Quick Navigation

Overview

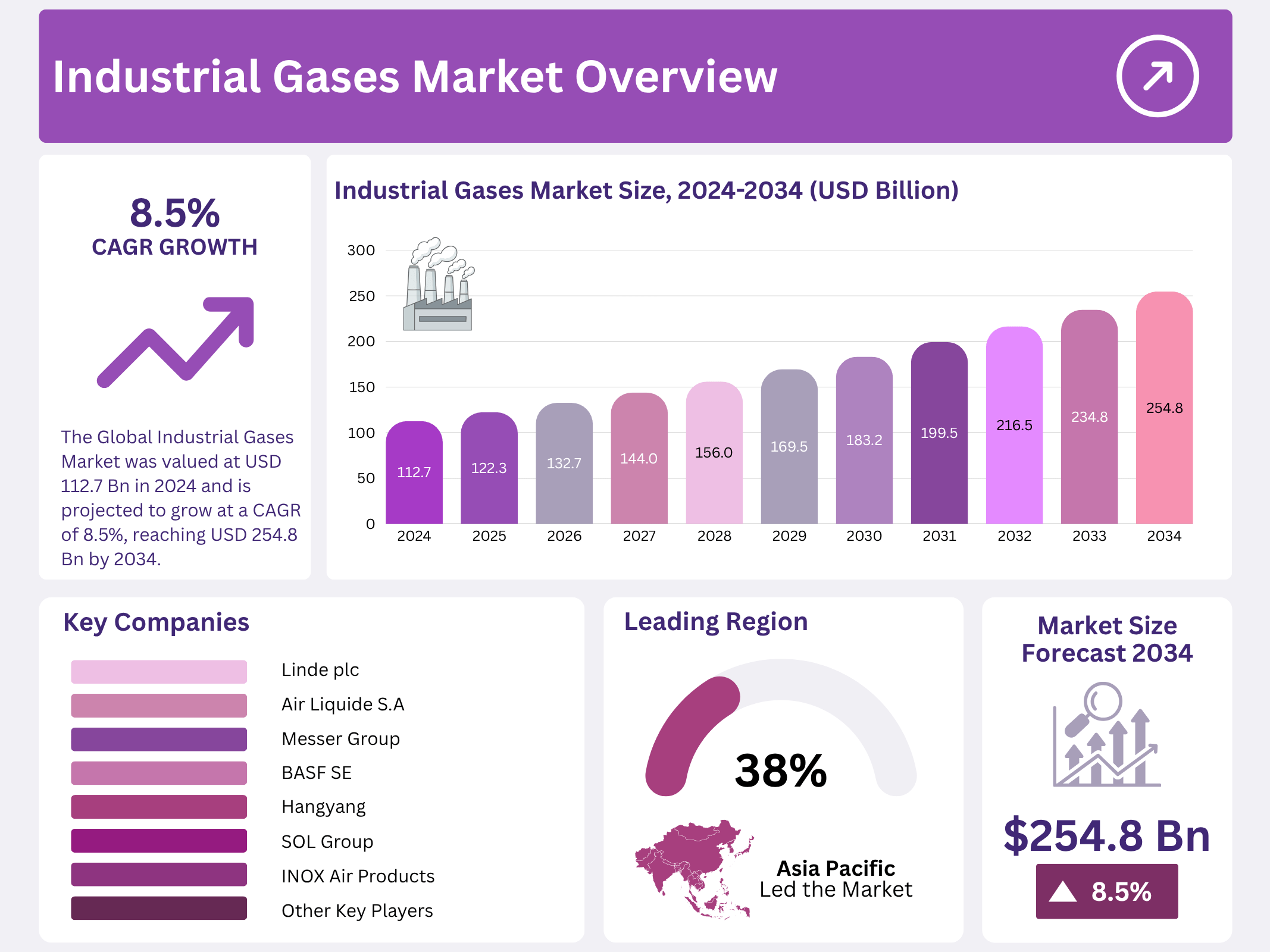

New York, NY – November 10, 2025 – The Global Industrial Gases Market is projected to expand from USD 112.7 billion in 2024 to USD 254.8 billion by 2034, achieving a compound annual growth rate (CAGR) of 8.5% over the forecast period from 2025 to 2034. Industrial gases encompass a variety of gaseous chemicals produced for diverse industrial applications, including oxygen, nitrogen, hydrogen, carbon dioxide, and noble gases such as argon and xenon.

These gases, which are typically in gaseous form at room temperature, can be stored as liquids or solids based on specific usage and storage needs, owing to their unique chemical and physical properties. These gases are indispensable across multiple sectors, including steel production, oil and gas, chemicals, petrochemicals, biotechnology, healthcare, environmental protection, and energy generation. In the oil and gas industry, hydrogen and nitrogen are critical for refining processes, enhanced oil recovery, and safety measures like inerting and blanketing.

