, Semi Furnished, Unfurnished), Based on Business(Sales, Rental, Lease), Based on Mode(Online, Offline) |

| Competitive Landscape | Brookfield Asset Management Inc., CBRE Global Investors, CBRE Group, Inc., Colliers International Group Inc., Cushman & Wakefield, Digital Realty Trust, Inc., Equity Residential, Hines, Host Hotels & Resorts, Inc., Jones Lang LaSalle (JLL), Knight Frank LLP, Lendlease Corporation Limited, Mitsui Fudosan Co., Ltd., Newmark Group, Inc., Prologis, Inc., Savills plc, Simon Property Group, Inc., The Blackstone Group Inc., Unibail-Rodamco-Westfield SE, Vornado Realty Trust |

Key Market Segments

By Property Type

In 2024, the Residential Segment led the real estate market, securing over 38.3% of the revenue share. This segment includes single-family homes, apartments, and condominiums, meeting the housing needs of individuals and families. Commercial Real Estate held a substantial share, encompassing office buildings, retail spaces, and hotels. It attracts businesses and investors seeking opportunities in commercial operations and rental income.

The Industrial Segment played a key role, driven by demand for warehouses, manufacturing facilities, and distribution centers, fueled by the rise of e-commerce and logistics needs in major hubs. Land Properties, such as undeveloped and agricultural land, also contributed significantly to the market. These properties appeal to investors and developers for development projects, farming, or long-term investment.

By Furnishing Type

Fully Furnished Properties dominated in 2024, capturing over 41.6% of the market share. These properties, equipped with furniture, appliances, and amenities, provide convenience and immediate occupancy for tenants and buyers. Semi-Furnished Properties held a notable share, offering a balance between fully furnished and unfurnished options. These include essential fixtures, allowing tenants to personalize their spaces. Unfurnished Properties, while a smaller segment, remain relevant by offering flexibility for tenants or buyers to customize spaces according to their preferences, often at a lower cost.

By Business Model

The Rental Segment led the market in 2024, accounting for over 54.5% of the market share. Rentals provide temporary property use through periodic payments, appealing to those seeking flexibility in residential or commercial spaces. Property Sales represented a significant portion, involving ownership transfers of residential, commercial, or land properties through one-time transactions with long-term impacts. Leasing, or long-term rentals, remained important, offering stability for businesses and individuals through extended contractual agreements.

By Transaction Mode

Offline Transactions dominated in 2024, holding over 76.3% of the market share. Conducted through physical offices, agents, and in-person viewings, this mode appeals to those preferring personalized, face-to-face interactions. Online Transactions, though smaller, are growing rapidly. Digital platforms, websites, and apps enable property searches, agent communication, and transaction completion, offering convenience for tech-savvy users.

Regional Analysis

In 2024, the Asia Pacific region solidified its position as a key player in the global real estate market, commanding a 53% share. This growth is driven by rapid real estate sector expansion, fueled by increasing urbanization, population growth, and extensive infrastructure development. China and India significantly contributed to the region’s dominance, with their thriving economies and large-scale urbanization projects boosting demand for residential, commercial, and industrial properties.

These countries have become hubs for investment and development activities. The region’s real estate demand is further enhanced by its diverse applications across sectors such as retail, hospitality, healthcare, and education. Led by China and India, the Asia Pacific leverages strong construction and development capabilities to support new property and infrastructure projects, meeting the region’s growing needs.

Top Use Cases

- Property Price Prediction: Using data like past sales, location, and market trends, AI tools can predict property prices. This helps buyers and sellers make smart choices. Real estate agents can set competitive prices, while investors can spot good deals, saving time and money in a fast-moving market.

- Virtual Property Tours: AI-powered virtual tours let buyers explore homes online using 3D models. This saves time for clients and agents, as people can view properties from anywhere. It boosts engagement, speeds up decisions, and makes the buying process easier, especially for out-of-town buyers.

- Market Trend Analysis: By studying data on sales, rentals, and economic factors, analysts can spot market trends. This helps developers know where to build and investors decide when to buy or sell. Understanding demand for homes or commercial spaces guides better business plans.

- Lead Generation for Agents: AI tools analyze online behavior, like website visits or social media activity, to find potential buyers or renters. This helps agents focus on serious clients, improving their sales. It saves time and increases success by targeting people already interested in real estate.

- Fraud Detection in Transactions: AI checks property listings and deals for suspicious patterns, like fake prices or documents. This protects buyers, sellers, and agents from scams. It ensures safer transactions, builds trust in the market, and helps avoid costly legal issues for everyone involved.

Recent Developments

1. Brookfield Asset Management Inc.

Brookfield is aggressively expanding its renewable energy and transition investments, aligning with global decarbonization trends. Recently, it launched a massive global decarbonization fund. This strategy positions real estate assets for a lower-carbon future while seeking strong returns, showcasing a pivot towards sustainable investing within its vast portfolio.

2. CBRE Global Investors

CBRE Global Investors was officially rebranded to IQON Capital in 2024 following its acquisition by IQON. The new entity is focusing on enhancing its data-driven investment approach and global real estate portfolio management. This strategic rebrand marks a new chapter, emphasizing a technology-forward and analytical methodology for identifying value and managing assets for its institutional clients.

3. CBRE Group, Inc.

CBRE is heavily investing in AI and technology, launching a generative AI tool to help clients optimize office space design. Furthermore, it continues to lead in property sales and advisory, recently closing significant industrial portfolio deals. Their focus remains on leveraging technology and data analytics to enhance client services across leasing, valuation, and investment sales globally.

4. Colliers International Group Inc.

Colliers is strategically expanding its service lines through acquisitions, notably in project management and engineering consulting. The firm emphasizes high-growth sectors like data centers and renewable energy infrastructure. This growth-by-acquisition strategy, coupled with empowering leadership with significant equity stakes, aims to drive entrepreneurial innovation and capture market share in specialized, high-demand areas of the real estate market.

5. Cushman & Wakefield

Cushman & Wakefield is strengthening its capital markets and valuation advisory services. They are also prioritizing insights into emerging trends, such as the future of office spaces and logistics, helping clients navigate a complex market shaped by hybrid work and economic uncertainty.

Conclusion

The Real Estate Market is growing fast, driven by rising demand for homes, urban growth, and new technology. Tools like AI and data analytics are making buying, selling, and investing easier and safer. With trends like remote work boosting suburban home sales and sustainability shaping buyer choices, the industry is set for strong growth.