Quick Navigation

Overview

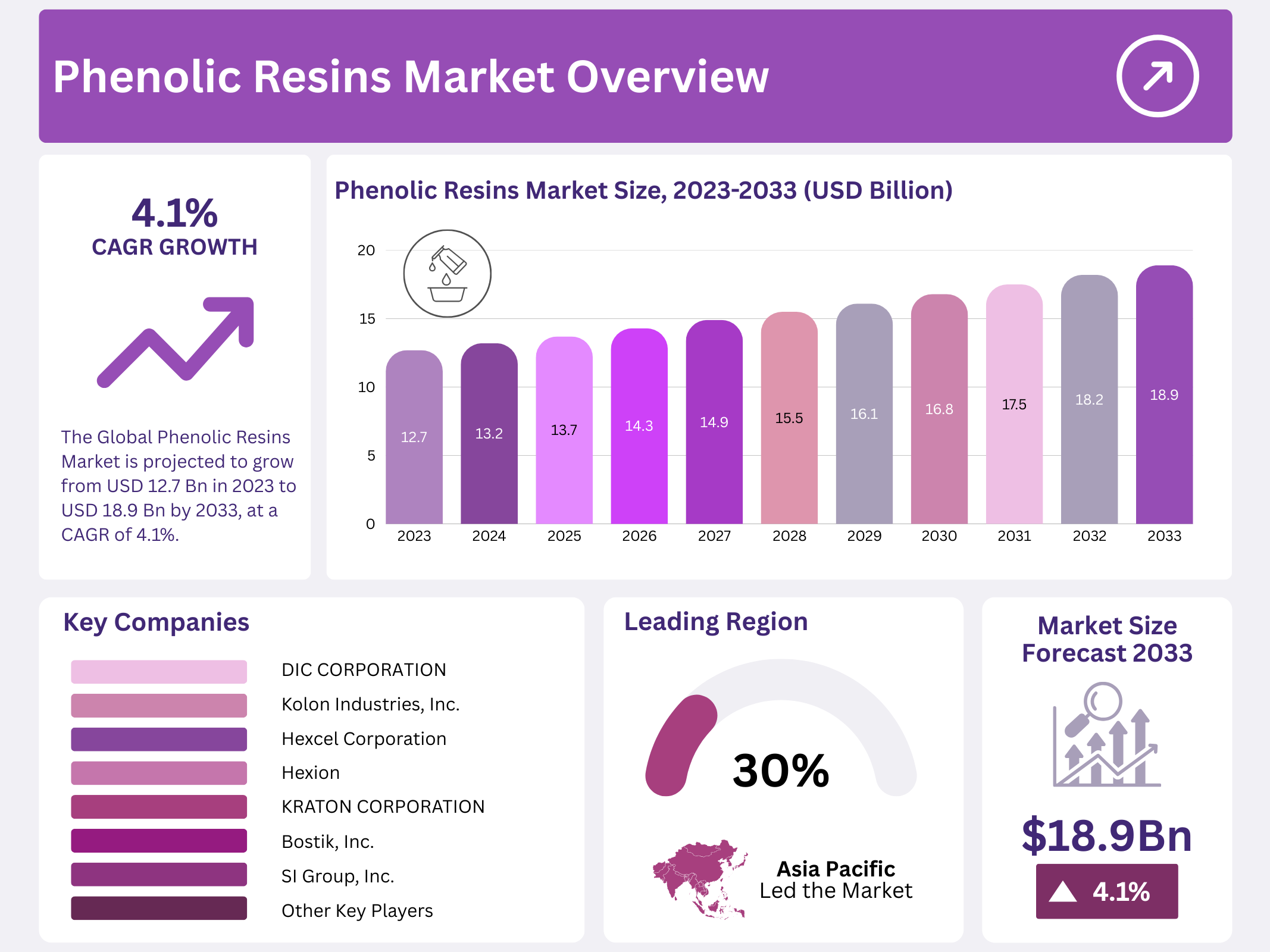

New York, NY – December 26, 2025 – The Global Phenolic Resins Market size is expected to be worth around USD 18.9 billion by 2033, from USD 12.7 billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2024 to 2033. Growth factors include ongoing construction activity, stricter fire-safety needs in public and high-rise buildings, higher vehicle production and repair cycles, and wider use of engineered wood products and laminates in interiors.

The Phenolic Resins Market is growing steadily because these resins are trusted “workhorse” materials in building, transport, and industrial manufacturing. Demand stays strong in wood panels and insulation for construction, in molded parts for electrical and household uses, and as binders in friction materials like brake pads. Buyers like phenolic resins for heat resistance, flame performance, dimensional stability, and reliable bonding, which keeps the market popular in safety-critical applications.

