Quick Navigation

Overview

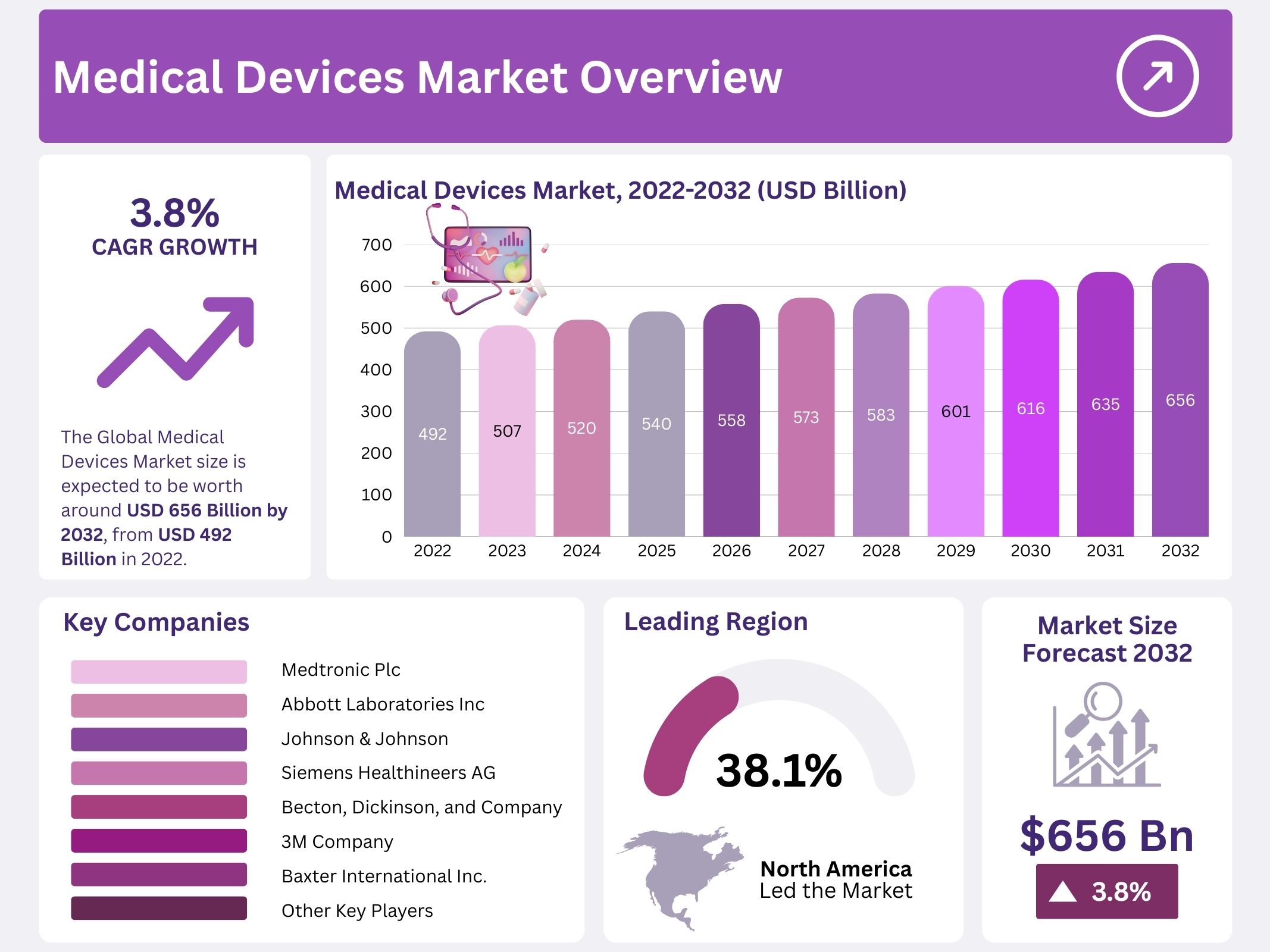

The Global Medical Devices Market is projected to reach approximately USD 656 billion by 2032, increasing from USD 492 billion in 2022. This represents a compound annual growth rate (CAGR) of 3% during the forecast period of 2022–2032. The growth is driven by an increase in complex surgical procedures and expanding global populations. Technological advancements in medical technologies, particularly in brain monitoring devices, are contributing significantly to market expansion. Medical devices are integral in diagnosing and treating various medical conditions, enhancing clinical outcomes and patient care effectiveness.

Medical devices offer significant benefits, including improving patient quality of life and enabling effective treatment for various illnesses. Their use spans multiple medical disciplines, from surgical interventions to disease management. The Food and Drug Administration (FDA) categorizes these devices into three main classes: Class I, Class II, and Class III. Each classification is based on the potential risk to patient health and the level of regulatory control required. This classification ensures that safety and performance standards are maintained across all medical device categories.

