Quick Navigation

Overview

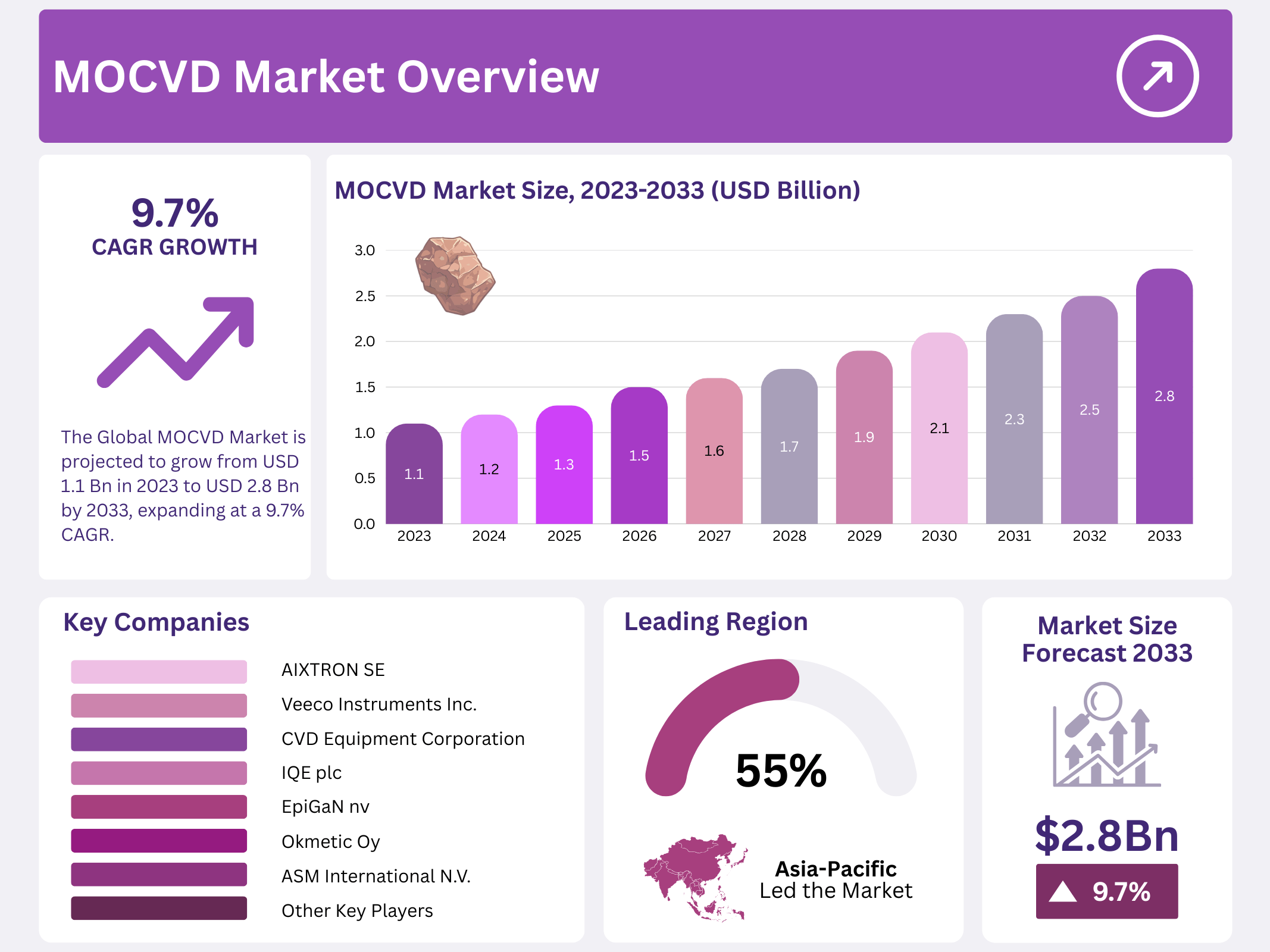

New York, NY – January 01, 2026 – The global Metal Organic Chemical Vapor Deposition (MOCVD) Market is projected to witness strong growth over the next decade, expanding from USD 1.1 billion in 2023 to nearly USD 2.8 billion by 2033, reflecting a solid CAGR of 9.7%. This expansion is primarily driven by continuous technological advancements in semiconductor fabrication, rising adoption of energy-efficient LED lighting, and the steady growth of the global semiconductor industry. MOCVD systems play a critical role in enabling precise material deposition, which is essential for next-generation electronic manufacturing.

Demand for MOCVD technology is strongly supported by the increasing need for high-performance electronic and optoelectronic components across industries such as consumer electronics, automotive, and telecommunications. The technology’s ability to produce high-quality epitaxial layers makes it indispensable for manufacturing LEDs, compound semiconductors, and photovoltaic cells. As devices become smaller, faster, and more energy-efficient, manufacturers are increasingly relying on MOCVD to meet stringent performance and reliability requirements.

