Quick Navigation

Overview

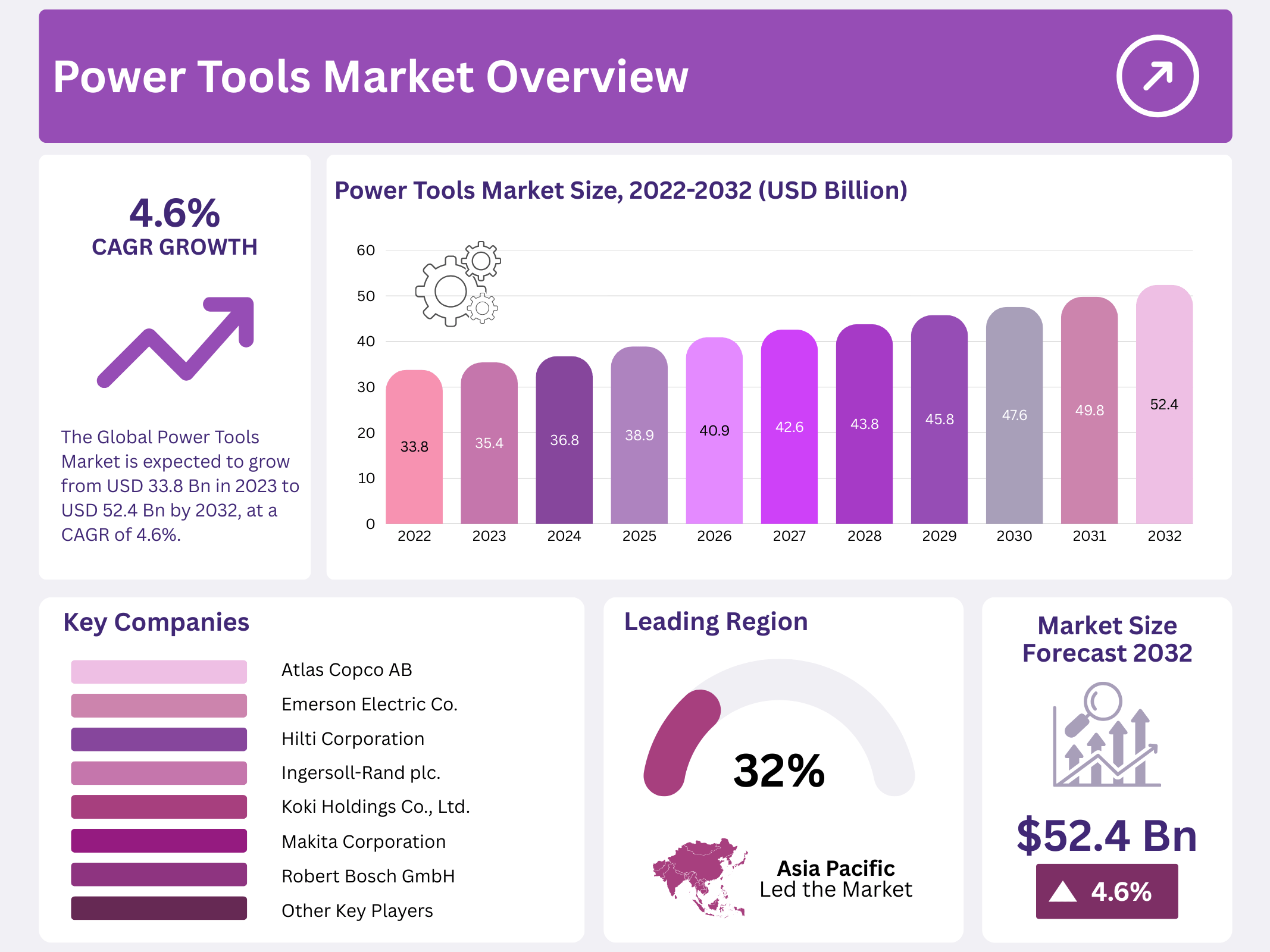

New York, NY – September 26, 2025 – The Global Power Tools Market was valued at USD 33.8 billion, and it is projected to reach USD 52.4 billion by 2032, expanding at a CAGR of 4.6% between 2023 and 2032. Power tools, which operate on external energy sources rather than manual labor, have become indispensable in modern industries due to their efficiency, portability, and ability to reduce labor costs.

These tools are widely utilized across applications such as production lines, maintenance, repair, packaging, and DIY activities. Their primary functions include cutting, drilling, sawing, and polishing, which significantly enhance productivity and precision. Industries like automotive, construction, aerospace, petrochemicals, and oil and gas have undergone notable transformations with the adoption of advanced power tools, leading to improved output and reduced manual dependency.

