Quick Navigation

Overview

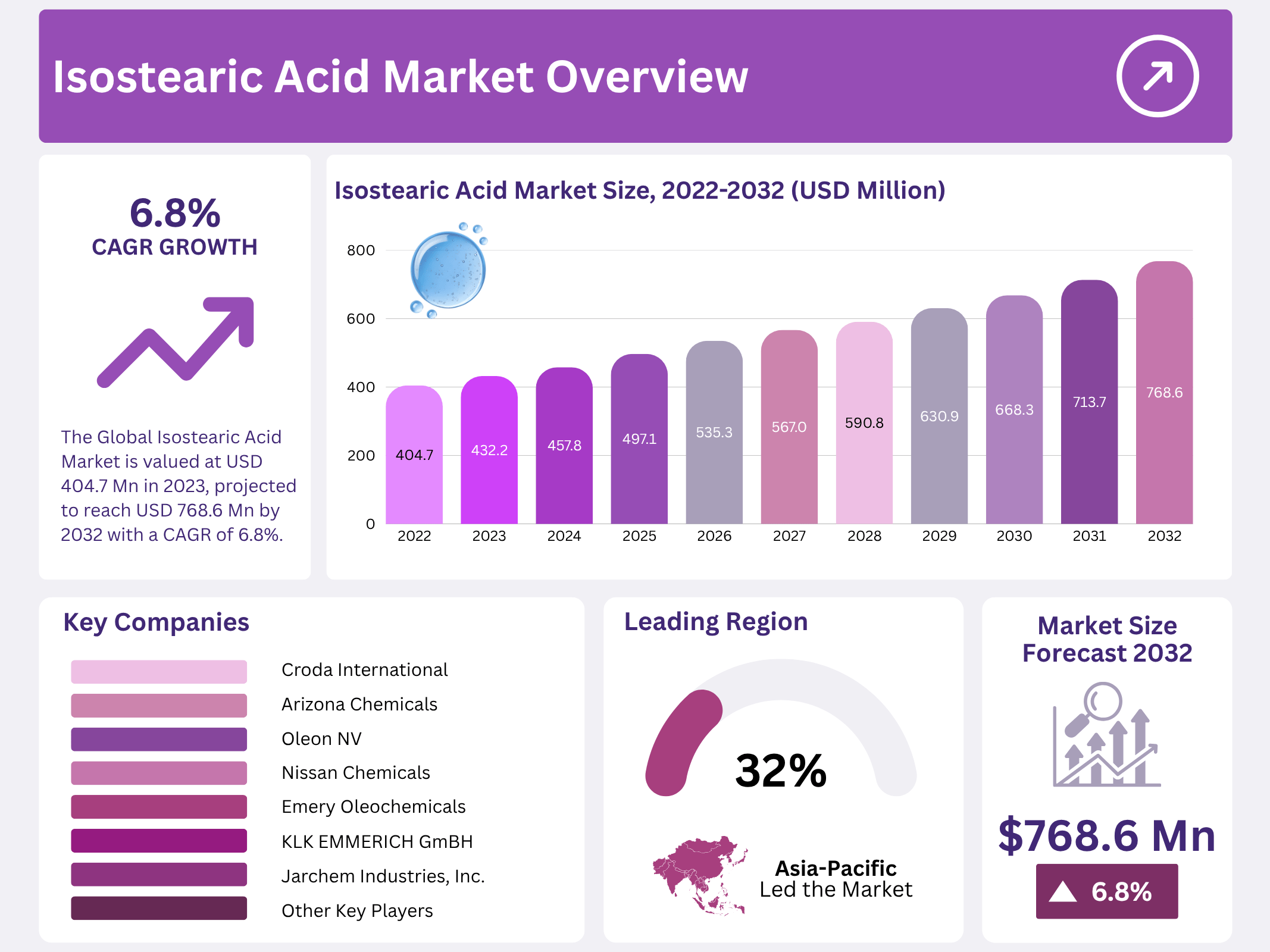

New York, NY – November 03, 2025 – The Global Isostearic Acid Market was valued at USD 404.7 million in 2023 and is projected to reach USD 768.6 million by 2032, growing at a CAGR of 6.8% during the forecast period. Isostearic acid is a branched-chain fatty acid widely used in personal care and cosmetic formulations such as soaps, shampoos, lotions, and skin creams due to its chemical stability and versatility.

