Quick Navigation

Overview

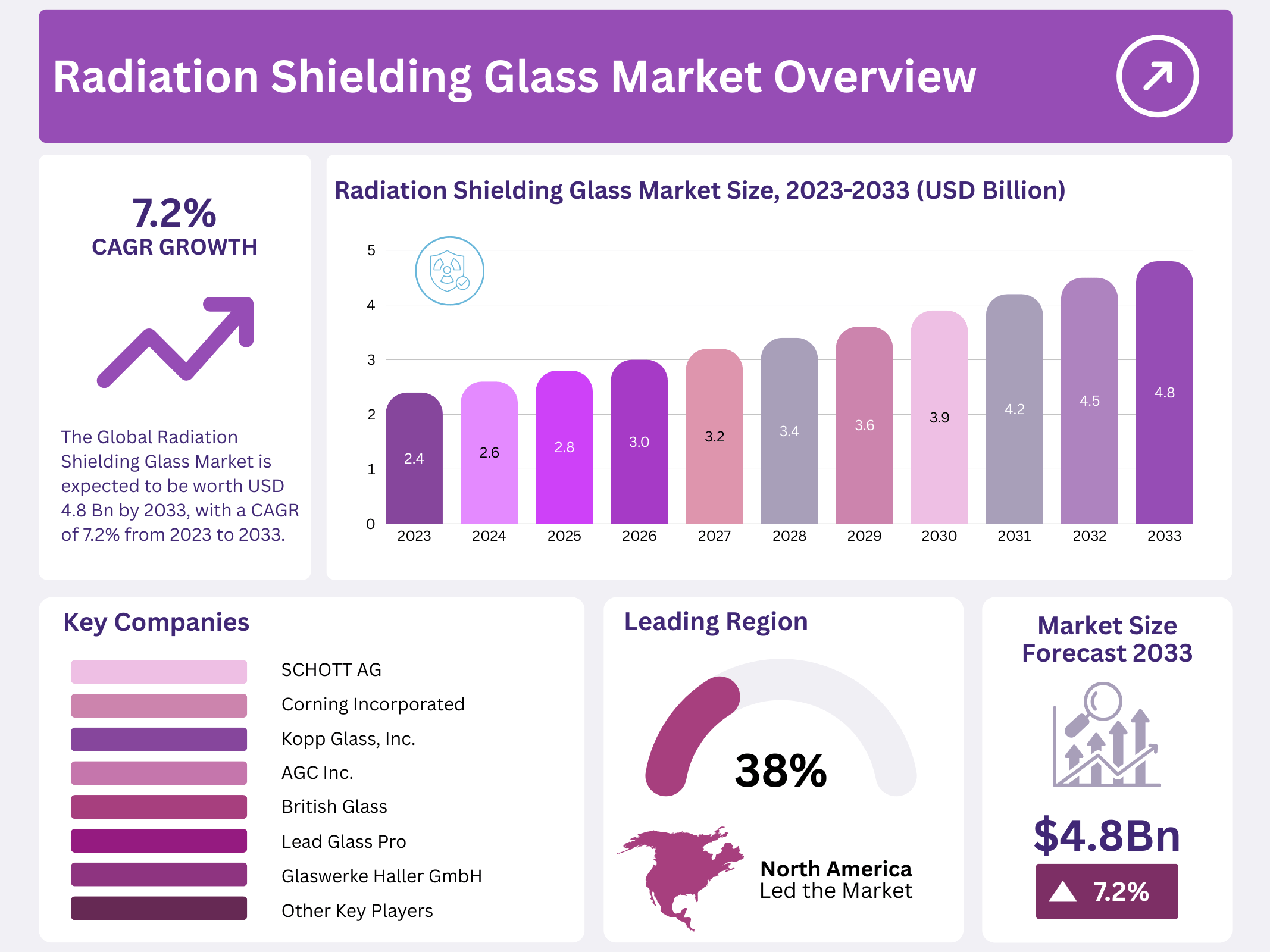

New York, NY – January 07, 2026 – The Global Radiation Shielding Glass Market is experiencing significant growth, driven by increasing demand across various industries, including healthcare, nuclear energy, and research laboratories. The market size is expected to reach approximately USD 4.8 billion by 2033, growing from USD 2.4 billion in 2023, at a compound annual growth rate (CAGR) of 7.2% during the forecast period from 2023 to 2033.

This growth is primarily attributed to the rising awareness about radiation hazards and the need for protective measures in environments where radiation exposure is prevalent. Advancements in technology have also contributed to the market’s expansion, with the development of high-performance shielding glass that is not only effective but also increasingly cost-efficient.