Growth opportunities are especially prominent in power electronics and energy-efficient solutions, where advanced semiconductor materials are critical. The Asia Pacific region continues to dominate the market due to rapid expansion in electronics and automotive manufacturing, alongside heavy investments in semiconductor fabrication infrastructure. Government-backed initiatives and the strengthening of local manufacturing capabilities position the region as the central hub for MOCVD market growth.

Key Takeaways

- The Global MOCVD Market is projected to grow from USD 1.1 billion in 2023 to USD 2.8 billion by 2033, expanding at a 9.7% CAGR.

- GaN-MOCVD captured a 45.6% market share in 2023, favored for power electronics in automotive and telecommunications.

- LED Manufacturing holds 41.5% market share in 2023, meeting global demand for energy-efficient lighting.

- Consumer Electronics leads MOCVD usage with 36.8% market share in 2023, driven by demand for advanced electronics like smartphones.

- Asia Pacific leads with a 55.4% market share in 2023, driven by demand from consumer electronics and automotive sectors.

MOCVD Statistics

- The growth temperatures for MOCVD and MBE are around 1300 K and 1000 K, respectively. The buffer layers used in the MBE and MOCVD growth processes are thin GaN layers that are generated at 770 K.

- The substrate temperatures for normal device growth are greater than MBE and fall between 500 and 1500 degrees Celsius because MOCVD uses hot gas flow and surface chemical reaction.

- For the MOCVD samples, an AlN buffer layer was utilized, and 1040°C is a common growth temperature. Both MOCVD and MBE samples exhibit an increase in free carrier concentration at Mg values up to 1×1019 cm−3.

- The aforementioned observations demonstrate that deep donors are required to explain the compensatory behavior and the 2.9 eV recombination appearance in heavily Mg-doped GaN produced by MOCVD.

- The following conditions are necessary for AlN development by HT-MOCVD: substrate temperature of 1550 K, operating pressure of 40 Torr, gas flow rate of 50 slm, and susceptor rotational speed of 400 rpm.

- Growing crystalline GaN films at 600 °C confirms the viability of the ICP-MOCVD, which is crucial for (opto)electronic devices. The improvement of 1.86% in the corresponding non-uniformity brings it very close to the commercial MOCVD.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 1.1 Billion |

| Forecast Revenue (2033) | USD 2.8 Billion |

| CAGR (2024-2033) | 9.7% |

| Segments Covered | By Type(GaN-MOCVD, GaAs-MOCVD, Others), By Application(LED Manufacturing, Semiconductor Devices, Optoelectronic Devices, Power Electronics, Others), By End-Use(Consumer Electronics, Automotive, Telecommunications, Aerospace & Defense, Others) |

| Competitive Landscape | AIXTRON SE, Veeco Instruments Inc., ASM International N.V., Taiyo Nippon Sanso Corporation, CVD Equipment Corporation, Tokyo Electron Limited, Jusung Engineering Co., Ltd., Applied Materials, Inc., Intelligent Epitaxy Technology, Inc., Northrop Grumman, IQE plc, EpiGaN nv, Xiamen Powerway Advanced Material Co., Ltd., Okmetic Oy |

Key Market Segments

By Type

In 2023, GaN-MOCVD maintained a leading position in the market, accounting for over 45.6% of the total share. This dominance is mainly supported by the rapid adoption of gallium nitride–based devices in power electronics, along with growing demand for compact, high-efficiency components in automotive and telecommunications applications. GaN devices are valued for their ability to operate at high frequencies and withstand elevated temperatures, making them suitable for demanding and mission-critical environments.

The GaAs-MOCVD segment also represents a significant portion of the market, driven by its importance in producing high-speed electronic and optoelectronic components. Its capability to support devices operating at very high frequencies has strengthened its use in wireless communications, satellite technologies, and advanced radar systems. Meanwhile, the Others category—including materials such as indium phosphide (InP) and aluminum nitride (AlN)—is gaining momentum as ongoing research expands MOCVD applications into emerging semiconductor technologies.

By Application

In 2023, LED manufacturing dominated the MOCVD market, capturing more than 41.5% share. This leadership is linked to the strong global shift toward energy-efficient lighting solutions, as LEDs offer longer lifespans and lower energy consumption than conventional lighting. Government policies and sustainability initiatives worldwide continue to accelerate adoption across residential, commercial, and industrial sectors.

Semiconductor devices form the next major application segment, with MOCVD enabling the production of high-performance chips used in smartphones, computing systems, and advanced electronics. Growth in smart devices and digital infrastructure has directly increased demand. Optoelectronic devices also rely heavily on MOCVD due to the precision required for components used in communications, sensing technologies, and medical equipment.

