Quick Navigation

Introduction

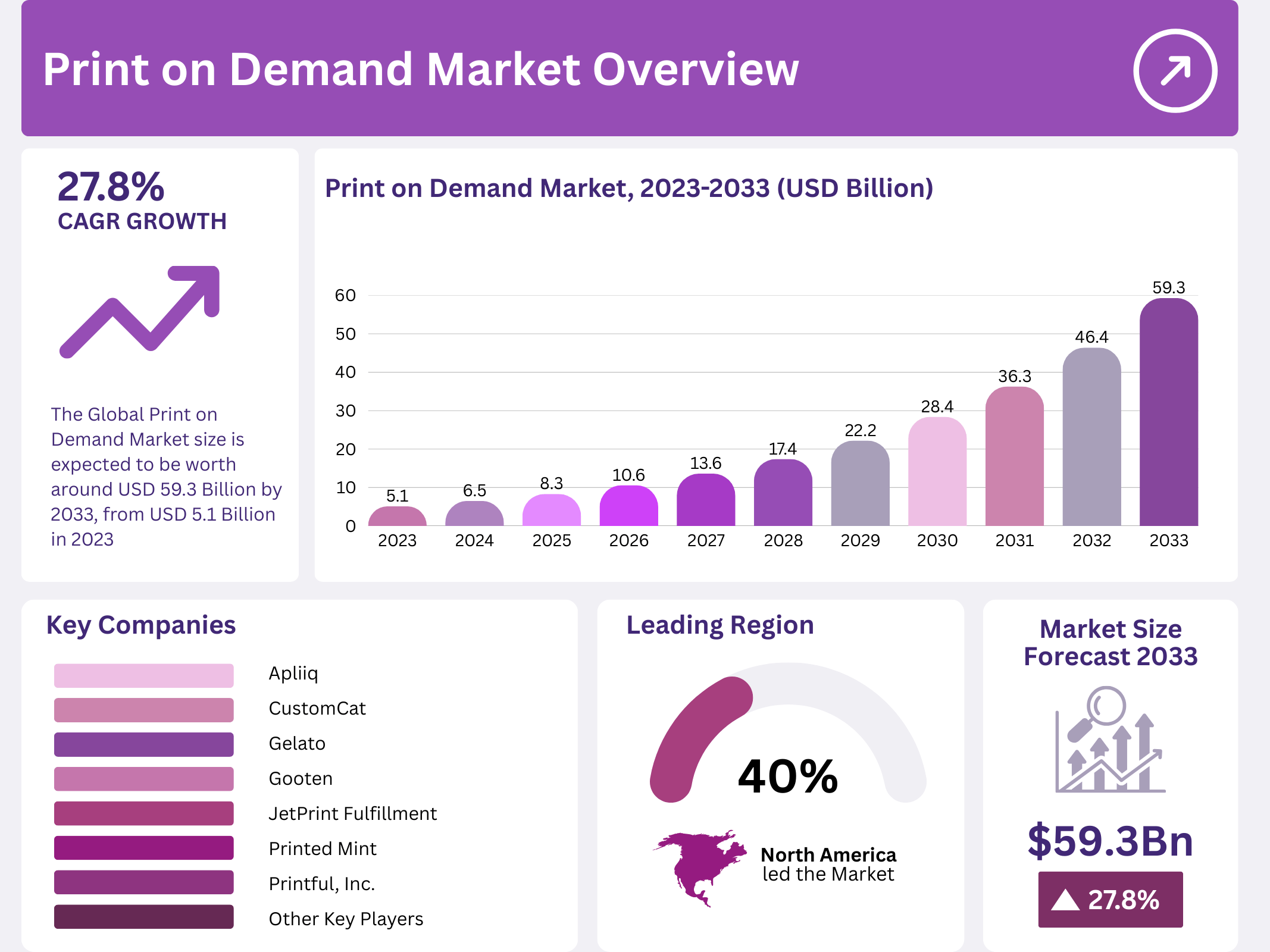

The global Print on Demand market is undergoing a structural transformation as businesses increasingly shift toward flexible, asset-light production models. In 2023, the market was valued at USD 5.1 Billion, reflecting growing acceptance among entrepreneurs, creators, and e-commerce brands seeking scalable customization without inventory risk.

As digital commerce accelerates, Print on Demand enables sellers to respond quickly to changing consumer preferences. Products are manufactured only after orders are confirmed, which significantly reduces waste and upfront costs. Consequently, this model aligns strongly with sustainability goals and modern supply-chain efficiency.

Moreover, the market’s growth trajectory remains robust. By 2033, the Print on Demand market is expected to reach USD 59.3 Billion, expanding at a CAGR of 27.8%. This momentum is driven by platform innovation, social commerce adoption, and rising demand for personalized consumer goods.

