Quick Navigation

Introduction

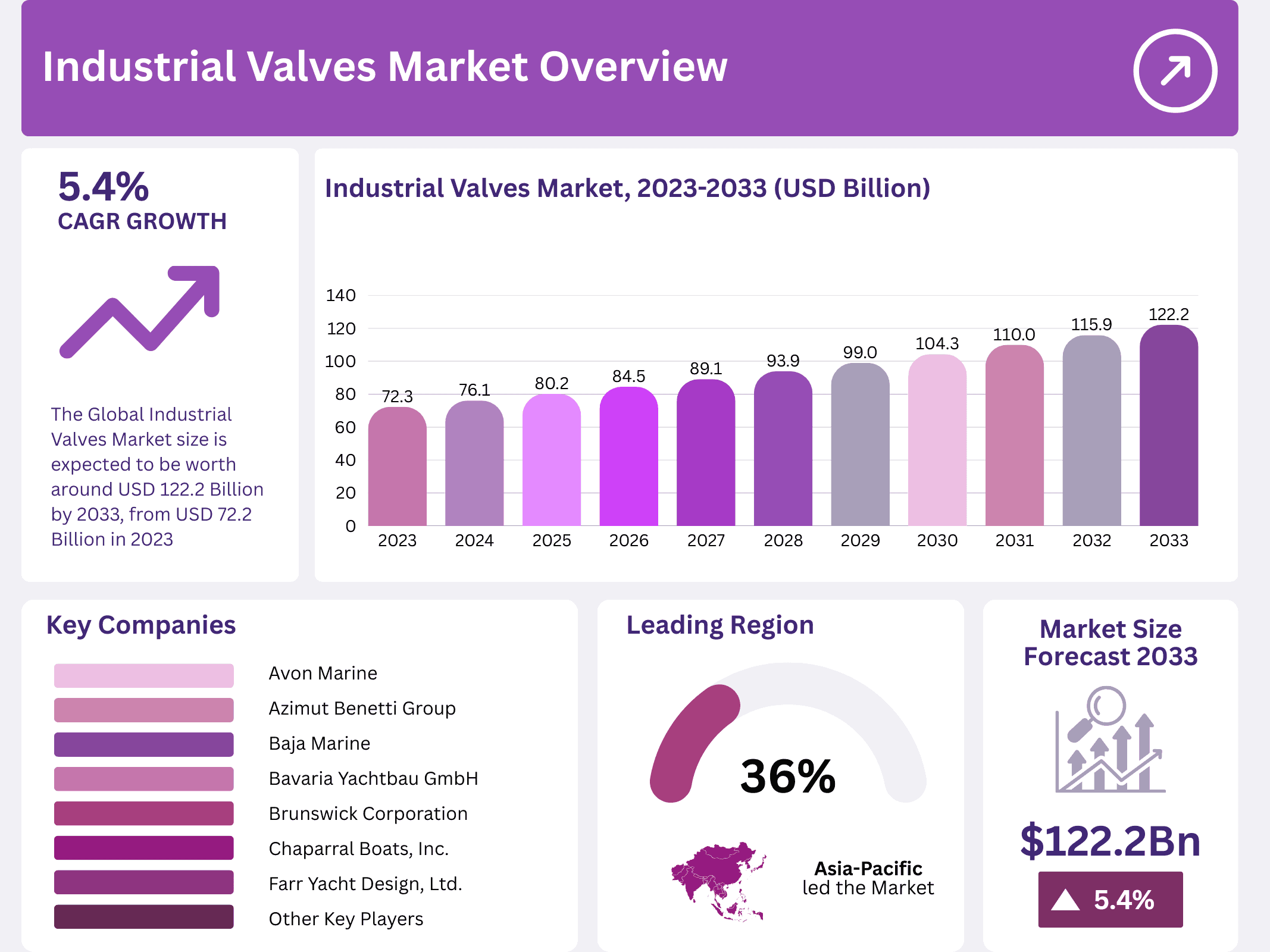

The global industrial valves market is forecast to reach $122.2 billion by 2033, up from $72.2 billion in 2023, growing at a CAGR of 5.40%. Asia Pacific led the market in 2023 with 36% share and $25.9 billion in revenue.

The global industrial valves market is undergoing significant transformation, driven by evolving industry needs and a renewed focus on sustainability. These mechanical components are crucial in managing fluid flow across sectors such as oil & gas, water treatment, and manufacturing.

Increasing industrialization across developing economies is amplifying demand for efficient fluid control systems. Simultaneously, infrastructure modernization and regulatory compliance requirements have propelled the adoption of high-performance valves.

