Quick Navigation

Overview

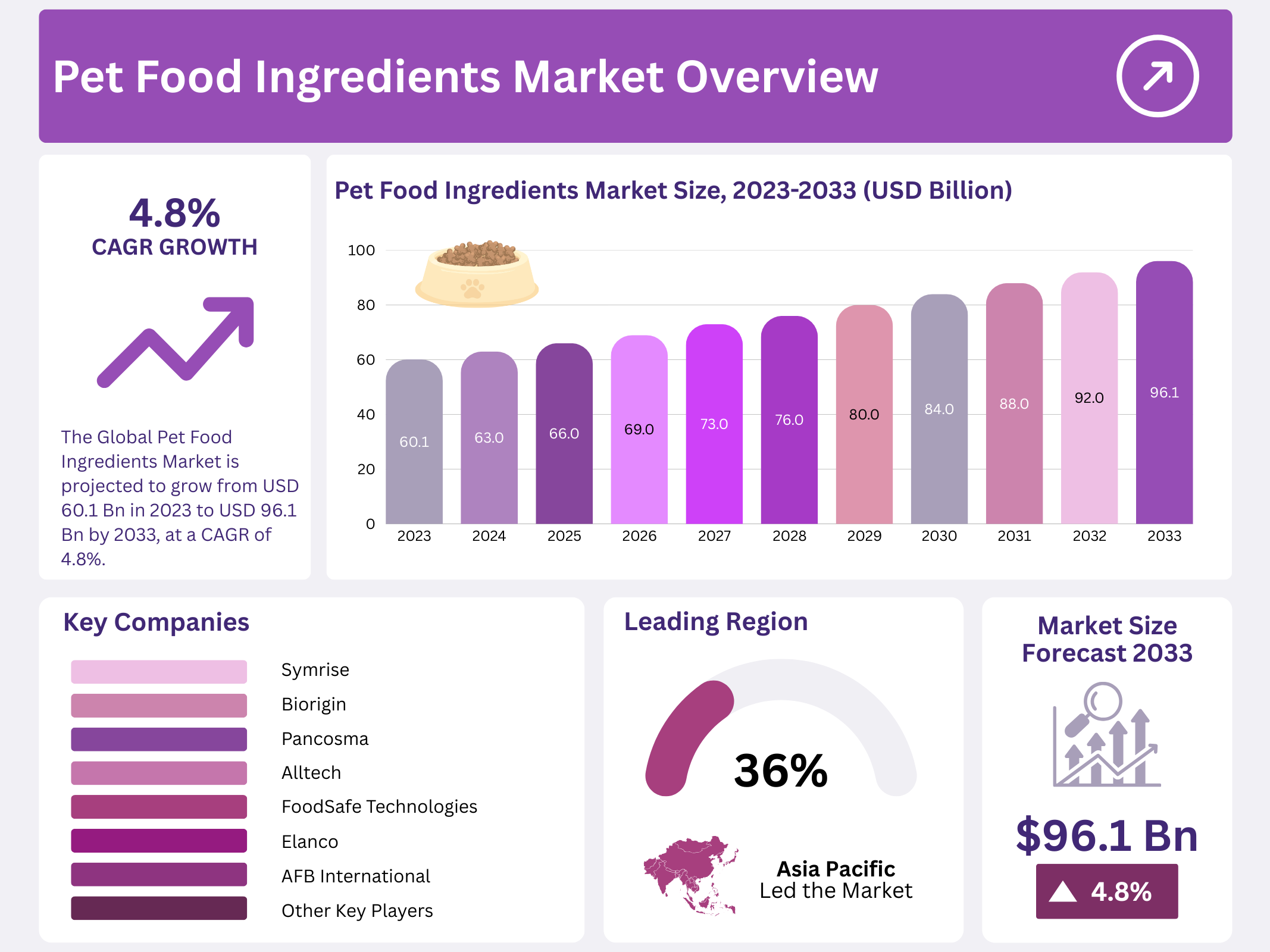

New York, NY – December 19, 2025 – The Global Pet Food Ingredients Market is projected to reach a value of approximately USD 96.1 billion by 2033, rising from USD 60.1 billion in 2023. This steady expansion reflects a CAGR of 4.8% over the forecast period from 2023 to 2033, supported by increasing pet ownership and growing spending on premium pet nutrition worldwide.

