Quick Navigation

Overview

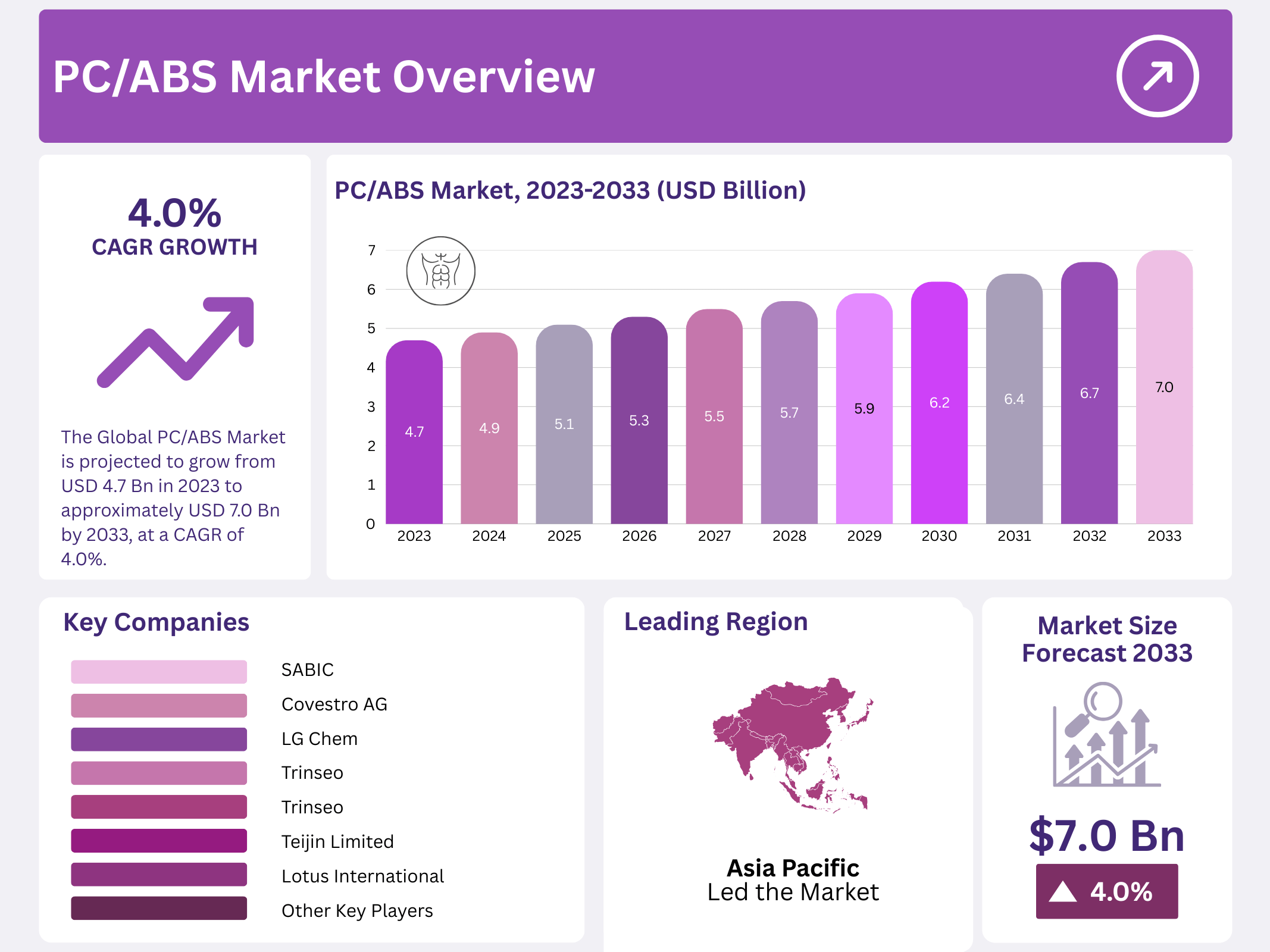

New York, NY – January 13, 2026 – The Global PC/ABS Market is projected to reach a value of approximately USD 7.0 billion by 2033, rising from USD 4.7 billion in 2023, and expanding at a steady CAGR of 4.0% over the forecast period from 2023 to 2033. PC/ABS (Polycarbonate/Acrylonitrile Butadiene Styrene) represents a high-performance thermoplastic blend that merges the strength, heat resistance, and toughness of polycarbonate with the processability and flexibility of ABS.