Technological advancements are reshaping valve manufacturing, with smart and automated solutions gaining popularity. These systems enhance monitoring, reduce maintenance downtime, and ensure precise control across complex industrial processes.

Governmental initiatives such as the U.S. Department of Energy’s investment of $46 million in energy efficiency further support innovation in valve technologies. These developments are expected to contribute to improved sustainability and operational efficiency across industries.

Key Takeaways

- The Global Industrial Valves Market is projected to reach USD 122.2 Billion by 2033, up from USD 72.2 Billion in 2023, growing at a CAGR of 5.40%.

- In 2023, Globe Valves held a 40% market share in the By Type segment.

- Steel dominated the By Material segment with a 35% share in 2023.

- Oil and Power led the By Application segment with a 43% market share in 2023.

- Asia Pacific accounted for a 36% share and USD 25.9 Billion in revenue in 2023.

Market Segmentation Overview

By Type

Globe Valves led the market with a 40% share in 2023, favored for their ability to regulate flow in critical industries. Their adaptability and precision make them ideal in energy-intensive operations.

Other types such as Ball, Gate, and Butterfly Valves serve specific industrial needs. Innovations in design are expanding their use in sectors like water treatment and food processing.

By Material

Steel accounted for a 35% market share due to its high durability and pressure-resistance. Its application spans petrochemicals, oil & gas, and utilities.

Other materials like Cast Iron and Plastic are growing in popularity for cost-sensitive or corrosion-prone environments, especially in wastewater systems and chemicals.

By Application

Oil and Power dominated the application segment with a 43% share in 2023, driven by their heavy reliance on valve precision and reliability in managing fluid dynamics.

Sectors such as Food & Beverage, Water & Wastewater, and Chemicals are adopting advanced valve technologies to enhance safety, efficiency, and hygiene compliance.

Drivers

Rising Focus on Energy Efficiency: Industrial sectors are prioritizing sustainability, increasing demand for smart, energy-efficient valve solutions. The integration of automation helps reduce energy usage and minimize environmental impact.

Government-Led Investments: Programs like the DOE’s $46 million allocation for industrial efficiency are accelerating innovation in fluid control technologies, promoting widespread adoption of advanced valve systems.

Use Cases

Oil & Gas Pipeline Control: Industrial valves are essential in managing flow, pressure, and safety in upstream and downstream operations. Their performance directly impacts operational stability and environmental compliance.

Municipal Water Systems: Cities utilize advanced valve technologies to ensure clean water distribution and efficient wastewater treatment. Smart valves aid in leak detection and predictive maintenance, enhancing public infrastructure.

Major Challenges

Stringent Environmental Regulations: Manufacturers face complex global compliance demands. Adapting to evolving environmental standards increases R&D costs and slows product launch cycles.

Rising Raw Material Costs: Steel and alloy prices significantly impact manufacturing costs. This challenge, coupled with intense competition, restricts profitability for industry players.

Business Opportunities

Smart Valve Integration: There is growing demand for IoT-enabled valves across oil & gas, water treatment, and process manufacturing. These solutions allow remote monitoring, fault detection, and automated control.

Emerging Market Expansion: Rapid urbanization and infrastructure development in Asia, Latin America, and Africa open new avenues for manufacturers to deploy scalable valve solutions in utilities and construction sectors.

Regional Analysis

Asia Pacific: With 36% share and $25.9 billion in revenue in 2023, Asia Pacific leads due to large-scale infrastructure projects and industrial growth, especially in China and India.

North America and Europe: These mature markets emphasize high-performance valves due to advanced manufacturing sectors and strict compliance. Adoption of smart valve systems remains strong in utilities and energy industries.

Recent Developments

- May 2023: IMI Plc acquired a high-pressure valve manufacturer to expand in aerospace and defense, boosting market capabilities by 20%.

- March 2023: Forbes Marshall launched an IoT-based smart valve monitoring system, reducing downtime by 25% in processing industries.

- January 2023: Flowserve Corp introduced a new energy-efficient valve series, cutting industrial operational costs by up to 30%.

Conclusion

The global industrial valves market is poised for sustained growth through 2033, fueled by innovation, automation, and rising infrastructure demands. From traditional sectors like oil & gas to emerging smart utilities, valve technologies are evolving to meet rigorous performance and environmental standards.

As energy efficiency and sustainability take center stage, companies investing in smart, durable, and compliant valve systems stand to gain significant competitive advantages. With strong backing from governments and industrial modernization, the market outlook remains optimistic and opportunity-rich.