Quick Navigation

Overview

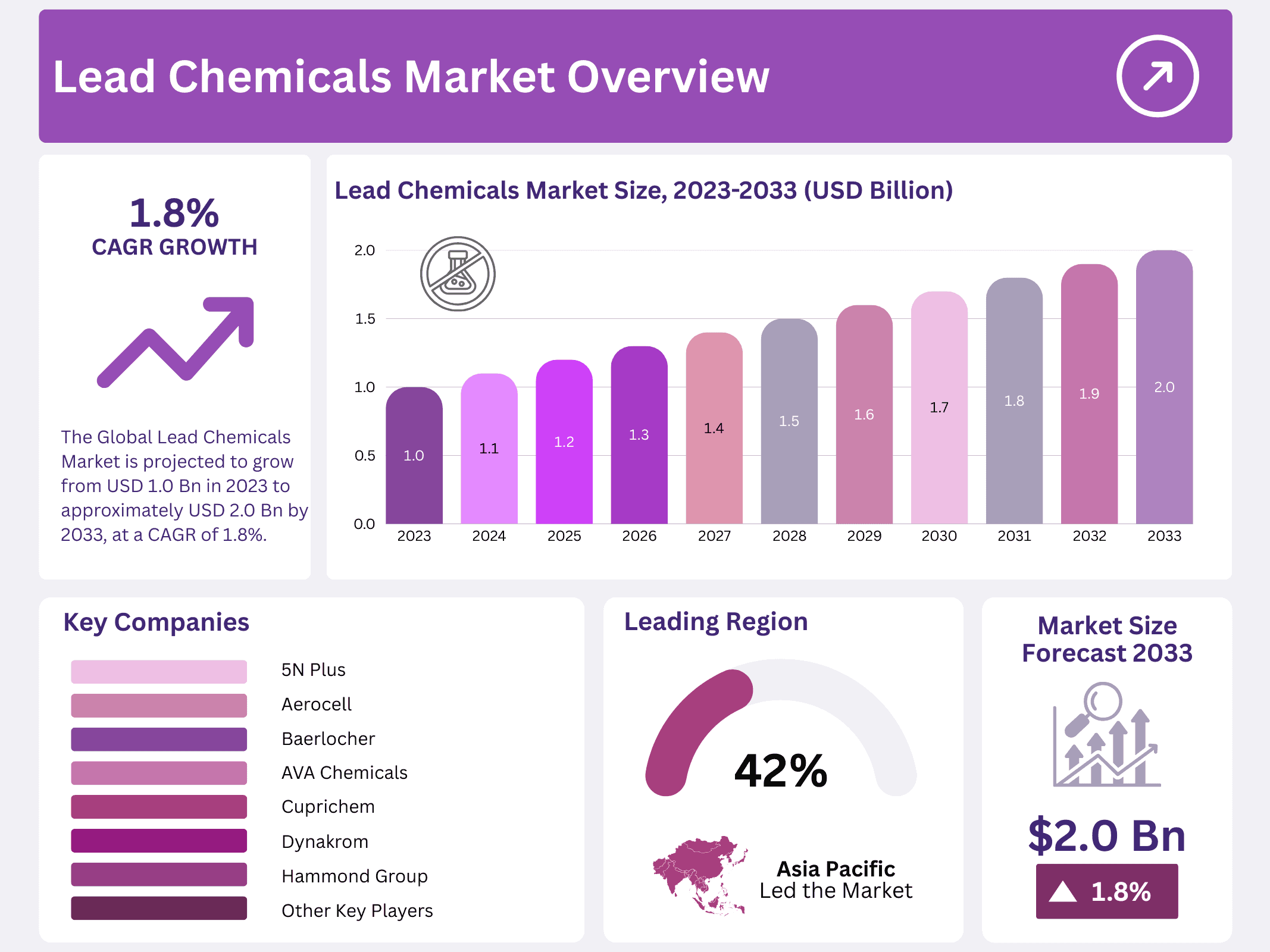

New York, NY – January 19, 2026 – The Global Lead Chemicals Market is projected to reach a value of around USD 2.0 billion by 2033, up from USD 1.0 billion in 2023, growing at a modest CAGR of 1.8% during the forecast period. This steady growth reflects the continued but controlled demand for lead-based compounds across select industrial applications. While overall usage has declined in some regions, specific industries still rely on lead chemicals due to their proven performance and cost efficiency.

