Quick Navigation

Introduction

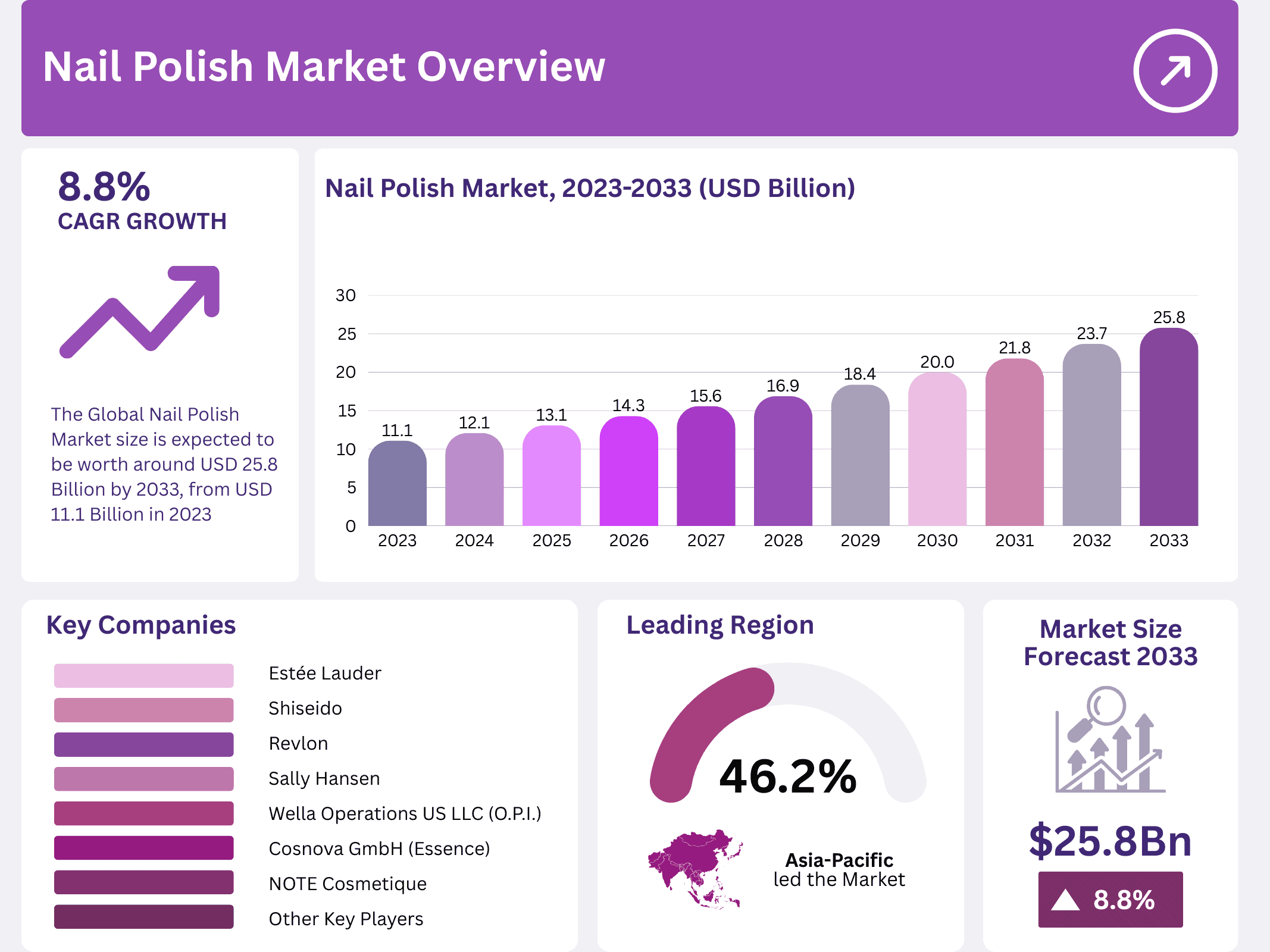

The global nail polish market demonstrates remarkable growth trajectory, expanding from USD 11.1 billion in 2023 to an anticipated USD 25.8 billion by 2033. This represents a compound annual growth rate of 8.8% throughout the forecast period. Consequently, the industry reflects evolving consumer preferences and increased beauty consciousness worldwide.

