Quick Navigation

Overview

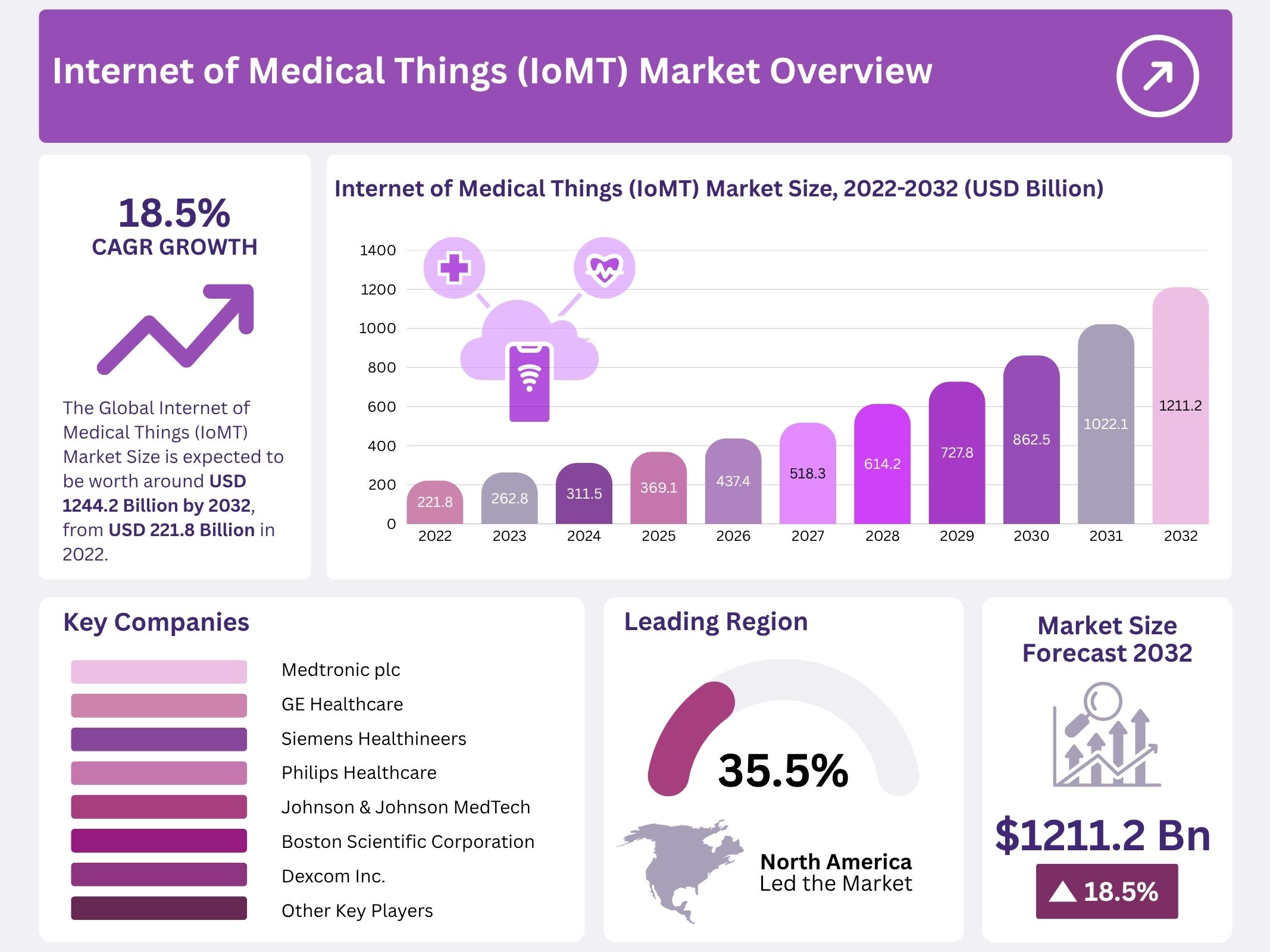

The Internet of Medical Things (IoMT) market is projected to reach about USD 1,211.22 billion by 2034, rising from USD 221.84 billion in 2024. Growth is expected at a CAGR of 18.5% from 2025 to 2034. Expansion has been supported by the steady adoption of connected medical devices and digital health platforms. The demand for real-time data, automation, and efficient clinical workflows has continued to shape the direction of this market.

Remote patient monitoring has emerged as a primary driver of adoption. Healthcare providers have increased the use of home-based devices to observe vital signs and reduce unnecessary hospital visits. Real-time alerts have strengthened early diagnosis and supported better patient safety. The preference for continuous observation instead of episodic checkups has encouraged hospitals and clinics to integrate IoMT platforms into routine care delivery.

The rising burden of chronic diseases has further accelerated uptake. Conditions such as diabetes, cardiovascular disorders, and respiratory illnesses require constant supervision. IoMT devices have enabled consistent data collection, which has improved treatment accuracy and long-term disease management. This ongoing clinical demand has strengthened the need for connected devices and cloud-supported health systems that organize patient information in a centralized environment.

