Quick Navigation

Overview

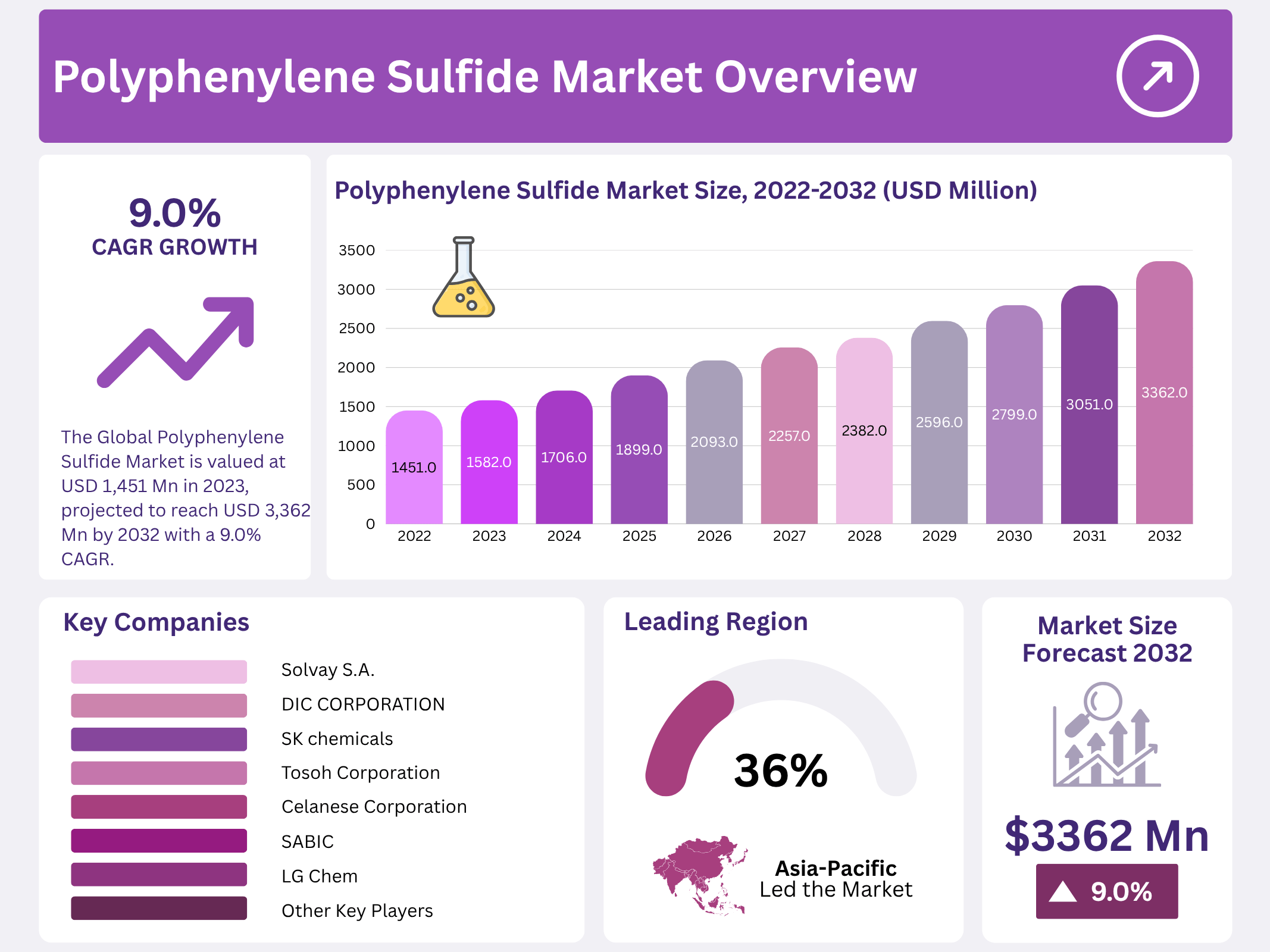

New York, NY – November 04, 2025 – The Global Polyphenylene Sulfide (PPS) Market was valued at USD 1,451 million in 2022 and is projected to reach USD 3,362 million by 2032, expanding at a CAGR of 9.0% from 2023 to 2032. PPS is a high-performance engineering plastic widely used across industries due to its excellent resistance to high temperatures, chemicals, and mechanical stress. Its ability to maintain dimensional stability under harsh environments makes it a preferred material in demanding applications.

