Quick Navigation

Overview

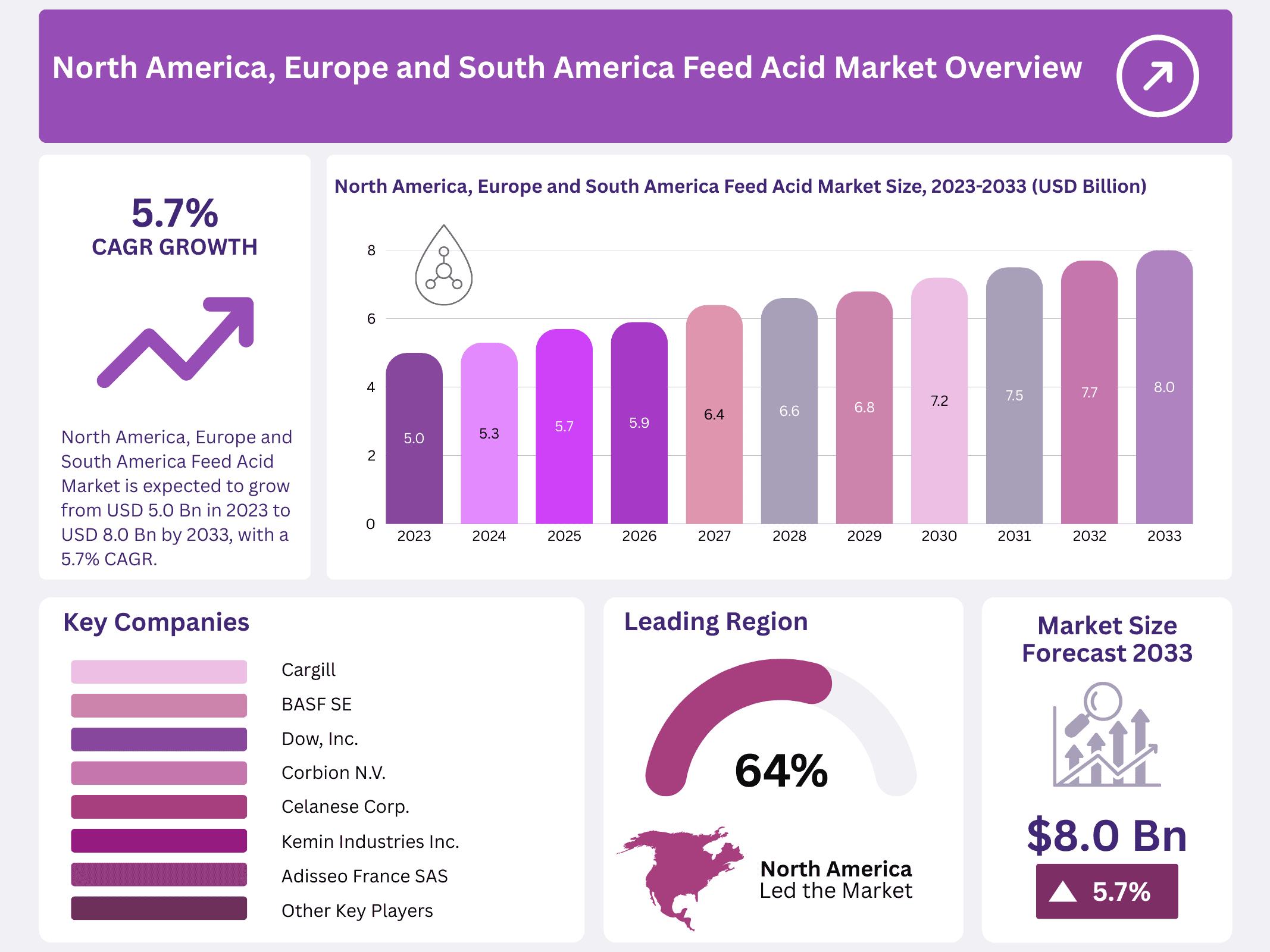

New York, NY – January 28, 2026 – The North America, Europe, and South America Feed Acid Market is projected to reach USD 8.0 billion by 2033, rising from USD 5.0 billion in 2023 at a CAGR of 5.7%. In North America, growth is supported by advanced farming systems and a strong focus on improving animal health to meet rising demand for premium meat and dairy. Feed acids such as propionic and formic acid are used widely to enhance digestion, preserve feed, and inhibit harmful bacteria, with strict regulations in the U.S. and Canada ensuring safe and efficient usage.

