Quick Navigation

Overview

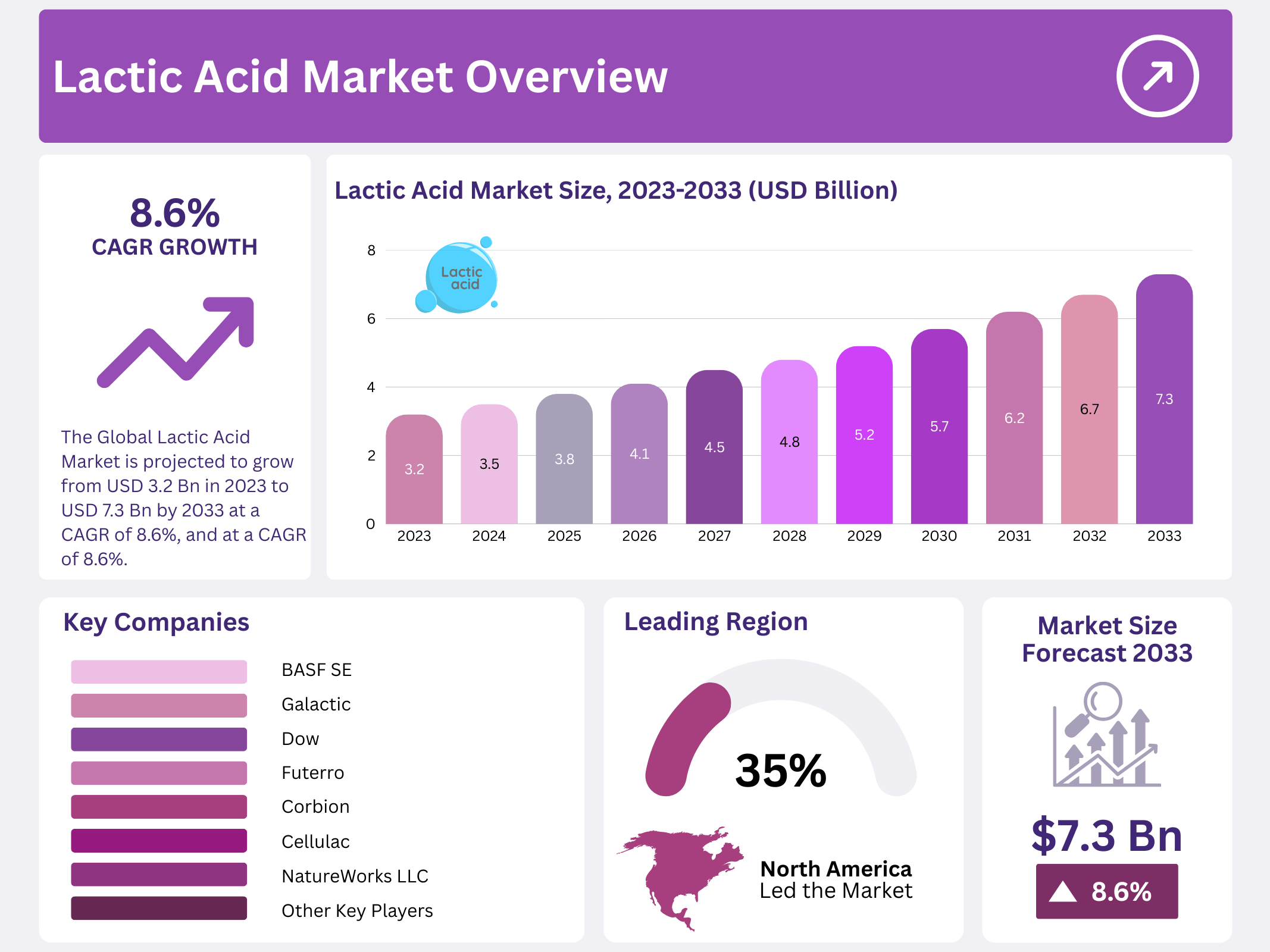

New York, NY – December 10, 2025 – The Global Lactic Acid Market is projected to reach a value of USD 7.3 billion by 2033, expanding from USD 3.2 billion in 2023, at a CAGR of 8.6% during the forecast period from 2023 to 2033. This steady growth reflects rising demand across multiple industries and increasing adoption of bio-based chemicals worldwide.

