Quick Navigation

Introduction

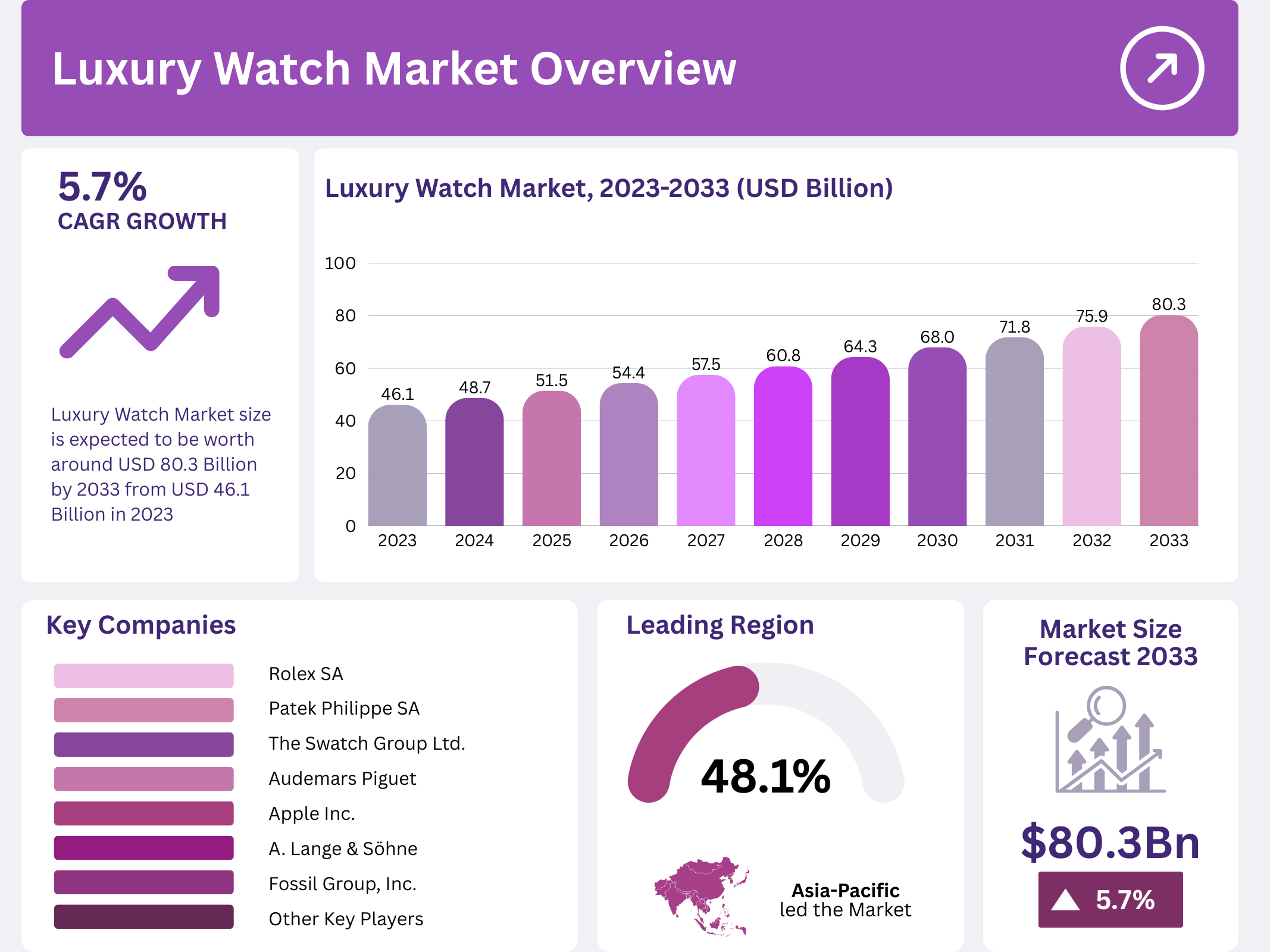

The global luxury watch market has seen remarkable growth in recent years, driven by increasing consumer affluence, a strong demand for exclusivity, and a cultural association with status and success. Valued at USD 46.1 billion in 2023, the market is expected to reach USD 80.3 billion by 2033, growing at a CAGR of 5.7%. Luxury watches are considered symbols of prestige and often reflect superior craftsmanship, attracting affluent buyers seeking both fashion statements and investment opportunities.

