Quick Navigation

Introduction

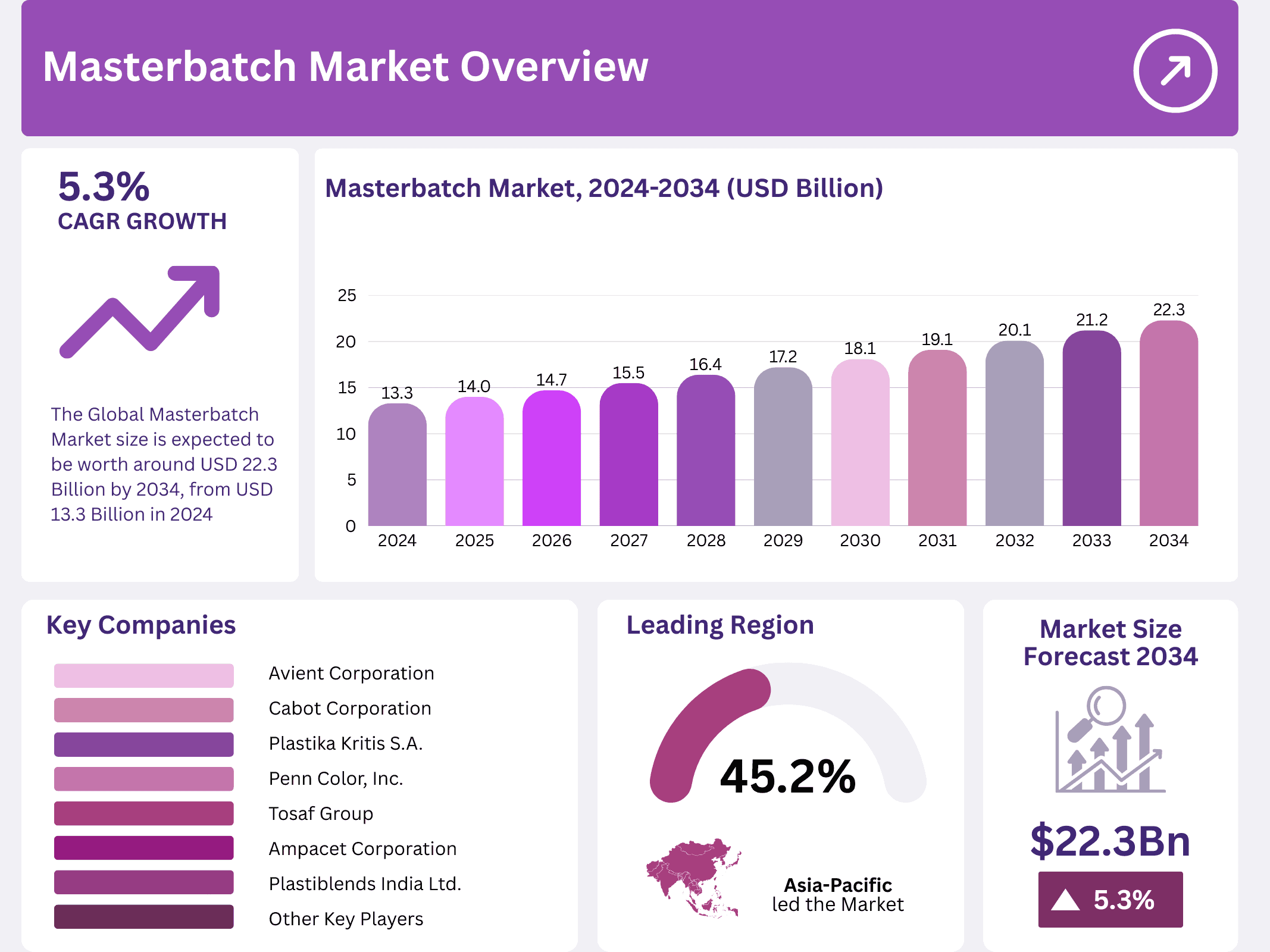

The global masterbatch market demonstrates remarkable growth potential, projected to reach USD 22.3 billion by 2034, expanding from USD 13.3 billion in 2024. This trajectory reflects a compound annual growth rate of 5.3% throughout the forecast period. Consequently, masterbatches continue to reshape plastic manufacturing across multiple industries worldwide.

These specialized mixtures serve as concentrated solutions that impart colors, properties, and functionalities to plastics during production processes. Moreover, they enable manufacturers to achieve precise coloration without compromising the inherent characteristics of plastic materials. Industries ranging from automotive to packaging increasingly rely on these innovative solutions for enhanced product quality.

