Quick Navigation

Introduction

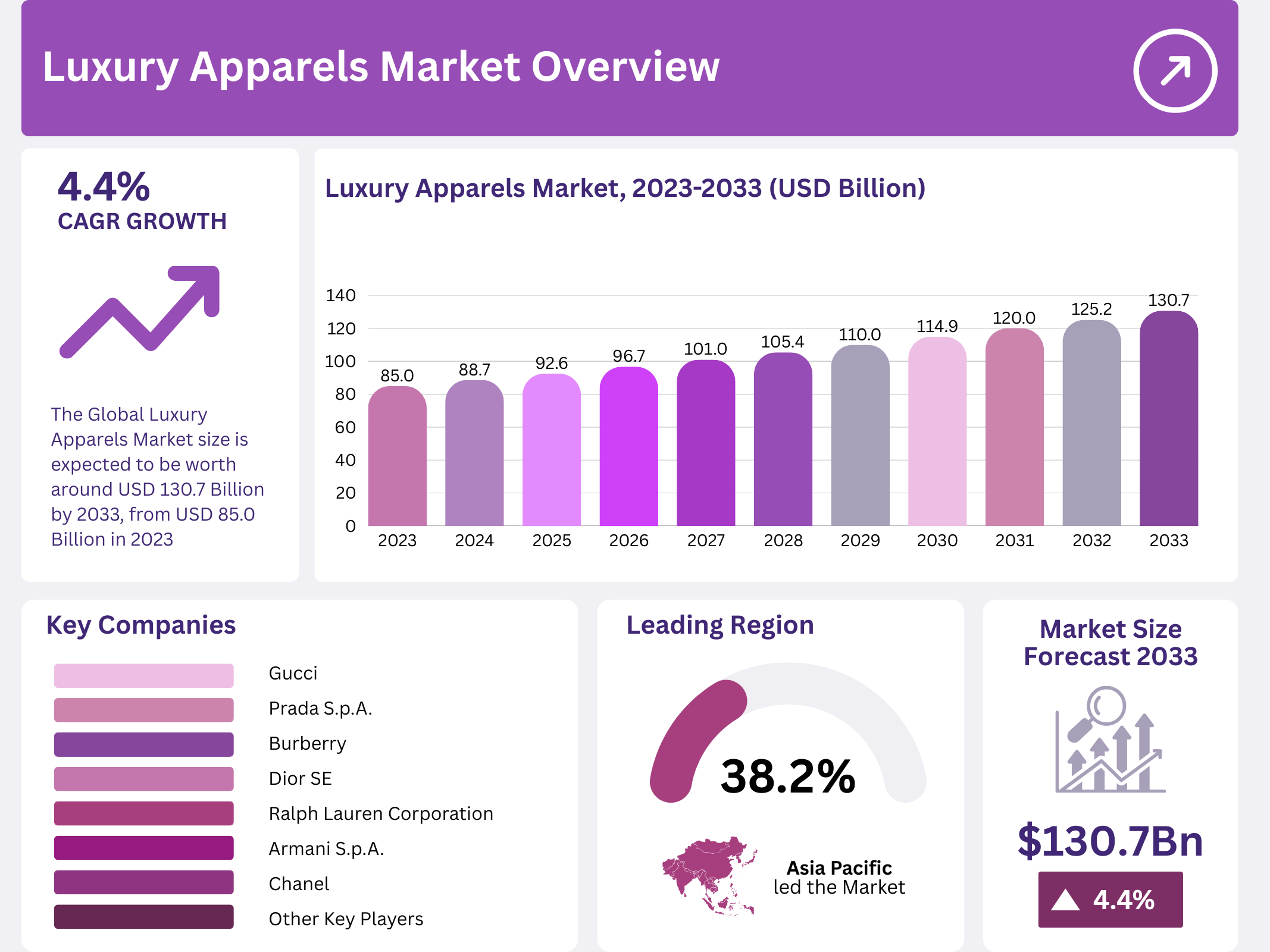

The global luxury apparels market demonstrates remarkable resilience and growth potential, projected to reach USD 130.7 billion by 2033 from USD 85.0 billion in 2023. This expansion reflects a steady compound annual growth rate of 4.4% throughout the forecast period. Consequently, luxury fashion brands are experiencing unprecedented opportunities driven by evolving consumer preferences and digital transformation.

Premium fashion houses including Gucci, Chanel, and Louis Vuitton continue dominating the landscape through superior craftsmanship and exclusive designs. Moreover, these brands successfully combine heritage appeal with contemporary innovation, catering to discerning clientele seeking status and sophistication. The market encompasses haute couture, ready-to-wear collections, and premium athleisure segments that attract affluent consumers worldwide.