Growth in the PPS market is primarily driven by its rising adoption in automotive, electrical & electronics, and industrial sectors. Automakers increasingly use PPS for lightweight and heat-resistant components, while the electronics industry benefits from its electrical insulation properties. Continuous technological advancements in PPS production have also enhanced performance characteristics and cost efficiency, boosting global consumption.

The Asia-Pacific region dominates the global PPS market due to the strong presence of end-use industries and cost-effective manufacturing infrastructure. Countries such as China, Japan, and South Korea lead production and consumption, supported by readily available raw materials and affordable labor. The region’s industrial growth, coupled with increasing awareness of PPS’s long-term performance benefits, continues to propel overall market expansion.

Key Takeaways

- The Global Polyphenylene Sulfide Market is valued at USD 1,451 million in 2023, projected to reach USD 3,362 million by 2032 with a 9.0% CAGR.

- Linear PPS leads the market with 61% revenue share in 2022 due to high crystallinity and superior mechanical/thermal properties.

- Automotive application dominates with 34% revenue share in 2022, driven by heat and chemical resistance.

- Asia Pacific holds the largest market share at 36% and is expected to grow at the highest CAGR.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 1451 Million |

| Forecast Revenue (2032) | USD 3362 Million |

| CAGR (2023-2032) | 9.0% |

| Segments Covered | By Type-Linear PPS, Cured PPS, and Branched PPS; By Application-Automotive, Electrical & Electronics, Filter Bags, Aerospace, Industrial, Coatings, and Other Applications |

| Competitive Landscape | Toray Industries Inc., DIC CORPORATION, Solvay S.A., Lion Idemitsu Composites Co. Ltd, Polyplastics Co. Ltd., Tosoh Corporation, SK Chemicals, Chengdu Letian Plastics Co. Ltd., Celanese Corporation, TEIJIN LIMITED, SABIC, Zhejiang NHU Co. Ltd., LG Chem, RTP Company, Ensinger, Other Key Players |

Key Market Segments

By Type Analysis

The Polyphenylene Sulfide (PPS) Market is segmented by type into linear PPS, cured PPS, and branched PPS. Among these, the linear PPS segment stands out as the most lucrative in the global market. In 2022, it captured a dominant revenue share of 61%, driven by its high crystallinity, excellent dimensional stability, and superior mechanical and thermal properties.

Linear PPS finds extensive use across diverse applications, including automotive, electrical and electronics, and industrial sectors. In contrast, branched PPS offers a lower melting point and enhanced processability compared to its linear counterpart. This makes it particularly suitable for applications in electrical and electronics, industrial settings, and coatings.

By Application Analysis

The PPS market is categorized by application into automotive, electrical & electronics, filter bags, aerospace, industrial, coatings, and other segments. The automotive segment emerges as the most lucrative, holding a 34% revenue share in 2022. Its prominence stems from PPS’s exceptional high-temperature resistance, chemical resistance, and dimensional stability, making it ideal for fuel system components, electrical parts, and under-the-hood applications. Beyond automotive uses, PPS is widely adopted in electrical and electronics for components like connectors, switches, and sockets. These applications benefit from its high dielectric strength, dimensional stability, and robust resistance to elevated temperatures and chemicals.

Regional Analysis

Asia Pacific dominated the polyphenylene sulfide (PPS) market, capturing the largest revenue share of 36%. The region is also projected to achieve the highest CAGR during the forecast period, fueled by rapid industrialization, urbanization, and increasing demand for high-performance materials.

These factors are expected to drive significant growth in the Asia Pacific PPS market. North America represents another key market for PPS, supported by strong demand from the automotive and aerospace sectors. Growing emphasis on sustainability and the rising need for advanced, high-performance materials are anticipated to further propel the expansion of the PPS market in North America.

