Quick Navigation

Overview

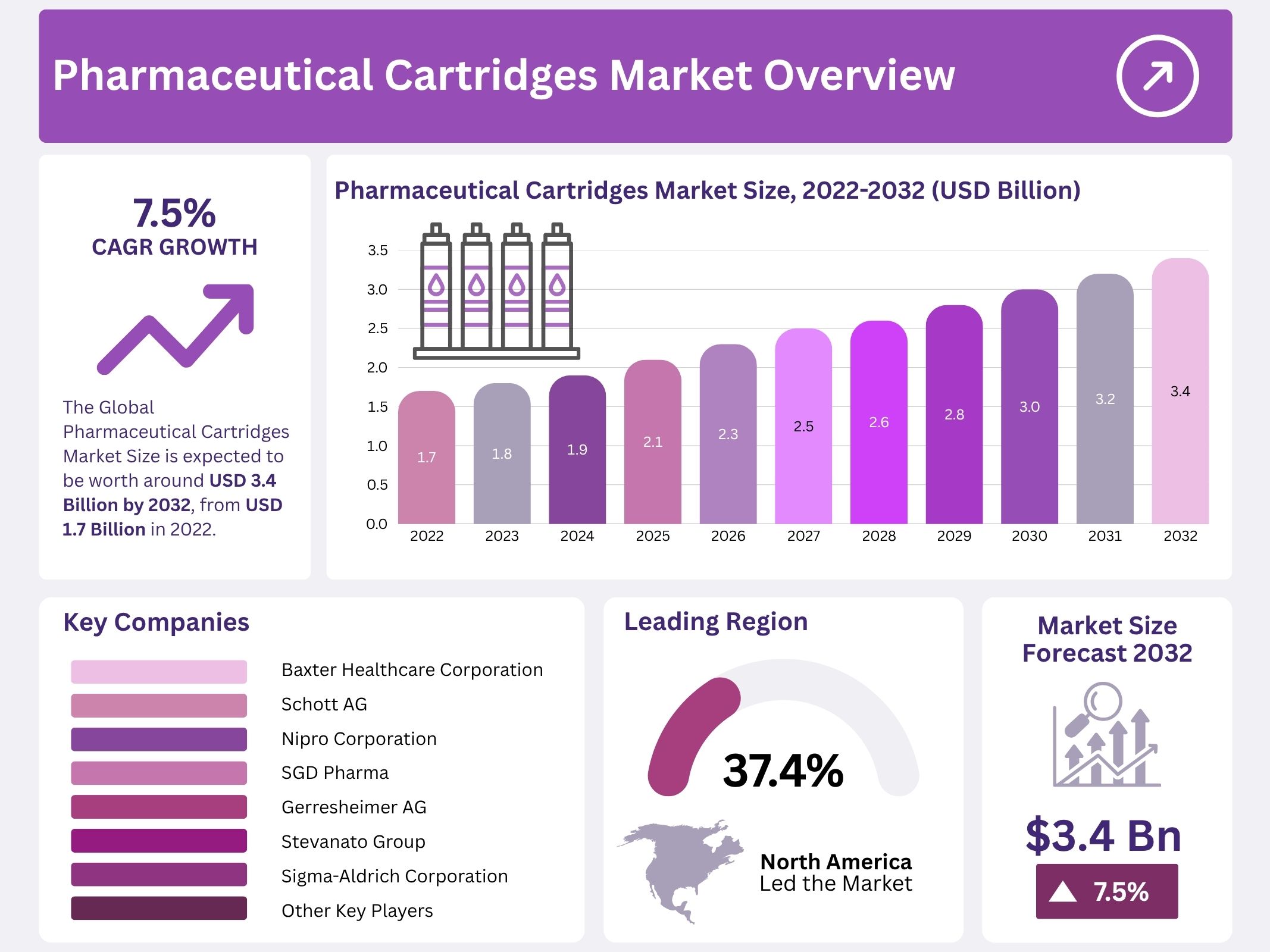

The Pharmaceutical Cartridges Market is projected to reach USD 3.4 billion by 2032. The value was around USD 1.7 billion in 2022. Growth is expected at a CAGR of 7.5% during 2023 to 2032. Market expansion is driven by the increasing adoption of injectable therapies and self-administration technologies. The shift from traditional packaging formats to cartridge-based solutions is strengthening product demand. Standardization in drug delivery and emphasis on safety also contribute. Manufacturers continuously focus on precision, sterility, and reduced contamination risks. These attributes make cartridges a reliable choice for modern drug formulations targeting improved patient outcomes.