Furthermore, the demand for radiation shielding glass is gaining momentum in the healthcare sector, particularly in medical imaging and diagnostic facilities, where radiation protection is essential for both patients and medical staff. Opportunities also lie in the growing adoption of nuclear power plants globally, as they require specialized radiation shielding solutions to ensure safety.

The rising focus on research and development activities aimed at improving the functionality and durability of radiation shielding glass is expected to support long-term market growth. With continuous innovation, expanding applications, and an increasing focus on safety, the radiation shielding glass market is well-positioned to witness sustained expansion in the coming years.

Key Takeaways

- The Global Radiation Shielding Glass Market is expected to be worth USD 4.8 billion by 2033, with a CAGR of 7.2% from 2023 to 2033.

- Lead Glass dominance held over 75.8% market share in 2023, preferred for its radiation attenuation properties and reliability.

- X-Ray Shielding Prominence secured 61.5% market share in 2023, widely used in medical facilities for safety during diagnostic procedures.

- Medical applications led with over 68.6% market share in 2023, crucial for safety in healthcare environments.

- North America is the leading region, accounting for 38.4% of global revenue in 2023.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 2.4 Billion |

| Forecast Revenue (2033) | USD 4.8 Billion |

| CAGR (2024-2034) | 7.2% |

| Segments Covered | By Type(Lead Glass, Lead-Free Glass), By Radiation Type(X-Ray Shielding, Gamma Ray Shielding, Neutron Shielding), By Application(Medical, Research and Laboratory, Nuclear Energy, Industrial) |

| Competitive Landscape | SCHOTT AG, Corning Incorporated, Nippon Electric Glass Co., Ltd., Ray-Bar Engineering Corp., Kopp Glass, Inc., Nuclear Lead Co., Inc., Radiation Protection Products, Inc., Pilkington Group Limited, Isolite Corporation, British Glass, Glaswerke Haller GmbH, AGC Inc., Lead Glass Pro, MarShield Custom Radiation Shielding Products, Epurex Films GmbH |

Key Market Segments

By Type

In 2023, Lead Glass clearly dominated the radiation shielding glass market, accounting for more than 75.8% of the total market share. This strong position reflects its long-standing acceptance as the most reliable solution for radiation protection across multiple industries. Lead glass remained the preferred choice due to its proven performance and widespread availability.

Lead glass is widely valued for its high radiation absorption capability, making it essential in environments where exposure to ionizing radiation must be carefully controlled. Its continued dominance highlights the industry’s reliance on a material that consistently meets safety standards while delivering dependable shielding performance.

In comparison, lead-free glass captured a smaller share of the market. Although demand for lead-free options is growing due to environmental and health considerations, adoption remains limited. Most end users continue to favor lead glass because of its established effectiveness and regulatory compliance.

By Radiation Type

In 2023, X-ray shielding emerged as the leading radiation type segment, holding a dominant market share of over 61.5%. Its leadership position highlights the widespread need for X-ray protection, particularly in medical and diagnostic environments where X-ray exposure is routine.

X-ray shielding glass plays a vital role in hospitals and diagnostic centers, helping protect healthcare professionals and patients during imaging procedures. The high adoption rate of X-ray equipment directly supported the strong demand for effective shielding glass solutions.

Gamma ray shielding accounted for a smaller portion of the market. While it is critical for applications such as nuclear facilities and industrial radiography, its usage is more specialized, limiting its overall market share compared to X-ray shielding.

Neutron shielding represented the smallest share due to its highly specialized application in nuclear power plants and advanced research facilities. The dominance of X-ray shielding reflects its broad, everyday use and ongoing demand across healthcare and industrial sectors.

By Application

In 2023, Medical Applications led the radiation shielding glass market, capturing more than 68.6% of total demand. This dominance underscores the essential role of radiation shielding glass in healthcare settings where safety and visibility are equally important.

Radiation shielding glass is extensively used in X-ray rooms, CT scan areas, and diagnostic imaging facilities. The growing volume of medical imaging procedures continues to drive demand for transparent barriers that provide reliable radiation protection without obstructing visibility.

Research and laboratory applications held a smaller market share but remained an important segment. Radiation shielding glass is critical in laboratories where researchers work with radioactive materials, ensuring safe observation while maintaining operational efficiency.

Regional Analysis

The Radiation Shielding Glass Market is led by North America, with the United States holding the largest share. The region’s strong position is supported by high disposable income, advanced healthcare infrastructure, and rising awareness of aging-related skin and joint concerns. Together, these factors enable North America to account for a significant 38.4% share of the global hyaluronic acid market.