The improvement of digital health infrastructure has also supported market growth. Advances in cloud computing, cybersecurity, and device interoperability have increased the reliability of smart medical systems. The rollout of 5G networks has enhanced data transmission speeds and improved device performance. Hospitals have adopted integrated platforms that link medical devices with electronic records and analytics tools, supporting a more connected healthcare ecosystem.

Government support and changing healthcare priorities have reinforced adoption. Policies that promote digital transformation, along with financial incentives and national health programs, have encouraged modernization of clinical systems. The shift toward value-based care has increased interest in technologies that reduce costs and enhance outcomes. IoMT solutions have assisted in lowering readmission rates and improving decision-making efficiency. Rising patient acceptance of wearables and mobile health applications has expanded usage beyond clinical settings. Together, these developments have created a stable foundation for sustained market expansion.

Key Takeaways

- The IoMT market generated US$221.84 billion in 2024 and is forecast to reach US$1,211.22 billion by 2034, supported by an 18.5% CAGR.

- Hardware held 44.7% of the component segment in 2024, surpassing software and services in overall contribution to market structure.

- Cloud-based deployment accounted for 68.8% of the market in 2024, significantly exceeding the adoption level observed for on-premise models.

- Wireless connectivity captured 52.1% share in 2024, advancing ahead of wired systems and shaping device integration across healthcare environments.

- Wearable devices represented 45.7% of the type segment in 2024, outperforming stationary, implantable, and other device categories.

- Patient monitoring held 37.8% share in 2024, establishing a stronger application presence than telemedicine, medication management, and other use cases.

- Hospitals and clinics accounted for 41.8% of end-user share in 2024, maintaining a leading position over home healthcare, pharmaceutical firms, and research bodies.

- North America secured 35.5% of the global market in 2024, reflecting strong healthcare digitalization and accelerated adoption of connected medical technologies.

Regional Analysis

North America has been identified as the leading region in the Internet of Medical Things market. Its dominance has been supported by strong healthcare infrastructure and steady digital transformation. A market share of 35.5% has been recorded, indicating high adoption levels. Growth has been supported by continuous investment in connected health technologies. The region has emphasized remote monitoring and data-driven care. This trend has strengthened operational efficiency. It has also improved clinical outcomes for patients across various care settings.

The United States and Canada have played a central role in this leadership position. Their healthcare systems have integrated advanced IoMT solutions at a rapid pace. Wearable technologies have been widely accepted, helping users track daily health indicators. Devices such as smartwatches have supported early detection and chronic disease management. Providers have used these tools to support virtual care. This development has reduced pressure on hospitals. It has also encouraged preventive healthcare practices. Adoption has increased across consumers and clinical teams.

Connected medical devices have been embedded in hospital workflows throughout the region. Smart infusion pumps and ECG monitors have become common in clinical environments. These devices continuously transmit patient data to healthcare teams. This flow of information has strengthened medical decision making. It has enabled early intervention in critical cases. Efficiency gains have been observed in treatment processes. Hospitals have adopted automated monitoring systems. These systems have reduced manual tasks. They have also improved accuracy in patient assessments.

The regional market has benefited from strong regulatory support and innovation ecosystems. Funding for digital health startups has expanded. Partnerships between medical device firms and technology providers have increased. These collaborations have accelerated IoMT integration in multiple specialties. Long-term growth has been supported by a shift toward value-based care. Healthcare organizations have relied on data analytics and connected tools. This reliance has enhanced patient engagement. It has also improved long-term care management. The region is expected to maintain steady growth.

Segmentation Analysis

Hardware Segment Analysis

The hardware segment holds a significant position in the Internet of Medical Things market. It accounts for 44.7% of total market share. This dominance is driven by the adoption of connected medical devices, wearables, and sensors. These components collect and transmit real-time health data, which supports clinical decisions. Devices such as smartwatches, continuous glucose monitors, and connected ECG systems enable continuous monitoring. Growth has been supported by rising demand for chronic disease management tools. In April 2025, Forescout highlighted device vulnerabilities in its annual risk report.

Cloud-Based Deployment Model Analysis

The cloud-based deployment model dominated the IoMT market in 2024 with a 68.8% share. This position has been supported by scalability, reduced infrastructure costs, and remote availability. Cloud platforms allow healthcare systems to store and analyze large volumes of patient data. They also enable real-time sharing across various locations. Solutions such as Cerner’s cloud EHR and Philips HealthSuite demonstrate this capability. These platforms integrate device data and support remote monitoring. In June 2025, Polar introduced a screen-free wearable designed to offer simple and cost-effective functionality.

Wireless Connectivity Analysis

The wireless connectivity segment leads the IoMT market with a 52.1% share. Growth has been driven by flexibility, scalability, and simple integration. Wireless technologies such as Wi-Fi, Bluetooth, and cellular networks support smooth communication between devices and healthcare systems. These technologies enable remote monitoring and real-time patient management. Wearable trackers, smart thermometers, and blood pressure monitors rely on wireless links for continuous data flow. This connectivity supports telemedicine and home healthcare services. It also strengthens chronic disease management by improving access to patient information.