A key growth factor is the rising prevalence of chronic illnesses such as diabetes, rheumatoid arthritis, and hormonal disorders. These conditions require long-term injectable treatments. Pharmaceutical cartridges serve as essential components in self-injecting systems like insulin pens and pen-injectors. Increasing aging populations and patient preference for home-based care are accelerating cartridge usage. Improved adherence and dosing accuracy support this trend. Healthcare systems are also promoting minimally invasive delivery formats to lower clinical burdens. As a result, demand for convenient, ready-to-use drugs is growing steadily across global markets.

Glass and advanced polymer materials remain widely used in cartridge production. Innovations in coatings and container strength are improving chemical resistance and reducing product breakage. This supports the storage of sensitive biologics requiring high purity. Enhanced sealing mechanisms further protect drug quality during transportation and handling. Manufacturers invest in technologies that meet stringent regulatory expectations for quality and reliability. These advancements allow expansion of injectable biologics that need secure and stable packaging. The improved performance of cartridges is expected to provide strong competitive advantages within pharmaceutical delivery systems.

Biopharmaceutical R&D is increasing adoption of cartridges for new therapies. Regulatory encouragement for standardized delivery systems supports faster commercialization. Pharmaceutical companies are outsourcing manufacturing to specialized partners to optimize costs and capacity. Collaboration between device makers and drug developers is rising. This integration ensures compatibility between the cartridge and the final delivery device. Growth opportunities are strong in emerging economies with improving healthcare access. Supportive government initiatives and expanding treatment coverage are further strengthening industry scalability.

A positive outlook for the pharmaceutical cartridges market is anticipated over the forecast period. Continuous growth in injectable drug usage, stronger focus on patient-centric care, and upgrades in cartridge technology are key drivers. The market is expected to benefit from increasing approvals of biologics that rely on accurate and sterile delivery solutions. The combination of innovation, chronic disease burden, and global healthcare improvements positions cartridges as a preferred packaging option within modern drug delivery ecosystems.

Key Takeaways

- The pharmaceutical cartridges market is projected to expand at a 7.5% CAGR, reaching approximately USD 3.4 billion by 2032, according to industry insights.

- Increasing prevalence of chronic diseases like diabetes and arthritis is reported to significantly contribute to higher demand for pharmaceutical cartridges globally.

- Glass cartridges are said to dominate with nearly 64% share, valued for strong durability, chemical resistance, and safe drug containment.

- Cartridges with 5–50 ml capacity reportedly capture around 37% share, being preferred for efficient medication storage and accurate drug delivery.

- A noticeable consumer inclination toward natural treatments such as Ayurveda and Homeopathy is observed to restrain pharmaceutical cartridge market growth.

- The introduction of innovative cartridge formats and advanced secure packaging solutions is expected to enhance market expansion opportunities.

- Growing demand for injectable drugs, especially within chronic disease management, is cited as a key driver encouraging cartridge manufacturing advancements.

- Manufacturers are exploring biodegradable and eco-friendly materials to support sustainability goals and meet environmentally conscious consumer demands.

- Prefilled syringes are increasingly preferred due to improved patient compliance, dosing accuracy, and reduced contamination risks in drug administration.

- North America reportedly leads with a 37.4% market share, while Asia Pacific is anticipated to experience the fastest growth in upcoming years.

Regional Analysis

North America accounted for the largest share of the global pharmaceutical cartridges market. The region represented a revenue share of 37.4%. The dominance can be attributed to the high burden of chronic diseases. Conditions such as diabetes, obesity, and arthritis are widely prevalent. A higher number of patients require constant medication. The market is supported by technological advancements and strong healthcare systems. Pharmaceutical cartridges are preferred for injectable therapies. They help ensure efficient drug administration. The demand is expected to maintain steady growth throughout the forecast period.

The increased incidence of diabetes in North America has had a major impact on the demand for pharmaceutical cartridges. These devices assist in accurate insulin doses. They also allow safe and long-term medication storage. Insulin therapy is considered an essential treatment for many patients. The expanding patient pool leads to continuous product adoption. Manufacturers focus on precise designs for patient convenience. The presence of leading pharmaceutical companies further supports market expansion. The region benefits from high healthcare expenditure and strong regulatory monitoring.

