Quick Navigation

Introduction

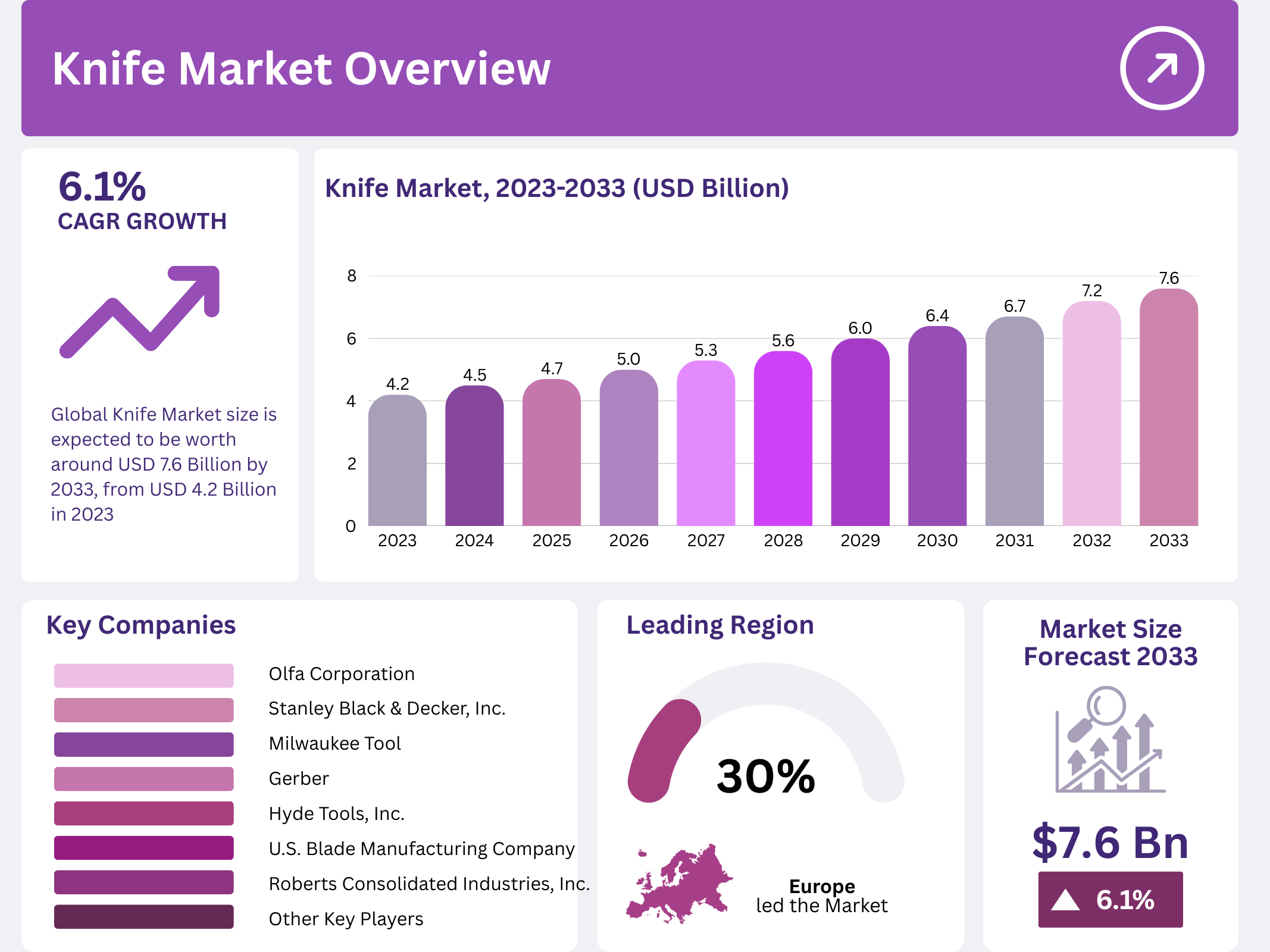

The Global Knife Market is poised for substantial growth, projected to reach USD 7.6 billion by 2033, rising from USD 4.2 billion in 2023, at a CAGR of 6.1% between 2024 and 2033. This steady trajectory underscores the indispensable role of knives across culinary, tactical, and outdoor applications.

In recent years, knives have transcended their traditional role as mere cutting tools to become essential instruments in diverse domains — from gourmet kitchens to survival expeditions. Increasing participation in outdoor activities and home cooking trends are key factors fueling demand for both utility and premium-grade knives globally.

Moreover, rapid innovations in materials, ergonomic designs, and multipurpose functionality have propelled the knife market’s evolution. Manufacturers are integrating cutting-edge alloys, customizable options, and eco-friendly materials to align with evolving consumer preferences and sustainability goals.

Key Takeaways

- The Knife Market was valued at USD 4.2 billion in 2023 and is expected to reach USD 7.6 billion by 2033, with a CAGR of 6.1%.

- In 2023, Fixed Blades led the type segment with 45%, favored for their durability in outdoor and tactical applications.