Class I and Class II devices have the least regulatory controls but must comply with specific labeling requirements. These devices are generally used to support or sustain human life. Examples include external defibrillators, implant endosseous devices, and pulse generators. While their regulatory requirements are less stringent than Class III devices, they still require adherence to strict manufacturing and quality control guidelines. This regulatory framework ensures that even lower-risk devices meet essential safety and performance standards in the healthcare environment.

Medical device establishments encompass companies involved in manufacturing, assembling, or processing these products. The industry covers a wide range of devices, including diagnostic imaging systems, in-vitro diagnostic tools, and dental equipment. Continuous innovation in design and functionality is improving diagnostic accuracy, treatment precision, and patient safety. The sector’s expansion is further supported by growing healthcare infrastructure and increasing investments in advanced technologies. These trends are expected to sustain market growth throughout the forecast period.

Key Takeaways

- The global medical devices market is forecast to reach USD 656 billion by 2032, growing at a CAGR of 3% from 2022 levels.

- Complex surgical procedures and expanding global populations are primary drivers contributing to sustained market expansion in the coming decade.

- Technological advancements in medical technology, including brain monitoring devices, are expected to significantly accelerate market growth opportunities.

- The In-Vitro Diagnostics segment is projected to register the fastest CAGR due to rising diagnostic needs for chronic and infectious diseases globally.

- Other key segments include wound management, minimally invasive surgery, cardiovascular, orthopedic, ophthalmic, and diabetes care devices.

- Hospitals and ambulatory surgery centers dominated market share in 2022, supported by high healthcare spending and robust infrastructure.

Segmentation Analysis

The In-Vitro Diagnostics (IVD) segment is projected to register a higher CAGR between 2022 and 2032. Growth can be attributed to the increasing adoption of real-time diagnostic testing for accurate detection of chronic and infectious diseases, including diabetes, cancer, and HIV/AIDS. The minimally invasive surgery segment is expected to expand, driven by technological advancements in surgical robotics and increased adoption by healthcare providers. Benefits such as reduced recovery time, minimal scarring, and lower complication risks are accelerating its uptake. In addition, cardiovascular and orthopedic devices are anticipated to grow rapidly due to the increasing prevalence of cardiac conditions and orthopedic disorders. These advancements are improving surgical precision and patient safety, thereby enhancing market penetration over the coming decade.

From an end-user perspective, hospitals and ambulatory surgery centers dominated the global medical devices market in 2022. This dominance is due to rising healthcare expenditure, improving infrastructure, and favorable reimbursement policies. According to WHO, many developing countries have fewer hospital beds per million people than recommended, prompting substantial investment in healthcare infrastructure. Such initiatives are projected to continue over the next five years, enhancing access to medical devices and driving demand across diverse care settings globally.

Driver, Restraints, Opportunity and Trend

Rising Chronic Disease Prevalence Driving Medical Device Demand

The growing incidence of chronic conditions such as diabetes, cancer, and osteoarthritis is significantly increasing the demand for medical devices. Sedentary lifestyles, aging populations, and lifestyle-related health risks contribute to higher diagnosis rates. For example, the International Diabetes Federation estimates cases will rise from 537 million in 2021 to 783 million by 2045. Similarly, 1.9 million new cancer cases were recorded in 2021. With increasing per capita healthcare spending and improved reimbursement policies, more patients are seeking diagnostic and therapeutic procedures, driving global medical equipment demand.

Shift Towards Homecare Boosting Portable Device Adoption

The rising treatment costs and hospital burden are encouraging the adoption of home healthcare solutions. Evidence from the American Journal of Managed Care shows home care management can reduce costs by 19% compared to hospital-based treatment. Growing elderly populations and the push for remote patient management are accelerating this trend. Medical device companies are introducing user-friendly, portable devices, such as wearable sensors for vital sign monitoring. For instance, Shimmer Research launched Verisense Pulse+ in 2021 to measure heart rate, oxygen saturation, activity, and sleep patterns for clinical trials.

Regulatory and Workforce Challenges Restraining Growth

The medical devices market faces constraints due to stringent regulatory changes, data protection requirements, and a shortage of skilled healthcare professionals. The U.S. FDA now demands additional clinical data to validate safety and efficacy, lengthening approval timelines. Although processes like the 510(k) have been accelerated over the past decade, product launches are still impacted by higher compliance costs. This raises development expenses, delays market entry, and limits investment in innovation, particularly for advanced medical equipment, which could hinder growth in competitive global markets.

