Quick Navigation

Introduction

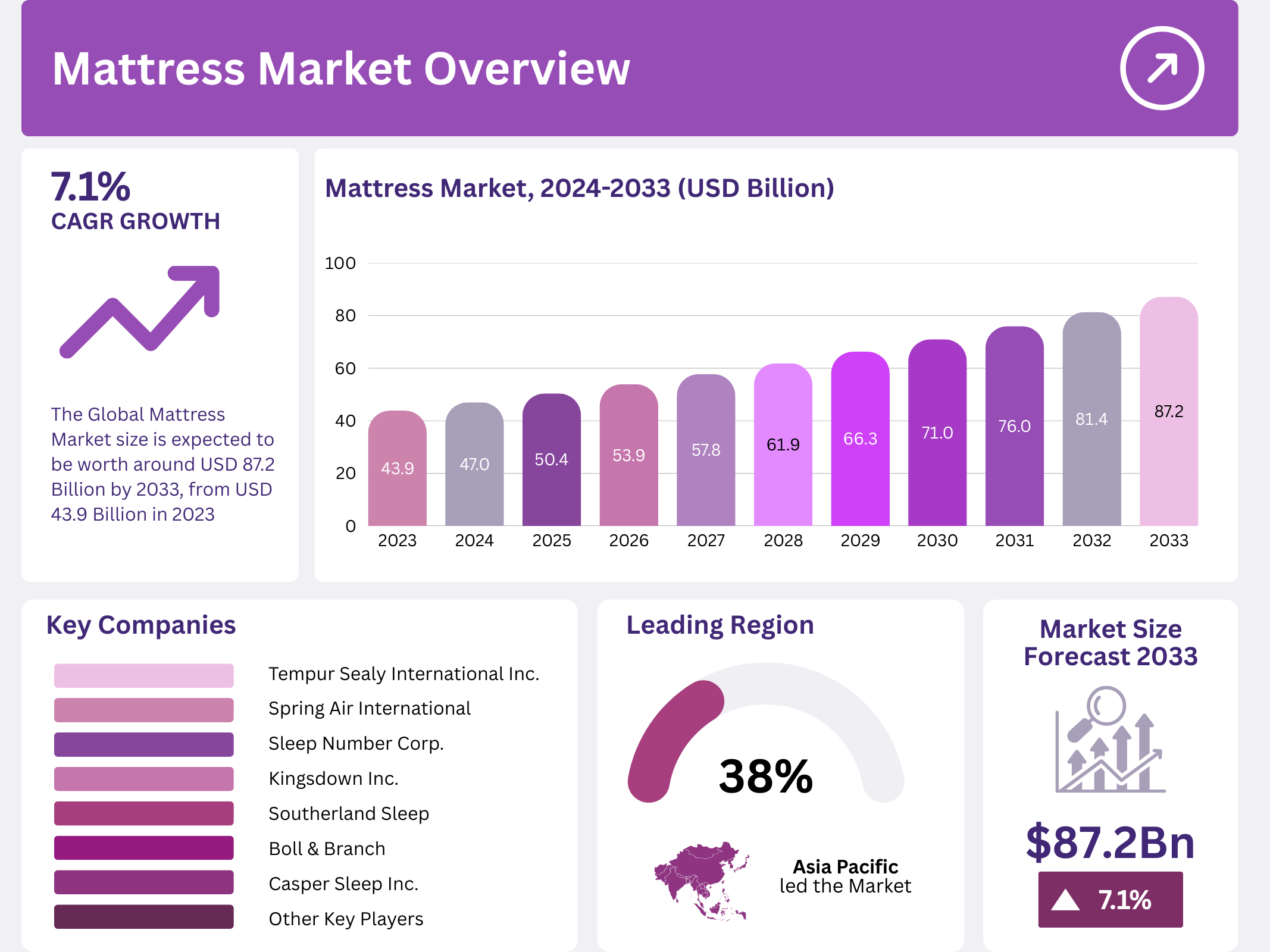

The global mattress market is experiencing significant growth, with a projected size of USD 87.2 Billion by 2033, up from USD 43.9 Billion in 2023, reflecting a compound annual growth rate (CAGR) of 7.1% during the forecast period from 2024 to 2033. This growth is driven by increasing consumer demand for comfort and sleep health, supported by rising disposable incomes and innovations in mattress technology.

Mattresses, essential for providing comfort and supporting sleep quality, are becoming increasingly vital as consumers prioritize better sleep. As people spend more time at home, driven by global lifestyle shifts, there is a growing emphasis on investing in premium home products. The rise of e-commerce platforms has also facilitated easier access to a wide variety of mattress options, contributing to the market’s expansion.

Key Takeaways

- The global mattress market was valued at USD 43.9 Billion in 2023, and is projected to reach USD 87.2 Billion by 2033, growing at a CAGR of 7.1%.

- In 2023, foam mattresses led the market with a 45% share, known for their comfort and body contouring properties.

