Quick Navigation

Introduction

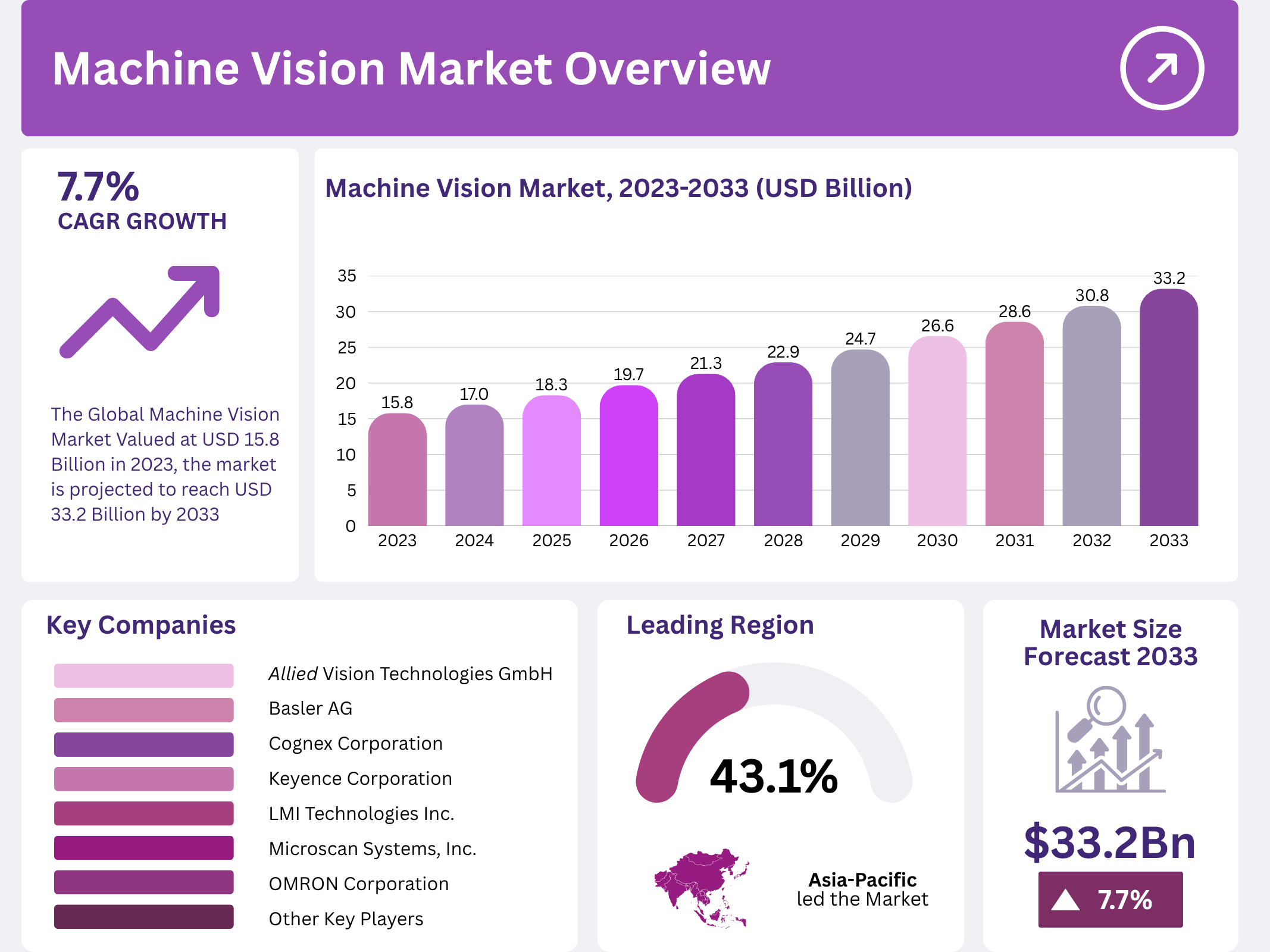

The Global Machine Vision Market is witnessing rapid expansion, driven by the increasing integration of automation and AI technologies. Valued at USD 15.8 Billion in 2023, the market is projected to reach USD 33.2 Billion by 2033, growing at a CAGR of 7.7% during the forecast period.

As industries transition toward smart manufacturing, machine vision systems are becoming critical in enhancing precision, productivity, and quality control. This technological evolution is transforming industrial operations by enabling real-time inspection, process control, and intelligent decision-making capabilities across sectors like automotive and electronics.

Furthermore, advancements in imaging sensors, deep learning, and AI are propelling the adoption of machine vision systems globally. With Asia Pacific leading the market share, the technology is poised to redefine industrial efficiency and automation worldwide.

Key Takeaways

- The Global Machine Vision Market size is expected to reach USD 33.2 Billion by 2033 from USD 15.8 Billion in 2023, growing at a CAGR of 7.7%.