Similarly, in the chemical sector, they facilitate synthesis reactions and optimize manufacturing processes, underscoring their role as foundational elements in modern industrial operations. The market’s growth is primarily fueled by rapid infrastructure development and industrialization in emerging economies, such as India and other developing regions, where demand is surging across key industries. Supportive government policies, including tax incentives and streamlined regulatory frameworks, are further encouraging investments and innovations in the sector.

Key Takeaways

- The Global Industrial Gases Market was valued at USD 112.7 billion in 2024 and is projected to grow at a CAGR of 8.5%, reaching USD 254.8 billion by 2034.

- Among product types, atmospheric gases accounted for the largest market share of 48.4%.

- Among the distribution, merchants accounted for the majority of the market share at 44.4%.

- By end-use, healthcare accounted for the largest market share of 23.6%.

- The Asia Pacific is estimated to be the largest market for industrial gases, with a 38.9% market share.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 112.7 Billion |

| Forecast Revenue (2034) | USD 254.8 Billion |

| CAGR (2025-2034) | 8.5% |

| Segments Covered | Product Type (Atmospheric Gases, Hydrocarbon Gases, Noble Gases, Specialty Gases), By Distribution (Merchant, On-site, Packaged), By End-use (Healthcare, Metallurgy and Glass, Food and Beverages, Retail, Chemicals and Petrochemicals, Electronics, Energy and Power, Others) |

| Competitive Landscape | Linde plc, Air Liquide S.A., Messer Group, Yingde Gases Group Company Limited, Buzwair Industrial Gases Factory, BASF SE, INOX Air Products, Iwatani Corporation, Taiyo Nippon Sanso Corporation, Hangyang, SOL Group, Strandmøllen A / S, Bhuruka Gases Limited, Matheson Tri-Gas, Inc., Other Key Players |

Key Market Segments

By Product Type

Atmospheric Gases Dominate the Industrial Gases Market

The industrial gases market is segmented by product type into atmospheric gases, hydrocarbon gases, noble gases, specialty gases, and others. In 2024, atmospheric gases captured the largest revenue share at 48.4%, driven by the extensive use of oxygen, nitrogen, and argon in critical industries such as healthcare, metallurgy, electronics, and food processing. Oxygen plays a vital role in medical treatments and steel production, while nitrogen is widely applied in inerting, blanketing, and refrigeration. The combination of cost-effectiveness, abundant natural availability, and versatile industrial applications continues to solidify the leadership of atmospheric gases in the market.

By Distribution Type

Merchant Segment Leads Industrial Gases Distribution

In terms of distribution, the market is classified into on-site, merchant, and packaged segments. The merchant distribution channel emerged as the leader in 2024, accounting for 44.4% of the market share. This dominance stems from its flexibility, cost-efficiency, and ability to cater to a diverse range of medium-scale industrial users. Gases are delivered in liquid or gaseous form via tankers or cylinders, making this model ideal for sectors like healthcare, food and beverage, and manufacturing that require reliable, scalable, and convenient supply without the need for on-site production facilities.

By End-Use Type

Healthcare Sector Emerges as a Prominent Driver in Industrial Gases

By end-use, the market is divided into healthcare, metallurgy & glass, food & beverages, chemicals & petrochemicals, electronics, energy & power, and others. The healthcare segment led the market in 2024 with a 23.6% share, fueled by the indispensable role of medical gases—including oxygen, nitrous oxide, and carbon dioxide in patient care, anesthesia, respiratory therapy, and diagnostic procedures. The growing prevalence of chronic and respiratory illnesses, expanding healthcare infrastructure investments, and heightened demand for critical care services, intensified by post-pandemic preparedness, have significantly increased the global consumption of medical-grade gases in hospitals and clinical settings.

Geopolitical Impact Analysis

Trade-Tariff Wars Between Major Regions Affecting Supply Chain Prices in the Global Industrial Gases Market

Geopolitical developments are profoundly influencing the global industrial gases market, with factors like transit agreements through Ukraine, extreme weather disruptions, and heightened tensions disrupting supply chain reliability, transportation routes, and energy availability, core elements for producing and distributing gases such as oxygen, nitrogen, and hydrogen. These interruptions often result in supply fluctuations, elevated operational costs, and delivery delays, particularly for energy-intensive manufacturing processes.

Compounding this, ongoing US-China and transatlantic trade conflicts have imposed tariffs on chemical and gas-related imports, driving up raw material and intermediate good prices, prompting companies to diversify supply chains and pivot to alternative regional markets to buffer against escalating tariff burdens. These tariff escalations and geopolitical strains are fostering tighter supply conditions and heightened price volatility in the industrial gases market.

In Europe, the Netherlands’ transmission tariff surge is inflating costs for industrial consumers and fueling inflation, especially as LNG import dependency rises amid limited pipeline options. Concurrently, US-China trade frictions—marked by reciprocal tariffs and export curbs along with Asia-Pacific duties- are inflating manufacturing expenses and curbing industrial gas demand, while macroeconomic uncertainties and storage inflexibilities are poised to temper global demand growth in 2025, fundamentally altering dynamics across the value chain.

