Quick Navigation

Overview

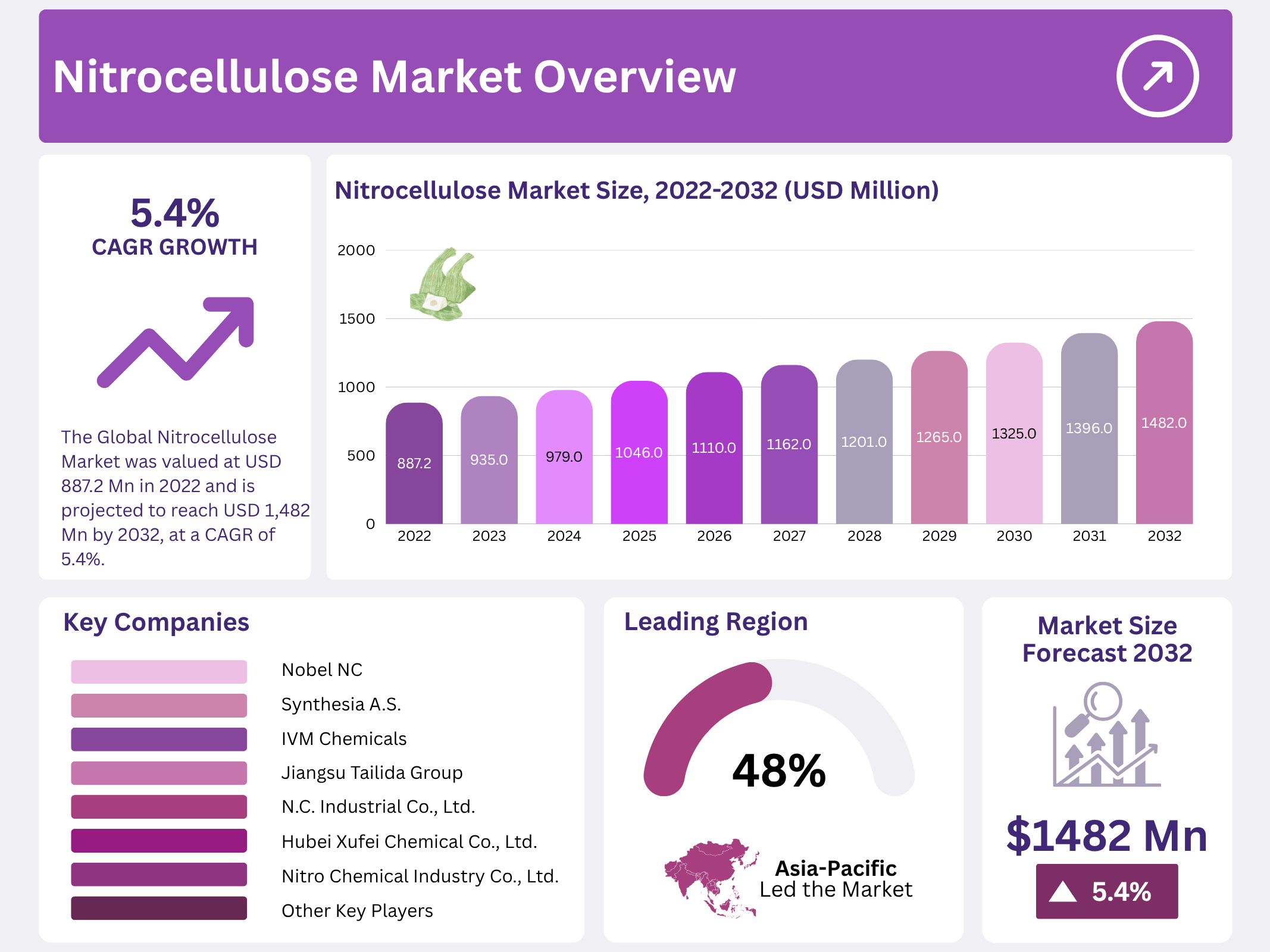

New York, NY – October 15, 2025 – The Global Nitrocellulose Market was valued at USD 887.2 million in 2022 and is projected to reach USD 1,482 million by 2032, expanding at a CAGR of 5.4% from 2023 to 2032. This steady growth is driven by the increasing use of nitrocellulose in printing inks, paints & coatings, and other industrial sectors.

Rising demand for automotive paints, coupled with greater environmental awareness and the superior performance of hybrid and electric vehicles, is expected to further propel revenue growth during the forecast period. Nitrocellulose, also known as cellulose nitrate, is a highly inflammable compound composed of cellulose nitric esters. Its excellent adhesion properties and chemical stability make it a preferred ingredient in coatings and inks.

The expanding packaging industry has amplified the need for printing inks, creating new opportunities for nitrocellulose producers and ensuring sustained market momentum. The COVID-19 pandemic caused significant disruptions to the automotive sector, severely affecting nitrocellulose demand. Restrictions on global trade, reduced vehicle production, and declining consumer demand led to heavy losses across the value chain. Despite this short-term setback, the market is anticipated to recover as industrial activities and automotive manufacturing rebound, supported by the growing shift toward sustainable and high-performance materials.

Key Takeaways

- The Global Nitrocellulose Market is projected to grow from USD 887.2 million in 2022 to USD 1,482 million by 2032 at a CAGR of 5.4%.

- M-grade nitrocellulose leads with a 48% market share, driven by its use in cosmetics, personal care, and industrial applications.

- Printing inks hold a 28% market share, fueled by demand for eco-friendly inks in packaging and digital printing.