This compound is primarily derived from plant-based oils like castor oil, making it a more sustainable alternative to traditional fatty acids. Its molecular structure provides excellent oxidative stability and resistance to rancidity, helping extend the shelf life of cosmetic and skincare products. These qualities make it particularly valuable for formulations exposed to air and light over extended periods.

Beyond stability, isostearic acid contributes to product texture, consistency, and emollient properties, improving the overall sensory feel of lotions and creams. It also enhances skin moisturization, making it an essential ingredient for hydrating products. As consumer demand for eco-friendly and naturally sourced ingredients continues to rise, the role of isostearic acid in sustainable personal care and cosmetic applications is expected to strengthen further in the coming decade.

Key Takeaways

- The Global Isostearic Acid Market is valued at USD 404.7 million in 2023, projected to reach USD 768.6 million by 2032 with a CAGR of 6.8%.

- The adhesives segment leads by application with 28% revenue share in 2022, serving as a key additive in adhesives and paint lubricants.

- The chemical esters segment dominates by end-user, with 37% revenue share, used to produce high-value esters like isopropyl, glyceryl, and isostearyl isostearate.

- Asia-Pacific region holds the largest market share at 32%, driven by strong demand in personal care, lubricants, and chemical manufacturing.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 404.7 Million |

| Forecast Revenue (2032) | USD 768.6 Million |

| CAGR (2023-2032) | 6.8% |

| Segments Covered | By Application (Adhesives, Coating & Paintings, Finishing Agents, Solvents, Surfactants, and Other Applications), By End-User (Cosmetics & Personal Care, Chemical Esters, Lubricant & Greases, and Other End-Users) |

| Competitive Landscape | Croda International, Arizona Chemicals, Oleon NV, Nissan Chemicals, Emery Oleochemicals, Jarchem Industries, Inc., KLK EMMERICH GmbH, Santa Cruz Biotechnology, Inc., Vantage Specialty Chemicals, Foreverest Resources Ltd., SysKem Chemie GmbH, Kraton Corporation, Other Key Players |

Key Market Segments

By Application Analysis

The Adhesives Segment Leads the Market

The global isostearic acid market is segmented by application into adhesives, coatings & paints, finishing agents, solvents, surfactants, and others. Among these, the adhesives segment dominates, holding a 28% revenue share in 2022. Isostearic acid serves as a key additive in adhesives, paint lubricants, and personal care formulations.

Its amphiphilic nature, featuring both hydrophobic and hydrophilic ends, enables strong interactions with polar and non-polar substances, making it an effective surfactant. Additionally, its high oil solubility positions it as an excellent emulsifier and dispersant in oil-based systems, enhancing its utility across diverse industrial applications.

By End-User Analysis

The Chemical Esters Segment is Dominant

By End-User, the market is divided into cosmetics & personal care, chemical esters, lubricants & greases, and others. The chemical esters segment holds the largest share at 37% of total revenue. Isostearic acid is a versatile precursor for producing high-value chemical esters, including isopropyl isostearate, glyceryl isostearate, and isostearyl isostearate.

These esters offer specialized performance attributes, driving demand in multiple sectors. Its superior emollient and moisturizing properties also make isostearic acid a preferred ingredient in personal care products such as lotions, creams, and soaps. Rising consumer preference for high-performance skincare and cosmetic formulations is expected to further boost demand in this category over the forecast period.

Regional Analysis

Asia-Pacific Dominates the Global Isostearic Acid Market

Asia-Pacific (APAC) holds the leading position in the global isostearic acid market, commanding a 32% revenue share. The region’s robust expansion is driven by surging demand across key end-use sectors, including personal care, lubricants, and chemical manufacturing.

