Quick Navigation

Introduction

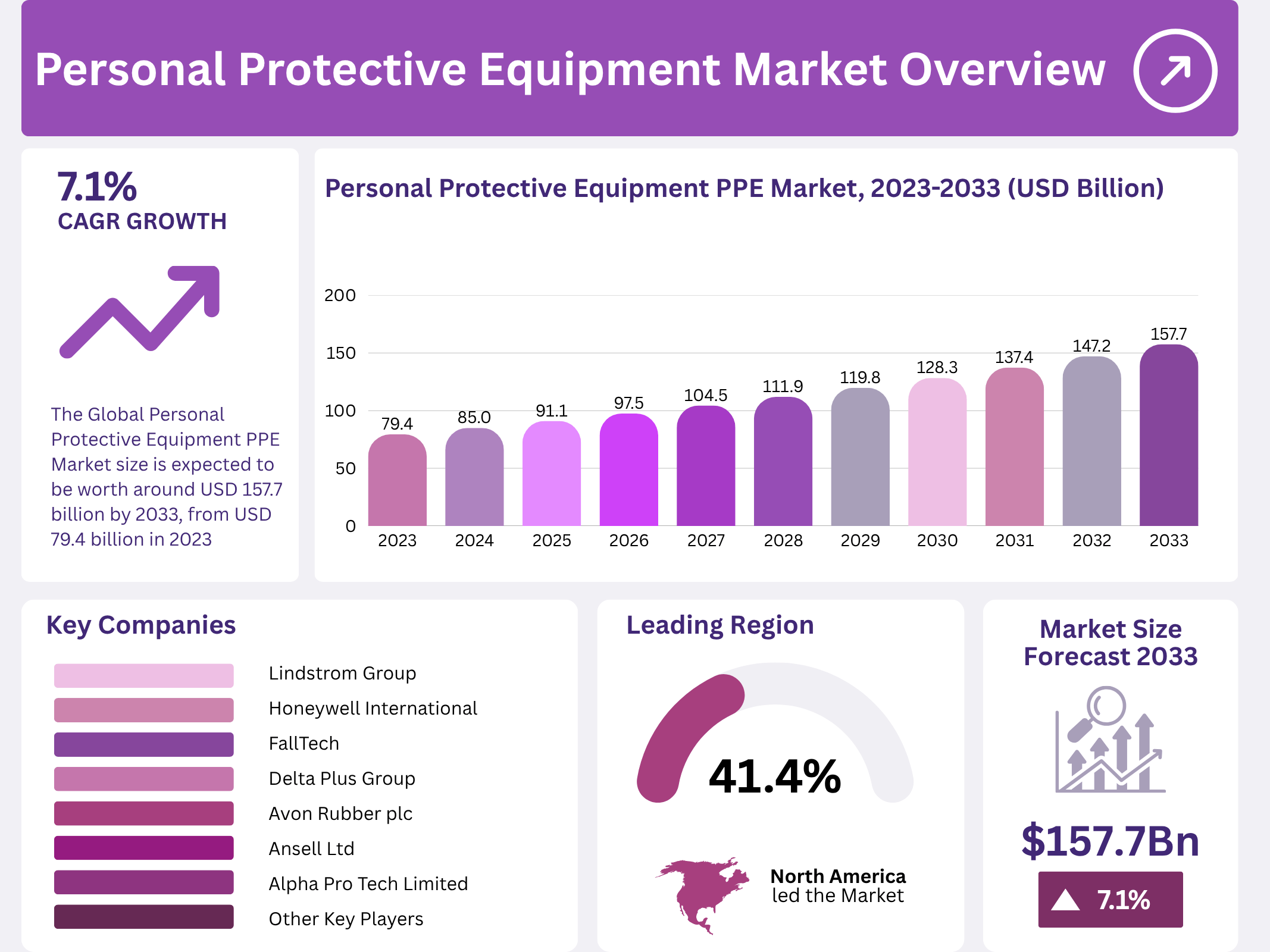

The global Personal Protective Equipment (PPE) market surges forward, valued at USD 79.4 billion in 2023. Consequently, it targets USD 157.7 billion by 2033, advancing at a CAGR of 7.1%. Thus, rising workplace safety awareness propels this growth.

Moreover, health emergencies accelerate demand. Additionally, PPE shields workers across healthcare, construction, and manufacturing. Therefore, stringent regulations further strengthen market expansion.

Furthermore, innovations enhance comfort and compliance. Hence, the COVID-19 pandemic underscores PPE’s critical role, thereby sustaining long-term demand.

Key Takeaways

- In 2023, the market for Personal Protective Equipment PPE generated a revenue of US$ 79.4 billion, with a CAGR of 7.1%, and is expected to reach US$ 157.7 billion by the year 2033.

- The product type segment is divided into protective clothing and footwear, eye & face protection, hearing protection device, respiratory protection, and head protection, with protective clothing and footwear taking the lead in 2023 with a market share of 36.2%.