- The Asia Pacific region commands a 48% market share due to rapid urbanization and construction activities.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 887.2 Million |

| Forecast Revenue (2032) | USD 1482 Million |

| CAGR (2023-2032) | 5.4% |

| Segments Covered | Product, Application |

| Competitive Landscape | Nitro Chemical Industry Co., Ltd.; T.N.C. Industrial Co., Ltd.; Hubei Xufei Chemical Co., Ltd.; Jiangsu Tailida Group; Sichuan North Nitrocellulose Corp. (SNC); Nitrex Chemicals India Pvt. Ltd.; Nobel NC; Synthesia A.S.; IVM Chemicals,Other companies |

Key Market Segments

By Product Type

The nitrocellulose market is segmented into M-grade, E-grade, and other categories, with the M-grade segment leading at a 48% market share. M-grade cellulose is widely used as a thickener in consumer products, emulsifiers in oils, dietary supplement capsules, and in aerospace and automotive industries. The M-grade segment is poised for significant growth during the forecast period, driven by the booming probiotics and cosmetics markets, where it serves as a key emulsifier in personal care and cosmetic products.

By Application

Printing ink holds the largest share of the nitrocellulose market at 28%, fueled by technological advancements and rising demand for eco-friendly inks. These inks are critical in packaging, logistics, inkjet printing, outdoor signage, and digital applications. Nitrocellulose-based lamination inks are gaining traction in the packaging industry due to their vibrant colors, strong lamination properties, low odor, and minimal solvent retention. Environmental concerns have prompted stricter industry standards.

Nitrocellulose lacquers, known as wood coatings, are used in furniture, decking, sliding doors, windows, carpets, and

industrial applications. They are also integral in manufacturing steel strings for musical instruments, particularly in the U.S., due to their ease of use in repairs, touch-ups, and high-gloss finish. The market for nitrocellulose-based printing inks is expected to grow, driven by their brilliance, fast solvent evaporation, and compatibility with modern printing technologies like gravure and flexography.

Regional Analysis

The Asia Pacific region dominates the nitrocellulose market with a 48% share, propelled by rapid urbanization and increased residential and commercial construction. Europe is expected to see notable growth during the forecast period, driven by demand for automotive paints to support the production of hybrid and electric vehicles by major automobile manufacturers, alongside strong consumer interest in these vehicle types.

Top Use Cases

- Printing Inks: Nitrocellulose is widely used in printing inks for packaging and digital printing. Its vibrant color output, quick drying, and strong adhesion make it ideal for high-quality prints in logistics, outdoor signage, and eco-friendly inks, meeting the growing demand for sustainable, high-performance printing solutions in various industries.

- Wood Coatings: Nitrocellulose lacquers are popular for wood coatings in furniture, decking, and windows. They provide a glossy finish, easy application, and quick drying, making them perfect for both residential and industrial uses, ensuring durable and visually appealing surfaces with minimal maintenance.

- Automotive Paints: In the automotive industry, nitrocellulose is used in paints and coatings for vehicles. It offers excellent adhesion, durability, and a smooth finish, supporting the production of hybrid and electric vehicles, where high-quality coatings are essential to meet aesthetic and protective needs.

- Cosmetics and Personal Care: Nitrocellulose serves as a thickener and emulsifier in cosmetics like nail polish and skincare products. Its ability to create smooth textures and stable formulations enhances product quality, driving its demand in the rapidly growing beauty and personal care market worldwide.

- Musical Instrument Strings: Nitrocellulose is used in coatings for steel strings in guitars and other musical instruments. It provides a protective layer, ensuring durability and ease of maintenance, while enhancing the strings’ appearance and performance, especially in regions with strong music industries.

Recent Developments

1. Nitro Chemical Industry Co., Ltd.

Nitro Chemical Industry continues to focus on expanding its production capacity and enhancing the quality of its nitrocellulose products for the coatings, printing inks, and wood finish markets. Recent developments include investments in more efficient and environmentally friendly manufacturing processes to reduce environmental impact and meet stricter global regulations. The company aims to strengthen its supply chain to better serve international clients.

2. N.C. Industrial Co., Ltd.

N.C. Industrial has been actively developing specialized grades of nitrocellulose for the leather finishing and automotive refinish sectors. Their recent focus is on creating high-solids, low-VOC formulations that help customers comply with environmental standards. The company is also enhancing its global logistics and distribution network to ensure reliable and timely delivery to its international customer base, reinforcing its position as a key supplier.

3. Hubei Xufei Chemical Co., Ltd.

Hubei Xufei Chemical has recently focused on capacity expansion and technological upgrades within its nitrocellulose production lines. The company is emphasizing the production of stable and high-purity nitrocellulose for applications in premium coatings and printing inks. A key recent development is their increased outreach in Asian and South American markets, aiming to capture a larger share of the global specialty chemicals trade.

4. Jiangsu Tailida Group

Jiangsu Tailida Group is investing in advanced production technology to improve the safety and consistency of its nitrocellulose products. Recent developments highlight their push into the aerospace and defense sectors by supplying high-grade nitrocellulose for specialized propellants and explosives. Simultaneously, they are expanding their product range for industrial coatings to include more durable and fast-drying solutions for a variety of substrates.

5. Sichuan North Nitrocellulose Corporation (SNC)

As a major player in China, SNC’s recent developments are centered on a significant, state-supported expansion of its manufacturing facilities to bolster the domestic and global supply chain. The company is focusing on producing nitrocellulose for both civilian industrial uses and strategic national applications. They are also implementing advanced wastewater treatment and safety systems to modernize their production operations and minimize environmental impact.

Conclusion

Nitrocellulose is a versatile material with growing demand across industries like printing, automotive, cosmetics, and wood coatings. Its unique properties, such as quick drying, durability, and eco-friendly applications, make it essential for modern manufacturing. As industries prioritize sustainability and innovation, nitrocellulose is poised for steady market growth, driven by its adaptability and performance in diverse applications.