Quick Navigation

Introduction

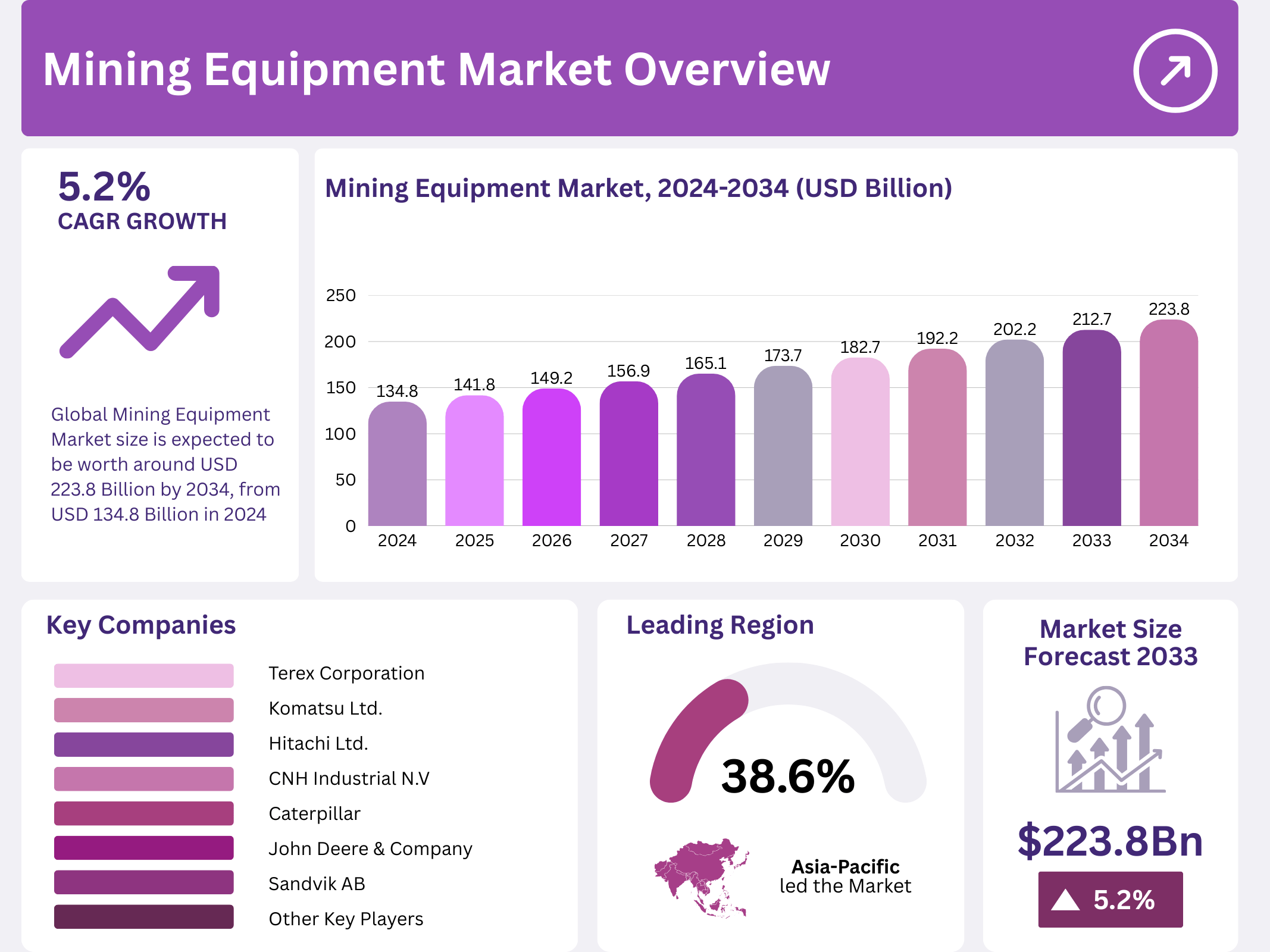

The global mining equipment market is entering a new growth phase, supported by rising industrial activity and mineral demand worldwide. In 2024, the market stood at USD 134.8 Billion and is projected to reach USD 223.8 Billion by 2034, reflecting steady long-term expansion.

Mining equipment plays a critical role in extracting, transporting, and processing minerals across surface and underground operations. These machines improve productivity while reducing manual risks. As mining projects scale up globally, demand for advanced drills, loaders, trucks, and crushers continues to rise.

Moreover, energy transition trends are reshaping mineral priorities. Lithium, cobalt, and nickel are increasingly required for electric vehicle batteries and digital infrastructure. As a result, mining companies are investing in efficient equipment to increase output while controlling costs and operational downtime.