Furthermore, nail polish serves as both a protective coating and aesthetic enhancement for fingernails and toenails. The product encompasses various colors, finishes, and innovative formulations catering to diverse consumer segments. Moreover, the market spans premium luxury brands and accessible mass-market offerings, ensuring broad demographic appeal across age groups and income levels.

Additionally, social media influence and beauty influencers significantly impact consumer purchasing decisions within this sector. Platforms like Instagram and TikTok showcase emerging nail art trends, driving demand for novel colors and designs. Subsequently, brands invest heavily in digital marketing strategies to capture consumer attention and build lasting brand loyalty.

Meanwhile, health-conscious consumers increasingly seek non-toxic, vegan, and cruelty-free formulations. This shift prompts manufacturers to reformulate traditional products, incorporating sustainable ingredients and environmentally responsible packaging. Therefore, brands prioritizing ethical production methods gain competitive advantages in capturing new market segments.

Similarly, the pandemic accelerated home-based manicure trends, establishing DIY beauty routines as mainstream practices. Consumers embraced at-home nail care solutions, purchasing professional-grade products for personal use. Consequently, this behavioral shift created sustained demand for retail nail polish products beyond traditional salon services.

Ultimately, innovation drives market competitiveness through enhanced formulations offering quick-drying properties and extended wear durability. Manufacturers continuously develop advanced products meeting consumer expectations for convenience, longevity, and aesthetic appeal. Thus, the nail polish industry remains dynamic, adapting rapidly to emerging consumer preferences and market trends.

Key Takeaways

- The Nail Polish Market was valued at USD 11.1 billion in 2023 and is expected to reach USD 25.8 billion by 2033, with a CAGR of 8.8%.

- In 2023, Liquid Polish dominated the product type segment with 54%, due to its versatility and consumer preference for traditional formulas.

- In 2023, Glossy Finish led the finishes segment with 26%, reflecting its popularity for providing a classic, high-shine look.

- In 2023, Specialty Stores dominated the distribution channel with 38%, owing to their wide variety of professional nail products.

- In 2023, Asia Pacific led the market with 38%, driven by a growing beauty industry and rising disposable income in the region.

Market Segmentation Overview

Product Type

Liquid polish commands the product type segment with 54% market share, reflecting widespread consumer preference for traditional formulations. This dominance stems from extensive color variety, ease of application, and quick-drying properties. Additionally, liquid polishes accommodate diverse price points, appealing to both budget-conscious consumers and luxury goods purchasers seeking premium options.

Conversely, gel polishes represent significant growth potential, offering high-gloss finishes and extended durability requiring UV or LED curing. These products appeal to consumers prioritizing longevity over application convenience. Furthermore, innovative categories including peel-off formulas and breathable nail polishes address niche markets seeking health-conscious alternatives and convenient removal options.

Finishes

Glossy finishes dominate with 26% market share, delivering classic high-shine aesthetics that enhance color vibrancy across applications. This finish appeals broadly across demographics, complementing both casual and formal occasions with versatile styling options. Moreover, ongoing innovations improve wear time and chip resistance, strengthening consumer loyalty toward glossy formulations.

Nevertheless, alternative finishes including matte, glitter, and satin capture substantial market segments serving specific aesthetic preferences. Matte finishes attract fashion-forward younger consumers, while glitter polishes serve special occasions and festive celebrations. Subsequently, satin finishes bridge traditional and contemporary aesthetics, offering subtle sheen without excessive shine for sophisticated styling preferences.

Distribution Channel

Specialty stores lead distribution channels with 38% market share, providing comprehensive product ranges and expert customer service unavailable through general retailers. These establishments offer professional-grade selections, product testing opportunities, and knowledgeable staff recommendations valued by discerning consumers. Consequently, specialty stores cultivate loyal customer bases through superior shopping experiences and exclusive product offerings.

Meanwhile, e-commerce platforms experience rapid growth, delivering convenience and global product accessibility to tech-savvy consumers. Supermarkets and hypermarkets provide competitive pricing alongside grocery shopping convenience, while independent stores attract local clientele through personalized service and unique product curation.

Drivers

Increasing Beauty Consciousness: Growing awareness of personal grooming and aesthetic presentation drives substantial market expansion across demographic segments. Consumers increasingly view nail polish as essential fashion statements rather than optional beauty products. Furthermore, rising disposable incomes enable greater spending on premium nail care products offering superior quality and diverse color selections. Social media platforms amplify this trend, with influencers and celebrities showcasing nail art designs that followers eagerly replicate.