The market in North America is influenced by greater awareness regarding advanced drug delivery systems. The availability of supportive reimbursement policies enhances adoption. Medical professionals recommend cartridges for self-administration. This improves patient compliance and treatment accuracy. Rising geriatric population levels also contribute to demand. Older individuals face higher risks of chronic diseases. Hospitals and home-care settings actively use cartridges. Product innovations ensure consistent safety and sterility. The forecast anticipates stable revenue growth due to strong product demand.

Asia Pacific is expected to record the fastest growth in the pharmaceutical cartridges market. The region has shown increased healthcare spending. The penetration of leading pharmaceutical companies is rising. Many firms are expanding operations and marketing capabilities. Chronic diseases such as diabetes are becoming more common. There is a growing shift toward self-injectable medication formats. Developing countries are improving access to healthcare facilities. Government programs promote better treatment adherence. These elements encourage the adoption of pharmaceutical cartridges across the region in the coming years.

Segmentation Analysis

The market has been dominated by the glass material segment. It accounted for around 64% of the total share. The growth of this segment can be attributed to its strong production capacity. Glass shows high resistance to scratches and chemical damage. It also offers excellent tolerance and stability. These factors drive strong adoption in medical packaging. Its suitability in injection systems further increases demand. Plastic materials are gaining traction. Their market growth is expected during the forecast period. Adoption may rise due to improved usability and emerging innovation.

The 5-50 ml capacity segment held the largest share of the market. It represented around 37% of total demand. These cartridges are widely used in the healthcare sector. They support safe medication delivery in small to moderate volumes. This ensures correct dosage and maintains patient safety. The segment benefits from high reliability and easier handling. Cartridges of 51-250 ml capacity are usually made of glass. They are preferred for storing large medication volumes. These product types show stable demand in hospital and clinical applications.

By Material

- Glass

- Plastic

By Capacity

- Below 5 ml

- 5-50 ml

- 51-250 ml

- Above 250 ml

Key Players Analysis

The Pharmaceutical Cartridges Market is driven by the strategic initiatives of major companies to strengthen production capabilities and regional presence. Market players are focused on expanding manufacturing facilities and improving product quality standards. The growth of the sector is supported by rising demand for sterile and durable packaging formats for injectable therapeutics. It has been observed that companies are increasing investments in advanced glass and polymer technologies to enhance drug safety. Such steps are expected to create new opportunities for business expansion and long-term revenue generation.

Leading participants are continuously developing innovative product portfolios to align with regulatory requirements and patient safety needs. The introduction of improved materials and coatings is supporting better drug compatibility. Key companies are working to enhance supply chain infrastructure in emerging and developed economies. These efforts are focused on ensuring uninterrupted product availability. Through innovation and compliance with international guidelines, the leading players are improving product performance and achieving stronger market acceptance.

Several companies are also strengthening their geographic footprint through acquisitions, partnerships, and facility expansions. This approach allows them to cater to growing pharmaceutical production in Asia and other fast-growing regions. Gerresheimer AG expanded its presence by establishing two specialist glassworks in India and three in China to meet local and global needs for high quality drug packaging. This expansion enhances customer reach and supports increased demand for injectable formats. Regional manufacturing also improves cost efficiency and delivery timelines for customers.

Prominent companies contributing to market growth include Baxter Healthcare Corporation, Schott AG, Nipro Corporation, SGD Pharma, Gerresheimer AG, Stevanato Group, Sigma-Aldrich Corporation, Pierrel S.p.A., and West Pharmaceutical Services Inc. Other key players are also adopting competitive strategies to maintain strong positioning. Investments in research and production technologies are supporting sustainable growth. Strong focus on product integrity and supply reliability is encouraging pharmaceutical companies to collaborate with trusted cartridge suppliers. This trend will likely continue to benefit established players in the global market.

Market Key Players

- Baxter Healthcare Corporation

- Schott AG

- Nipro Corporation

- SGD Pharma

- Gerresheimer AG

- Stevanato Group

- Sigma-Aldrich Corporation

- Pierrel S.p.A.

- West Pharmaceutical Services, Inc.

- Other Key Players

Conclusion

The pharmaceutical cartridges market is expected to grow steadily due to higher use of injectable medicines and a strong shift toward self-administration. Demand is supported by rising cases of long-term diseases that require regular and accurate dosing at home. The importance of safe, sterile, and easy-to-use packaging drives continuous innovation in cartridge materials and design. Leading manufacturers are improving quality, expanding production, and strengthening partnerships with drug developers. Growth in biologics and better access to healthcare in developing regions will further support adoption. The market outlook remains positive, as patient comfort, product safety, and reliable delivery continue to guide industry progress.