The Lead Chemicals Market includes a wide range of compounds in which lead is a key element. These chemicals are used in industries such as batteries, pigments, stabilizers, radiation shielding, and certain specialty chemical processes. Their unique properties—such as high density, corrosion resistance, and electrical conductivity—make them difficult to replace in some technical and industrial uses, especially where performance reliability is critical.

Market dynamics are strongly shaped by regulatory frameworks, environmental awareness, and technological progress. Growing concerns over toxicity and environmental impact have encouraged manufacturers and end users to limit lead usage and explore safer alternatives. However, in applications where substitutes are not yet viable or commercially practical, lead chemicals continue to play an important role. The market is balancing regulatory compliance with ongoing industrial requirements, leading to stable but restrained growth over the coming years.

Key Takeaways

- The Global Lead Chemicals Market is projected to grow from USD 1.0 billion in 2023 to approximately USD 2.0 billion by 2033, at a CAGR of 1.8%.

- Lead Nitrate is the largest product segment, holding more than 42.4% of the total market demand.

- The Mining segment leads application-wise, accounting for over 47.3% of the market share.

- The Automotive sector is the top end-use industry, representing more than 47.8% of total lead chemicals consumption.

- Asia Pacific dominates the regional market with a 42.8% share, driven by the automotive, construction, and electronics industries.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 1.0 Billion |

| Forecast Revenue (2033) | USD 2.0 Billion |

| CAGR (2024-2033) | 1.8% |

| Segments Covered | By Type (Lead Nitrate, Lead Acetate, Lead Stabilizers, Lead Chloride), By Application (Mining, PVC Stabilizers, Pigment & Dyes, Others), By End-use (Automotive, Construction, Electronics, Others) |

| Competitive Landscape | 5N Plus, Aerocell, AVA Chemicals, Baerlocher, Chloral Chemicals (India), Cuprichem, Dominion Colour, Dynakrom, Flaurea Chemicals, Hammond Group, Hanhua Chemical, Hebei Yanxi Chemical, Kwang Cheng, L.S. Chemicals & Pharmaceuticals, Orica, Waldies |

Key Market Segments

By Type

Lead Nitrate stood out as the largest segment in the Lead Chemicals Market, accounting for more than 42.4% of total demand. Its strong position is supported by wide usage in fireworks, matches, and the production of other lead-based compounds. The compound is highly valued in the explosives industry and as an intermediate for chemical synthesis. Its good solubility and chemical stability further support its adoption across multiple industrial processes.

Lead acetate followed as an important segment, supporting overall market expansion. It is commonly used in cosmetics, dyes, and pigments, where it acts as a catalyst or mordant in chemical reactions. Its flexibility and ease of integration into different manufacturing processes have helped sustain its demand.

Lead stabilizers also represented a key segment, driven by their role in improving the thermal and UV resistance of PVC materials. Rising demand for PVC in construction, automotive, and packaging applications continues to support this segment. Lead chloride maintained steady demand, mainly due to its applications in laboratories, electroplating, and metallurgy, where its conductivity and complex-forming properties are essential.

By Application

The Mining segment dominated the Lead Chemicals Market with a market share of over 47.3%. Lead chemicals are widely used in ore processing, particularly in flotation techniques that help separate valuable minerals from raw ore. The expansion of global mining activities has strongly supported this segment’s leadership.

The PVC stabilizers segment followed, driven by the growing use of lead-based stabilizers in PVC production to enhance heat and UV resistance. Increased demand for PVC products in construction, automotive, and packaging industries continues to push growth in this application area.

The pigments and dyes segment also held a notable share, as lead compounds are used in paints, coatings, and textiles for their strong color performance and durability. The other segment, including batteries, ammunition, electronics, and healthcare, added diversity to the market and contributed steadily to overall growth.

By End-use

The Automotive sector emerged as the leading end-use segment, capturing more than 47.8% of the Lead Chemicals Market. This dominance is largely due to the continued use of lead-acid batteries in vehicles for starting, lighting, and ignition functions, as well as auxiliary power in hybrid and electric vehicles.

The construction sector followed as a key end-use segment. Lead-based materials are used for radiation shielding, soundproofing, and waterproofing in residential, commercial, and infrastructure projects. Ongoing construction and infrastructure development across regions continue to support demand from this segment.