This combination delivers a material with strong impact resistance, good thermal stability, and excellent surface finish, making it well-suited for demanding applications across multiple industries. The market benefits from the material’s compatibility with diverse manufacturing techniques such as injection molding, extrusion, and thermoforming. This versatility enables manufacturers to produce complex, lightweight, and aesthetically appealing components with consistent quality and cost efficiency.

PC/ABS is widely used in the automotive sector for both interior and exterior components, where durability and design flexibility are essential. In electronics, it is commonly applied in housings and enclosures for devices such as laptops, smartphones, and other consumer electronics. The consumer goods industry relies on PC/ABS for robust, high-quality products, while the healthcare sector adopts the material for medical device housings due to its ability to meet strict safety and hygiene standards.

Key Takeaways

- The Global PC/ABS Market is projected to grow from USD 4.7 billion in 2023 to approximately USD 7.0 billion by 2033, at a steady CAGR of 4.0%.

- Virgin PC/ABS dominated the material type segment in 2024, accounting for more than 74.5% of total demand due to its superior quality and performance.

- General Grade led the product grade segment in 2024 with over 34.5% market share, driven by its versatile use across multiple industries.

- Extrusion Molding was the leading processing method in 2024, holding more than 45.6% market share for producing continuous profiles, sheets, and pipes.

- The Automotive sector was the largest end-use application in 2024, capturing over 45.6% of the market share, thanks to demand for lightweight and durable components.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 7.0 Billion |

| Forecast Revenue (2033) | USD 4.7 Billion |

| CAGR (2024-2033) | 4.0% |

| Segments Covered | By Type(Virgin, Recycled), By Grade(General Grade, Flame Retardant Grade, Reinforced Grade, High Heat Grade, Others), By Processing Method(Extrusion Molding, Injection Molding, Blow Molding, Thermoforming, 3D Printing, Others), By End-use(Automotive, Electrical & Electronics, Consumer Appliance, Aerospace & Defense, Building & Construction, Healthcare, Others) |

| Competitive Landscape | Covestro AG, SABIC, LG Chem, Trinseo, Chi Mei Corporation, Teijin Limited, Trinseo, Chi Mei Corporation, Formosa Chemicals & Fibre Corporation, Denka Company Limited, RTP Company, Lotus International, Kingfa Sci. & Tech. Co., Ltd., ELIX Polymers, Mitsubishi Engineering-Plastics Corporation |

Key Market Segments

By Type

In 2024, the PC/ABS market was segmented into Virgin and Recycled types. Virgin PC/ABS clearly dominated the market, accounting for more than 74.5% of total demand. Its leadership is driven by superior material quality, consistent performance, and reliable mechanical properties, which are essential for applications in automotive, electronics, and consumer goods. High impact strength, dimensional stability, and premium surface finish make virgin PC/ABS the preferred choice for performance-critical components.

In contrast, the Recycled PC/ABS segment held a smaller share but showed increasing momentum. Rising environmental awareness, sustainability targets, and regulatory pressure to reduce plastic waste are supporting adoption. While recycled grades may face performance limitations in certain high-end applications, improving recycling technologies and growing acceptance of circular manufacturing practices are expected to gradually strengthen demand.

By Grade

In 2024, the PC/ABS market was categorized into General Grade, Flame Retardant Grade, Reinforced Grade, High Heat Grade, and Others. General Grade held the leading position, capturing more than 34.5% of the market. Its dominance is supported by broad usage across automotive, consumer electronics, and household appliances, where a balance of performance, processability, and cost efficiency is required.

Flame Retardant Grade represented a substantial share, driven by strict fire safety regulations in electronics, construction, and transportation. Its ability to meet safety standards without compromising mechanical strength supports steady demand. Reinforced Grade gained traction in applications requiring enhanced stiffness and load-bearing capacity, particularly in automotive and industrial machinery.

By Processing Method

In 2024, PC/ABS processing methods included Extrusion Molding, Injection Molding, Blow Molding, Thermoforming, 3D Printing, and Others. Extrusion Molding led the segment with over 45.6% market share, supported by its efficiency in producing continuous profiles, sheets, and pipes used in automotive, construction, and packaging applications.

Injection Molding followed closely, valued for precision, repeatability, and the ability to manufacture complex, high-quality components for electronics, automotive parts, and medical devices. Blow Molding, while smaller in share, remained essential for hollow products such as containers and packaging. Thermoforming contributed through its flexibility in shaping large, lightweight components, particularly in automotive and appliances. Meanwhile, 3D Printing emerged as a fast-growing segment, driven by demand for rapid prototyping and customized production.

