Quick Navigation

Overview

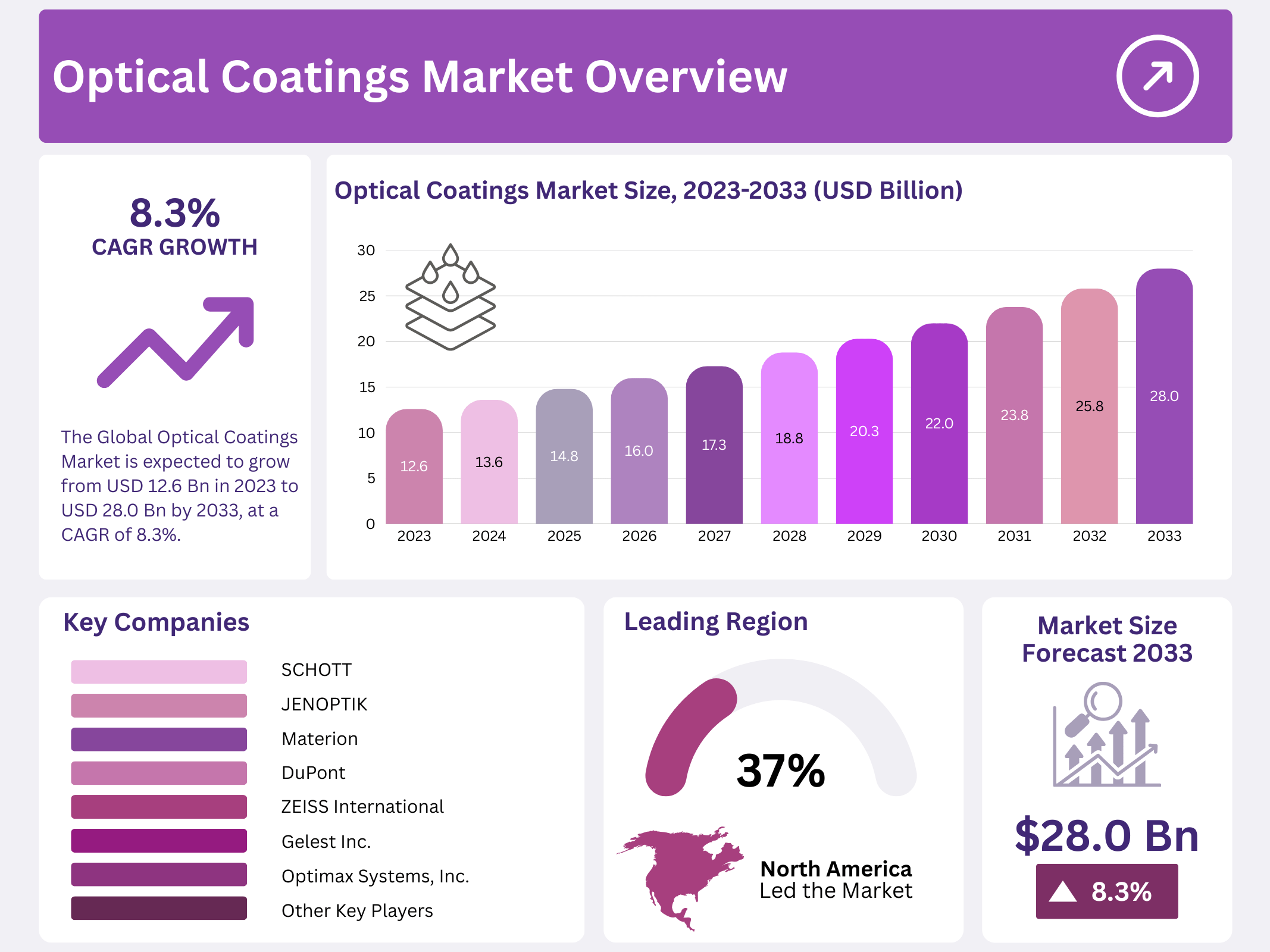

New York, NY – December 05, 2025 – The Global Optical Coatings Market is projected to grow strongly over the coming decade. The market size is expected to reach around USD 28.0 billion by 2033, rising from USD 12.6 billion in 2023. This growth reflects a steady CAGR of 8.3% during the forecast period from 2023 to 2033, supported by expanding industrial and commercial demand.