- Considering application, the market is divided into automotive, manufacturing, construction, oil & gas, and healthcare. Among these, manufacturing held a significant share of 31.5%.

- North America led the market by securing a market share of 41.4% in 2023.

Market Segmentation Overview

By Product Type

Protective clothing and footwear dominate, capturing 36.2% share in 2023. Consequently, regulatory standards rise. Thus, hazards in construction and manufacturing necessitate advanced gear. Moreover, lightweight fabrics improve adoption.

By Application

Manufacturing leads with 31.5% share. Additionally, industrial expansion intensifies risks. Therefore, machinery and chemicals demand comprehensive PPE. Furthermore, stricter regulations boost equipment uptake across plants.

Drivers

Growing innovation propels the PPE market. Companies develop advanced solutions, thereby enhancing safety. For instance, collaborations redesign reusable masks, gaining NIOSH approval. Thus, reusable and comfortable options increase demand across industries.

Rising investments further drive growth. Ansell opens a US$ 80 million plant in India. Consequently, production capacity expands. Moreover, focus on surgical gloves meets healthcare needs, thereby supporting market expansion in high-activity regions.

Use Cases

In healthcare, PPE protects against infections. Workers use masks, gloves, and gowns daily. Thus, pandemics highlight essential roles. Additionally, reusable respirators ensure sustained protection, thereby reducing shortages during crises.

In manufacturing, gear safeguards from machinery hazards. Helmets, gloves, and eyewear prevent injuries. Consequently, compliance with regulations improves. Moreover, smart PPE monitors exposures in real time, thereby enhancing worker safety.

Major Challenges

Low-quality products restrain market growth. Counterfeits flood regions, undermining trust. Thus, substandard items fail standards. Additionally, they increase occupational risks, thereby discouraging investments in legitimate PPE.

Supply chain disruptions pose challenges. Geopolitical tensions cause shortages. Consequently, raw material prices rise. Moreover, economic downturns limit budgets, thereby impacting production and demand for high-quality equipment.

Business Opportunities

Advanced PPE development offers prospects. Lightweight and comfortable designs boost compliance. Thus, IoT integration enables real-time monitoring. Additionally, smart gear appeals to industries, thereby driving innovation and market share.

Mergers and acquisitions expand reach. Honeywell acquires Norcross for US$ 1.2 billion. Consequently, portfolios strengthen. Moreover, distribution improves, thereby fostering growth in regulated sectors through consolidated expertise.

Regional Analysis

North America leads with 41.4% share, valuing USD 32.9 billion. Regulations enforce safety. Thus, COVID-19 sustains demand. Additionally, partnerships accelerate glove supply, thereby maintaining dominance in healthcare and industry.

Asia Pacific grows fastest via industrialization. China and India expand manufacturing. Consequently, workforce safety rises. Moreover, stricter frameworks post-pandemic boost advanced PPE, thereby projecting highest CAGR.

Recent Developments

- In 2022, Honeywell International entered into a commercial partnership with AstraZeneca to co-develop next-generation respiratory inhalers. These inhalers will utilize near-zero global warming potential (GWP) propellants for the treatment of asthma and chronic obstructive pulmonary disease (COPD).

- In February 2023, Ansell Ltd acquired Careplus (M) Sdn Bhd, enhancing its capacity to produce surgical gloves. This move aims to address increasing global demand, bolster the company’s supply chain, and maintain tighter quality control over its product offerings.

- In January 2022, MSA Safety Incorporated completed the acquisition of Bristol Uniforms, a UK-based PPE manufacturer, for US$60 million. This acquisition boosts MSA Safety’s influence in the fire service sector and enhances its portfolio of PPE solutions.

- In March 2022, MSA Safety, 3M, and Dentec Safety Specialists collaborated to redesign reusable industrial face masks, enhancing protection for healthcare workers and addressing mask shortages.

- In April 2022, Honeywell completed the acquisition of Norcross Safety Products LLC, a leading PPE manufacturer, for US$ 1.2 billion. This strategic move enabled Honeywell to enhance its industrial safety portfolio and increase its foothold in the highly regulated PPE market.

- In March 2023, Ansell inaugurated its Greenfield Manufacturing Plant in India with an investment of US$ 80 million, underscoring the growing focus on expanding PPE production capacity.

- In August 2022, a strategic partnership between Supermax Healthcare Canada and Minco Wholesale & Supply Inc. further accelerated the availability of key products like rubber gloves and medical supplies across the region.

Conclusion

The PPE market advances robustly toward USD 157.7 billion by 2033. Innovations and regulations sustain growth. Thus, opportunities in smart and comfortable gear emerge. Consequently, key players consolidate via acquisitions. Moreover, regional leaders like North America and Asia Pacific drive expansion. Therefore, addressing challenges ensures resilient progress in worker safety worldwide.