Significantly, the market encompasses three primary categories: color masterbatches, additive masterbatches, and filler masterbatches. Each category addresses specific manufacturing requirements and performance objectives. Furthermore, additive concentrations typically range from 15% to 80%, with most formulations containing between 40% and 65% additives for optimal results.

Importantly, sustainability emerges as a defining trend reshaping the masterbatch landscape. Environmental regulations and consumer preferences drive the transition from petroleum-based materials toward biodegradable alternatives. Subsequently, the European Union’s ambitious target to reduce plastic packaging volumes by 20% by 2040 accelerates demand for eco-friendly solutions.

Additionally, the Asia-Pacific region commands a dominant position, accounting for 45.2% of the global market share. China and India spearhead this regional leadership through robust manufacturing capabilities and rapid industrial expansion. Therefore, the interplay between sustainability initiatives, regulatory frameworks, and regional dynamics continues shaping market evolution.

Ultimately, the masterbatch market stands at the intersection of innovation and environmental responsibility. Manufacturers increasingly seek solutions that deliver both performance excellence and ecological benefits. This convergence creates unprecedented opportunities for industry stakeholders committed to advancing sustainable manufacturing practices globally.

Key Takeaways

- The Global Masterbatch Market is projected to grow from USD 13.3 billion in 2024 to USD 22.3 billion by 2034, at a CAGR of 5.3%

- Black Masterbatch dominates with a 28.4% market share, utilized widely in sectors like automotive and electronics

- Polypropylene is the most used polymer in the Masterbatch Market, accounting for 27.6% of the market due to its versatile properties

- Packaging is the largest end-use sector in the Masterbatch Market, holding a 27.1% share, essential for its role in enhancing product presentation and durability

- Asia Pacific leads the Masterbatch Market with a 45.2% share, driven by strong manufacturing outputs from China and India

Market Segmentation Overview

Black masterbatch establishes market leadership with a commanding 28.4% share, attributed to its exceptional UV stabilization properties and thermal stability. Automotive components, consumer electronics, and agricultural films extensively utilize this segment. Meanwhile, white masterbatch serves critical applications demanding high brightness, particularly in medical and food packaging sectors.

Color masterbatches address aesthetic requirements across consumer goods and packaging industries, enabling brand-specific customization. Additive masterbatches enhance plastic properties through antimicrobial, anti-static, and flame-retardant characteristics tailored to industry specifications. Concurrently, filler masterbatches incorporate materials like calcium carbonate, improving physical properties while reducing production costs significantly.

Polypropylene emerges as the leading polymer, capturing 27.6% market share through its chemical resistance, flexibility, and durability advantages. This polymer dominates packaging, automotive components, consumer goods, and textile applications. Furthermore, its versatility enables manufacturers to meet diverse aesthetic and functional requirements across multiple end-use sectors.

Polyethylene masterbatches serve packaging and agricultural applications, valued for their toughness and optical clarity characteristics. PVC masterbatches find extensive use in construction for piping and cable insulation applications. Additionally, PET masterbatches prove essential in beverage packaging, while biodegradable plastics gain traction amid growing environmental consciousness worldwide.

Packaging dominates end-use applications with a 27.1% market share, driven by demand for durable, visually appealing solutions. Masterbatches enable precise color matching, UV protection, and barrier properties essential for food, beverage, and healthcare packaging. Building and construction sectors utilize masterbatches for pipes and fittings requiring UV resistance and flame retardancy properties.

Drivers

The packaging industry’s expansion significantly propels masterbatch market growth, with the sector projected to exceed USD 1 trillion by 2025. Consumer preferences for convenience, product safety, and aesthetic appeal drive this demand. Masterbatches provide essential coloration and functional properties to packaging materials for foods, beverages, and consumer goods. This synergy between packaging innovations and masterbatch development creates dynamic market opportunities aligned with evolving consumer behaviors and technological advancements.

Environmental regulations catalyze eco-friendly masterbatch development, particularly Europe’s REACH regulations restricting hazardous chemicals. Innovations like Cabot Corporation’s REPLASBLAK™, featuring circular black masterbatches with up to 100% attributed recycled content, exemplify industry responses. These developments align with global sustainability goals while opening new market opportunities. The automotive industry’s growth further fuels demand, with approximately 85 million motor vehicles produced worldwide in 2022, necessitating advanced materials meeting stringent durability, performance, and aesthetic standards.