Geographic concentration remains strong across North America, Europe, and the rapidly expanding Asia-Pacific region. Furthermore, rising wealth among high-net-worth individuals in emerging economies provides substantial momentum for market expansion. Urbanization and the growing affluent middle class in China, India, and Southeast Asia create new avenues for luxury brand penetration.

Digital transformation fundamentally reshapes how consumers engage with luxury apparels through e-commerce platforms and social media channels. Additionally, personalization and sustainability have emerged as defining trends, with brands integrating eco-conscious materials to appeal to environmentally aware shoppers. These developments signal a paradigm shift where traditional luxury values meet modern consumer expectations for transparency and ethical production.

The competitive landscape features established heritage brands alongside innovative newcomers competing for market share. Similarly, consumer demographics are evolving, with millennials and Gen Z prioritizing unique, high-quality products that reflect personal values. This dynamic environment creates both challenges and opportunities for luxury apparels brands navigating seasonal trends, cultural factors, and shifting consumer expectations.

Market participants increasingly recognize that luxury extends beyond physical garments to encompass experiences of exclusivity and prestige. Therefore, brands invest heavily in creating immersive shopping environments, personalized services, and authentic storytelling. This holistic approach strengthens brand loyalty while addressing the sophisticated demands of today’s luxury consumers seeking meaningful connections with their fashion choices.

Key Takeaways

- The global luxury apparels market is projected to grow from USD 85.0 billion in 2023 to USD 130.7 billion by 2033, driven by a steady CAGR of 4.4%.

- Topwear dominates with a 41% market share, reflecting strong consumer demand for visible, brand-centric pieces that convey status.

- The women’s segment leads with 63% market share, emphasizing the high spending power and influence of female consumers in the luxury apparels sector.

- Offline stores retain a dominant 67% market share, underscoring the importance of experiential, in-person shopping for luxury apparels.

- Asia-Pacific holds the largest regional share at 38.2%, driven by rapid wealth growth and brand-conscious consumers in key markets like China and India.

Market Segmentation Overview

Topwear commands the largest product segment with 41% market share, driven by consumer preference for visible luxury items. Consequently, tailored shirts, designer blouses, and premium tops remain essential wardrobe staples that effectively communicate social status. These pieces benefit from global fashion trends emphasizing quality, craftsmanship, and brand prestige in professional and social settings.

Bottomwear represents a substantial market portion, blending comfort with luxury through designer trousers, skirts, and premium denim. Additionally, this category appeals to consumers seeking versatile pieces offering both style and functionality across various occasions. The segment leverages the growing demand for sophisticated casual wear that maintains luxury standards while providing everyday wearability.

Women dominate end-user segmentation with 63% market share, reflecting sustained demand for high-end fashion among female consumers. Furthermore, rising disposable income among women across key markets strengthens their purchasing power and brand influence. Social media and digital platforms amplify brand reach, catering to well-informed female audiences prioritizing quality, exclusivity, and heritage.

Men’s luxury apparels demonstrates robust growth beyond traditional formal wear, expanding into casual and athleisure categories. Moreover, evolving lifestyle preferences and increased brand consciousness among urban male consumers drive segment expansion. Luxury brands increasingly target male demographics through diversified product lines and strategic marketing campaigns, supporting the segment’s upward trajectory.

Offline stores maintain dominance with 67% market share, fulfilling consumers’ desire for immersive, tactile shopping experiences. Subsequently, specialty stores and brand-exclusive outlets provide curated selections and personalized service highly valued by luxury shoppers. These physical retail environments allow customers to assess quality and authenticity firsthand, reinforcing brand trust and purchase confidence.

Online stores expand rapidly as digital channels become integral to luxury shopping experiences, particularly among younger demographics. Therefore, luxury brands invest in sophisticated digital interfaces and virtual shopping capabilities to replicate in-store appeal. This digital evolution enables convenient access to exclusive collections while maintaining the prestige associated with luxury purchasing.

Key Market Drivers

Expanding wealth among high-net-worth individuals and the rising affluent middle class fuel substantial market growth. China and India witness middle-class expansion at 6-8% annually, creating new consumer segments aspiring to luxury ownership. These affluent consumers prioritize premium fashion as symbols of status and success, driving brands to expand offerings in fast-growing markets.

Digital transformation accelerates market accessibility through e-commerce platforms accounting for nearly 25% of total luxury sales. Virtual try-ons, AI-driven personalization, and interactive customer service enhance online shopping experiences, engaging tech-savvy younger consumers. This digital shift breaks geographic barriers, connecting luxury brands directly with global audiences while strengthening customer loyalty through data-driven personalization.