Opportunities and Technological Trends in Medical Devices

Market opportunities exist in targeting elderly-focused products, in-vitro diagnostics, disposable equipment, and contactless technologies. By 2025, in-vitro diagnostics are projected to generate USD 33.6 billion annually. The pandemic accelerated adoption of wearable health devices, AI-driven diagnostics, and electronic health records, enabling remote monitoring and reducing paperwork. Manufacturers have diversified production to meet high-demand needs, including PPE and testing kits. Companies such as Markforged and Formlabs shifted to producing face shields and swabs, showing how agile innovation and partnerships with healthcare agencies can strengthen market presence.

Regional Analysis

North America is expected to lead the medical devices market in the coming years. The region benefits from advanced healthcare technologies, high treatment adoption, and strong government support for early disease detection. Chronic disease prevalence, significant healthcare expenditure, and the presence of key market players support this dominance. In Canada, a growing elderly population is a major driver. According to the United Nations Population Fund, 19% of Canadians were aged 65 or older in 2022. This demographic shift increases demand for devices treating age-related health conditions.

Elderly individuals are more prone to respiratory, cardiopulmonary, and orthopedic disorders, creating higher demand for specialized medical equipment. Rising cases of chronic conditions such as stroke, cardiovascular disease, and heart disease have increased the number of cardiopulmonary bypass procedures. In the United States, heart disease prevalence reached 6.8% in 2021, according to the American Heart Association. This was 1.8% above the total population average. Such trends highlight the growing need for advanced diagnostic and therapeutic devices, which is expected to fuel market growth during the forecast period.

Lifestyle factors, including physical inactivity, continue to raise chronic disease risks. Research published in Cardiovascular Diabetology in June 2021 linked a 31% increase in inactivity to higher incidences of Type II diabetes, heart disease, stroke, and related mortality. As more heart surgeries are performed to treat blocked arteries, demand for innovative devices will rise. Industry players are responding through product innovations, acquisitions, and collaborations. These strategies are designed to maintain competitive positions and meet the increasing regional demand for technologically advanced medical equipment.

Key Players Analysis

The global medical devices market is characterized by significant fragmentation due to the presence of numerous participants at both global and regional levels. Medtronic maintains the largest market share, supported by its broad product portfolio and strong international brand recognition. Many companies allocate substantial resources to Research and Development (R&D) to introduce innovative solutions and enhance existing products. Additionally, firms focus on strengthening global distribution networks to diversify product offerings and expand market presence, ensuring competitive positioning in an evolving healthcare landscape.

The competitive environment is further intensified by the coexistence of regional and local manufacturers. Market leaders with established brands and extensive distribution capabilities present strong competition. To sustain growth and competitiveness, companies adopt strategic initiatives such as forming partnerships, launching new products, and entering untapped markets. These expansion strategies are aimed at increasing market penetration, improving operational efficiency, and addressing evolving healthcare needs. The dynamic nature of the industry encourages continuous innovation and adaptability among all participants.

- Medtronic Plc

- Abbott Laboratories Inc

- Johnson & Johnson

- Siemens Healthineers AG

- Becton, Dickinson, and Company

- Accord Medical Products Private Limited

- 3M Company

- ARKRAY Healthcare Pvt. Ltd

- Baxter International Inc.

- Agappe Diagnostics Ltd

- Braun Medical Inc.

- BioTelemetry Inc.

- Canon Medical Systems Corporation

- Boston Scientific

- Chart Industries

- Danaher Corporation

- Dentsply Sirona

- Covidien Healthcare

- Fisher & Paykel Healthcare

- Hoffmann-La Roche Ltd

- Envista Holdings Corporation

- Fesenius Medical Care

- FUJIFILM Holdings Corporation

- General Electric Company

- Fresenius Medical Care

- Hitachi Group

- Masimo Corporation

- NIPRO Corporation

- ResMed Inc.

- SIEMENS AG

- SCHILLER Healthcare

- Shanghai Runda Medical Technology Co. Ltd.

- Stanley Healthcare

- Getinge Group

- Hamilton Medical AG

- Koninklijke Philips N.V.

- Lepu Medical Technology Company Co. Ltd

- Metran Co. Ltd

- Nihon Kohden Corporation

- Novartis

- Teleflex Medical

- Themis Bioscience

- Olympus Corporation

- PHILIPS HEALTHCARE

- Roche

- Terumo Corporation

- Shandong WeiGao Group Medical Polymer Company Limited

- Shinva Medical Instrument Company Limited

- Smiths Medical

- Jude

- Stryker Corporation

- SunMed

- Yuwell

- Jiangsu Yuyue Medical Equipment & Supply Co. Ltd

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]