Product Innovation: Continuous formulation advancements maintain market dynamism and consumer engagement through enhanced product performance. Manufacturers develop polishes offering extended wear, rapid drying times, and improved durability addressing consumer convenience priorities. Additionally, eco-friendly formulations using natural, non-toxic ingredients attract health-conscious consumers concerned about chemical exposure. These innovations differentiate brands within competitive markets while meeting evolving consumer expectations.

Use Cases

Professional Salon Services: Nail salons constitute primary application environments where professional technicians utilize premium nail polish products for client services. These establishments require high-performance formulations delivering consistent results, vibrant colors, and extended wear durability. Consequently, professional-grade products command premium pricing while establishing quality benchmarks influencing consumer purchasing decisions for at-home use.

DIY Home Manicures: At-home nail care represents rapidly expanding use cases, particularly following pandemic-driven behavioral shifts toward self-service beauty routines. Consumers purchase professional-quality polishes, application tools, and nail art accessories for personal use at home. This trend democratizes access to salon-quality results while providing cost-effective alternatives to professional services, thereby expanding overall market consumption.

Major Challenges

Health and Safety Concerns: Chemical ingredients including toluene, formaldehyde, and dibutyl phthalate raise significant health concerns among increasingly informed consumers. These substances prompt regulatory scrutiny and consumer backlash, forcing manufacturers to invest in reformulation efforts. Additionally, stringent regulatory requirements across regions create compliance complexities requiring substantial research and development investments, potentially delaying product launches and increasing operational costs.

Intense Market Competition: The proliferation of established brands and emerging competitors creates highly competitive environments characterized by aggressive pricing strategies. These price wars compress profit margins, making market share retention increasingly challenging for manufacturers. Furthermore, rapidly evolving consumer preferences regarding colors, finishes, and application techniques demand organizational agility and responsive product development capabilities that strain resources.

Business Opportunities

Emerging Market Expansion: Developing regions including Asia-Pacific, Latin America, and Africa present substantial growth opportunities through expanding middle-class populations and rising disposable incomes. These relatively untapped markets demonstrate increasing beauty consciousness and personal care spending, offering significant potential for brands establishing early market presence. Furthermore, localized product development addressing regional preferences can capture dedicated consumer segments seeking culturally relevant beauty solutions.

Sustainable Product Development: Growing environmental awareness creates opportunities for brands offering eco-friendly, sustainable nail polish formulations and packaging solutions. Consumers increasingly prioritize products made from natural, non-toxic ingredients that minimize environmental impact throughout product lifecycles. Additionally, vegan and cruelty-free certifications attract ethically conscious consumers willing to pay premium prices for products aligning with personal values, thereby enhancing brand differentiation and customer loyalty.

Regional Analysis

Asia Pacific Dominance: Asia Pacific commands 38% market share valued at USD 4.22 billion, driven by substantial youth populations and increasing beauty consciousness across the region. Countries including China, Japan, and South Korea possess robust beauty industries influencing global trends and consumer preferences. Moreover, expanding e-commerce infrastructure and tech-savvy consumer bases facilitate market penetration for both local and international brands seeking regional growth opportunities.

North America Performance: North America holds 30% market share, characterized by strong demand for premium products and innovative formulations offering extended wear and enhanced performance. Consumers in this region demonstrate willingness to invest in luxury nail care products featuring advanced technologies and superior aesthetics. Additionally, established distribution networks and high digital engagement rates support effective marketing campaigns and brand-building initiatives across demographic segments.

Recent Developments

- In August 2024, Sally Hansen partnered with Warner Bros. to launch a limited-edition nail polish collection inspired by Beetlejuice Beetlejuice, featuring eight vibrant shades within the Miracle Gel™ line with iconic black-and-white pinstripe designs.

- In June 2024, Mooncat partnered with Cartoon Network to release a Powerpuff Girls nail polish collection, featuring six vegan and cruelty-free jelly “flakie” lacquers with shades inspired by the animated series.

Conclusion

The global nail polish market demonstrates robust growth prospects, expanding from USD 11.1 billion in 2023 to USD 25.8 billion by 2033 at 8.8% CAGR. This expansion reflects increasing beauty consciousness, social media influence, and continuous product innovation addressing evolving consumer preferences. While health concerns and intense competition present challenges, opportunities in emerging markets and sustainable product development offer substantial growth potential for forward-thinking brands.