Quick Navigation

Overview

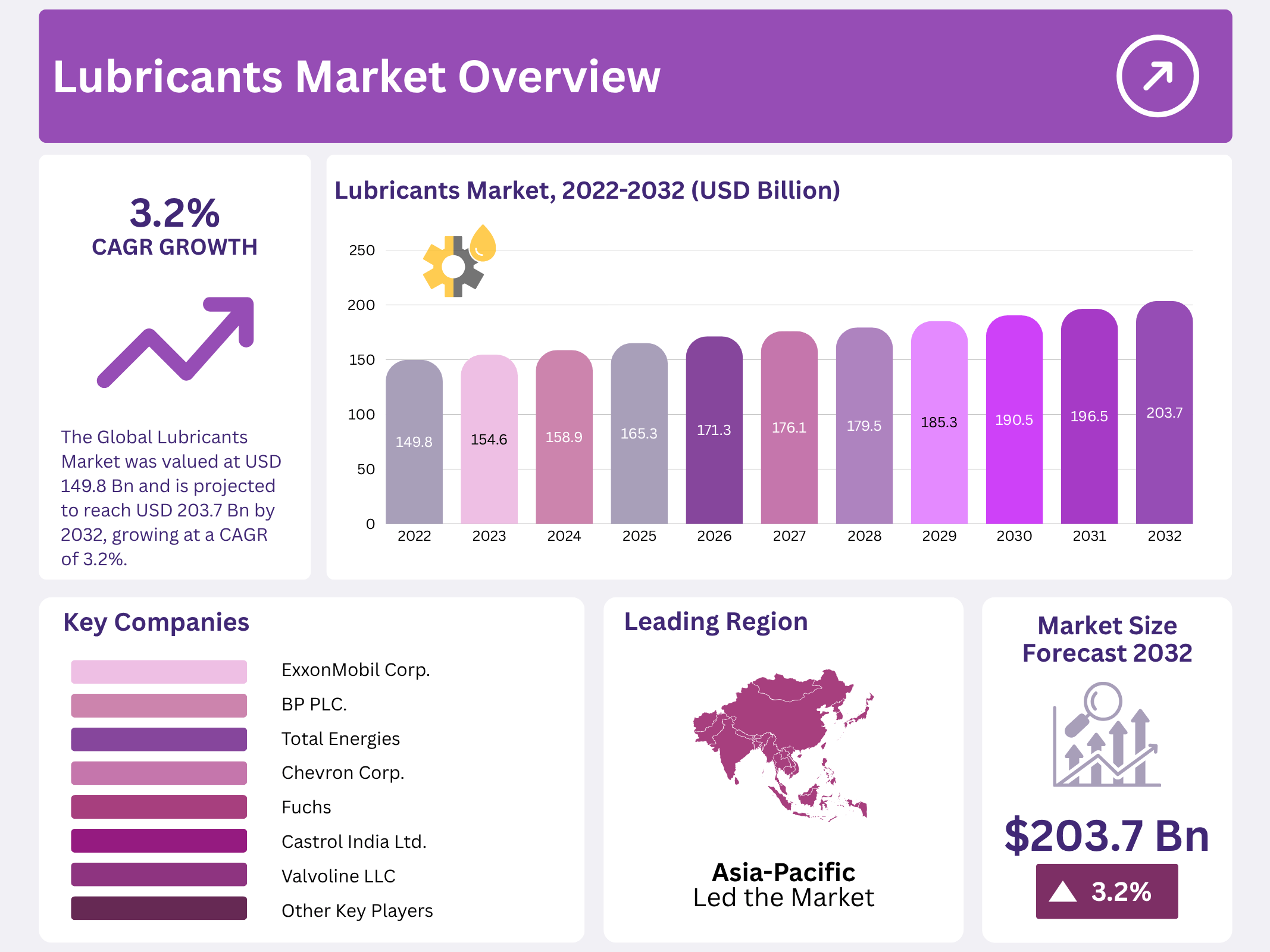

New York, NY – October 10, 2025 – The Global Lubricants Market was valued at USD 149.8 billion and is projected to reach USD 203.7 billion by 2032, growing at a CAGR of 3.2% between 2023 and 2032. This expanding market encompasses a diverse range of lubricants used across automotive, industrial, marine, and other applications, reflecting its essential role in modern mechanical systems and industrial processes.

Lubricants play a critical role in reducing friction and wear between moving surfaces, dissipating heat generated during mechanical motion, and preventing rust and corrosion on metal components. Their efficient use not only extends equipment lifespan but also ensures smooth operation and energy efficiency across a variety of machinery and vehicles.