Market growth is largely driven by the shift toward high-quality, functional, and natural ingredients in pet food formulations. Pet owners are becoming more aware of animal health, nutrition, and wellness, which is encouraging manufacturers to include proteins, vitamins, minerals, probiotics, and specialty additives that support digestion, immunity, and overall vitality.

Pet food ingredients include both natural and synthetic components used to formulate balanced diets for companion animals. These ingredients provide essential nutrients required for growth, energy, and long-term health, making them a critical part of the pet food value chain. As pets are increasingly treated as family members, demand for nutritionally complete and safe ingredients continues to rise.

Key Takeaways

- The Global Pet Food Ingredients Market is projected to grow from USD 60.1 billion in 2023 to USD 96.1 billion by 2033, at a CAGR of 4.8%.

- Dogs accounted for over 40% of total market demand, driven by a large global dog population and high spending on dog nutrition.

- Cat food ingredients held a strong share, closely following dogs, supported by widespread cat ownership in urban and suburban areas.

- Amino Acids dominated with over 33% market share, due to their essential role in muscle development, immunity, and overall pet health.

- Asia Pacific was the largest regional market in 2023, capturing over 36.9% of global revenue.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 60.1 Billion |

| Forecast Revenue (2033) | USD 96.1 Billion |

| CAGR (2024-2033) | 4.8% |

| Segments Covered | By Material Type (Titanate, Alumina, Ferrite, Zirconate, Other Material Types), By Application (Monolithic Ceramics, Ceramic Coatings, Ceramic Filters, Others), By End-use Industry (Electrical & Electronics, Transportation, Medical, Defence & Security, Environmental, Chemical, Others) |

| Competitive Landscape | The 3M Company, AGC Ceramics Co., Ltd., CeramTec GmbH, CoorsTek Inc., Elan Technology, KYOCERA Corporation, Morgan Advanced Materials, Murata Manufacturing Co., Ltd., Nishimura Advanced Ceramics Co., Ltd., Ortech Advanced Ceramics, Other Key Players |

Key Market Segments

Pet Analysis

In 2023, Dogs dominated the pet food ingredients market, accounting for over 40% of total demand. This leadership is driven by the large global dog population and consistently high spending on dog nutrition. Cat food ingredients also represented a strong share, following closely behind dogs, supported by widespread cat ownership across urban and suburban regions worldwide.

Fish food ingredients formed a comparatively smaller segment of the market. Demand in this category is mainly linked to aquarium and ornamental fish owners, making it more niche and specialized than dog and cat food ingredients. While essential, fish nutrition remains limited to a specific consumer base.

Ingredients Analysis

In 2023, Amino Acids held a dominant position in the pet food ingredients market, capturing over 33% of the total share. Their importance stems from their essential role in muscle development, immunity, and overall pet health. As pet owners increasingly prioritize balanced nutrition, amino acids remain a core ingredient across premium and mass-market pet food formulations.

Among amino acids, lysine plays a critical role as a key protein-building component. Since animals do not produce sufficient lysine naturally, it must be supplied through diet or supplementation. Lysine offers similar biological value to soybean protein and is widely used due to its cost-effectiveness and nutritional efficiency, making it a preferred ingredient in companion animal diets.

Regional Analysis

The Asia Pacific region emerged as the largest market in 2023, holding more than 36.9% of global revenue. Market growth is supported by rising pet populations, increasing disposable income, and stronger humanization trends. As consumers become more price-conscious, demand is gradually shifting from premium products toward high-quality mass-market alternatives.

