Quick Navigation

Overview

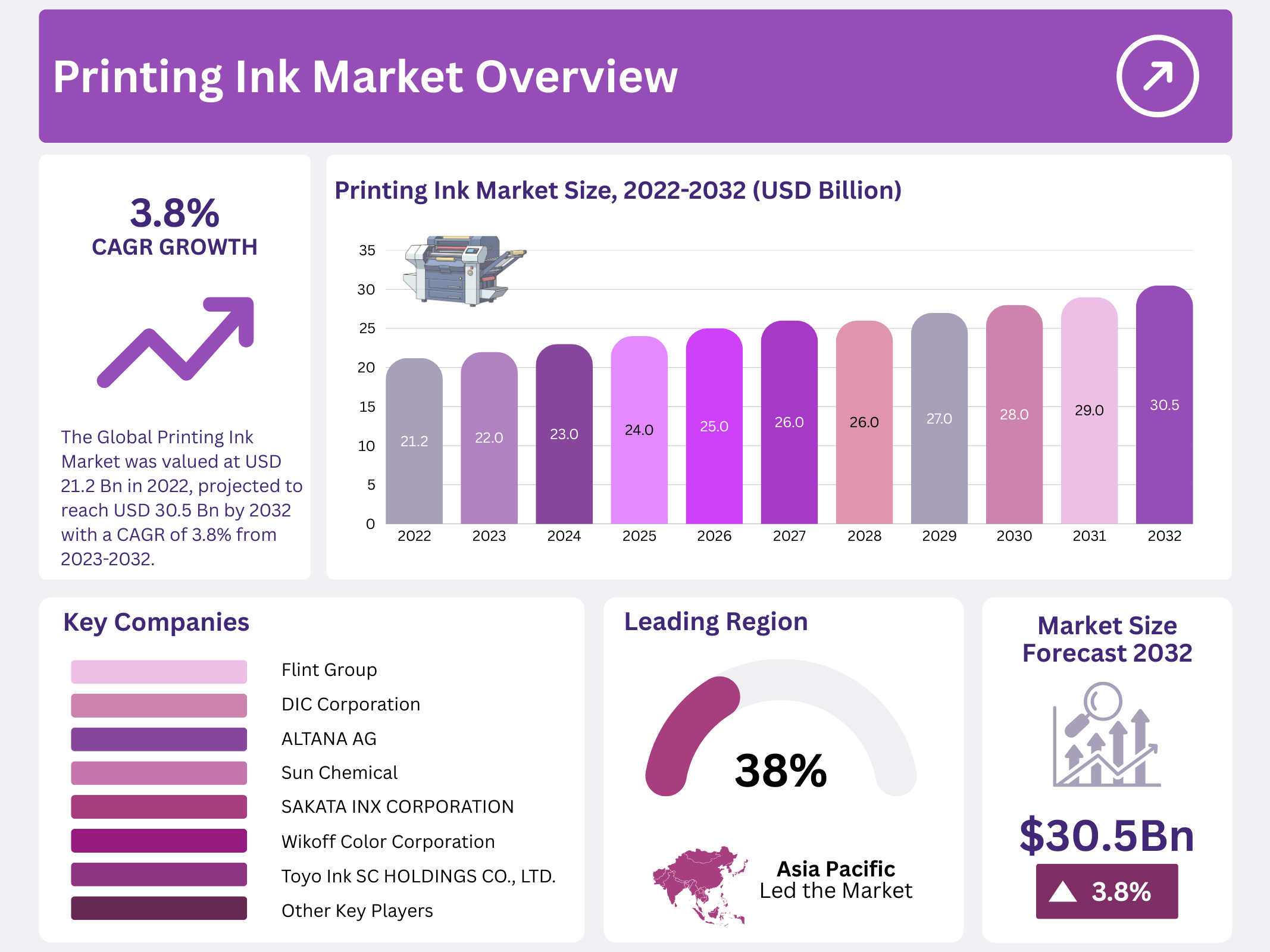

New York, NY – December 23, 2025 – In 2022, the global Printing Ink Market was valued at USD 21.2 billion and is projected to reach around USD 30.5 billion by 2032. During the period from 2023 to 2032, the market is expected to grow at a CAGR of 3.8%, driven by steady demand from packaging, publishing, and commercial printing applications across both developed and emerging economies.