Top Use Cases

- Automotive Components: Polyphenylene sulfide shines in car parts like fuel lines, pump housings, and under-hood valves. Its strong heat and chemical resistance keep these pieces safe from engine oils and hot gases. This material cuts weight compared to metal, boosting fuel savings, and molds easily for precise fits in tight spaces. Overall, it supports greener, tougher vehicles for daily drives.

- Electrical and Electronics Parts: In gadgets, PPS crafts connectors, switches, and circuit housings that handle high heat and sparks without failing. Its top-notch insulation blocks electricity leaks, while flame resistance adds safety in crowded device boards. Easy to shape into tiny, detailed forms, it fits modern tech needs like phones and laptops, ensuring long-lasting performance in everyday use.

- Aerospace Structures: For planes, PPS forms lightweight panels, ducting, and seat frames that endure extreme altitudes and flames. Its stability in wild temperature swings prevents warping, and low smoke output keeps cabins safer during issues. Blended with fibers, it rivals heavy metals but flies lighter, aiding fuel-efficient flights and reliable travel across the skies.

- Industrial Filtration Systems: PPS builds tough filter bags and membranes for factories cleaning air from coal plants or chemicals. It shrugs off acids, steam, and abrasives, lasting longer than cloth alternatives in harsh setups. This cuts downtime for upkeep, saving costs, and supports cleaner operations in power and paper mills where steady flow matters most.

- Appliance and Consumer Goods: Home tools like hair dryers, grills, and cooker parts use PPS for its heat-proof build that won’t melt or warp under steam. In lab gear, it sterilizes easily without degrading, handling repeated cleans. Its smooth finish accepts colors well, making items look sharp, while strength ensures safe, durable use in busy kitchens and workshops.

Recent Developments

1. Toray Industries Inc.

Toray is advancing its PPS compounds for high-performance applications, focusing on the automotive and electronics sectors. Recent developments include new grades with improved thermal conductivity for heat management in electric vehicle (EV) components and halogen-free flame-retardant grades for electronics. The company emphasizes materials that contribute to vehicle electrification and miniaturization of electronic devices, leveraging PPS’s excellent heat and chemical resistance.

2. DIC CORPORATION

DIC has been actively expanding its PPS business through capacity expansion and new product development. A key recent move is the development of sustainable PPS compounds using recycled materials. They are also introducing new grades with enhanced flow properties for thinner-wall molding in complex electronic connectors and automotive parts, aiming to meet the stringent requirements for miniaturization and improved productivity in high-volume manufacturing.

3. Solvay S.A.

Solvay continues to innovate with its Ryton PPS, launching new grades aimed at the rapidly growing electric vehicle market. Recent developments include high-flow, high-thermal-conductivity compounds for components like battery cell holders and cooling systems. Solvay is also focusing on sustainable solutions, having conducted lifecycle assessments and exploring bio-based raw material options to reduce the carbon footprint of its PPS products.

4. Lion Idemitsu Composites Co. Ltd

Formed from the composites businesses of Idemitsu Kosan and Lion, this company is strengthening its PPS portfolio. Recent developments focus on creating super engineering plastics alloys, combining PPS with other polymers to achieve unique property balances. They are also enhancing their low-warpage and high-strength PPS compound grades to serve the precise demands of automotive sensors, LED components, and other high-tolerance applications.

5. Polyplastics Co. Ltd.

Polyplastics, a leader in PPS with its DURAFIDE brand, is heavily investing in capacity expansion to meet global demand. A key recent development is the launch of new low-chlorine-grade PPS, which minimizes corrosion of metal inserts and contacts in sensitive electronic components. They are also advancing high-rigidity, low-warpage grades and materials designed for large, intricate parts in automotive and industrial applications.

Conclusion

Polyphenylene Sulfide is a standout player in high-demand sectors, blending tough heat handling with smart chemical shields in a lightweight package. It steps in where metals falter, easing production while lifting product life and safety across autos, tech, and heavy industry. With pushes for lighter, greener designs, PPS gears up to claim bigger shares, promising steady growth through smarter, tougher everyday solutions.