Quick Navigation

Overview

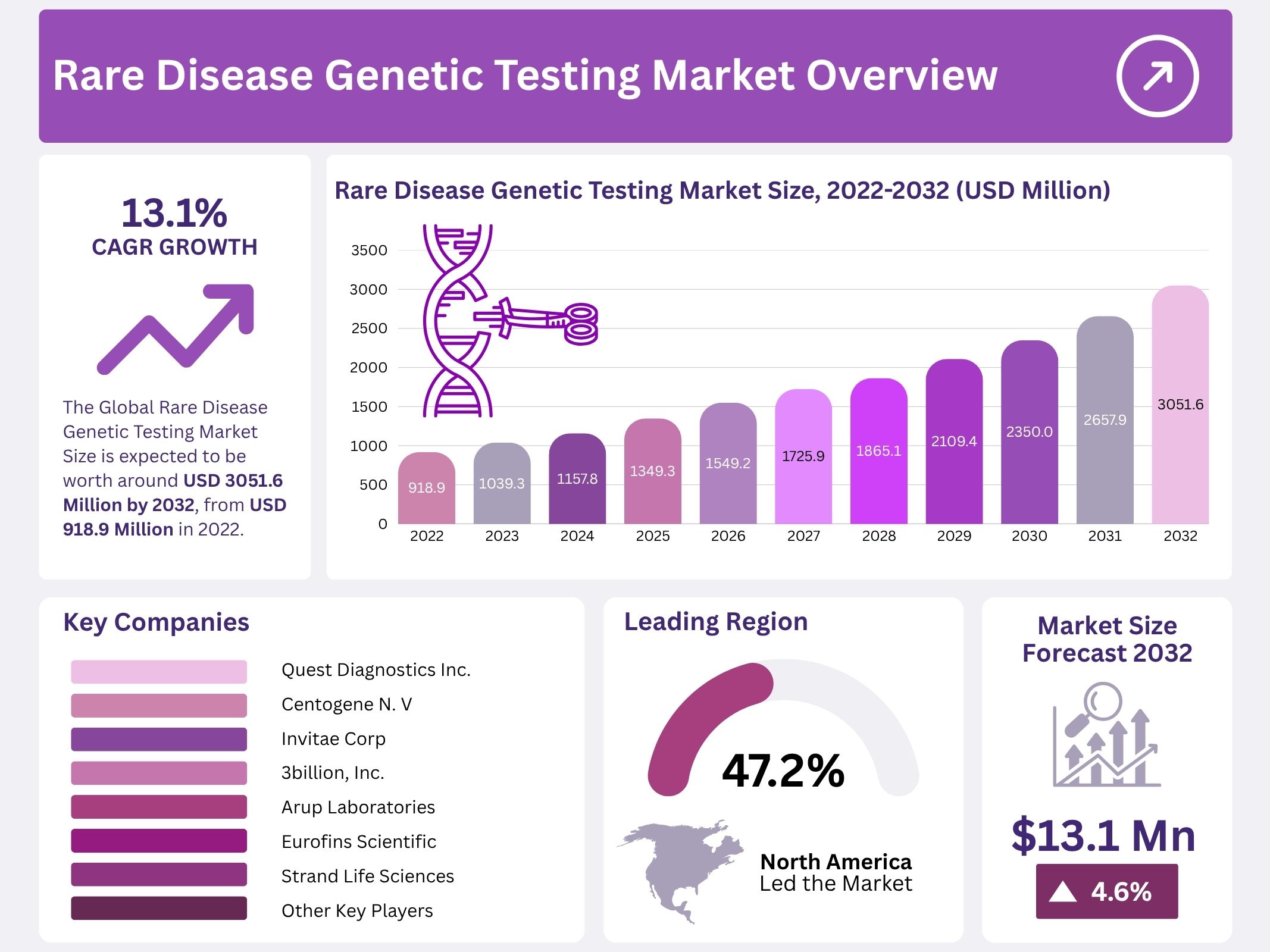

The global Rare Disease Genetic Testing Market was valued at USD 918.94 million in 2023 and is projected to reach USD 3,051.6 million by 2032, expanding at a CAGR of 13.1% from 2022 to 2032. The market growth is driven by increasing awareness of rare diseases, advancements in genetic sequencing, and integration of genetic testing into mainstream healthcare. Rising efforts by governments and healthcare organizations to promote rare disease diagnosis have created a supportive environment for market expansion. Growing patient awareness and early adoption of advanced diagnostics are key contributors to sustained demand.