Importantly, the ecosystem supports small businesses and independent creators. Low entry barriers allow new sellers to test ideas rapidly, while advanced software platforms streamline design, fulfillment, and logistics. As a result, Print on Demand continues to attract global interest across multiple product categories.

Looking ahead, the market is expected to evolve through automation, sustainable materials, and deeper e-commerce integrations. These developments position Print on Demand as a long-term growth engine within the broader digital retail economy.

Key Takeaways

- The market was valued at USD 5.1 Billion in 2023 and is projected to reach USD 59.3 Billion by 2033.

- The market is growing at a CAGR of 27.8% during the forecast period.

- Software platforms accounted for 72% of the market in 2023.

- Apparel dominated the product segment with a 37.5% share.

- North America led with a 40% market share, valued at USD 2.04 Billion.

- Asia Pacific recorded the highest CAGR of 27.9%.

Market Segmentation Overview

The Print on Demand market is primarily segmented by platform type, including software-based and service-based solutions. Software platforms dominate due to their scalability and integration capabilities, allowing sellers to manage designs, orders, and fulfillment through centralized dashboards. As digital adoption increases, software continues to drive operational efficiency.

Service-based platforms, although holding a smaller share, play a crucial role in supporting creators lacking technical expertise. These providers manage printing and shipping end-to-end, enabling easy market entry. Consequently, service platforms contribute to inclusivity and ecosystem expansion.

By product type, apparel represents the largest segment, accounting for 37.5% of the market in 2023. Customized t-shirts, hoodies, and activewear benefit from mass appeal and fast design turnaround. As fashion personalization grows, apparel remains the core revenue driver.

Other product categories, including home décor, drinkware, and accessories, continue to gain traction. These segments appeal to gifting and lifestyle personalization trends. Together, diversified product offerings strengthen market resilience and support sustained demand growth.

Drivers

The rapid expansion of global e-commerce is a primary growth driver. Online marketplaces and social commerce platforms allow sellers to integrate Print on Demand services seamlessly. This reduces inventory risk while enabling instant global reach, which significantly accelerates market adoption.

Additionally, rising consumer demand for personalized and sustainable products supports long-term growth. Surveys indicate strong willingness to pay more for eco-friendly options. As a result, Print on Demand aligns well with evolving consumer values and purchasing behavior.

Use Cases

Independent creators and small businesses widely use Print on Demand to launch branded merchandise without upfront manufacturing investment. This enables faster market testing and creative freedom. Consequently, entrepreneurs can scale successful designs while minimizing financial exposure.

Enterprises also leverage Print on Demand for promotional products and limited-edition campaigns. By producing items only when needed, brands maintain exclusivity and reduce waste. This approach improves brand engagement while supporting sustainable operations.

Major Challenges

Intense competition remains a key challenge due to low entry barriers. A high number of sellers compete across popular categories, leading to pricing pressure and reduced margins. Therefore, differentiation through branding and niche targeting is critical.

Quality consistency and fulfillment speed also pose operational challenges. As customer expectations rise, businesses must invest in reliable partners and technology. Failure to maintain standards can directly impact customer retention and brand reputation.

Business Opportunities

Global expansion presents significant opportunities, particularly in emerging e-commerce markets. By localizing designs and marketing strategies, sellers can address regional preferences. This diversification reduces dependence on mature markets and enhances revenue stability.

Technological advancements, including automation and AI-driven design tools, further unlock growth potential. These innovations improve production efficiency and customer personalization. As adoption increases, technology-driven differentiation will shape competitive advantage.

Regional Analysis

North America leads the market with a 40% share in 2023, supported by strong e-commerce infrastructure and high digital adoption. The region benefits from advanced logistics networks and a large base of online entrepreneurs.

Asia Pacific is the fastest-growing region, recording a CAGR of 27.9%. Rapid digital transformation, expanding online retail, and rising entrepreneurial activity drive this momentum. As infrastructure improves, regional demand is expected to accelerate further.

Recent Developments

- In October 2024, Spoke Custom expanded its headquarters to a 107,000-square-foot facility in Georgia, significantly increasing production capacity.

- In July 2024, Merch Factory partnered with Wix to automate Print on Demand operations for Indian e-commerce merchants.

- In July 2024, Gooten partnered with TikTok Shop to enable direct monetization of social commerce through Print on Demand integration.

Conclusion

The global Print on Demand market is positioned for sustained high-growth over the next decade. Strong e-commerce adoption, personalization demand, and scalable business models continue to reshape the competitive landscape. As innovation and sustainability converge, Print on Demand is set to remain a vital component of the digital commerce ecosystem.