Use Cases

Professional networking and corporate environments drive demand for luxury topwear that communicates competence and social standing. Executives and professionals invest in designer shirts, blazers, and premium business attire to project authority and credibility. These garments serve as visual indicators of success, facilitating relationship-building and career advancement in competitive business landscapes.

Social occasions and lifestyle expression motivate luxury apparels purchases among millennials and Gen Z consumers seeking authentic brand connections. High-quality fashion pieces enable self-expression and identity formation while signaling alignment with personal values including sustainability. These consumers leverage luxury fashion to curate distinctive personal brands across both physical and digital social environments.

Major Challenges

Counterfeit goods valued at approximately USD 500 billion globally undermine brand equity and revenue for genuine luxury apparels. Online platforms and social media increase counterfeit accessibility, creating consumer confusion and diluting brand exclusivity. This proliferation damages trust, diminishes perceived value, and tarnishes brand reputation when consumers encounter substandard experiences with fake products.

Sustainability expectations challenge traditional luxury production models as 7 million tons of textiles are discarded annually with only 12% recycled. Consumers increasingly demand transparency around sourcing and manufacturing processes, requiring significant operational adjustments. Luxury brands must balance heritage craftsmanship with eco-conscious materials and circular fashion principles while maintaining premium quality standards and profit margins.

Business Opportunities

Digital innovation through augmented reality, virtual try-ons, and AI personalization creates engagement channels reaching younger, tech-savvy audiences. These technologies enable immersive brand experiences while collecting valuable consumer data for tailored offerings. Luxury brands leveraging these capabilities can differentiate themselves, enhance customer satisfaction, and build long-term loyalty in increasingly competitive markets.

Expansion into untapped markets across Asia and the Middle East provides substantial growth avenues as affluent populations increase. Collaborative partnerships with artists, influencers, and the growing acceptance of resale and rental luxury fashion offer innovative business models. These opportunities align with evolving consumer preferences for access over ownership while maintaining brand prestige and exclusivity.

Regional Analysis

Asia-Pacific leads with 38.2% market share, generating USD 32.4 billion revenue in 2023 through burgeoning middle-class consumers. China, Japan, India, and South Korea drive regional growth with young, affluent demographics eager to engage with high-end fashion brands. Expanding luxury retail outlets and increasing brand consciousness accelerate market penetration across these economically dynamic territories.

Europe maintains its position as a luxury stronghold, home to prestigious fashion houses in France, Italy, and the United Kingdom. The region benefits from strong tourist influx and local consumers valuing heritage craftsmanship and bespoke tailoring. North America demonstrates steady demand through high per capita income and mature retail infrastructure, while emerging markets in Latin America and the Middle East show promising growth potential.

Recent Developments

- In 2024, Nordstrom Family proposes a USD 3.8 billion buyout to take the company private, offering USD 23 per share with financing from family members, Mexico’s El Puerto de Liverpool, and bank funding.

- In 2023, Tapestry, Inc. agrees to acquire Capri Holdings for USD 8.5 billion, offering Capri shareholders USD 57 per share in cash, uniting Coach, Kate Spade, Versace, and Jimmy Choo.

- In 2023, Shein acquires Missguided, a UK fast-fashion brand, expanding its global marketplace model to over 150 million customers.

- In 2024, The Row secures USD 1 billion investment from Chanel, L’Oréal, and prominent investors including Natalie Massenet for future growth.

- In 2024, Ruffini Partecipazioni Holding partners with LVMH, which purchases a 10% stake in Ruffini’s investment vehicle Double R.

- In 2024, Frasers Group reacquires part of Matches Fashion’s intellectual property following earlier receivership placement.

- In 2023, Kering completes acquisition of a 30% stake in Valentino following regulatory approval, strengthening its luxury portfolio.

Conclusion

The global luxury apparels market stands poised for sustained growth through 2033, driven by expanding affluent populations and digital transformation.

Key players including Gucci, Chanel, LVMH, and emerging brands navigate evolving consumer expectations balancing heritage craftsmanship with sustainability and innovation. Asia-Pacific’s dominance reflects shifting economic power, while established markets maintain significance through brand loyalty and sophisticated consumer bases.

Challenges including counterfeiting and sustainability demands require strategic responses, yet opportunities in digital engagement, personalization, and untapped markets offer substantial potential. Ultimately, luxury apparels brands that successfully integrate traditional excellence with modern values will capture the loyalty of discerning consumers seeking both prestige and purpose in their fashion investments.