Advancements in next-generation sequencing (NGS) and genomic technologies have improved testing accuracy, speed, and affordability. These innovations enable detailed analysis of genetic mutations responsible for rare diseases. As costs continue to decline, access to genetic testing has widened across clinical and research applications. Integration of bioinformatics and data analytics has also strengthened result interpretation, enabling more precise diagnosis and treatment planning. Continuous innovation in sequencing tools has encouraged healthcare providers to adopt comprehensive genetic testing panels for both preventive and diagnostic purposes.

The integration of genetic testing into clinical and preventive care has transformed rare disease diagnosis. Healthcare professionals increasingly include genetic screening in prenatal, newborn, and adult health programs to support early detection and personalized treatment. Early diagnosis improves clinical outcomes and helps in managing complex genetic conditions effectively. The growing recognition of genetic testing as an essential diagnostic step has led to its inclusion in hospital workflows and national healthcare strategies. This trend enhances patient access to accurate and timely testing services worldwide.

Government support and policy initiatives have significantly influenced the market’s growth trajectory. National rare disease frameworks and healthcare reforms are promoting genomic medicine adoption. Investments in public health infrastructure and standardization of testing protocols have increased accessibility and reliability. Collaborations among hospitals, research institutes, and diagnostic companies have accelerated technological advancement and knowledge sharing. These partnerships enhance laboratory capabilities and strengthen diagnostic capacity in both developed and emerging markets.

The expansion of precision medicine and increased industry investment continue to boost innovation in the sector. Genetic testing enables tailored therapies and personalized treatment strategies, aligning with the growing demand for precision healthcare. Companies are focusing on developing user-friendly testing kits and advanced bioinformatics platforms to simplify the testing process. Additionally, the rise of healthcare infrastructure and diagnostic awareness in emerging markets presents new growth avenues. Collectively, these factors are expected to sustain strong momentum in the global rare disease genetic testing market throughout the forecast period.

Key Takeaways

- The global market is projected to grow from USD 918.94 million in 2023 to USD 3,051.6 million by 2032, registering a 13.1% CAGR.

- Population expansion has heightened the demand for genetic testing in identifying rare diseases, significantly contributing to overall market growth.

- Continuous technological advancements in genetic testing have improved diagnostic accuracy, increasing adoption for rare disease identification and analysis.

- Ongoing product innovations in genetic diagnostics have further stimulated market expansion, enhancing testing efficiency and accessibility.

- High testing costs continue to restrict accessibility, particularly in low- and middle-income regions, posing a major affordability challenge.

- The endocrine disorders segment is anticipated to expand rapidly at a 21.0% CAGR, supported by improved understanding of genetic mechanisms.

- Next-generation sequencing (NGS) technology leads the market, contributing over 35.22% of total revenue due to its high precision and scalability.

- Research laboratories and contract research organizations (CROs) held the largest end-user share in 2022, accounting for more than 47% of the market.

- Diagnostic laboratories are expected to grow at the fastest rate, with a 16.1% CAGR, driven by expanding clinical applications of genetic testing.

- The Asia Pacific region is projected to experience the highest growth at 18.1% CAGR, supported by growing awareness and favorable policy initiatives.

Regional Analysis

In 2022, North America dominated the global rare disease genetic testing market with a share of over 47.2%. The strong regional presence is supported by advanced healthcare infrastructure and high diagnostic adoption. A large number of disease registries and extensive research and development facilities for ultra-rare diseases further enhance regional growth. Moreover, significant investments in disease detection and supportive healthcare programs strengthen market leadership across the region, positioning North America as a key contributor to global revenue generation.

The Asia Pacific region is expected to record the fastest growth rate, with a projected CAGR of 18.1% during the forecast period. The rise in diagnostic awareness and improvement in testing capabilities are key growth factors. Additionally, increased healthcare investments and expanding access to advanced testing technologies are accelerating adoption across emerging economies. The growing focus on early diagnosis and patient management also contributes to the region’s rapid expansion within the rare disease genetic testing market.

Government initiatives and supportive policies are expected to further boost the Asia Pacific market. Several countries are implementing frameworks aimed at improving disease detection and management. These initiatives are encouraging collaborations among healthcare providers, laboratories, and research institutions. Furthermore, a growing patient base and increasing recognition of rare diseases create new opportunities for market players. As awareness and infrastructure continue to develop, the Asia Pacific region is likely to emerge as a critical hub for genetic testing innovation and expansion.