The market is further fueled by the growing demand from affluent individuals and an increasing middle-class population in emerging economies. With technological advancements and a strong online presence, the market continues to evolve. The digitalization of sales channels and the rise of pre-owned luxury watches provide ample opportunities for market players to diversify their offerings and cater to a broader consumer base.

Key Takeaways

- The global luxury watch market is projected to grow from USD 46.1 billion in 2023 to USD 80.3 billion by 2033, reflecting a robust CAGR of 5.7%.

- Mechanical segment dominates with 71.9% share in 2023.

- Offline distribution channel leads with 69.5% share in 2023.

- Asia-Pacific region holds the largest market share of 48.1% in 2023, driven by affluent consumer bases in China, Japan, and India.

- India experienced a 20% increase in luxury watch demand, highlighting significant growth opportunities.

- Rolex’s strong performance, achieving CHF 10.1 billion ($11.5 billion) in 2023, with over 1.24 million watches produced.

Market Segmentation Overview

By Product Type

The luxury watch market can be segmented into Mechanical and Electronic categories. The Mechanical segment dominates with a 71.9% market share in 2023, driven by consumer preference for traditional craftsmanship, intricate designs, and heritage. Electronic watches, including smartwatches, are growing at a slower pace but have gained traction due to tech-savvy consumers. Brands like Apple, with its Hermès editions, have propelled the rise of hybrid models, combining traditional aesthetics with modern features.

By Distribution Channel

The market is primarily driven by the Offline distribution channel, which holds a 69.5% share in 2023. Consumers continue to favor in-person shopping experiences, valuing the opportunity to physically assess luxury timepieces and receive personalized service. In contrast, the Online segment, though smaller in share, is growing rapidly, driven by the increasing adoption of e-commerce platforms and virtual boutiques. Brands are investing in digital strategies to enhance accessibility and provide a seamless online shopping experience.

Drivers

Rising Consumer Affluence and Status Symbolism

As disposable incomes grow, especially among high-net-worth individuals (HNWIs) in developed markets and the emerging middle class in countries like China and India, luxury watches are increasingly seen as status symbols. These timepieces are more than just functional devices; they represent success, craftsmanship, and exclusivity. The global luxury watch market benefits from this rising affluence, with luxury watches becoming essential items for those wishing to display wealth and taste.

Demand for Exclusivity and Heritage

The desire for exclusivity continues to drive the market. Luxury watch brands emphasize limited editions, unique designs, and heritage collections that appeal to collectors and investors. Watches such as Rolex’s Submariner and Patek Philippe’s perpetual calendars are not just accessories but collectibles that appreciate over time. This trend of valuing heritage, craftsmanship, and exclusivity underpins the sustained demand for luxury watches, especially in regions with a growing affluent consumer base.

Use Cases

Luxury Watches as Investment Assets

Luxury watches have increasingly become collectible assets. Many buyers view high-end timepieces as investment pieces, with certain models appreciating over time. The pre-owned market for luxury watches is growing, driven by collectors seeking rare and limited-edition pieces. The ability to resell these watches at a higher price makes them an attractive investment, especially in markets like Switzerland, where Swiss-made watches command premium prices.

Rolex as a Symbol of Prestige

Rolex, the market leader, has positioned itself as a status symbol. The brand’s impeccable craftsmanship and enduring popularity make it the most sought-after luxury watch in the world. With over 1.24 million watches produced in 2023, Rolex continues to maintain a strong hold on the market, appealing to both collectors and individuals seeking a prestigious watch. Rolex’s continued success is a reflection of the broader trend in which luxury watches are not just timepieces but symbols of social status.