One of the strongest growth drivers is the rising adoption of cordless technology, which offers greater flexibility and extended operating hours. The increasing use of cordless tools is reshaping the global market, as professionals and consumers alike prefer tools that combine performance with mobility. This trend is expected to continue fueling market expansion over the forecast period.

However, challenges persist. High maintenance costs, fluctuating raw material prices, and expenses linked to moving parts remain barriers to smooth growth. Despite these restraints, the demand for energy-efficient, easy-to-use, and technologically advanced tools continues to create strong opportunities. As industries focus on efficiency and sustainability, the power tools market is set for steady growth, with cordless innovations playing a central role in shaping its future trajectory.

Key Takeaways

- The Global Power Tools Market is expected to grow from USD 33.8 billion in 2023 to USD 52.4 billion by 2032, at a CAGR of 4.6%.

- Drilling and fastening tools lead the market, driven by their simplicity, affordability, and wide use in industrial and residential settings.

- Cordless electric power tools hold a significant market share, boosted by advancements in battery technology and expanded offerings.

- Industrial applications, especially in construction and automotive, dominate due to frequent use in sawing, cutting, and drilling.

- Asia Pacific commands 32.4% of market revenue, fueled by rapid industrialization and urbanization in China and India.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 33.8 Billion |

| Forecast Revenue (2032) | USD 52.4 Billion |

| CAGR (2023-2032) | 4.6% |

| Segments Covered | By Tool Type – Drilling and Fastening Tools, Sawing and Cutting Tools, Material Removal Tools, Routing Tools, Demolition Tools, and Other Tool Types; By Mode of Operation – Engine Driven, Electric (Corded Power Tools, and Cordless Power Tools), Pneumatic, and Hydraulic; By Applications – Industrial, Construction, Agriculture, Residential, Automotive, Aerospace, Oil and Gas, and Other Applications. |

| Competitive Landscape | Atlas Copco AB, Emerson Electric Co., Hilti Corporation, Ingersoll-Rand plc., Koki Holdings Co., Ltd., Makita Corporation, Robert Bosch GmbH, Snap-on Incorporated, Stanley Black & Decker Inc., Techtronic Industries Co. Ltd., Enerpac Tool Group, and Other Key Players. |

Key Market Segments

Type Analysis

Drilling and fastening tools hold the largest share of the power tools market and are expected to maintain their dominance throughout the forecast period. Drills, valued for their simplicity and affordability, are widely used in both industrial and residential applications, including basic repairs and maintenance, driving significant segmental growth.

Meanwhile, the sawing and cutting tools segment is projected to grow steadily, fueled by the efficiency of power saws, which outperform traditional saws in speed and effort. These tools are extensively utilized in forestry, agriculture, and industrial settings to boost productivity. Additionally, the material removal tools segment, including grinders and sanders, is anticipated to grow due to rising demand in industrial environments like automotive factories and metal processing workshops.

Mode of Operation

Electric power tools, particularly cordless models, dominate the global market due to their ease of use and efficiency, bolstered by advancements in powerful battery packs. Cordless electric tools held a significant market share and are expected to continue leading during the forecast period, with manufacturers expanding their cordless offerings for both industrial and household applications.

Engine-driven power tools, such as pressure washers, lawnmowers, and generators, are poised for notable growth, driven by daily use and a shift toward electronic ignition and fuel injection systems due to stricter emissions regulations. Conversely, pneumatic tools, reliant on compressed air, are expected to see declining demand due to their energy inefficiency, as noted by the U.S. Department of Energy. Hydraulic power tools are projected to experience moderate growth.

Application Analysis

Industrial applications account for the largest share of the power tools market, driven by frequent use of tools for sawing, cutting, and drilling. The construction and automotive industries, embracing technological advancements, are key contributors to this dominance. Construction, in particular, fuels market growth due to the widespread use of cordless power tools for efficient cutting, drilling, and grinding, supported by rising construction spending in countries like the U.S., U.K., and China.

Heavy-duty power tools, enhanced by innovations in batteries and motors, further propel this segment. The residential segment, however, is expected to grow at the highest CAGR, driven by the rising DIY culture, particularly in North America and Europe, where high per capita spending on DIY tools supports activities like home renovations and gardening. In developing countries, affordable DIY tools and accessible e-commerce platforms are increasing the demand for residential power tools, offering cost savings compared to hiring labor.

