Quick Navigation

Introduction

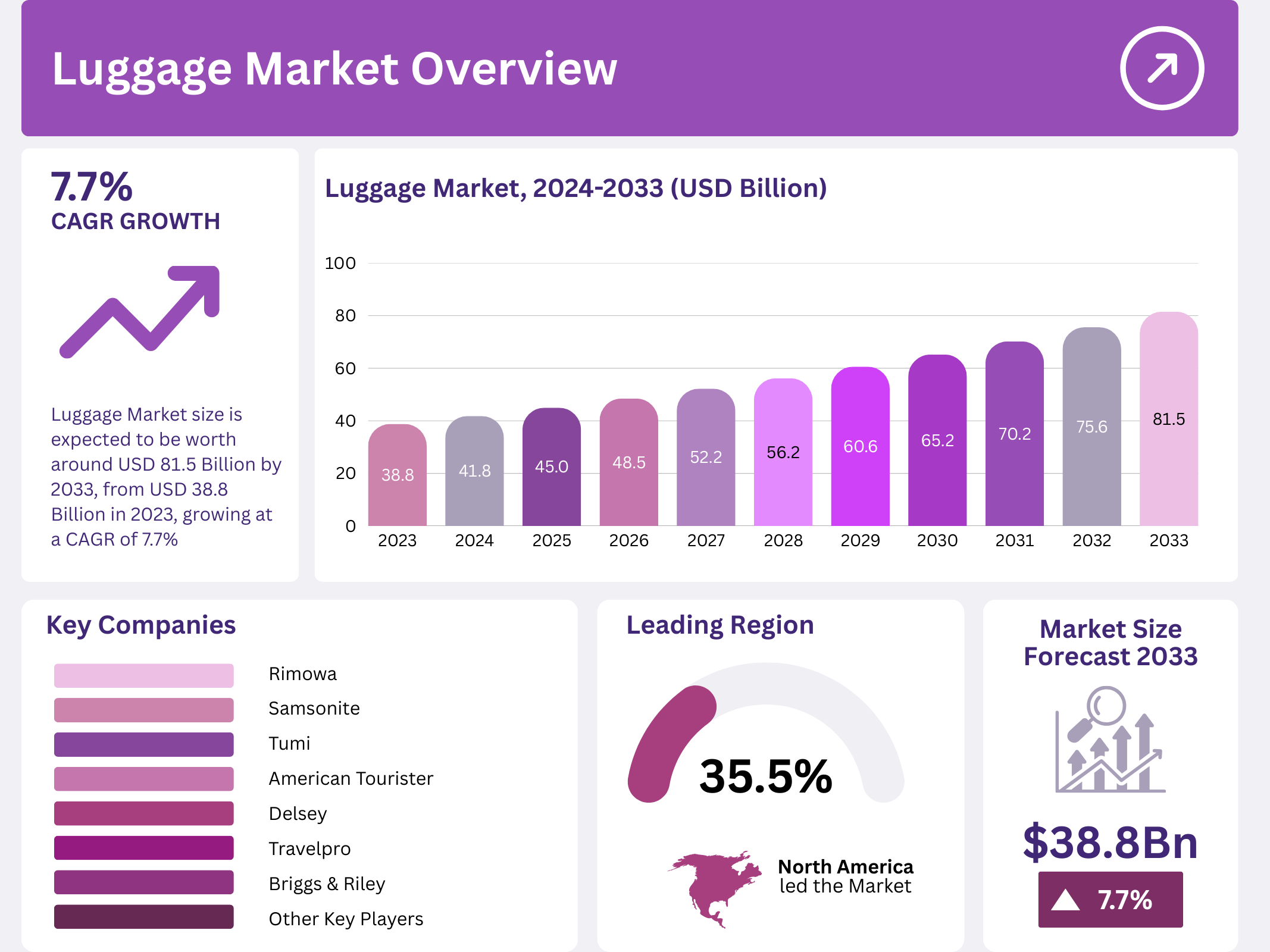

The global luggage market is experiencing significant growth, projected to reach a value of USD 81.5 billion by 2033, up from USD 38.8 billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2024 to 2033. This growth is fueled by increasing travel and tourism, rising disposable incomes, and a growing interest in lifestyle upgrades, with a particular focus on travel convenience and product quality.

Travel bags, business bags, and casual bags are the core categories within the market, each catering to different consumer needs. The surge in demand for travel-related products, from luggage sets to accessories, is also being driven by the rise of smart luggage features such as GPS tracking and USB charging ports, creating significant business opportunities for innovative manufacturers.

Key Takeaways

- The global luggage market is projected to grow from USD 38.8 billion in 2023 to USD 81.5 billion by 2033, at a CAGR of 7.7%.

- Travel Bags led the market in 2023, capturing 44.2% of the market share, driven by rising tourism and personal travel.

- Soft-sided luggage dominated with a 61.8% share in 2023, attributed to its lightweight and versatile design.

- Offline channels held a 66.2% share in 2023, fueled by consumers’ preference for in-store shopping experiences.