Regional Analysis

Asia Pacific Commands the Largest Share of the Global Industrial Gases Market

In 2024, the Asia Pacific region led the global industrial gases market with a commanding 38.9% share, propelled by swift urbanization, robust economic expansion, and entrenched industrial bases in sectors like healthcare, pharmaceuticals, and electronics, which are driving unprecedented demand for these essential inputs.

Explosive population growth, urban infrastructure booms, and surging healthcare investments are amplifying needs for medical-grade gases, including oxygen, nitrous oxide, and specialized mixtures vital for respiratory support, surgeries, and diagnostics, as hospital expansions and equipment upgrades proliferate across the region.

The Asia-Pacific surge extends to emerging clean energy frontiers, particularly the rapid proliferation of electric vehicle (EV) production and lithium-ion battery fabrication. Nations like China, Japan, South Korea, and India are aggressively advancing clean transport agendas, spurring demand for industrial gases integral to battery processes—from electrolyte synthesis to electrode formation.

As Asia Pacific cements its status as the world’s EV and battery manufacturing epicenter, bolstered by China’s supply chain supremacy and region-wide policy incentives, these investments in gigafactories and EV adoption are cementing the area’s dominance, ensuring sustained growth for industrial gas providers amid the global shift to sustainable mobility.

Top Use Cases

- Healthcare Support: Industrial gases like oxygen and nitrous oxide are vital in hospitals for breathing assistance during surgeries and treatments for lung issues. They help patients recover faster by providing pure air mixtures for therapy sessions. In emergency care, these gases ensure quick response in ambulances and clinics, making medical procedures safer and more effective for everyone involved.

- Food Preservation: Nitrogen and carbon dioxide keep fresh produce and meats longer by filling packages to block out spoiling air. This simple trick stops bacteria growth, letting stores sell crisp veggies and juicy steaks without waste. It also chills foods quickly in processing plants, helping families enjoy safe meals straight from the fridge.

- Welding and Metalwork: Argon and acetylene create hot, clean flames for joining metals in car factories and construction sites. These gases shield the work area from bad air, making strong bonds that last. Workers use them daily to build bridges, vehicles, and tools, ensuring everything holds up under heavy use.

- Electronics Manufacturing: Pure nitrogen and helium clean tiny parts during chip-making for phones and computers. They prevent dirt from ruining delicate circuits, boosting device speed and reliability. Factories rely on these gases to assemble high-tech gadgets that power our daily lives, from smartwatches to laptops.

- Chemical Production: Hydrogen and oxygen speed up reactions to make everyday items like plastics and fertilizers. They mix safely in labs to create stronger materials for packaging and farming. This process helps industries produce more with less energy, supporting cleaner ways to build products we all use.

Recent Developments

1. Linde plc

Linde continues to advance its green hydrogen projects and carbon capture initiatives. A key development is the start-up of a new large-scale air separation unit for OCI NV in Texas, supplying low-carbon nitrogen and oxygen. The company is also expanding its on-site gas generation footprint globally, signing long-term contracts to supply high-purity nitrogen to the electronics and manufacturing sectors, reinforcing its strategy of stable, long-term revenue streams.

2. Air Liquide S.A

Air Liquide is heavily investing in the energy transition, notably with a large-scale electrolyzer for renewable hydrogen in Normandy, France, and a major carbon capture unit in Belgium. The company also completed the acquisition of 20-plus cryogenic tankers from Hess, significantly boosting its logistics capabilities in the US. Their commitment to R&D remains strong, with new partnerships focused on developing hydrogen mobility and biogas solutions.

3. Messer Group

Messer is actively expanding its production and distribution network in the Americas. A major recent development is the start of operations at its new air separation unit in Maceió, Brazil, strengthening its position in the Latin American market. The company is also focusing on sustainability, investing in new, energy-efficient production technologies and launching a “green” carbon dioxide product line sourced from bio-ethanol production for various industries.

4. Yingde Gases Group Company Limited

Yingde Gases is focusing on operational efficiency and strategic growth within China. Recent developments include signing new on-site gas supply contracts with major steel and chemical customers to secure long-term revenue. The company is also upgrading its existing facilities to enhance reliability and reduce energy consumption. Their strategy emphasizes consolidating their domestic market leadership while selectively exploring specialty gas opportunities in the electronics and healthcare sectors.

5. Buzwair Industrial Gases Factory

Buzwair is modernizing and expanding its operational capacity to serve the growing Gulf region. A key recent development is the significant investment in new cylinder filling stations and a state-of-the-art logistics center to improve distribution efficiency and safety. The company is also launching new specialty gas mixtures tailored for the region’s petrochemical and environmental monitoring sectors, aiming to capture more value in high-purity application segments.

Conclusion

Industrial Gases as the quiet heroes powering modern life, from keeping food fresh on shelves to fueling breakthroughs in medicine and tech. With industries booming worldwide, especially in fast-growing areas like clean energy and electronics, demand keeps rising steadily. Innovations in safer production and greener methods are making these gases even more essential, promising a future where they help tackle big challenges like sustainability and health needs without missing a beat.