Lactic acid is widely used across diverse end-use sectors, including pharmaceuticals and food & beverages, due to its safety profile and functional versatility. Demand is particularly strong in emerging economies such as India, China, and Indonesia, where rapid industrialization, expanding food processing activities, and growing healthcare needs are accelerating consumption.

A major growth driver is the increasing use of lactic acid in the production of polylactic acid (PLA), a biodegradable and compostable thermoplastic made from renewable resources. Since lactic acid is produced through fermentation processes and holds Generally Recognized as Safe (GRAS) status, it is highly attractive for food-contact applications. Its safety is further endorsed by recognition from the U.S. Food and Drug Administration, supporting its expanding commercial adoption.

Key Takeaways

- The Global Lactic Acid Market is projected to grow from USD 3.2 billion in 2023 to USD 7.3 billion by 2033 at a CAGR of 8.6% during the forecast period.

- Corn is preferred as a raw material due to cost efficiency, sustainability, renewability, and limited petroleum-based alternatives.

- Polylactic acid (PLA) segment held the largest revenue share of 30% in 2023, driven by biodegradability and versatility.

- PLA demand is supported by durability, mechanical strength, transparency, cost-effectiveness, and growth in the automotive and packaging sectors.

- North America dominated the market with 42% revenue share in 2021, led by strong personal care, pharmaceutical, and food & beverage industries.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 3.2 Billion |

| Forecast Revenue (2033) | USD 7.3 Billion |

| CAGR (2024-2033) | 8.6% |

| Segments Covered | By Type (Glazed Ceramic Tile, Unglazed Ceramic Tile, and Porcelain Tile), By Application (Household Usage and Commercial Usage) |

| Competitive Landscape | BASF SE, Galactic, Dow, Jungbunzlauer Suisse AG, NatureWorks LLC, Musashino Chemical (China) Co., Ltd., Futerro, Corbion, Henan Jindan Lactic Acid Technology Co., Ltd., ThyssenKrupp AG, Cellular, Vaishnavi Bio-Tech, TEIJIN LIMITED, Danimer Scientific |

Key Market Segments

Raw Material Analysis

Corn has emerged as a preferred raw material as rising environmental concerns, wider adoption of sustainable processing methods, and the limited availability of petroleum-based feedstocks continue to support demand for corn-based lactic acid products. Its renewability and stable supply further strengthen its position in large-scale commercial production.

Yeast extract has traditionally been one of the commonly used inputs in lactic acid manufacturing; however, the high production cost associated with yeast-based processes has encouraged manufacturers to adopt alternatives such as Corn Steep Liquor (CSL). CSL is a corn-derived by-product obtained during corn steeping and offers a more economical and efficient nutrient source for fermentation, making it widely used in industrial lactic acid production.

By Applications Analysis

The polylactic acid (PLA) segment dominated the market by application, accounting for the largest revenue share of 30% in 2023. This dominance is attributed to PLA’s favorable properties, such as durability, mechanical strength, transparency, and cost-effectiveness. Growing demand for biodegradable materials, consistent expansion of the automotive sector, and rising consumption across multiple end-use industries continue to support the segment’s growth.

In automotive applications, PLA is increasingly used in lightweight components for vehicle interiors, including trims and under-the-hood parts. These materials help reduce overall vehicle weight while improving performance and fuel efficiency. As the focus on sustainable and recyclable bioplastics intensifies, demand for PLA is expected to rise significantly, supported by its ability to enhance durability while meeting environmental and efficiency requirements.

Regional Analysis

North America led the lactic acid market in 2021, accounting for the highest revenue share of 42%. This leadership was mainly supported by the strong presence of the personal care, pharmaceutical, food, and beverage industries across the region. Rising healthcare spending, particularly in the United States, has expanded pharmaceutical manufacturing, which continues to support steady demand for lactic acid in drug formulations and related applications.

Market growth in North America is further strengthened by the concentration of major personal care and cosmetic producers such as Procter & Gamble and Colgate-Palmolive. These companies benefit from a well-established manufacturing ecosystem and consistent consumer demand for hygiene and beauty products.