- In 2023, Hardware held a dominant market position in the “By Offering” segment with a 63.1% share.

- PC Based systems led the “By Product” segment with a 55.2% share in 2023.

- Quality Assurance and Inspection dominated the “By Application” segment with a 52.3% share in 2023.

- Automotive held a 20.5% market share in the “By End-use” segment in 2023.

- Asia Pacific accounted for a 43.1% market share in 2023, valued at USD 6.8 Billion.

Market Segmentation Overview

By Offering, the Hardware segment maintained a leading 63.1% market share in 2023. This dominance is driven by the demand for high-speed, high-resolution cameras, processors, and LED lighting systems that support precision imaging and real-time analysis across manufacturing industries.

By Product, PC Based systems accounted for a 55.2% market share, attributed to their flexibility and superior processing capabilities. These systems support multiple cameras and handle complex imaging tasks, making them ideal for industries requiring detailed inspections and data-driven decision-making.

By Application, Quality Assurance and Inspection led with a 52.3% share, underscoring the critical role of automated defect detection and compliance verification in manufacturing. These systems reduce human error and enhance productivity while ensuring consistent product standards.

By End-use, the Automotive industry emerged as the largest segment with a 20.5% share. Machine vision plays a pivotal role in assembly verification, defect detection, and robotic guidance, enabling enhanced safety, efficiency, and product precision in vehicle production.

Drivers

Rising Industrial Automation: The surge in automation across industries such as automotive, pharmaceuticals, and electronics is a primary growth driver. Machine vision systems enhance accuracy, speed, and consistency, leading to improved product quality and reduced operational costs in automated manufacturing environments.

Technological Advancements in AI: Integration of AI and machine learning algorithms is transforming image processing capabilities. These technologies enable systems to detect anomalies, analyze data in real-time, and make intelligent decisions, pushing machine vision into new frontiers of industrial innovation.

Use Cases

Quality Control in Manufacturing: Machine vision is revolutionizing quality assurance by detecting defects and inconsistencies invisible to the human eye. In electronics and automotive production, these systems ensure flawless products, reducing waste and enhancing brand reliability.

Robotics and Automation: In industrial robotics, machine vision systems guide robotic arms for precise assembly and positioning. This use case enhances efficiency, minimizes errors, and supports fully automated production lines across multiple industries.

Major Challenges

High Implementation Costs: The installation and maintenance of machine vision systems require significant financial investment. Small and medium-sized enterprises often find it challenging to adopt these technologies due to budget constraints and high initial setup costs.

Integration Complexity: Integrating machine vision systems with existing infrastructure can be technically demanding. It requires specialized expertise and may lead to operational disruptions during implementation, slowing down adoption in some industries.

Business Opportunities

AI and IoT Integration: Combining machine vision with AI and IoT technologies offers immense opportunities for developing intelligent, adaptive systems. These integrations enhance predictive maintenance, process optimization, and real-time analytics across industrial sectors.

Expansion into Emerging Economies: Increasing industrialization and automation in emerging markets like India, Brazil, and Southeast Asia create vast opportunities. Growing manufacturing activities and government initiatives toward smart factories are fueling machine vision adoption.

Regional Analysis

Asia Pacific: Dominating with a 43.1% market share and revenue of USD 6.8 Billion in 2023, Asia Pacific leads due to rapid industrialization and the presence of major manufacturing hubs. Countries like China, Japan, and South Korea drive growth through investments in automation and high-tech production facilities.

North America and Europe: North America remains a key player with advanced adoption of AI-driven automation, especially in automotive and aerospace sectors. Europe follows closely, with strong regulatory standards for product quality and precision engineering boosting machine vision demand in Germany, Italy, and France.

Recent Developments

- In April 2023, Keyence Corporation launched a new AI-based image processing system aimed at enhancing automation and precision in industrial applications.

- In March 2023, Microscan Systems, Inc. expanded its product line with high-resolution cameras designed for detailed inspections in manufacturing environments.

- The U.S. National Science Foundation announced a USD 140 million investment in seven new National Artificial Intelligence Research Institutes to advance AI and machine vision technologies.

- Basler AG increased R&D investments to integrate deep learning into camera technologies, improving image analysis capabilities and performance.

- Allied Vision Technologies GmbH introduced advanced infrared and hyperspectral imaging solutions, enabling enhanced inspection and monitoring in harsh industrial conditions.

Conclusion

The Global Machine Vision Market is entering a transformative era, driven by technological advancements and the increasing shift toward industrial automation. With a projected value of USD 33.2 Billion by 2033, the market will continue to thrive across sectors such as automotive, electronics, and pharmaceuticals.

Despite challenges like high implementation costs and integration complexity, the fusion of AI, IoT, and advanced imaging technologies offers unprecedented opportunities. As industries pursue precision and efficiency, machine vision systems will remain at the forefront of global manufacturing innovation.