- North America led the luggage market in 2023 with a 35.5% share, supported by a strong tourism sector and high consumer spending.

Market Segmentation Overview

By Type: Travel bags were the leading segment in 2023, capturing more than 44.2% of the market share. The demand for versatile, durable luggage options that cater to both short and long-term travel needs helped this segment perform well. The resurgence of business travel post-pandemic also spurred growth in this category.

By Material: In 2023, soft-sided luggage held a dominant market share of 61.8%, thanks to its flexibility, lightweight nature, and cost-effectiveness. Soft-sided luggage offers versatility in packing and is particularly favored for domestic travel. The practicality of soft-sided designs continues to drive demand, with brands focusing on functionality and convenience.

By Distribution Channel: Offline channels led the luggage market in 2023, accounting for 66.2% of the market share. Consumer preferences for in-store shopping experiences, where they can evaluate product quality and design firsthand, remain strong. This channel continues to dominate, although online retail is growing steadily due to the convenience and variety it offers.

Drivers

Surge in Global Travel and Tourism: A major driver behind the luggage market’s growth is the significant resurgence of global travel and tourism. As economies recover and borders reopen post-pandemic, both leisure and business travel have increased. This has led to a surge in demand for various types of luggage, such as travel bags, business cases, and casual bags.

Rising Disposable Incomes and Lifestyle Upgrades: Growing disposable incomes, particularly in emerging markets, have led consumers to invest in higher-quality luggage options. As more people travel internationally, there is a higher demand for stylish, durable, and practical luggage. Additionally, the demand for premium products, including smart luggage, is increasing as consumers seek both functionality and modern design.

Use Cases

Smart Luggage Integration: The integration of smart technology into luggage is revolutionizing the travel experience. Luggage equipped with GPS tracking, built-in charging ports, and biometric locks is growing in demand, especially among tech-savvy travelers. The Internet of Things (IoT) enables users to track their bags via smartphones, enhancing security and convenience.

Eco-Friendly Travel Solutions: As sustainability becomes a significant global focus, eco-friendly luggage solutions are gaining traction. Consumers are seeking luggage made from recycled materials, and brands are responding by offering products that reduce environmental impact. This shift toward sustainability represents a growing use case for eco-conscious consumers.

Major Challenges

Proliferation of Counterfeit Products: The luggage market faces a significant challenge due to the widespread sale of counterfeit products. These imitation goods, sold at lower prices, undermine brand trust and contribute to financial losses for legitimate manufacturers. Addressing the counterfeiting issue is essential for maintaining market integrity.

Supply Chain Disruptions: Another challenge facing the luggage market is the disruption in global supply chains. The shortage of raw materials, coupled with manufacturing delays, has impacted the production of luggage items. These disruptions have led to inventory shortages, affecting the ability of manufacturers to meet growing demand.

Business Opportunities

Smart Luggage Development: The increasing demand for smart luggage presents significant business opportunities. Manufacturers that invest in developing luggage with smart features, such as GPS tracking, charging ports, and digital locking systems, can gain a competitive edge in the market. These products cater to the tech-savvy traveler, offering convenience and security.

Emerging Market Expansion: The growing middle class in emerging economies such as Asia Pacific and Latin America presents untapped market potential for luggage manufacturers. As urbanization increases and disposable incomes rise, there is a greater demand for travel-related products. Expanding into these regions offers significant growth prospects.

Regional Analysis

North America: North America held the largest market share in 2023, accounting for 35.5% of the global luggage market. The strong tourism sector, coupled with high consumer spending on premium and smart luggage, drives the region’s dominance. This region continues to be a leader, with significant demand for both luxury and durable luggage products.

Asia Pacific: The Asia Pacific region is experiencing the fastest growth in the luggage market, driven by rising disposable incomes and urbanization. Countries such as China, India, and Japan are seeing a growing middle class, leading to increased demand for travel bags, business cases, and casual bags. The region’s expanding tourism sector also contributes to market growth.

Recent Developments

- In 2024, Yatra Online, Inc., India’s largest corporate travel services provider, announced the acquisition of Globe All India Services Limited (INR 1280 million, ~USD 15.25 million).

- In 2023, VistaJet partnered with Italian luxury brand Valextra to launch an exclusive travel collection.

- In 2024, Samsonite continued its sustainability efforts with the “Luggage Trade-In Campaign,” offering discounts for trade-ins of old luggage.

- In October 2024, Vela Software Spain S.L. updated its privacy notice, enhancing data protection measures.

- In 2024, SITA expanded services by acquiring ASISTIM, a leader in airline flight operations.

Conclusion

The global luggage market is poised for strong growth over the next decade, driven by the resurgence in travel, rising disposable incomes, and an increasing preference for both functional and stylish travel products. With innovations such as smart luggage and eco-friendly solutions gaining momentum, the market is set to evolve further. Despite challenges such as counterfeit products and supply chain disruptions, there are abundant opportunities for manufacturers to capture growth in emerging markets and through the development of technologically advanced luggage solutions. The continued dominance of North America and the rapid growth in Asia Pacific offer a balanced regional perspective for future market trends.