Market expansion is largely driven by rapid technological progress in optical deposition techniques and advanced fabrication processes. Improvements in thin-film coating accuracy, durability, and performance are enabling manufacturers to deliver higher-efficiency optical components. At the same time, increasing demand for energy-efficient and high-performance optical devices is accelerating adoption across multiple end-use industries.

Optical coatings are now widely used in diverse applications, including architectural glass for solar control, automotive displays and sensors, and consumer electronics such as solar panels. Additional demand comes from telecommunications, medical imaging and diagnostics, as well as military and defense systems, where precision optics and reliability are critical.

Key Takeaways

- The Global Optical Coatings Market is expected to grow from USD 12.6 billion in 2023 to USD 28.0 billion by 2033, at a CAGR of 8.3% from 2023 to 2033.

- Anti-Reflective Coatings dominated in 2023 with over 30.1% revenue share.

- Vacuum Deposition is the leading technology for precise and high-quality coatings.

- The Consumer Electronics segment led the market with more than 32.0% revenue share in 2023.

- North America held the largest share at 37.8% of global revenue in 2023.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 12.6 Billion |

| Forecast Revenue (2033) | USD 28.0 Billion |

| CAGR (2024-2033) | 8.3% |

| Segments Covered | By Product (Anti-Reflective Coatings, High Reflective Coatings, Transparent Conductive Coatings, Filter Coatings, Beam Splitter Coatings, Others), By Technology (Vacuum Deposition, E-beam Evaporation, Sputtering Process, Ion-Assisted Deposition), By End-Use(Consumer Electronics, Solar, Medical, Telecommunication, Architecture, Aerospace & Defense, Automotive, Others) |

| Competitive Landscape | Reynard Corporation, Sigmakoki Co. Ltd, SCHOTT, Quantum Coating, JENOPTIK, PPG Industries Inc., Materion, Inrad Optics, Newport Corporation, ZEISS International, DuPont, Nippon Sheet Glass Co. Ltd, Optimax Systems, Inc., Optical Coatings Technologies, Gelest Inc. |

Key Market Segments

Product Analysis

Based on product type, the Anti-Reflective Coatings segment held a dominant market position, accounting for more than 30.1% of total revenue in 2023. These coatings are thin-film optical layers designed with multiple materials, each having a different refractive index. The carefully engineered thickness of each layer minimizes surface reflection, improving light transmission and visual clarity. As a result, anti-reflective coatings are widely used in camera lenses, display screens, eyeglasses, magnifying lenses, and other optical components made from glass and plastic substrates.

During the forecast period, demand for anti-reflective coatings is expected to rise significantly due to their expanding use in photovoltaic panels, automobile displays, architectural windows, and GPS navigation systems. At the same time, the Conductive Coatings segment is anticipated to register strong growth, primarily driven by the increasing installation of solar panels and other energy-related applications that require efficient light transmission and electrical conductivity.

Solar energy production is expected to grow rapidly as governments and industries focus more on alternative and renewable energy sources. Countries such as India and China are making large-scale investments in solar infrastructure, while consumer adoption of solar panels, heaters, and coated glass windows continues to increase. These trends are expected to further support long-term growth in the optical coatings market.

By Technology

Vacuum Deposition remains the leading technology due to its flexibility and ability to apply precise coatings in a controlled environment. It is widely used across industries that require high-quality optical performance and consistent coating thickness.

E-beam Evaporation is valued for its exceptional precision, making it suitable for applications that require ultra-thin coatings, particularly in electronic displays and semiconductor manufacturing. Sputtering is extensively adopted for its efficiency in producing uniform, durable coatings and is commonly used in architectural glass, consumer electronics, and advanced optical systems.

Ion-Assisted Deposition enhances coating adhesion and film density, making it ideal for demanding applications in aerospace and automotive sectors. Other emerging and specialized technologies continue to gain attention by addressing niche requirements and supporting innovation in optical coating applications.

By End-Use

From an application perspective, the Consumer Electronics segment led the market with a revenue share exceeding 32.0% in 2023. Growth in this segment is expected to continue during the forecast period, supported by rising disposable incomes and increasing demand for smartphones, smart TVs, and wearable devices. Continuous advancements in display technologies are further boosting the need for high-performance optical coatings.

Infrared and anti-reflective coatings are increasingly used in electronic devices for improved visual quality and impact resistance. Additionally, sustained technological progress within the semiconductor industry is expected to drive further demand. In the automotive sector, optical coatings are widely applied to speedometer displays, windshields, gear-knob tops, and vehicle windows. The growing use of UV-resistant, scratch-resistant, and abrasion-resistant coatings in automotive components is expected to support steady market expansion.