North America remained a major regional market, led by the United States, followed by Canada, with Mexico ranking third. The U.S. benefits from a mature pet food industry and high ownership rates of dogs and cats, placing it among the top global pet-owning countries. Both the U.S. and China show strong demand–supply balance in pet food ingredients, with China experiencing rapid consolidation among ingredient manufacturers through mergers and acquisitions.

Top Use Cases

- Human-Grade Ingredients: Pet owners now choose foods made with the same quality ingredients as human meals, like fresh chicken, carrots, and blueberries. These provide better nutrition without fillers or artificial additives. This approach helps pets stay energetic and healthy while giving owners peace of mind that they feed safe, wholesome meals to their companions.

- Functional Ingredients for Wellness: Brands add targeted ingredients such as glucosamine for joints, omega-3s for skin and coat, and antioxidants for immunity. These support specific health needs, especially in older pets or active breeds. Owners pick these foods to prevent issues and keep their dogs and cats feeling strong and vibrant every day.

- Novel Proteins for Sensitive Pets: Ingredients like duck, venison, salmon, or insect protein serve pets allergic to common chicken or beef. These alternatives reduce itching, digestive upset, and discomfort. More owners turn to them for gentle nutrition that lets sensitive pets enjoy meals without reactions and live comfortably.

- Natural and Minimally Processed Ingredients: Whole foods such as sweet potatoes, peas, berries, and real meats appear in gently cooked or raw-style recipes. These keep nutrients intact and avoid heavy processing. Pet parents prefer them for cleaner eating that mirrors nature and promotes better digestion and overall vitality.

- Sustainable and Eco-Friendly Ingredients: Companies use responsibly sourced items like upcycled vegetables, ocean-friendly fish, or plant-based proteins to lessen environmental impact. These appeal to owners who care about the planet. This choice supports greener production while delivering balanced nutrition that feels good for both pets and the earth.

Recent Developments

1. FoodSafe Technologies

FoodSafe has expanded its range of natural antioxidant and antimicrobial blends for pet food shelf-life extension, responding to demand for clean-label preservation. Their recent focus is on synergizing plant-based extracts to combat oxidation in high-fat recipes, ensuring safety and freshness without synthetic additives. This development supports manufacturers in meeting consumer preferences for natural, stable products.

2. Symrise

Symrise’s Pet Food division is innovating with sustainable, palatable protein solutions, including hydrolyzed vegetable proteins and yeast-based palatants. A key development is their “TasteSense” portfolio extension for pet food, which uses plant-based ingredients to enhance umami and mask minerals or functional additives. They emphasize reducing the environmental pawprint while maintaining high acceptance among pets.

3. AFB International

AFB International, a subsidiary of Ensign-Bickford Industries, recently advanced its “NovaGreen” initiative, focusing on sustainable, bio-based palatant ingredients. Their R&D highlights novel fermentation-derived palatants that provide exceptional flavor for alternative protein formats (like insect or plant-based). This supports the industry’s shift towards novel, eco-friendly proteins without compromising on pet consumption.

4. DuPont Nutrition & Health (now IFF)

Under IFF, the legacy DuPont business has launched new probiotic strains specifically researched for canine and feline gut health, such as the HOWARU line. Recent developments include combination solutions pairing probiotics with prebiotic fibers to support microbiome balance, immunity, and nutrient absorption in pet food, backed by clinical studies in pets.

5. Biorigin

Biorigin continues to pioneer natural ingredient solutions, recently launching a specialized yeast cell wall product for pet food mycotoxin management and immune support. Their development focuses on bioactive compounds from sugarcane yeast that enhance intestinal health and pathogen control. This provides a natural alternative to chemical binders in pet nutrition.

Conclusion

The Pet Food Ingredients sector, pet owners increasingly treat pets as true family members who deserve thoughtful, high-quality nutrition. The shift toward cleaner, functional, and responsible ingredients reflects deeper care for pet wellness, transparency, and sustainability. Brands that embrace these values build stronger trust and loyalty, creating a vibrant market focused on happier, healthier lives for pets everywhere.