Regional Analysis

Asia Pacific holds the dominant position in the global power tools market, commanding 32.4% of total revenue. The region’s growth is fueled by rapid industrialization, urbanization, and robust industrial advancements. Countries like China and India are driving this expansion through increased development activities and supportive government policies aimed at bolstering the manufacturing sector.

Taparia Tools Ltd., a 53-year-old Indian manufacturer and exporter of high-quality precision hand tools, is actively expanding its manufacturing capabilities. The company participated in the 2022 IndoMach Industrial & Machinery Expo in Hyderabad, focusing on collaboration and showcasing enhanced products to distributors.

The North American market is projected to experience substantial growth over the forecast period. Key drivers include ongoing industrial and infrastructure development, coupled with a shortage of affordable labor, which has accelerated the adoption of DIY activities. Additionally, the presence of major industry players investing in innovation and product development significantly contributes to the region’s market expansion.

Top Use Cases

- Construction Projects: Power tools like drills and saws make building homes and offices quicker and easier by cutting wood, drilling into concrete, and fastening materials firmly. Workers use them daily to shape beams, install wiring, and assemble frames, saving time and effort on large sites while ensuring strong, precise results for safer structures.

- Automotive Repairs: In car shops, grinders and impact wrenches help mechanics fix vehicles fast by removing rusted bolts, smoothing metal parts, and tightening new components. These tools handle tough jobs like engine overhauls or bodywork, letting repair teams work efficiently without manual strain and deliver reliable fixes for everyday drivers.

- Home DIY Improvements: Homeowners grab cordless sanders and routers to refresh kitchens or build shelves, sanding surfaces smooth and carving custom edges with little hassle. This hands-on approach lets families personalize spaces affordably, boosting creativity and pride in their homes while tackling small fixes like patching walls or assembling furniture.

- Woodworking Crafts: Crafters rely on routers and jigsaws to create detailed furniture or decor, carving intricate patterns and joining pieces neatly. These tools turn raw wood into polished art, helping hobbyists or small shops produce unique items like tables or carvings, blending skill with speed for enjoyable, professional-looking outcomes.

- Manufacturing Assembly: Factories use fastening tools and polishers to put together products like appliances, speeding up lines by driving screws and finishing surfaces cleanly. This keeps production flowing smoothly, reduces worker fatigue, and ensures high-quality goods roll out consistently for brands serving global customers.

Recent Developments

1. Atlas Copco AB

Atlas Copco continues to innovate in professional power tools with a focus on connectivity and ergonomics. Their recent developments include expanding the range of battery-powered tools and enhancing the ToolLink system, which provides real-time data on tool usage and tightening results for quality control in manufacturing and assembly. This focus on Industrial Internet of Things (IIoT) aims to improve productivity and traceability for its industrial customers.

2. Emerson Electric Co.

Emerson’s power tool developments are primarily channeled through its RIDGID brand. Recent focus has been on expanding their 18V OCTANE platform, featuring brushless technology for high-demand applications. They have also emphasized cordless innovations across their product lines, including wet/dry vacuums and job site radios, promoting the interoperability of batteries within their system to provide a complete cordless solution for professional tradespeople.

3. Hilti Corporation

Hilti is heavily investing in its Nuron battery platform, a new cordless ecosystem unifying all tool categories. A key recent development is the introduction of intelligent tools like the Nuron SIW 22-A cordless impact wrench, which connects to the ON! Track tracking software. This allows for digital torque documentation, tool control, and fleet management, highlighting Hilti’s strategy of combining hardware with cloud-based services for construction site efficiency.

4. Ingersoll Rand plc.

Under the Ingersoll Rand brand, the company focuses on durable tools for critical applications. A significant recent development is the launch of the QX Series of cordless impact wrenches and grinders. These tools feature brushless motors and advanced battery technology designed for high performance in demanding environments like automotive and heavy industry. They also continue to enhance their cordless product range to compete aggressively in the professional market.

5. Koki Holdings Co., Ltd.

Koki Holdings, the maker of HiKOKI and Metabo power tools, is driving innovation in battery technology. A major recent development is the introduction of the MultiVolt platform, which includes cordless tools that can be powered AC adapter via a special power supply. This provides ultimate flexibility, eliminating the gap between corded and cordless performance for professionals.

Conclusion

The Power Tools sector is a vibrant force shaping modern work and home life. Fueled by bustling building booms and a love for hands-on projects, these handy devices are evolving with smarter batteries and user-friendly designs that make tasks simpler and safer. Expect wider adoption in everyday fixes and big industry shifts, promising steady gains as folks and firms chase efficiency and fresh ideas without the old hassles.