Europe ranks as the second-largest regional market. Growth across this region is driven by increasing beauty consciousness, ongoing technological advancements, and the growing adoption of procedures that require shorter surgical and recovery times. Within Europe, Germany holds the largest market share, reflecting strong demand from both medical and aesthetic applications, while the UK market is experiencing the fastest growth due to expanding cosmetic treatment adoption.

The Asia-Pacific hyaluronic acid market is expected to witness the most rapid expansion during the forecast period. This growth is fueled by rising medical demand in emerging economies, greater acceptance of minimally invasive treatments, and improving disposable income levels. China dominates the regional market in terms of share, while India stands out as the fastest-growing market, supported by expanding healthcare access and increasing awareness of aesthetic and therapeutic applications.

Top Use Cases

- Healthcare Facilities: Radiation shielding glass is widely used in healthcare settings, particularly in diagnostic imaging rooms, X-ray, and CT scan suites. It protects medical staff and patients from radiation exposure, ensuring compliance with safety regulations. The global healthcare sector’s increasing reliance on imaging technologies is expected to drive further demand for such glass.

- Nuclear Power Plants: Radiation shielding glass is crucial in nuclear power plants, where it helps protect workers and the environment from harmful radiation. As the nuclear energy sector expands, especially in regions like Asia and Europe, the need for specialized shielding solutions is growing.

- Research Laboratories: In scientific research environments, particularly those dealing with radioactive materials, radiation shielding glass is used in labs to prevent radiation leakage and ensure safety. The increasing number of research projects in nuclear physics and material science is contributing to a steady rise in the use of radiation-shielding products.

- Aerospace and Defense: Radiation shielding glass plays a vital role in aerospace and defense applications, including spacecraft, satellites, and military vehicles. It protects electronics and personnel from harmful cosmic radiation. With an increasing focus on space exploration, the demand for this specialized glass is expected to grow significantly in the coming years.

- Architectural Applications: Radiation shielding glass is used in modern architecture, particularly in hospitals, research institutions, and nuclear facilities. It is incorporated into windows and facades to provide radiation protection while maintaining aesthetics. The growing trend in incorporating safety features into architectural designs is driving increased demand for radiation shielding glass in building projects.

Recent Developments

1. SCHOTT AG

SCHOTT is advancing with its MIRAN series, now offering superior radiation shielding across medical, nuclear, and security sectors. Recent developments focus on enhancing lead-free compositions that provide high density and clarity without compromising protection. They have also optimized glass for CT room windows, combining improved X-ray attenuation with better color neutrality for less visual strain. Their innovation targets stricter safety regulations and broader architectural integration.

2. Corning Incorporated

Corning leverages its specialty glass expertise to develop advanced radiation shielding solutions, primarily for the medical and scientific industries. Recent progress includes enhancing the optical quality and durability of leaded glasses used in diagnostic imaging and therapy suites. They are also refining large-format, high-clarity panels for nuclear facility viewing windows, ensuring consistent protection and visibility for operator safety in critical environments.

3. Nippon Electric Glass Co., Ltd. (NEG)

Nippon Electric Glass is expanding its “Radiation Shielding Glass” lineup with a focus on high-precision applications like PET-CT and proton therapy. They have developed glasses with extremely high lead equivalence (over 30mm Pb) while controlling the yellow tint. Innovations also include improved chemical strengthening processes for better surface durability and the development of thinner, lighter panels for easier installation in modern healthcare facilities.

4. Ray-Bar Engineering Corp.

Ray-Bar specializes in custom-engineered shielding solutions, recently advancing its glass products for hybrid operating rooms and interventional radiology. They focus on integrating large, leaded glass windows into prefabricated shielding walls and doors, streamlining construction. Developments also include improving the bonding integrity between glass and lead or steel frames to ensure no radiation leakage, meeting the most stringent NCRP guidelines for new medical installations.

5. Kopp Glass, Inc.

Kopp Glass applies its high-precision glass molding and coloring expertise to create custom radiation shielding components. Recent work involves developing unique, dense glass formulations for specialized shielding in diagnostic equipment, veterinary clinics, and dental offices. They focus on smaller, engineered parts like viewports and protective lenses that require specific shapes, spectral properties, and exact lead equivalencies, often for OEM applications in niche markets.

Conclusion

Radiation shielding glass stands out as a vital material across various sectors, driven by growing emphasis on safety and technological progress. As demand rises from expanding healthcare needs and stricter regulations, innovations like smart variants promise enhanced functionality, positioning this product for sustained relevance in protecting people from ionizing threats while supporting operational clarity.