Use Cases

Automotive applications demonstrate masterbatch versatility in coloring and enhancing plastic components throughout vehicle interiors and exteriors. Manufacturers utilize masterbatches to achieve consistent color matching across dashboard components, trim panels, and exterior body parts. The materials provide UV stabilization protecting against prolonged sunlight exposure while maintaining aesthetic appeal. Additionally, masterbatches enable automakers to reduce vehicle weight by 10% by 2025, supporting fuel efficiency objectives through lightweight plastic component development.

Healthcare and medical device sectors increasingly rely on specialty masterbatches incorporating antimicrobial agents and antistatic properties. Medical packaging requires masterbatches delivering high brightness, opacity, and barrier protection ensuring product safety and sterility. Pharmaceutical processes utilize non-migratory antistatic masterbatches providing immediate and permanent antistatic properties to polyolefin films. These specialized solutions address stringent regulatory requirements while enhancing functionality and safety across diverse medical applications globally.

Major Challenges

Raw material price volatility presents significant challenges for masterbatch manufacturers, particularly regarding polymer resins and carrier materials. Supply-demand imbalances, geopolitical tensions, and supply chain disruptions drive these fluctuations. Polyethylene prices witnessed nearly 60% increases in 2021, underscoring market vulnerability to external shocks. This unpredictability impacts cost structures and pricing strategies, creating operational uncertainty that complicates long-term planning and restrains market growth through increased financial risks.

Competition from substitutes, particularly liquid colorants and additives, threatens traditional masterbatch market share and expansion potential. Liquid colorants account for 26% of the global colorants market, offering advantages including ease of use and uniform color distribution. These alternatives prove particularly appealing in packaging applications where consistency proves critical. Consequently, masterbatch producers must innovate and differentiate offerings to maintain competitiveness and relevance amid evolving market preferences and technological advancements.

Business Opportunities

Light-weighting trends across industries, particularly automotive, present substantial growth opportunities for masterbatch manufacturers. Plastic producers increasingly seek masterbatches enabling lighter end products supporting portability and fuel efficiency objectives. Automakers’ targets to reduce vehicle weight by 10% by 2025 underscore this opportunity’s urgency and potential. Developing masterbatches contributing to lighter yet durable plastic components aligns with automotive industry goals while reflecting broader sustainability and efficiency trends.

Specialty additives expansion offers lucrative opportunities across healthcare, construction, and automotive sectors demanding customized solutions. Industries require masterbatches with specialized additives including antimicrobial agents, oxygen scavengers, and flame retardants meeting specific regulatory standards. Smart color technologies incorporating thermochromics, photochromic pigments, and metallic effects enable interactive, aesthetically enhanced products. These innovations address consumer demands for dynamic, engaging products across packaging, toys, consumer electronics, and fashion sectors, driving market growth through value-added functionality.

Regional Analysis

Asia Pacific dominates with 45.2% market share valued at USD 5.9 billion, driven by robust manufacturing sectors in China and India. The region’s extensive plastic production and consumption, fueled by large populations and rapid industrialization, underpin this leadership position. Cost-effective manufacturing processes and supportive regulatory environments encourage innovative and sustainable material adoption. Growing emphasis on product aesthetics, functionality, and environmental sustainability shapes regional dynamics, establishing Asia Pacific as a hub for traditional and advanced masterbatch solutions.

North America demonstrates high demand for specialty and sustainable masterbatches, with advanced manufacturing sectors and stringent environmental regulations fostering innovation. Europe’s market reflects regulatory compliance focus and strong sustainability commitment, increasing demand for eco-friendly masterbatches and material science innovations. The Middle East and Africa show growth potential through infrastructure development and economic diversification. Latin America benefits from emerging manufacturing sectors and growing consumer goods demand, presenting opportunities for masterbatch applications across diverse industries globally.

Recent Developments

- In October 2023, Ampacet introduced ProVital+ Permstat, a non-migratory antistatic masterbatch providing immediate and permanent antistatic properties to polyolefin films used in pharmaceutical processes

- In July 2023, Delta Tecnic developed a solution simplifying thermoplastic polyurethane cable coloring, allowing manufacturers to use single color masterbatches for all TPU cables, reducing references and standardizing final colors

- In June 2023, Colourmaster NIP achieved ISO 14001 accreditation, recognizing their commitment to continuous environmental improvements including waste reduction, energy efficiency, and carbon footprint reduction

Conclusion

The masterbatch market stands poised for substantial growth through 2034, driven by sustainability imperatives, technological innovations, and expanding end-use applications. Manufacturers embracing eco-friendly solutions and specialty additives will capture emerging opportunities across automotive, packaging, and healthcare sectors. Regional dynamics, particularly Asia Pacific’s dominance, combined with evolving regulatory landscapes, will continue shaping competitive strategies and investment priorities throughout the forecast period.