Market opportunities are expanding in low-emission and higher-performance grades, including resins designed to cut odor and improve curing speed, while meeting tighter environmental expectations. Producers can also gain share by building capacity closer to high-growth regions, improving supply reliability, and tailoring products for fast-moving segments such as insulation, composites, and specialty industrial binders—supporting broader market expansion over the next decade.

Key Takeaways

- The Global Phenolic Resins Market is projected to grow from USD 12.7 billion in 2023 to USD 18.9 billion by 2033, at a CAGR of 4.1% during 2024–2033.

- Novolac resins hold approximately 35% of total market volume, thanks to their excellent heat resistance, hardness, and solvent resistance, especially in electrical & electronics applications.

- The Foundry & Moldings segment led demand in 2023, accounting for over 30% of the total market.

- Wood adhesives are the most widely preferred application due to strong water resistance, moisture durability, weather stability, and ease of use.

- Building & Construction remains a dominant end-use segment, driven by use in insulation, laminates, and particleboard binders for their fire resistance and thermal stability.

- Asia Pacific holds the largest regional share (30.9% in 2023), fueled by rapid growth in the construction, automotive, and consumer goods industries.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 12.7 Billion |

| Forecast Revenue (2033) | USD 18.9 Billion |

| CAGR (2024-2033) | 4.1% |

| Segments Covered | By Product(Novolac, Resol, Other Products), By Application(Wood Adhesives, Insulation, Molding, Laminates, Coatings, Paper Impregnation, Other Applications), By End-use Industry(Building & Construction, Electrical and Electronics, Automotive, Lumber, Building and Construction, Others) |

| Competitive Landscape | DIC CORPORATION, Kolon Industries, Inc., Sumitomo Bakelite Co., Ltd., Hexcel Corporation, Georgia-Pacific Chemicals, KRATON CORPORATION, Hexion, Bostik, Inc., SI Group, Inc. |

Key Market Segments

Product Analysis

Resole resins are further classified into liquid and solid forms. Novolac resins accounted for about 35% of the total market volume, supported by their strong performance characteristics such as high heat resistance, superior hardness, and excellent solvent resistance. These properties make them suitable for demanding industrial applications, especially in electrical and electronic components. Growth in the electrical and electronics industries across North America is further supporting demand for novolac resins.

Innovation continues to play an important role in market expansion. Newly developed phenolic resin products with enhanced performance are helping meet changing consumer requirements. In addition, the ability of phenolic resins to protect substrates from corrosive chemicals due to their impermeable nature is boosting adoption. The introduction of modified phenolic resins, including cyanate ester and benzoxazine-based phenolic resins, is expected to further support market growth.

Application Analysis

In 2023, the Foundry & Moldings segment led the market, accounting for over 30% of total demand. Based on application, phenolic resins are used in wood adhesives, molding compounds, insulation materials, paper impregnation, and laminates. Among these, wood adhesives are widely preferred due to their strong water resistance, moisture durability, weather stability, and ease of dilution.

The Asia Pacific region is expected to be the largest market for wood adhesives, supported by rising disposable income and increased construction and furniture production. Molding compounds are also gaining strong traction and are widely used in electrical and electronics, household goods, automotive components, and commutators. Their excellent dimensional stability allows manufacturers to produce durable electrical equipment and kitchenware, driving future demand.

The molding resins segment is growing rapidly in the Asia Pacific, mainly due to China’s expanding petrochemical sector. Additionally, lower crude oil prices have encouraged bulk trading, production, and distribution of petrochemical derivatives, further supporting market growth. To offset price volatility and sustain annual growth, major phenolic resin producers are adopting strategic initiatives.

By End-Use

Building & Construction remains a major end-use segment. Phenolic resins are widely used in insulation materials, laminates, and particleboard binders due to their durability, fire resistance, and thermal stability. The Electrical and Electronics segment also holds a significant share.

Phenolic resins are commonly used in circuit boards and flame-retardant components because of their excellent electrical insulation properties. In the Automotive sector, phenolic resins are used in brake and clutch linings where high temperature resistance and reliability are critical for vehicle safety.

The Lumber segment is another important area of application. Phenolic resins are used to treat wood, improving strength, durability, and resistance to moisture, insects, and environmental damage, making them suitable for long-term structural use.