Regional Analysis

North America led the global optical coatings market in 2023, accounting for 37.8% of total industry revenue. Growth in the region is driven by the expansion of the U.S. solar sector and a stronger emphasis on domestic manufacturing. In addition, rising U.S. defense spending is creating attractive opportunities for reflective coatings, particularly in aerospace and defense applications.

The region is also a key manufacturing hub for small- and medium-scale medical equipment, which is expected to support sustained demand for optical coatings over the forecast period. Strong activity in related industries such as instrumentation and microelectronics further contributes to the demand for optical-coated components, as these sectors rely on advanced coatings to enhance optical performance and durability.

Top Use Cases

- Consumer Electronics Displays: Optical coatings reduce glare and boost light transmission on screens like those in smartphones and TVs. They help create sharper images and vibrant colors by minimizing reflections from surrounding light. This makes devices easier to use in bright environments and enhances overall user experience, driving demand in the fast-growing gadget market where clear visibility is key for customer satisfaction.

- Eyeglass and Camera Lenses: These coatings cut down unwanted reflections on lenses, allowing more light to pass through for clearer vision. In eyewear, they prevent foggy or hazy views, while in cameras, they sharpen photos by reducing lens flare. This simple enhancement improves daily comfort and professional photography, making it a staple in personal and creative tools.

- Automotive Headlights and Mirrors: Coatings on car lights and rearview mirrors improve brightness and cut glare for safer night driving. They protect against harsh weather and scratches, ensuring long-lasting performance. As vehicles become smarter with advanced lighting, these coatings support better road visibility and contribute to the rising trend in electric and autonomous car designs.

- Solar Panels: Optical layers on solar cells increase light absorption to capture more sunlight efficiently. They shield panels from dirt and UV damage, keeping energy output steady over time. With the global push for green energy, these coatings play a vital role in making renewable sources more reliable and cost-effective for homes and businesses.

- Medical Imaging Devices: In tools like endoscopes and microscopes, coatings enhance image clarity by filtering specific light wavelengths. They allow doctors to see finer details during procedures, improving accuracy and patient outcomes. This application supports the expanding healthcare sector, where precise visuals are essential for diagnostics and treatments.

Recent Developments

1. Reynard Corporation

Reynard has expanded its expertise in complex, high-performance filter coatings for biomedical and aerospace laser systems. Recent developments focus on ultra-narrowband and ultra-wideband filters that withstand extreme environments. They emphasize tailoring coatings for specific customer applications in next-generation LiDAR and fluorescence imaging, moving beyond standard offerings.

2. Sigmakoki Co. Ltd. (SIGMAKOKI)

Sigmakoki is advancing its proprietary “IBS (Ion Beam Sputtering) Coating” technology to produce ultra-low-loss and high-damage-threshold coatings. Recent work targets precision optics for quantum computing and high-power industrial lasers. They highlight improved uniformity and durability for critical components like mirrors and beam splitters used in advanced research and manufacturing.

3. SCHOTT AG

SCHOTT is innovating in large-area and durable anti-reflective glass coatings for displays, architecture, and solar energy. A key development is their “AMIRAN” and “Anti-Reflective” glass for museum displays and high-end retail, offering exceptional clarity. They also advance coatings for aerospace windows and laser optics, focusing on robustness and performance under stress.

4. Quantum Coating Inc.

Specializing in precision optical thin films, Quantum Coating has recently enhanced its capabilities for high-volume, high-repeatability coating services. Developments include advanced AR (anti-reflective) coatings for consumer electronics sensors and SWIR (Short-Wave Infrared) coatings for autonomous vehicle and surveillance systems, emphasizing fast turnaround for prototyping and production.

5. JENOPTIK AG

JENOPTIK’s Optical Systems division is advancing coatings for high-power EUV (Extreme Ultraviolet) and deep-UV lithography systems, critical for semiconductor manufacturing. They also report progress on robust, environmentally stable coatings for defense-grade infrared optics and space applications, focusing on maximizing throughput and longevity in the most demanding operational conditions.

Conclusion

Optical coatings stand as a cornerstone in modern technology, quietly transforming how we capture, direct, and utilize light across everyday and specialized tools. As industries like electronics, renewables, and healthcare evolve with smarter designs, these versatile layers continue to unlock sharper performance and greater durability without adding bulk.