Europe represents one of the largest consumers of feed acids, driven by its well-established livestock sector and stringent food safety regulations. EU initiatives to reduce antibiotic use in animal farming have accelerated the shift toward feed acids as natural growth promoters and preservatives. Countries including Germany, France, and the U.K. are leading the regional market due to their advanced animal husbandry systems and strong emphasis on sustainable, welfare-oriented farming practices.

The feed acid market is expanding quickly as livestock production grows and meat consumption continues rising. Brazil and Argentina remain key contributors, backed by large cattle populations and strong export-oriented meat industries. Adoption of feed acids in the region is driven by the need to improve feed efficiency, enhance digestion, and support overall livestock health. Growing investments from global feed additive manufacturers are further propelling the market as South America positions itself as a major supplier of animal protein worldwide.

Key Takeaways

- The Feed Acid Market is expected to grow from USD 5.0 billion in 2023 to USD 8.0 billion by 2033, with a 5.7% CAGR.

- Formic acid leads the market with a 27.4% share due to its role in feed preservation and microbial control.

- Swine feed accounts for 33.4% of the market, driven by the need for better growth and health in swine livestock.

- Cattle feed applications represent 27.9% of the market, focusing on improving digestive health and milk production.

- North America holds a 64.8% market share, valued at USD 2.9 billion in 2023, leading in feed acid consumption.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 5.0 Billion |

| Forecast Revenue (2033) | USD 8.0 Billion |

| CAGR (2024-2033) | 5.7% |

| Segments Covered | By Product Type(Formic Acid, Propionic Acid, Acetic Acid, Butyric Acid, Citric Acid, Others), By Feed Type(Swine, Ruminant, Poultry, Others), By Application(Cattle, Calf, Poultry, Aquaculture, Pet Food, Others) |

| Competitive Landscape | Cargill, BASF SE, Archer-Daniels-Midland Co., Dow, Inc., Koninklijke DSM NV, Eastman Chemical Co., Celanese Corp., Corbion N.V., Kemin Industries Inc., Novus International, Inc., Adisseo France SAS, Ajinomoto Co. Inc., CJ CheilJedang Corporation, Evonik Industries AG, Guangdong Haid Group Co. Ltd., Kemin Industries Inc. |

Key Market Segments

By Product Type

Formic Acid led the feed acid market across North America, Europe, and South America with a share of over 27.4%, driven by its strong preservation capabilities, ability to reduce microbial growth, and role in improving overall feed quality for healthier livestock. Propionic Acid remained a key segment due to its antifungal efficiency, particularly in preventing mold growth in stored feed and grains.

Acetic Acid continued to find widespread use for enhancing feed palatability and supporting digestive health, especially in dairy and beef-intensive regions. Although smaller in share, Butyric Acid played a vital role in improving gut health and nutrient absorption, making it especially valuable for poultry and swine production. Citric Acid also maintains broad usage for its safe and effective pH-lowering properties, creating conditions that inhibit pathogenic bacteria in feed.

By Feed Type

Swine feed dominated the feed acid market in North America, Europe, and South America, accounting for more than 33.4% of the market. Its leadership is supported by the high reliance on feed acids to improve growth, gut health, and feed conversion efficiency in swine.

The Ruminant segment, including cattle and sheep, also held a notable share, with feed acids used widely to enhance digestibility and prevent ruminal acidosis, ultimately improving milk yield and overall herd health. The Poultry segment further contributed significantly, benefiting from feed acids that support gut integrity, suppress harmful bacteria, and improve feed efficiency, all vital for achieving rapid growth rates in commercial poultry farming.

By Application

Cattle were the leading application segment in the feed acid market across North America, Europe, and South America, securing over 27.9% of the market. This strong position stems from the high demand for feed acids that improve digestion, nutrient absorption, and milk production. The Calf segment also grew steadily, with feed acids playing a crucial role in early growth, immune development, and digestive efficiency.

Poultry applications represented another major share, as acids help maintain gut health, strengthen disease resistance, and improve feed conversion—especially important for large-scale poultry systems. Aquaculture emerged as a fast-growing application area, utilizing feed acids to enhance growth and disease resistance in fish. Meanwhile, Pet Food applications continued to rise, supported by the use of feed acids to improve preservation, quality, and palatability of pet diets.