- Household use dominated the end-use segment with 78% in 2023, driven by a growing focus on sleep quality and home comfort.

- Offline distribution accounted for 68% of mattress sales in 2023, as many consumers prefer testing mattresses before purchasing.

- In 2023, Asia-Pacific led the market with 38% market share and a value of USD 16.68 Billion, driven by rapid urbanization and growing disposable incomes.

Market Segmentation Overview

The global mattress market is segmented into type, end-use, and distribution channels. Each of these segments is expected to witness steady growth, driven by increasing consumer preference for comfort, health-consciousness, and technological advancements.

Type Segmentation: Foam mattresses dominate with 45% market share, favored for their comfort and ability to conform to body shapes. These mattresses offer effective pressure relief, supporting spinal alignment and comfort during sleep. Other types like innerspring and hybrid mattresses also have growing demand, especially hybrid models which provide a balance between comfort and support.

End-Use Segmentation: Household use holds the largest share at 78%, primarily due to a heightened demand for comfort at home. Consumers increasingly focus on wellness and sleep quality. Meanwhile, the commercial segment is also growing, with hotels, resorts, and healthcare facilities investing in high-quality mattresses to enhance guest and patient experiences.

Distribution Channel Segmentation: Offline channels led the market with 68% share in 2023, driven by consumer preference for testing mattresses before purchase. However, online sales are growing steadily, aided by the rise of direct-to-consumer brands and advancements in augmented reality for a virtual in-store experience.

Drivers

- Increasing Focus on Sleep Health: The growing awareness around sleep health is driving demand for high-quality mattresses. As more consumers realize the importance of sleep in overall well-being, they are prioritizing comfort and support in their bedding choices, leading to increased market opportunities.

- Urbanization and Rising Disposable Income: Urbanization and rising disposable incomes, especially in developing countries, are fueling the demand for premium mattresses. With an expanding middle class, consumers are investing more in home comfort products like mattresses, thus driving market growth.

Use Cases

- Health-Conscious Consumers: The rise in health-conscious consumers is one of the key drivers for the mattress market. Many consumers now view mattresses as essential tools for improving their overall well-being, particularly for those suffering from sleep disorders or seeking better sleep quality.

- Hospitality Industry: The hospitality industry plays a significant role in the mattress market, with hotels and resorts investing in premium mattresses to provide better guest experiences. As the global tourism industry recovers, the demand for mattresses in commercial sectors continues to grow.

Major Challenges

- High Costs of Premium Mattresses: The cost of high-quality mattresses, particularly foam and hybrid models, limits their accessibility to budget-conscious consumers. While the demand for premium products is growing, price sensitivity remains a challenge in certain markets, restricting market penetration.

- Fluctuating Raw Material Prices: The price volatility of raw materials such as foam, latex, and springs can disrupt the production costs and profit margins for mattress manufacturers. These fluctuations pose a challenge in maintaining consistent pricing strategies while ensuring product quality.

Business Opportunities

- Smart Mattresses and Technological Advancements: The introduction of smart mattresses equipped with sleep monitoring technology presents a significant growth opportunity. These mattresses, which can adjust firmness and monitor sleep patterns, appeal to health-conscious consumers seeking innovative sleep solutions.

- E-Commerce Growth and Direct-to-Consumer Models: The rise of e-commerce platforms provides an opportunity for mattress companies to bypass traditional retail channels. With the convenience of online shopping and the ability to offer a wider range of products, companies can reach more customers and reduce operational costs.

Regional Analysis

Asia Pacific Dominates with 38% Market Share: Asia-Pacific leads the global mattress market with a 38% share, valued at USD 16.68 Billion. This growth is driven by rapid urbanization, rising disposable incomes, and increasing consumer awareness of sleep health in key markets like China, India, and Japan.

North America: North America remains a key player in the mattress market, driven by high consumer spending and growing demand for premium sleep products. The region’s market is bolstered by technological innovations such as smart mattresses and the growth of e-commerce platforms.

Recent Developments

- DreamCloud Flash Memory Foam Mattress Sale: DreamCloud launched a sale on its Flash Memory Foam Mattress, offering significant discounts to make luxury mattresses more accessible to a broader customer base.

- Mattress Warehouse Expansion Plans: Mattress Warehouse is expanding its retail footprint by opening new locations and enhancing its operational capacity to meet growing consumer demand.

- Tempur Sealy’s Acquisition of Mattress Firm: In September 2023, Tempur Sealy pursued a USD 4 billion acquisition of Mattress Firm. However, the deal is under scrutiny by the Federal Trade Commission due to concerns over reduced competition.

Conclusion

The global mattress market is poised for substantial growth in the coming years, driven by increasing consumer awareness of sleep health, technological advancements, and the growing preference for premium sleep solutions. While challenges such as high costs and fluctuating material prices exist, opportunities in smart mattresses, e-commerce, and emerging markets present a promising future for industry players. As consumers invest more in enhancing their sleep quality, the mattress market is expected to continue expanding, with innovations and strategic business moves supporting long-term growth.