By End-use

In 2024, the PC/ABS market was segmented by end-use into Automotive, Electrical & Electronics, Consumer Appliance, Aerospace & Defense, Building & Construction, Healthcare, and Others. Automotive dominated the market with more than 45.6% share, supported by growing demand for lightweight, durable, and visually appealing materials for interior and exterior vehicle components.

Electrical & Electronics followed as a major segment, benefiting from PC/ABS’s electrical insulation, heat resistance, and dimensional stability in device housings and enclosures. The Consumer Appliance segment also held a significant share, where impact resistance and design flexibility are critical for durable and attractive household products. Together, these segments highlight PC/ABS’s versatility and its strong positioning across performance-driven end-use industries.

Regional Analysis

The global PC/ABS market is geographically segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Each region contributes uniquely to market development based on industrial maturity, manufacturing activity, and end-use demand.

North America is expected to account for a significant share of global revenue and is projected to maintain a leading position in the PC/ABS market. This dominance is supported by strong demand from the automotive, electronics, and healthcare industries, along with continuous advancements in material technologies. The region benefits from well-established manufacturing infrastructure, high adoption of high-performance polymers, and ongoing investments in lightweight and durable materials.

Europe represents a mature market, driven by stringent regulatory standards, particularly in automotive safety, sustainability, and fire resistance. Demand is further supported by the region’s focus on recyclable materials and compliance with circular economy initiatives, encouraging innovation in advanced PC/ABS formulations.

Top Use Cases

- Automotive Interiors: PC/ABS is widely used in car dashboards, door panels, and consoles due to its blend of toughness and heat resistance. This material handles daily wear while offering a sleek finish that enhances vehicle aesthetics, making it ideal for modern automotive designs where durability meets style in high-traffic areas.

- Consumer Electronics Housings: PC/ABS shines in creating casings for laptops, smartphones, and TVs because of its impact strength and flexibility. It protects internal components from drops and heat, allowing for slim, lightweight designs that appeal to tech-savvy consumers seeking reliable gadgets in everyday use.

- Medical Device Enclosures: PC/ABS is favored for medical equipment housings and instrument panels thanks to its sturdy build and resistance to chemicals. This ensures safe, long-lasting performance in healthcare settings, supporting innovations in portable devices that prioritize hygiene and user safety without compromising on functionality.

- Industrial Tool Prototyping: PC/ABS’s role in prototyping power tools and machinery parts, leveraging its high strength and ease of molding. It enables quick iterations for rugged applications, helping manufacturers test designs efficiently and bring durable products to market faster in competitive industrial sectors.

- Outdoor Recreational Gear: PC/ABS is applied in helmets, protective gear, and equipment housings for its lightweight impact resistance. This material withstands harsh weather and rough handling, catering to active lifestyles and boosting demand in sports and leisure industries focused on safety and portability.

Recent Developments

1. Covestro AG

Covestro is advancing PC/ABS for automotive interiors with a new post-consumer recycled (PCR) content series, aiming for enhanced sustainability. The materials retain mechanical performance while reducing carbon footprint. Recent launches include grades of PCR content. The company is also expanding digital tools for material selection.

2. SABIC

SABIC introduced new FLAME RETARDANT PC/ABS grades targeting IT/electronics, improving sustainability with lower carbon emissions. They’ve also developed certified renewable PC/ABS from bio-based feedstocks. Recent launches support thin-wall applications in consumer electronics, focusing on regulatory compliance and circular economy goals.

3. LG Chem

LG Chem is focusing on eco-friendly PC/ABS with improved chemical resistance for electric vehicles and IT housings. They launched a PCR-containing series and enhanced heat/impact balance for 5G devices. Recent R&D aims at halogen-free flame-retardant grades to meet stricter environmental regulations.

4. Trinseo

Trinseo expanded its MAGNUM ABS and PC/ABS portfolios with new SUSTAINABILITY-FOCUSED grades containing recycled content. Recent developments target automotive exterior and interior parts, emphasizing low gloss, UV stability, and color consistency. They are also enhancing global production capabilities for these engineered materials.

5. Chi Mei Corporation

Chi Mei launched high-heat-resistant PC/ABS blends for automotive and electronics, improving flow and processability. They are developing halogen-free flame-retardant grades and increasing PCR content integration. Recent efforts focus on lightweighting and meeting international environmental standards.

Conclusion

PC/ABS stands out as a versatile material blending strength, flexibility, and heat resistance, driving its adoption across diverse industries. Its ability to meet evolving demands for durable yet aesthetic products positions it well for future growth, especially in innovative sectors prioritizing sustainability and performance.