- In 2023, Steel dominated the material segment with 60%, due to its affordability and strength.

- In 2023, Kitchen Knives represented 45% of the application segment, driven by rising culinary interests and home cooking trends.

- In 2023, Europe held the largest share at 30.0%, driven by high demand for premium and professional knives.

Market Segmentation Overview

The Type Segment is led by Fixed Blades, holding a 45% share, attributed to their strength and reliability. Fixed blades remain the top choice for outdoor enthusiasts, hunters, and tactical users due to their full-tang design and superior performance in heavy-duty applications. Meanwhile, Folding Blades cater to everyday carry users seeking portability and safety.

By Material, Steel dominates with a 60% share, owing to its balance of strength, sharpness, and cost-effectiveness. Its wide adaptability across kitchen, tactical, and outdoor knives ensures continued preference among professionals and hobbyists alike. Advancements in stainless and alloy steels further enhance edge retention and corrosion resistance.

In Application, Kitchen Knives command a 45% share, reflecting the consistent demand in culinary settings. With over 1 million restaurant and foodservice locations in the U.S., this segment benefits from rising home-cooking enthusiasm and professional culinary growth. Specialty knives designed for precision tasks are increasingly popular among both chefs and consumers.

Drivers

1. Rising Popularity of Outdoor Activities and Culinary Arts

The surge in outdoor recreation — including camping, hiking, and survival sports — significantly boosts knife demand. With 141.4 million Americans engaging in outdoor activities, knives have become essential tools for both safety and utility. Simultaneously, growing interest in culinary arts fosters demand for high-quality kitchen knives.

2. Increasing Demand for Multi-Functional Tools

Consumers now favor knives that integrate versatility and compactness, such as multi-tools combining blades with pliers, screwdrivers, and openers. This shift towards multifunctionality drives manufacturers to innovate and expand product offerings, catering to professional, tactical, and recreational needs.

Use Cases

1. Culinary and Food Preparation

In the culinary sector, knives are indispensable for precision cutting, dicing, and carving. With 14.5 million foodservice employees in the U.S., the demand for durable, ergonomic, and sharp kitchen knives remains robust, supporting both commercial kitchens and domestic users embracing gourmet cooking.

2. Outdoor and Tactical Applications

Knives are crucial for survivalists, military personnel, and construction professionals. With 5.2 million construction workers and 2.2 million military personnel relying on knives, durable and reliable designs are essential for field use, survival kits, and emergency preparedness.

Major Challenges

1. Stringent Government Regulations

Strict policies on knife sales and ownership, particularly in Europe and North America, limit market accessibility. Regulations targeting tactical and concealed knives restrict distribution, forcing companies to navigate complex legal landscapes while maintaining compliance and responsible marketing.

2. Volatility in Raw Material Prices

Fluctuating steel and alloy prices challenge manufacturers’ pricing strategies. Maintaining profitability while offering competitive prices becomes difficult, especially for brands reliant on high-quality materials. This volatility also impacts long-term contracts and inventory management.

Business Opportunities

1. Expansion in Emerging Economies

Developing regions such as Asia-Pacific and Latin America offer untapped potential. Rising disposable incomes, expanding hospitality sectors, and increased outdoor recreation participation create new consumer bases for affordable and versatile knife products.

2. Growth in Customization and E-commerce

The rising trend toward personalization — from engraved handles to customized blade types — presents lucrative opportunities. Furthermore, the rapid adoption of e-commerce platforms enables global reach, allowing direct-to-consumer sales and niche marketing for specialized designs.

Regional Analysis

1. Europe Leads with 30.0% Market Share

Europe dominates the global knife market, valued at USD 1.26 billion, driven by the region’s rich culinary tradition and craftsmanship heritage. Countries like Germany and France excel in premium knife manufacturing, emphasizing precision engineering, sustainability, and quality assurance.

2. Asia-Pacific Shows Accelerated Growth

Asia-Pacific exhibits rapid expansion, driven by local manufacturing hubs in Japan and China. Affordable pricing, diverse product lines, and growing interest in home cooking and outdoor lifestyles position this region as a key growth engine for global knife demand.

Recent Developments

- July 2024 – Blue Payment Agency: Introduced specialized payment gateways for Shopify merchants selling knives, overcoming restrictions from standard payment services like Stripe and PayPal.

- August 2024 – Pri0r1ty AI PLC: Raised £550,000 to launch its “Swiss Army Knife for SME Growth,” expanding AI-based support services for small businesses.

- June 2024 – New West KnifeWorks: Partnered with Chef Gator to release a 10″ Bowie Knife tailored for pitmasters, blending craftsmanship with functional design.

Conclusion

The Global Knife Market is on a dynamic growth path, fueled by rising culinary enthusiasm, outdoor recreation, and innovations in material science. Despite regulatory constraints and material cost fluctuations, opportunities abound in emerging economies, e-commerce expansion, and product customization. With a projected valuation of USD 7.6 billion by 2033, the industry is set to thrive through continued innovation, global reach, and alignment with evolving consumer trends.