The market’s growth is strongly influenced by the rising demand for high-performance lubricants capable of functioning under extreme conditions and delivering longer service life. Increasing technological advancements in machinery and engines are pushing manufacturers to develop synthetic and bio-based lubricants that meet stringent performance and environmental standards.

Moreover, the surging need for energy-efficient automobiles globally is propelling lubricant innovation, with manufacturers focusing on low-viscosity and eco-friendly formulations. As sustainability becomes central to industrial operations, lubricant producers are investing heavily in research, renewable base oils, and cleaner production methods to align with environmental goals and evolving regulatory frameworks.

Key Takeaways

- The Global Lubricants Market reached USD 149.8 billion, with projected revenue reaching approximately USD 203.7 billion by 2032 at an astounding compound annual growth rate of 3.2% during this timeframe.

- The market for lubricants encompasses synthetics, semi-synthetics, and minerals, with synthetics holding the highest market share at 39.3%.

- Automotive-grade lubricants are designed for specific engine components like engines, gearboxes, and transmissions; industrial-grade ones may also be applied in hydraulic systems, gears, bearings, and compressors.

- Markets for Lubricants have been divided into three broad end-use industries that use them: transportation, industry, and marine are the three biggest end-use markets that utilize Lubricant products.

- Asia Pacific is home to one of the fastest-growing oil and lubricants markets globally, featuring China and India as major lubricant producers and consumers, respectively.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 149.8 Billion |

| Forecast Revenue (2032) | USD 203.7 Billion |

| CAGR (2022-2032) | 3.2% |

| Segments Covered | By Type-Mineral, Semi-Synthetic, and Synthetic; By Product-Automotive Oils, Industrial Oils, Metalworking Fluids, Hydraulic Oils, Process Oils, Marine Oils, Greases, and Other Products; By End-Use Industry-Transportation, Industries, and Marine |

| Competitive Landscape | ExxonMobil Corp., Royal Dutch Shell Co., BP PLC., Total Energies, Chevron Corp., Fuchs, Castrol India Ltd., Amsoil Inc., JX Nippon Oil & Gas Exploration Corp., Philips 66 Company, Valvoline LLC, PetroChina Company Ltd., China Petrochemical Corp., Idemitsu Kosan Co. Ltd., Lukoil, Petrobras, Petronas Lubricant International, Quaker Chemical Corp., PetroFer Chemie, Buhmwoo Chemical Co. Ltd., Zeller Gmelin Gmbh & Co. KG, Blaser Swisslube Inc. |

By Type

The lubricants market is segmented into synthetic, semi-synthetic, and mineral lubricants. Synthetic lubricants lead the market, holding a 39.3% share and exhibiting the highest CAGR during the forecast period. These man-made lubricants excel in extreme conditions, withstanding high temperatures, pressures, and heavy loads due to their chemical composition.

Semi-synthetic lubricants, a blend of synthetic and mineral oils, offer a balance of affordability and enhanced performance. Mineral lubricants, derived from crude oil, are the most common and cost-effective but provide lower performance compared to synthetic and semi-synthetic options.

By Product

The lubricants market includes categories such as automotive oils, industrial oils, metalworking fluids, hydraulic oils, process oils, marine oils, greases, and others. Automotive lubricants dominate due to the vast transportation industry, where every vehicle requires oil for engines, gearboxes, and transmissions. Industrial lubricants serve diverse applications, including hydraulic systems, bearings, gears, and compressors. Marine lubricants are engineered to resist corrosion and wear, used in marine engines, transmissions, and equipment.

By End-Use Industry

The lubricants market is segmented into transportation, industrial, and marine industries. The transportation sector, encompassing commercial vehicles, automotive, and aviation, is the largest end-user. The industrial sector covers agriculture, mining, manufacturing, and construction. The marine industry includes commercial and recreational vessels, offshore drilling rigs, and ships.

Regional Analysis

The Asia Pacific region stands out as the fastest-growing market for lubricants globally. Countries such as China and India dominate both production and consumption, supported by rapid industrialization, urban expansion, and increasing vehicle ownership. The demand for lubricants in this region continues to rise due to the expanding automotive and industrial machinery sectors, which require high-quality lubricants to enhance equipment performance and longevity.

Ongoing infrastructure development and growth in manufacturing activities further boost lubricant usage across various industries. In North America, the lubricants market also holds a strong position, driven by well-established automotive, aerospace, and manufacturing industries.