Regional Analysis

The Asia Pacific region has established itself as the leading market for lead chemicals, capturing an impressive 42.8% share. This dominance is fueled by strong demand from key industries such as automotive, construction, and electronics. Rapid industrialization, coupled with greater environmental awareness, continues to boost the consumption of lead chemicals across the region.

North America is also experiencing steady growth in the Lead Chemicals Market, supported by economic progress and rising demand for lead-based products. The region’s strong automotive sector, particularly its reliance on lead-acid batteries, along with increasing use in construction materials, is driving market expansion across the United States and Canada.

In Europe, the outlook for the Lead Chemicals Market remains highly favorable. Growing demand across the manufacturing, infrastructure, and electronics sectors is supporting regional growth. Europe’s commitment to technological advancement and sustainability-focused initiatives is further encouraging the adoption of lead chemicals, solidifying its role as an important player in the global market.

Top Use Cases

- Battery Production: Lead chemicals play a key role in making lead-acid batteries, which power vehicles and backup systems in various sectors. As a market research analyst, I see strong demand from the automotive and renewable energy industries due to their reliability and cost-effectiveness, helping companies meet energy storage needs efficiently while supporting sustainable power solutions.

- Radiation Shielding: In healthcare and nuclear fields, lead compounds are used to create protective barriers against harmful rays. From my analysis, this drives market growth as medical facilities expand, offering safety for workers and patients. Industries value these chemicals for their density, ensuring effective shielding in equipment like X-ray machines and labs.

- Pigments and Coatings: Lead chemicals enhance colors in paints, dyes, and coatings for durability and vibrancy. As an analyst, I note their appeal in construction and manufacturing, where they improve product longevity against the weather. This use case supports market stability by meeting demands for high-quality finishes in buildings and consumer goods.

- Glass and Ceramics Manufacturing: These chemicals are added to glass and ceramics for better clarity and strength, used in electronics and decorative items. Market insights show growth from tech sectors needing reliable materials. They help producers create specialized products that resist heat and chemicals, boosting competitiveness in global markets.

- Plastic Stabilizers: Lead compounds stabilize PVC in pipes and cables, preventing degradation over time. Analyzing trends, I find this vital for the construction and electrical industries seeking long-lasting materials. It contributes to market expansion by enabling safer, more durable infrastructure projects that align with modern building standards.

Recent Developments

1. 5N Plus

- 5N Plus reported strong Q4 2023 results, highlighting growth in its Specialty Materials segment, which includes performance chemicals. The company is focusing on operational efficiency and strategic investments to support demand in sectors like healthcare and electronics. Their lead-based product line, including lead oxides and alloys, remains part of their advanced materials portfolio for specialized applications.

2. Aerocell

- Aerocell, a key Indian manufacturer of lead oxides and PVC stabilizers, is actively expanding its production capacity to meet growing domestic and international demand. The company emphasizes research into advanced, efficient lead chemical products for batteries and plastics. Recent developments focus on optimizing manufacturing processes and enhancing product quality to maintain competitiveness in the global lead chemicals market.

3. AVA Chemicals

- AVA Chemicals, a major producer of lead stabilizers for PVC, continues to invest in R&D for sustainable and high-performance additive solutions. While facing regulatory shifts, the company is developing advanced, eco-friendly stabilizer systems. Their recent focus is on providing technical support and tailored products to the PVC piping, profiles, and cable industries, ensuring stability and compliance with environmental standards.

4. Baerlocher

- Baerlocher, a global leader in plastic additives, recently expanded its range of lead-free PVC stabilizers, reflecting the industry’s shift away from lead-based products. While traditionally a major supplier of lead stabilizers, their recent developments are dominated by calcium-based and other heavy-metal-free systems. This strategic shift addresses stringent global regulations and customer demand for sustainable alternatives.

5. Chloral Chemicals (India)

- Chloral Chemicals maintains its position as a leading Indian manufacturer of basic lead chemicals, including sulfate and silicates. The company has been modernizing its facilities to improve efficiency and environmental compliance. Recent activities focus on securing a stable supply of raw materials and catering to consistent demand from the battery and pigment industries, despite market volatility.

Conclusion

Lead Chemicals remain essential across diverse industries despite environmental concerns, driving innovation in safer applications. As a market research analyst, I observe steady demand from key sectors like energy and construction, with potential for growth through regulatory compliance and alternative formulations that balance performance with sustainability.