Segmentation Analysis

The rare disease genetic testing market is segmented by disease type into endocrine and metabolism diseases, immunological disorders, neurological diseases, hematology diseases, cancer, musculoskeletal disorders, cardiovascular disease, and others. The endocrine and metabolism disease segment is projected to grow at a CAGR of 21.0% during the forecast period. Increased understanding of molecular and genetic factors, such as those causing Cushing’s syndrome, is driving the segment’s growth. Advancements in identifying genetic mutations in endocrine disorders are also expected to boost the demand for genetic testing instruments.

By technology, the market is categorized into next-generation sequencing (NGS), array technology, PCR-based testing, FISH, Sanger sequencing, karyotyping, and others. In 2022, the NGS segment dominated the market, accounting for over 35.22% of total revenue. The adoption of NGS-based gene panels for diagnosing cancer, neurological, and cardiovascular diseases has driven this growth. Moreover, whole exome sequencing (WES) is becoming a key method for detecting rare genetic causes of undiagnosed diseases, strengthening its position in clinical genetic testing.

Based on specialty, the market is divided into molecular genetic testing, chromosomal genetic testing, and biochemical genetic testing. The molecular genetic testing segment held the largest share in 2022, contributing more than 41.10% of global revenue. This segment is projected to record the fastest growth due to advancements in high-throughput technologies and their increasing use in clinical settings. Molecular tests help identify mutations or changes in short DNA segments linked to rare or ultra-rare genetic diseases, enhancing early diagnosis and treatment options.

In terms of end users, research laboratories and contract research organizations (CROs) accounted for more than 47% of total revenue in 2022. The dominance of this segment is attributed to the widespread use of molecular and biochemical genetic tests in laboratories. Many testing facilities, including CLIA-accredited labs, are expanding their capabilities in clinical cytogenetics and pathology. The diagnostic laboratories segment is anticipated to grow at the fastest CAGR of 16.1%, supported by the rising global adoption of advanced molecular genetic testing services.

Key Players Analysis

The market for rare disease genetic testing is highly competitive, with several established players driving innovation and expansion. Quest Diagnostics Inc. remains a key global leader, offering extensive genetic testing services. Companies such as Centogene N.V. and Invitae Corp. have strengthened their positions through strategic collaborations and global expansion. Their efforts to enhance diagnostic accuracy and affordability have significantly contributed to market growth, reflecting a growing demand for precise genetic analysis and improved patient outcomes across different regions.

Several players are actively investing in research and technological advancements to maintain a competitive edge. Eurofins Scientific, ARUP Laboratories, and Strand Life Sciences focus on expanding their test portfolios and enhancing laboratory automation. These companies emphasize developing advanced genomic sequencing platforms to improve test efficiency. Their continuous innovation supports faster diagnosis of rare conditions, which is critical in clinical decision-making. The integration of bioinformatics and next-generation sequencing technologies has further transformed the competitive landscape of this market.

Emerging players such as 3billion, Inc., Ambry Genetics, and Realm IDX, Inc. are contributing to the market’s expansion through personalized testing solutions. Their efforts focus on improving accessibility and turnaround time for rare disease diagnostics. Companies like Macrogen, Inc. and Baylor Genetics are leveraging partnerships with healthcare institutions to broaden their service reach. This approach allows them to provide region-specific solutions and expand testing capabilities in underdeveloped markets, ensuring a wider availability of rare disease testing services.

In addition, key participants including Fulgent Genetics Inc., Myriad Genetics, and Laboratory Corporation of America Holdings are emphasizing mergers, acquisitions, and strategic alliances to strengthen their presence. Firms such as Coopersurgical, Opko Health, and PreventionGenetics are investing in clinical collaborations and genetic counseling initiatives. These strategies aim to integrate diagnostic services with clinical expertise. As competition intensifies, ongoing innovation, partnerships, and portfolio diversification are expected to remain the primary growth strategies for companies in the rare disease genetic testing market.

Conclusion

The rare disease genetic testing market is growing steadily due to rising awareness, government support, and major advances in genetic sequencing technology. The use of next-generation sequencing and bioinformatics has improved diagnosis accuracy and made testing faster and more accessible. As healthcare systems continue to adopt precision medicine, demand for personalized and early diagnosis solutions is increasing. Strong collaborations among diagnostic companies, hospitals, and research institutions are also helping expand testing capabilities. With continuous innovation and growing patient awareness, the market is expected to maintain strong momentum, offering new opportunities for early detection and better treatment of rare diseases worldwide.