Demand for polylactic acid (PLA) is also expected to rise over the forecast period, supported by strong packaging requirements and growing environmental initiatives. Government measures in the U.S. aimed at reducing carbon emissions are encouraging the adoption of bio-based and biodegradable materials, positioning PLA as a preferred alternative in sustainable packaging applications across North America.

Top Use Cases

- Food Preservation: Lactic acid serves as a natural preservative in everyday foods like yogurt, pickles, and canned goods, helping to keep them fresh longer without harmful chemicals. It adds a tangy flavor that enhances taste while supporting clean-label trends. As shoppers demand healthier options, this use case boosts food safety and cuts waste, making meals more enjoyable and sustainable for families everywhere.

- Skincare Products: In cosmetics, lactic acid acts as a gentle exfoliant and moisturizer, smoothing skin and fighting dryness in lotions and creams. Its mild nature suits sensitive skin, promoting a glow without irritation. With rising interest in natural beauty routines, brands are turning to it for eco-friendly formulas, helping consumers achieve radiant results while embracing wellness-focused self-care practices.

- Drug Delivery Systems: Lactic acid forms biocompatible materials for pills and implants in pharmaceuticals, ensuring safe release of medicines over time. It supports healing in treatments for wounds or chronic conditions by breaking down harmlessly in the body. As healthcare shifts toward patient-friendly innovations, this application improves therapy effectiveness, offering hope for better recovery and personalized care options.

- Sustainable Packaging: Derived from bioplastics, lactic acid creates eco-friendly films and containers for groceries and goods, replacing traditional plastics that harm the environment. It composts easily, reducing landfill clutter. Amid growing calls for green alternatives, companies adopt them to meet consumer eco-demands, fostering a circular economy where packaging protects products while safeguarding the planet for future generations.

- Textile Dyeing: Lactic acid aids in coloring fabrics during dyeing and finishing, locking in vibrant hues while softening materials for comfortable wear. It minimizes water use in processes, aligning with sustainable fashion goals. As apparel brands prioritize ethical production, this use enhances the durability and appeal of clothes, empowering shoppers to choose stylish, earth-kind outfits that last longer.

Recent Developments

1. BASF SE

BASF is advancing its portfolio of biobased and biodegradable polymers, including lactic acid derivatives. In partnership with several firms, BASF focuses on innovation in sustainable solutions and aims to enhance its bioplastics segment. The company leverages lactic acid as a building block for eco-friendly materials, aligning with its broader sustainability targets.

2. Galactic

Galactic, now part of the TotalEnergies Corbion joint venture (as Corbion), continues to lead in lactic acid and bioplastics. Recent developments include expanding its Luminy PLA (polylactic acid) portfolio, focusing on high-heat and high-performance grades for packaging and durable applications, while progressing toward a circular economy model.

3. Dow

Dow has been exploring lactic acid-based materials primarily through partnerships and R&D in bioplastics and sustainable packaging. While not a direct lactic acid producer, Dow integrates bio-based monomers into polymer innovations, aiming to improve recyclability and reduce carbon footprint in alignment with its sustainability commitments.

4. Jungbunzlauer Suisse AG

Jungbunzlauer, a key producer of fermentation-derived ingredients, offers high-purity lactic acid for food, pharmaceutical, and industrial uses. Recent developments focus on sustainable production processes and expanding applications in biodegradable polymers and green solvents, reinforcing its commitment to natural and renewable solutions.

5. NatureWorks LLC

NatureWorks, a leading producer of PLA biopolymers from lactic acid, recently expanded its Ingeo biopolymer capacity. The company announced a new production facility in Thailand to meet global demand for sustainable materials. Innovations include advanced PLA grades for compostable packaging, fibers, and 3D printing applications.

Conclusion

Lactic acid stands out as a versatile building block in today’s push for greener living, bridging natural origins with innovative solutions across daily life. Its gentle, bio-based nature fuels a shift toward sustainable practices, from fresher foods to kinder skincare and durable eco-materials. Looking ahead, expect wider adoption as industries embrace fermentation tech and renewable sources, promising a healthier planet and smarter products that harmonize convenience with care for tomorrow’s world.