At the same time, governments are strengthening safety and environmental regulations. This pushes operators to replace older machinery with modern, compliant equipment. Consequently, manufacturers are focusing on automation, electrification, and digital integration to meet evolving industry standards.

Furthermore, emerging economies are expanding mining capacities to support infrastructure growth. Countries across Asia Pacific, Latin America, and Africa are investing heavily in mining assets. These developments position the mining equipment market as a key enabler of global industrial and energy supply chains.

Overall, the market outlook remains positive. Technological progress, sustainability goals, and rising mineral demand collectively create favorable conditions. These factors reinforce the mining equipment sector’s importance in supporting economic growth and industrial resilience worldwide.

Key Takeaways

- The Mining Equipment Market was valued at USD 134.8 Billion in 2024 and is projected to reach USD 223.8 Billion by 2034, growing at a CAGR of 5.2%.

- Surface Mining Equipment led the equipment type segment in 2024 with a share of 38.4%.

- Coal Mining dominated the application segment in 2024 with a market share of 39.3%.

- Asia Pacific held the largest regional share of 38.6% in 2024, valued at USD 52.03 Billion.

Market Segmentation Overview

By equipment type, surface mining equipment continues to lead due to its cost efficiency and large-scale application. In 2024, it accounted for 38.4% of the market. Open-pit and quarrying methods drive adoption, especially for coal, iron ore, and limestone extraction.

Meanwhile, underground mining equipment remains essential for accessing deeper reserves. Although capital-intensive, this segment supports the extraction of high-value minerals. Crushing, pulverizing, and screening equipment further enhance productivity by converting raw materials into usable forms efficiently.

By application, coal mining dominated the market with 39.3% share in 2024. Despite energy transitions, coal remains critical for electricity generation and steel production, particularly in developing economies with growing industrial demand.

Additionally, metal mining supports manufacturing, construction, and infrastructure development. Gas and oil extraction equipment remains vital for global energy security. Non-metal mining also contributes through minerals used in construction materials and industrial abrasives.

Drivers

One key driver is rising demand for critical minerals used in electric vehicles and renewable energy systems. Lithium, cobalt, and nickel demand continues to exceed supply, pushing mining companies to expand capacity using modern equipment.

Another driver is automation and digital transformation in mining. Autonomous trucks, remote drilling systems, and smart monitoring tools improve safety and efficiency. These technologies reduce labor risks and increase output consistency across large mining sites.

Use Cases

Mining equipment is widely used in large-scale surface mining operations to extract coal and iron ore efficiently. High-capacity haul trucks and excavators enable continuous material movement, supporting uninterrupted industrial supply chains.

In underground mining, advanced drilling and loading equipment is used to safely access deep mineral deposits. These machines help maintain worker safety while improving ore recovery rates in confined environments.

Major Challenges

High upfront costs remain a major challenge for mining operators. Advanced equipment requires significant capital investment, which can limit adoption among small and mid-sized mining companies, especially during commodity price fluctuations.

Strict environmental regulations also pose challenges. Compliance with emission norms and land restoration requirements increases operational costs. This can delay new equipment purchases and slow project approvals in regulated regions.

Business Opportunities

Sustainable mining presents strong growth opportunities. Demand for electric and hybrid mining equipment is increasing as companies aim to reduce carbon emissions. This shift opens innovation opportunities for equipment manufacturers.

Predictive maintenance and digital solutions also create value. IoT-enabled equipment helps reduce downtime and maintenance costs. As digital adoption grows, suppliers offering smart solutions gain competitive advantage.

Regional Analysis

Asia Pacific leads the market with a 38.6% share in 2024, valued at USD 52.03 Billion. China, India, and Australia drive demand through large-scale mining projects and infrastructure expansion.

North America and Europe maintain stable growth due to advanced technologies and safety regulations. Meanwhile, Latin America and the Middle East & Africa are emerging as high-growth regions due to new mining investments.

Recent Developments

- In November 2024, Peabody announced an agreement to acquire steelmaking coal assets from Anglo American, with completion expected by mid-2025.

- In November 2024, Orla Mining acquired the Musselwhite Mine in Canada for USD 810 Million, with the transaction finalized in February 2025.

Conclusion

The global mining equipment market is positioned for steady expansion over the next decade. Rising mineral demand, digital transformation, and sustainability initiatives are reshaping equipment requirements across mining operations.

While challenges such as high costs and regulatory pressures persist, innovation and strategic investments continue to unlock new growth avenues. As mining remains central to global industrial development, advanced equipment will play a critical role in shaping the sector’s future.