Regional Analysis

The Asia Pacific region held the largest market share at 30.9%, driven by rapid expansion across key end-use industries such as construction, consumer goods, and automobiles. Strong industrial growth, rising urbanization, and increasing infrastructure development continue to support regional demand. In addition, several countries in the region are focusing on the development of bio-based feedstocks for phenolic resin production. This shift toward sustainable raw materials is expected to strengthen market dynamics and support long-term growth in the near future.

North America and Europe are expected to witness steady growth due to increasing automobile production across both regions. Rising demand for phenolic resins in applications such as abrasives, adhesives, and automotive components is supporting market expansion. Growth in these regions is further supported by higher investment in research and development, along with efforts to identify and strengthen key industry participants, which will contribute to market advancement over the coming years.

The Middle East and Africa (MEA) market is experiencing growing momentum, supported by wide-ranging research and development initiatives. These efforts are helping the region emerge as one of the fastest-growing markets, driven by rising domestic demand. Technological innovation, along with increasing disposable income, is expected to have a positive impact on phenolic resin adoption across multiple industries.

Latin America has benefited from improved political stability, creating a favorable environment for economic growth and foreign investment. The region is expected to expand at a strong pace during the forecast period, supported by increased investments across industries aimed at meeting export demand, including consumer electronics. The availability of low-cost labor and accessible technologies is expected to further support the growth of phenolic resins in the region.

Top Use Cases

- Adhesives and Coatings: Phenolic resins serve as strong binders in adhesives and protective coatings across industries. They offer excellent resistance to heat, chemicals, and moisture, making them ideal for bonding wood in plywood or coating metal surfaces to prevent corrosion. This versatility helps manufacturers create durable products that withstand harsh environments, boosting reliability in construction and automotive sectors.

- Molded Products: In molding applications, phenolic resins are shaped into everyday items like billiard balls and laboratory countertops. Their high strength and heat tolerance ensure long-lasting performance under heavy use. Industries value them for creating precise, rigid components that resist wear, supporting innovation in consumer goods and scientific equipment where safety and durability are key.

- Electronics and Circuit Boards: Phenolic resins are essential in producing printed circuit boards and electrical insulators. They provide insulation against electricity and heat, enabling reliable performance in devices like computers and appliances. This application drives efficiency in the electronics market by ensuring components handle high temperatures and mechanical stress without failing.

- Rubber Enhancement in Tires: Added to rubber compounds, phenolic resins improve tire properties such as traction, stiffness, and abrasion resistance. They enhance road grip and longevity, making vehicles safer and more efficient. Automotive manufacturers rely on this to meet demands for high-performance tires that perform well in various conditions, supporting growth in transportation.

- Composites and Insulation: Phenolic resins reinforce composite materials and insulation products like pipe wraps and fiberglass structures. They contribute to lightweight yet strong builds that resist fire and chemicals. This makes them suitable for aerospace, building, and industrial uses, where energy efficiency and safety standards drive the need for advanced, protective materials.

Recent Developments

1. DIC CORPORATION

DIC is advancing sustainable phenolic resins by expanding its “Vyloglass” range, which uses bio-based raw materials like cardanol from cashew nut shells. Recent R&D focuses on reducing formaldehyde emissions and improving recyclability for automotive and electronics applications, supporting the circular economy.

2. Kolon Industries, Inc.

Kolon Industries is developing halogen-free, flame-retardant phenolic resins for the electric vehicle battery sector. Their recent innovations target high heat resistance and low smoke toxicity for battery module components, directly supporting next-generation EV safety standards and thermal management systems.

3. Sumitomo Bakelite Co., Ltd.

Sumitomo Bakelite is pioneering high-purity phenolic molding compounds for semiconductor packages, essential for advanced chips. They are also innovating in phenolic resins for carbon fiber prepregs used in lightweight automotive and aerospace structures, emphasizing performance under extreme conditions.

4. Hexcel Corporation

Hexcel’s recent work integrates high-performance phenolic resins into advanced composite prepregs for aerospace interiors. These resins provide exceptional fire-smoke-toxicity (FST) ratings and weight savings, meeting strict aviation regulations for cabin components and contributing to lighter, safer aircraft.

5. Georgia-Pacific Chemicals

Georgia-Pacific Chemicals is enhancing its specialty phenolic resin binders for sustainable wood products. Recent developments focus on resins with lower carbon footprints for engineered wood and insulation, improving production efficiency and environmental profiles to meet green building demands.

Conclusion

Phenolic Resins stand out as versatile materials with broad appeal across multiple industries due to their robust properties like heat resistance and durability. As a market research analyst, I see strong potential for continued adoption in emerging sectors focused on sustainability and performance, positioning them as a reliable choice for innovative product development and efficient manufacturing processes.