Printing inks are essential materials used to produce images, text, and graphic designs on various surfaces. They mainly contain dyes or pigments that provide color and visual clarity. These inks are widely used in lithographic and letterpress printing processes, where precise color reproduction and durability are critical for high-quality output in books, newspapers, labels, and packaging materials.

The composition of printing inks typically involves mixing pigments of the desired color with varnish or oil. For example, carbon black is commonly blended with thick linseed oil or similar oils, often combined with rosin oil and rosin varnish to enhance adhesion and gloss. Inkjet inks, on the other hand, consist of a base carrier such as water, oil, or solvent, along with colorants and specific chemical additives that improve properties like drying speed, stability, and print performance.

Key Takeaways

- The Global Printing Ink Market was valued at USD 21.2 billion in 2022, projected to reach USD 30.5 billion by 2032 with a CAGR of 3.8% from 2023-2032.

- Lithographic printing dominates the market due to high-quality, high-volume capabilities for magazines, newspapers, brochures, and advertising.

- Oil-based inks lead the market, favored for durability, consistent color, and compatibility with various printing processes in packaging, commercial, and publication segments.

- The packaging segment is expected to dominate market value during the forecast period, fueled by rising demand in food, consumer goods, industrial, and commercial applications.

- Asia Pacific holds the largest share at 38.0% revenue, maintaining leadership due to strong demand across multiple end-use industries throughout the forecast period.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 21.2 Billion |

| Forecast Revenue (2032) | USD 30.5 Billion |

| CAGR (2023-2032) | 3.8% |

| Segments Covered | By Process –Gravure, Flexographic, Lithographic, Digital, and Other Processes; By Formulation – Oil-Based, Solvent-Based, Water-Based, UV-Cured-Based; By End-User – Packaging, Commercial Publication, Textiles, and Other End-Users |

| Competitive Landscape | DIC Corporation, Flint Group, Toyo Ink SC HOLDINGS CO., LTD., Huber Group Deutschland GmbH, SAKATA INX CORPORATION, ALTANA AG, Wikoff Color Corporation, Sun Chemical, Tokyo Printing Ink MFG CO., LTD., and Other Key Players |

Key Market Segments

Process Analysis

Rising Demand for Lithographic Printing Across Multiple Applications

Lithographic printing continues to hold a dominant position in the global printing inks market, mainly due to its widespread use across publication, commercial printing, industrial printing, and other applications. Its ability to deliver high print quality at large volumes makes it a preferred choice for magazines, newspapers, brochures, and advertising materials.

Gravure printing inks are primarily used for high-quality image printing, especially photographs. These liquid inks are suitable for thin papers, films, metal foils, paper cups, and similar substrates. Their flexibility allows gravure printing to serve diverse applications such as food packaging, tobacco products, and cosmetics, using materials like cardboard, labels, foils, and plastic films.

Flexographic inks are widely used on substrates such as paper, laminates, corrugated boards, films, and foils. Due to their cost-effectiveness and environmentally friendly characteristics, flexographic inks are expected to witness rapid growth over the forecast period, particularly in packaging and labeling applications.

Formulation Analysis

Oil-Based Printing Inks Maintain Market Leadership

Oil-based printing inks dominate the global printing inks market, largely driven by their strong demand in packaging, commercial printing, and publication printing. These inks offer durability, consistent color performance, and compatibility with multiple printing processes.

However, increasing environmental concerns are pushing manufacturers, especially in North America, to focus on developing bio-based ink alternatives. Since oil-based inks are closely linked to crude oil prices, fluctuations in global oil markets significantly influence production costs and overall market growth in this region.

At the same time, rising demand for UV-cured inks, a growing customer base, and higher consumer spending power are supporting overall market expansion. Solvent-based inks remain limited to specific applications, while water-based printing inks are expected to experience steady growth due to their lower environmental impact.

End-User Analysis

Packaging Segment Expected to Lead Market Growth

The packaging segment is projected to dominate the global printing inks market in terms of value over the forecast period. This growth is supported by increasing demand for printed packaging across food, consumer goods, industrial products, and commercial applications.

Printing inks are widely used on materials such as paper, cardboard, plastics, and multilayer packaging structures. The rising focus on product branding, labeling, and shelf appeal continues to strengthen ink demand within the packaging industry, making it the most influential end-user segment in the market.