The United States remains the largest producer and consumer of lubricants in this region, benefiting from advanced technology, industrial innovation, and a robust automotive base. The rising need for high-performance and synthetic lubricants, especially in industrial applications, continues to fuel market growth. Additionally, the focus on energy efficiency and equipment optimization supports sustained demand across North American industries.

Top Use Cases

- Automotive Engines: In cars and trucks, lubricants like motor oils reduce friction between moving parts such as pistons and cylinders, preventing excessive heat buildup and wear. This keeps engines running smoothly, extends vehicle life, and improves fuel efficiency during daily drives or long hauls. Without proper lubrication, engines could seize up, leading to costly breakdowns and higher maintenance needs for drivers and fleet operators alike.

- Industrial Hydraulics: Factories rely on hydraulic fluids as lubricants to power machinery like presses and lifts, transmitting force while minimizing leaks and corrosion. These lubricants ensure precise control in operations, from assembly lines to heavy lifting, boosting productivity and safety. In manufacturing hubs, they help machines handle high pressures without failing, supporting non-stop production cycles.

- Marine Propulsion: Ships and boats use specialized gear oils to lubricate propellers and engines exposed to saltwater and constant motion. This protects against rust and grinding, allowing vessels to navigate rough seas efficiently and reliably. For shipping companies, it means fewer downtime repairs and smoother global trade routes, keeping cargo moving without interruptions.

- Aerospace Components: Aircraft demand high-performance synthetic lubricants for turbines and landing gear to withstand extreme temperatures and speeds. These reduce drag and vibration, ensuring safe takeoffs and landings under varying weather conditions. In aviation, they enhance reliability for pilots and passengers, while helping airlines cut fuel costs through optimized engine performance.

- Food Processing Equipment: In plants making snacks or beverages, food-grade greases lubricate conveyors and mixers without contaminating products. They prevent sticking and bacterial growth, maintaining hygiene standards while allowing machines to run at high speeds. This supports clean, efficient operations for brands, ensuring fresh goods reach shelves quickly and safely.

Recent Developments

1. ExxonMobil Corp.

ExxonMobil is expanding its premium synthetic lubricant portfolio, emphasizing sustainability. A key development is the launch of Mobil EV fluid ranges, specifically engineered for hybrid and electric vehicles to protect e-motors and batteries while improving efficiency. They are also advancing their Mobilgard line with bio-based, circular feedstocks to reduce the carbon footprint of marine engine oils, aligning with the industry’s decarbonization goals.

2. Royal Dutch Shell PLC

Shell is heavily investing in the transition to electric mobility through its lubricants division. The launch of the Shell E-Fluids portfolio, including thermal management fluids and e-greases, is designed for electric vehicle manufacturers. Concurrently, they are growing their Shell Naturelle range of biodegradable lubricants for consumer and industrial use and incorporating more certified circular base oils into their products to reduce reliance on virgin fossil resources.

3. BP PLC

BP’s Castrol is aggressively targeting the electric vehicle market. Their recent “Onward, Upward, Forward” strategy includes launching Castrol ON, a comprehensive range of EV fluids, e-greases, and thermal management fluids. They are also focusing on advanced data-driven services like Castrol ON Advanced EV Check, using oil analysis to predict vehicle maintenance needs, and expanding their presence in EV servicing networks globally.

4. TotalEnergies

TotalEnergies is innovating with high-performance, sustainable lubricants. They launched the QUARTZ EV Fluid line to meet the specific thermal and protection demands of electric vehicle powertrains. In the industrial sector, they introduced the ECO2 label for lubricants that demonstrably reduce energy consumption or use biodegradable formulations. Their focus includes increasing the use of circular base oils derived from recycled waste plastics.

5. Chevron Corp.

Chevron is strengthening its position with a dual focus on electrification and sustainability. They launched the Havoline EV line of fluids for hybrid and electric vehicles. Simultaneously, they are expanding their Ursa renewable and bio-based engine oils, made with sustainably sourced base oils. Chevron is also promoting its IoT-enabled lubricant analysis and condition monitoring services to help industrial clients optimize equipment life and reduce waste.

Conclusion

The Lubricants sector is a quiet powerhouse driving modern life forward. With steady demand from cars to factories, it’s shifting toward greener options like bio-based formulas that fit eco-friendly goals without losing performance. Industries worldwide lean on these essentials to boost efficiency and cut waste, promising a reliable path ahead as innovation keeps pace with everyday needs.