Regional Analysis

North America continued to lead the global feed acid market in 2023, capturing 64.8% of the total share with an estimated market value of USD 2.9 billion. This dominance is supported by the region’s advanced livestock industry, strong focus on animal nutrition, and high adoption of feed acid solutions driven by strict regulatory frameworks. Growing demand for premium-quality feed and increased emphasis on animal health further reinforce North America’s strong market position.

Europe ranked as the second-largest market. The region’s growth is propelled by its strict animal welfare regulations, continuous innovation in feed acid formulations, and commitment to sustainable farming practices. These factors contribute to steady expansion and heightened demand for high-performance feed additives.

South America, although smaller in scale, is rapidly emerging as a high-growth region within the feed acid industry. driven by rising agricultural investments, expanding livestock production, and broader access to cost-efficient feed acid solutions. Strengthening distribution channels and localized product development continue to support its upward trajectory.

Top Use Cases

- Preserving Feed Quality: Feed acids serve as natural preservatives in animal nutrition by lowering the pH level of feeds, which inhibits the growth of harmful bacteria, molds, and fungi during storage. This maintains the feed’s nutritional integrity, reduces spoilage risks, and ensures animals consume safe, high-quality meals, ultimately supporting better overall farm efficiency and animal well-being.

- Enhancing Digestion: In livestock like pigs and poultry, feed acids reduce stomach pH to activate enzymes that break down proteins and minerals more effectively. This improves nutrient absorption and utilization, leading to healthier animals with stronger growth rates, while minimizing waste from undigested feed and promoting sustainable farming practices.

- Controlling Pathogens: Feed acids exhibit antimicrobial effects that curb pathogenic bacteria in the gut, such as those causing infections. By balancing the intestinal microbiome, they lower disease occurrences like diarrhea, boost immune responses, and reduce reliance on antibiotics, making them valuable for maintaining herd health in intensive production systems.

- Boosting Growth Performance: Adding feed acids to diets helps animals convert feed into body mass more efficiently, resulting in higher weight gains and better feed conversion. This is particularly useful in broiler and swine farming, where it enhances productivity, cuts costs for producers, and meets market demands for faster-growing, healthier livestock.

- Supporting Gut Health: Feed acids aid in thinning the intestinal wall for improved nutrient uptake and foster beneficial bacteria growth, which is crucial during stressful periods like weaning in young animals. This reduces inflammation, prevents digestive disorders, and contributes to long-term vitality, aligning with trends toward natural additives in animal nutrition.

Recent Developments

1. Cargill

- Cargill has expanded its feed acid offerings through its Diamond V brand, focusing on synergistic blends for gut health and pathogen control. Recent developments emphasize research into acid combinations that support antibiotic-free production. The company promotes its Trugro and Prelock product lines as solutions for improving feed hygiene and animal performance.

2. BASF SE

- BASF has invested in research to optimize the use of feed acids like formic and propionic acid in swine and poultry diets. Their recent focus is on Luprosil and Lupro-Mix products, targeting improved feed preservation and gut health. Developments also highlight digital tools to help farmers calculate precise dosage for mycotoxin control and hygiene.

3. Archer-Daniels-Midland Co. (ADM)

- ADM is advancing its feed acid portfolio, including preservatives like propionic acid, through its NutriPass and Guardian lines. Recent strategy integrates acids into broader gut health and microbiome management solutions. Developments show a focus on encapsulated acid technologies for targeted release in the digestive tract to enhance efficacy and handling.

4. Dow, Inc.

- Through its Animal & Food Sciences business, Dow provides feed-grade propionic acid for mold inhibition and feed preservation. Recent developments promote their high-purity, globally supplied PROVILA and DOW Propionic Acid. The focus is on supply chain reliability and technical support for feed millers to ensure consistent feed quality and safety.

5. Koninklijke DSM NV (now dsm-firmenich)

- Following the merger, DSM-Firmenich integrates feed acid solutions into its comprehensive animal health platform. Recent developments focus on VevoVitall (benzoic acid) for swine, proven to improve performance and nitrogen retention. Innovations combine acids with enzymes, probiotics, and other additives for enhanced gut function and sustainability in farming.

Conclusion

Feed Acids stand out as versatile tools in animal nutrition, driving improvements in feed preservation, digestion, and health while reducing antibiotic use. Their adoption reflects a broader industry move toward sustainable practices that enhance livestock performance and meet consumer preferences for safer food production, positioning them as indispensable for future market growth.