Wearable Devices Type Analysis

Wearable devices represent the dominant type segment in the IoMT market with a 45.7% share. Adoption has increased due to demand for continuous monitoring and consumer health technologies. Devices such as smartwatches, wearable ECG sensors, and glucose monitors provide real-time insights. They track activity, sleep, heart rhythm, and other vital indicators. These tools support proactive care and chronic disease management. In July 2024, Samsung expanded its portfolio by introducing the Galaxy Ring and new smartwatch models. These additions enhanced accessibility to advanced wellness features.

Patient Monitoring Application Analysis

Patient monitoring remains the leading application segment in the IoMT market. Demand has risen due to the need for continuous and remote healthcare assessment. IoMT-enabled systems record vital parameters such as heart rate, glucose levels, and oxygen saturation. Remote ECG monitors, digital blood pressure cuffs, and wearable health trackers support clinical workflows. These tools allow healthcare providers to intervene quickly. In October 2023, InfoBionic received FDA clearance for its next-generation ECG device. The device includes a Bluetooth-enabled six-lead sensor for advanced cardiac monitoring.

Hospitals and Clinics End-User Analysis

Hospitals and clinics continue to be the primary end users in the IoMT market. These facilities use connected devices to improve patient care, enhance decision-making, and streamline operations. Systems such as remote monitoring tools, smart infusion pumps, and wearable devices reduce hospital visits and support chronic care management. IoMT technologies help staff manage workloads and increase operational efficiency. A 2022 study by Juniper Research projected that smart hospitals will deploy 7.4 million IoMT devices by 2026. This reflects a substantial increase from 2021 installations.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment Model

- Cloud-Based

- On-Premise

By Connectivity

- Wired

- Wireless

By Type

- Wearable Devices

- Stationary Devices

- Implantable Devices

- Other Device Types

By Application

- Patient Monitoring

- Telemedicine

- Medication Management

- Other Applications

By End User

- Hospitals and Clinics

- Home Healthcare

- Pharmaceutical Companies

- Research Organizations

Key Players Analysis

The Internet of Medical Things market has been shaped by strong innovation in connected medical solutions. Growth has been supported by the rising use of remote monitoring and data-driven care models. Medtronic, GE Healthcare, and Siemens Healthineers have been central to this shift. Their platforms support continuous data exchange, which improves diagnostic accuracy and patient oversight. These companies have focused on cloud-linked systems that help providers manage chronic diseases. Their integrated technologies have strengthened workflow efficiency and supported better care outcomes.

Advanced imaging, therapeutic automation, and remote monitoring tools have influenced market expansion. Companies such as Philips Healthcare, Johnson & Johnson MedTech, and Boston Scientific have expanded the use of IoMT in hospitals and home care. Their solutions are used to track vital signs, optimize treatment response, and support preventive care. The adoption of real-time analytics has improved decision-making. These players have positioned themselves as leaders in connected devices. Their investments have increased the reliability of digital health systems.

Wearable technologies and continuous glucose monitoring have increased the demand for patient-centric IoMT tools. Dexcom, Abbott Laboratories, and ResMed have led developments in these areas. Their devices transmit health data to clinicians, allowing faster intervention. This capability has improved chronic disease management. Apple and Google, through Fitbit, have also contributed by enabling consumer-grade monitoring that links with clinical systems. Their focus on ease of use has encouraged greater patient participation.

Connectivity and data security have become major priorities in the IoMT ecosystem. Companies such as Biotronik, Qualcomm Life, and Cisco Systems have supported this need by providing secure communication frameworks. Their platforms ensure smooth device integration, stable data flow, and strong cyber protection. These capabilities support large-scale deployment across hospitals. Other emerging participants continue to enhance interoperability and data intelligence. Their combined efforts have enabled a more connected and responsive healthcare environment, supporting sustained market growth.

Top Key Players in the Internet of Medical Things (IoMT) Market

- Medtronic plc

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Johnson & Johnson MedTech

- Boston Scientific Corporation

- Dexcom Inc.

- ResMed Inc.

- Abbott Laboratories

- Biotronik SE & Co. KG

- Apple Inc.

- Google LLC (Fitbit)

- Qualcomm Life

- Cisco Systems Inc.

- Other key players

Conclusion

The Internet of Medical Things market is expected to maintain steady expansion as connected healthcare systems become more widely used. Growth has been supported by stronger digital infrastructure, higher demand for continuous monitoring, and broader adoption of cloud-enabled platforms. The increasing need for remote care and long-term disease management has encouraged deeper integration of smart devices across clinical and home settings. Progress in wireless communication, data security, and device interoperability has strengthened the reliability of these systems. Ongoing support from healthcare providers, technology firms, and regulatory bodies is expected to reinforce adoption, creating a stable path for further development in connected medical ecosystems.