By End-Use

In 2023, Consumer Electronics emerged as the dominant end-use segment, holding over 36.8% market share. Continuous demand for smartphones, wearables, and other personal electronic devices has driven the need for high-quality semiconductor components produced using MOCVD processes. Rapid product innovation and shorter replacement cycles further support this segment’s strength.

The automotive sector represents another key end-user, particularly for LED lighting systems and power electronics essential to electric and advanced vehicles. Increased focus on vehicle safety, electrification, and energy efficiency has elevated semiconductor demand. Telecommunications also plays a vital role, as MOCVD is crucial for manufacturing high-performance components used in high-speed networks, including next-generation 5G infrastructure, where efficiency and reliability are critical.

Regional Analysis

Asia-Pacific is expected to dominate the global MOCVD market, capturing the largest share of 55.4%. The region’s leadership is fueled by surging demand for high-performance electronics and energy-efficient LED lighting in key sectors such as consumer electronics, automotive, and telecommunications. Massive ongoing investments in semiconductor fabrication capacity—particularly in China, South Korea, India, Taiwan, Thailand, Malaysia, and Vietnam—are set to sustain robust growth in MOCVD adoption throughout the forecast horizon.

North America is poised for steady expansion, supported by economic recovery and strong momentum in the automotive industry, where LED lighting and advanced power electronics are seeing rapid uptake. The region’s well-established semiconductor and electronics manufacturing base, combined with increasing focus on electric vehicles and 5G infrastructure, will continue to drive significant demand for MOCVD systems.

Europe is projected to experience solid growth, driven primarily by the automotive and aerospace sectors’ accelerating integration of sophisticated electronic components and lighting solutions. The region’s aggressive transition toward renewable energy and the rising need for high-efficiency power electronics in solar inverters, wind power systems, and EV charging infrastructure are expected to further boost MOCVD demand over the coming years.

Use Cases

- Optoelectronic Devices: MOCVD plays a vital role in manufacturing optoelectronic components such as LEDs, lasers, and photodetectors. The technology enables precise control over layer thickness and material composition, which is essential for achieving high light efficiency, reliability, and consistent performance in optoelectronic systems.

- Power Electronics: Using advanced materials such as gallium oxide and gallium nitride, MOCVD supports the development of high-performance power electronic devices. These components are widely used in electric vehicles, renewable energy systems, and 5G infrastructure, where high voltage handling and energy efficiency are critical.

- Microelectronics: In microelectronics manufacturing, MOCVD is used to deposit ultra-thin compound semiconductor layers required for devices like high electron mobility transistors (HEMTs). This precise layer growth improves device speed, thermal stability, and overall electrical efficiency.

- Solar Cells: MOCVD is extensively applied in the production of compound semiconductor-based solar cells. Its ability to form uniform, defect-free films enhances energy conversion efficiency, making it suitable for high-performance photovoltaic applications.

- Advanced Research and Development: MOCVD is a key tool in semiconductor research, supporting innovation in materials such as gallium nitride (GaN) and silicon carbide (SiC). Its accuracy and scalability enable researchers to develop next-generation electronic and optical devices with improved functionality and reliability.

Recent Development

- AIXTRON SE is a leading provider of MOCVD systems, crucial for manufacturing III-V compound semiconductors like gallium nitride (GaN). AIXTRON’s technology is pivotal for creating high-quality semiconductors used in various high-tech applications. Their systems, including the advanced AIX R6, are designed for cost-effectiveness and high throughput, essential for large-scale production of LEDs and other semiconductor devices.

- Veeco Instruments Inc. specializes in manufacturing equipment for semiconductor and advanced material applications, including MOCVD systems for creating power electronics, LED lighting, and solar cells. Veeco’s technology supports the production of devices requiring precise material properties and is recognized for enhancing production scalability and improving material quality.

- ASM International N.V. offers deposition systems that cater to semiconductor manufacturing, providing tools essential for atomic layer deposition (ALD), plasma-enhanced chemical vapor deposition (PECVD), and MOCVD. Their equipment is used globally to produce advanced semiconductor materials vital for electronics and solar industries.

- Taiyo Nippon Sanso Corporation is a major provider of industrial gases and related equipment, including MOCVD systems. They serve a broad spectrum of industries, focusing on enhancing semiconductor production processes and improving the efficiency and quality of electronic materials.

- CVD Equipment Corporation designs, develops, and manufactures a range of equipment, including MOCVD systems, for the production of advanced materials. Their systems are utilized in the research and development as well as commercial production of semiconductors, nanomaterials, and other technologically significant materials.

Conclusion

The Metal-Organic Chemical Vapor Deposition (MOCVD) is set for strong and sustained growth, supported by its critical role in manufacturing high-quality and highly precise semiconductor materials. Rising demand from renewable energy systems, advanced electronics, and LED manufacturing continues to accelerate market expansion, as industries seek greater efficiency, performance, and reliability in device fabrication.