Major Challenges

Economic Uncertainty and Consumer Confidence

The luxury watch market is highly sensitive to economic shifts. Global economic uncertainties, including recessions and geopolitical tensions, can dampen consumer spending, especially for discretionary items like luxury watches. During economic downturns, buyers may delay or cancel high-value purchases, causing fluctuations in sales. Furthermore, currency fluctuations impact the pricing and affordability of luxury watches in markets with unstable currencies, creating challenges for both buyers and manufacturers.

Competition from Digital and Smartwatches

While mechanical watches continue to dominate the luxury segment, digital and smartwatches are becoming more competitive. Brands like Apple have introduced premium smartwatch models, such as their Hermès collaborations, which appeal to tech-savvy luxury buyers. As the smartwatch market grows, traditional luxury watchmakers must balance the integration of technology with their focus on craftsmanship, creating potential challenges for established brands looking to maintain their traditional appeal.

Business Opportunities

Expansion in Emerging Markets

Emerging markets such as China, India, and Southeast Asia represent significant growth opportunities for luxury watch brands. These regions are witnessing substantial economic growth, leading to an expanding affluent class. In India, for instance, demand for luxury watches has increased by 20% in recent years. Luxury brands are targeting these markets by opening new retail stores, launching digital campaigns, and partnering with local distributors. This expansion is essential for brands aiming to secure long-term growth in these fast-developing regions.

Growing Pre-owned Luxury Watch Market

The pre-owned luxury watch market is another area of opportunity. Sustainability trends and consumer demand for rare timepieces have fueled the growth of this segment. Consumers are increasingly opting for pre-owned watches due to their uniqueness and affordability. Brands are capitalizing on this trend by offering certification programs for pre-owned timepieces, ensuring authenticity and preserving value. The pre-owned market allows luxury brands to reach a broader customer base, including younger buyers interested in premium watches at lower price points.

Regional Analysis

Asia-Pacific

The Asia-Pacific region dominates the luxury watch market, holding a 48.1% share in 2023. Countries like China, Japan, and India have large consumer bases with increasing disposable incomes. The growing desire for luxury goods, coupled with the region’s rich cultural traditions surrounding gifting and status, drives the demand for luxury timepieces. Furthermore, Hong Kong and Singapore serve as crucial trading hubs, enhancing the accessibility and availability of luxury watches throughout the region.

North America

North America, particularly the United States, is a significant player in the luxury watch market. The U.S. is home to a large base of affluent consumers, many of whom view luxury watches as status symbols and investment assets. The market benefits from a well-established retail network, with brands like Rolex, Patek Philippe, and Audemars Piguet enjoying strong brand recognition. Moreover, the increasing trend of watches as collectibles and investments, alongside online retail growth, supports sustained market growth in North America.

Recent Developments

- Rolex exceeded CHF 10.1 billion in sales in 2023, solidifying its leadership in the luxury watch market.

- Chanel entered the luxury watch market in 2024 with a 25% stake in MB&F, signaling a significant move for both brands.

- Cristiano Ronaldo launched his luxury watch collection, “Flight of CR7” and “Heart of CR7,” priced at £45,000, in 2024.

- LVMH entered a 10-year sponsorship deal with Formula 1 in 2024, enhancing the visibility of its watch brands, including TAG Heuer.

Conclusion

The global luxury watch market is poised for continued growth, with robust demand from affluent consumers, increasing interest in investment-grade timepieces, and expansion in emerging markets. Despite challenges such as economic volatility and the rise of smartwatches, luxury watch brands have significant opportunities to thrive by expanding into new regions, tapping into the pre-owned market, and incorporating technology into traditional timepieces. With leading brands like Rolex, Patek Philippe, and Audemars Piguet maintaining strong market positions, the luxury watch market remains an essential segment in the broader luxury goods industry.