Rapid population growth and rising disposable incomes in China and India are accelerating the consumption of premium personal care products, significantly boosting regional demand for isostearic acid. North America ranks as the second-largest market, fueled primarily by the United States, where the strong presence of major manufacturers and high consumer preference for advanced cosmetic and personal care formulations continue to drive steady growth in isostearic acid adoption.

Top Use Cases

- Personal Care Products: Isostearic acid acts as a gentle emollient in lotions, creams, and shampoos, helping to soften skin and hair while locking in moisture. Its mild scent and stability make it ideal for daily use items like soaps and sunscreens. This boosts product feel and shelf life, meeting growing demand for natural-feeling beauty routines.

- Lubricants and Greases: In machinery and automotive parts, isostearic acid reduces friction and wear, ensuring smooth operation even under heat. It adds thermal stability to oils and additives, extending equipment life. This makes it a go-to for industries needing reliable performance without breakdowns.

- Coatings and Paints: Isostearic acid improves flexibility and durability in protective paints and varnishes, creating a strong barrier against moisture and scratches. It helps paint spread evenly for a smooth finish. Builders and manufacturers value it for long-lasting surfaces in homes and vehicles.

- Adhesives and Binders: As an additive, isostearic acid strengthens bonds in glues and tapes, enhancing stickiness on tricky surfaces. Its surfactant qualities help mix ingredients better, leading to tougher holds. This supports construction and packaging needs for secure, weather-resistant joins..

- Chemical Esters Production: Isostearic acid forms esters used in emulsifiers for foods and cleaners, improving texture and stability. It creates smooth blends in confections and detergents. Formulators rely on it to develop versatile compounds that work across household and industrial cleaning tasks.

Recent Developments

1. Croda International

Croda is advancing its bio-based portfolio, with Isostearic Acid developments focusing on sustainability. Their “Esterol” range utilizes green chemistry to create high-performance, plant-derived isomers for cosmetics and lubricants. Recent efforts emphasize reducing carbon footprint and enhancing supply chain transparency, catering to the demand for sustainable, non-petrochemical ingredients in personal care and industrial applications.

2. Arizona Chemicals (a Kraton brand)

As part of Kraton Corporation, Arizona Chemicals leverages tall oil crude (TOFA) from pine trees to produce Sylfat Isostearic Acid. Recent developments focus on the consistent quality and supply of this bio-based alternative to petroleum-derived acids. Their innovation highlights the product’s role in creating high-performance lubricants, plasticizers, and surface coatings, emphasizing the value of the tall oil biorefinery model for sustainable chemicals.

3. Oleon NV

Oleon is actively expanding its specialty oleochemicals, including Isostearic Acid (branded as Prisorine). Their focus is on developing applications in cosmetics for emolliency and in lubricants for superior low-temperature performance. A key recent trend is promoting the 100% bio-based, readily biodegradable nature of their products, aligning with global regulatory shifts towards environmentally friendly ingredients in various industrial sectors.

4. Nissan Chemical

Nissan Chemical’s developments in Isostearic Acid are linked to its functional chemicals division. They focus on high-purity grades for demanding applications, particularly as dispersing agents and surface modifiers in the electronics and coatings industries. Their recent R&D likely explores its use in stabilizing nanoparticles and improving the durability of specialty polymers, emphasizing performance in high-tech, niche markets rather than large-volume commodity production.

5. Emery Oleochemicals

Emery Oleochemicals emphasizes the sustainable and high-performance characteristics of its Emery line of Isostearic Acids. Recent developments target the personal care market, where its excellent oxidative stability and emollient properties are key benefits for lotions and creams. Concurrently, they promote its use in synthesizing eco-friendly lubricants and greases, highlighting the product’s versatility and derivation from renewable resources.

Conclusion

Isostearic Acid as a rising star in sustainable formulations, blending natural origins with versatile performance across beauty, industrial, and chemical sectors. Its ability to stabilize, moisturize, and bind without harsh effects aligns perfectly with consumer shifts toward eco-friendly, effective products. Expect steady growth as brands innovate with this adaptable ingredient to meet diverse, quality-driven demands in everyday applications.