Regional Analysis

Asia Pacific Leads the Market with Strong Growth in Packaged Foods and Labeling

In 2022, the Asia Pacific accounted for the largest share of the global printing ink market, holding a revenue share of 38.0%. The region maintained a strong leadership position and is expected to continue dominating the market throughout the forecast period due to sustained demand across multiple end-use industries.

Market growth in the Asia Pacific is largely supported by rising consumption of packaged food products and the rapid expansion of the labeling industry. The growth of sectors such as food and beverage, healthcare, consumer goods, and e-commerce has significantly increased the need for high-quality printed packaging and labels, thereby driving ink demand across the region.

Meanwhile, North America is also expected to witness notable growth, supported by a well-established packaging industry and steady demand from commercial and industrial printing applications. Additionally, easy access to raw materials such as resins is expected to support printing ink production and market expansion in the region over the coming years.

Top Use Cases

- Packaging: Printing ink is essential in the packaging sector for creating colorful labels, cartons, and flexible wraps on materials like paper, plastic, and glass. It helps brands attract customers with vibrant designs while adding key details like barcodes and instructions. Eco-friendly options support sustainable practices, making packaging more appealing and functional for everyday products.

- Publishing: In the publishing world, printing ink brings books, newspapers, and magazines to life with clear text and images on paper. Fast-drying formulas speed up production processes, while plant-based inks reduce harm to the environment. This use case keeps information flowing, supporting education and entertainment in a simple, reliable way.

- Textiles: Printing ink adds patterns and colors to fabrics for clothing, home goods, and accessories in the textile industry. Durable inks like silicone withstand washing and wear, allowing for custom designs. This application fuels fashion trends, enabling personalization and quick changes to meet consumer tastes in apparel markets.

- Advertising: Printing ink creates eye-catching posters, billboards, and banners for marketing campaigns. Weather-resistant types ensure colors stay bright outdoors, grabbing attention from passersby. This helps businesses promote their offerings effectively, building brand recognition and influencing buying decisions in competitive environments.

- Industrial Applications: In industrial fields, printing ink is used on automotive parts, electronics, and sensors for functional purposes. Special inks like thermochromic change with heat, adding smart features to products. This expands opportunities in tech sectors, improving durability and innovation in manufacturing processes.

Recent Developments

DIC Corporation

- DIC has advanced its sustainable ink portfolio, launching bio-based and compostable packaging inks. The company is investing in water-based and low-VOC technologies to meet stringent environmental regulations. A recent partnership focuses on digital printing solutions for flexible packaging, enhancing print quality and efficiency. DIC continues to expand in Asia and North America through strategic acquisitions.

Flint Group

- Flint Group introduced “EkoCure ANCORA,” a low-energy curing ink for packaging, reducing energy. The company is also expanding its water-based ink capabilities for corrugated applications. Recent restructuring aims to strengthen its commercial and operational focus in response to market shifts. Sustainability commitments include increasing renewable raw material usage.

Toyo Ink SC HOLDINGS CO., LTD.

- Toyo Ink is developing functional inks for printed electronics and sustainable packaging. Their “Lioaccum” series uses biomass-derived materials. The group recently invested in digital inkjet R&D and acquired a stake in a conductive inks manufacturer to bolster its electronics materials division. They are also promoting circular economy initiatives in ink production.

Huber Group Deutschland GmbH

- Huber Group has launched “Hubercolor Genesis,” a new generation of offset inks with improved rub resistance and faster drying. They are focusing on UV-LED and EB curing technologies for energy-efficient printing. Recent expansions in Eastern Europe have enhanced their production network. The company emphasizes reducing the carbon footprint of its ink manufacturing processes.

SAKATA INX CORPORATION

- Sakata Inx released the “INX GREEN” series, sustainable inks made from recycled materials. They are advancing in digital textile printing inks and have developed new security inks for anti-counterfeiting. A recent joint venture in India aims to strengthen its global supply chain. The company is also investing in conductive inks for IoT device manufacturing.

Conclusion

Printing Ink is a versatile material driving creativity across industries, from everyday packaging to advanced tech. With a shift toward eco-friendly and efficient options, it adapts to modern needs, ensuring lasting impact. Overall, its role in enhancing visuals and functionality keeps it essential in evolving markets.